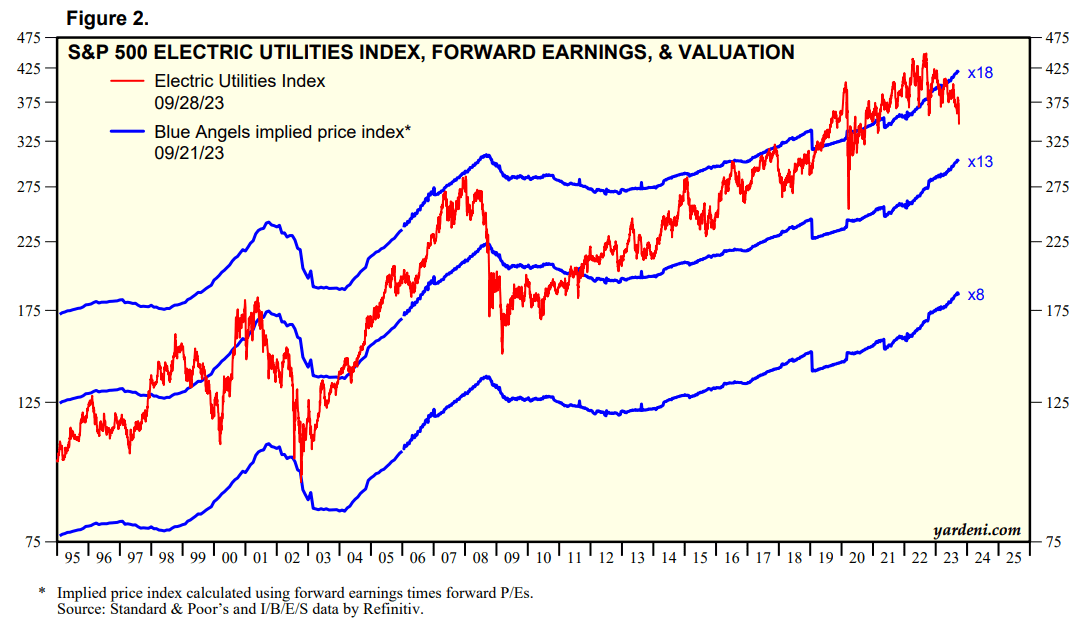

I recently upgraded the utilities sector to a buy based on the sector’s relative valuation. Fwd P/E multiples for utility stocks have gone from a 3x premium to the market to a 2x discount, as recession fears have abated and investors worry about ‘higher for longer’ interest rates. Utilities, due to their long-lived assets, tend to have high duration and lose value when interest rates increase.

While the utility sector’s relative Fwd P/E multiple looks attractive at ~16x compared to the S&P 500’s 18x, they are still not ‘cheap’ on an absolute basis (Figure 1).

Figure 1 – Utility sector’s valuation multiple has normalized (yardeni.com)

However, within the utility sector, we can find specific stocks where the absolute valuation is attractive. One such company is CLP Holdings Limited (OTCPK:CLPHY), a Hong Kong-listed utility company that is currently trading at just 13x Fwd P/E and sports a 5.3% dividend yield.

CLP is currently in the penalty box as its Australian subsidiary has run into trouble from derivative contracts struck when power prices were lower. While this has depressed earnings in the short term, the problem is ultimately fixable as these contracts roll off in the next few years. I believe CLP is worth a look as its core Hong Kong business is a cash cow with protected margins.

(Author’s note, financial figures in this article are quoted in Hong Kong dollars unless otherwise noted)

Company Overview

CLP Holdings Limited, or more commonly known as CLP Group, is a Hong Kong-listed utility company with a rich history spanning over a century. CLP’s roots can be traced back to 1901 when the utility was founded as China Light and Power Company Limited by Shewan, Tomes & Co., one of the leading British trading companies in Hong Kong at the time. The Kadoorie family of Hong Kong joined the board of CLP in the 1930s and remain controlling shareholders to this day.

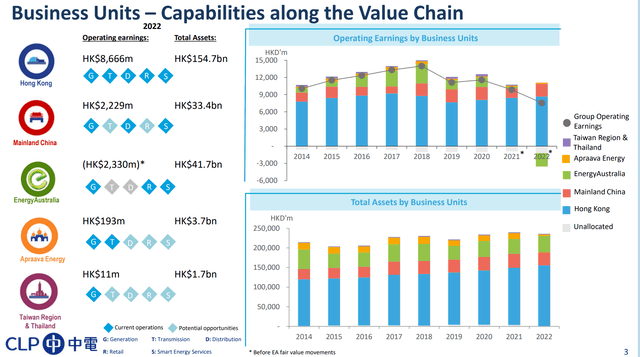

In recent years, CLP’s power businesses span five major markets across the Asia-Pacific, although Hong Kong remains the cornerstone asset of the company (Figure 2).

Figure 2 – CLP business overview (CLP investor presentation)

Hong Kong Is The Cash Cow

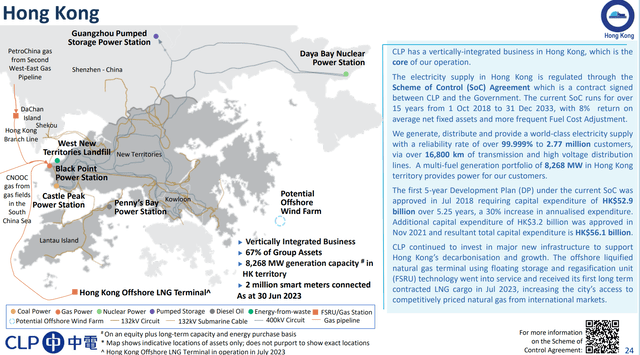

In Hong Kong, CLP operates a vertically integrated electric utility, including generation, transmission, distribution, and retail. CLP serves approximately 80% of the population of Hong Kong through its four local power stations and the importation and distribution of power from the Guangdong Daya Bay Nuclear Power Station (Figure 3)

Figure 3 – CLP Hong Kong overview (CLP investor presentation)

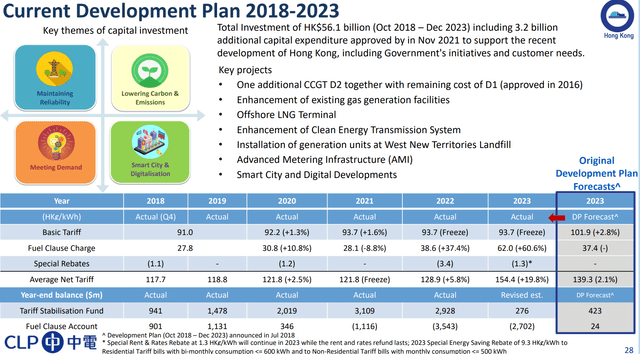

CLP’s operations in Hong Kong are regulated and monitored by the Scheme of Control (“SoC”) Agreement, which stipulates CLP’s levels of investment and return. The current SoC runs for over 15 years from October 1, 2018 to December 31, 2033, with a regulated 8% return on average net fixed assets plus more frequent Fuel Cost Adjustments (“FCA”).

In recent years, CLP’s Hong Kong business has been heavily investing in new infrastructure to support Hong Kong’s decarbonisation plans. This includes an offshore liquified natural gas terminal and regasification unit (“FSRU”) that went into operation in July 2023, plus capital expenditures to add a new natural gas power plant unit at the Black Point Power Station that will allow the gradual retirement of the coal-based power station at Castle Peak.

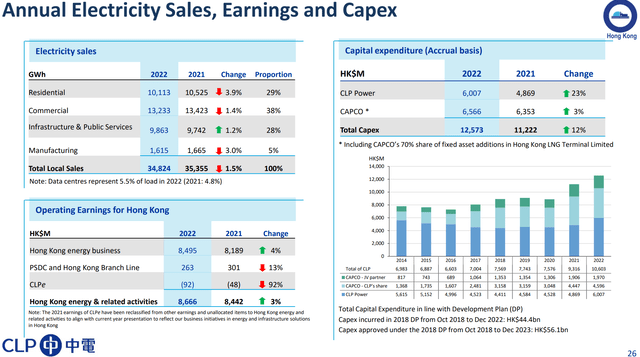

CLP earns very stable returns from its Hong Kong operations due to its monopolistic business, with $8.7 billion in operating income in 2022 compared to $8.4 billion in 2021 (Figure 4).

Figure 4 – CLP Hong Kong earns stable returns (CLP investor presentation)

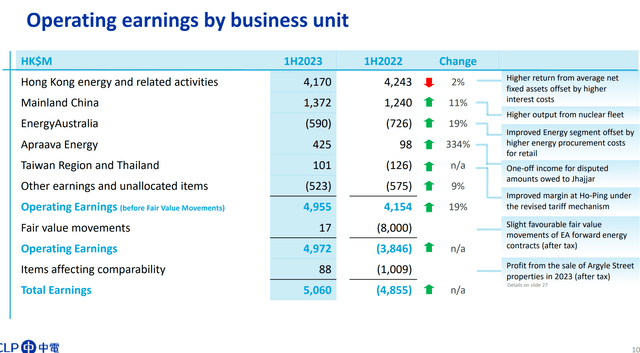

So far in 2023, Hong Kong has contributed $4.2 billion to the company’s $5.0 billion in operating income (Figure 5).

Figure 5 – CLP operating earnings in H1/23 (CLP investor presentation)

Due to the nature of the SoC agreement, CLP charges customers a Basic Tariff plus a variable Fuel Clause Charge that fluctuates based on prevailing fuel prices (Figure 6). The ability to pass through volatile fuel prices has been one of the key reasons for CLP’s stable earnings despite soaring fuel prices in the past few years.

Figure 6 – CLP SoC plan (CP investor presentation)

Australia Is The Problem Child

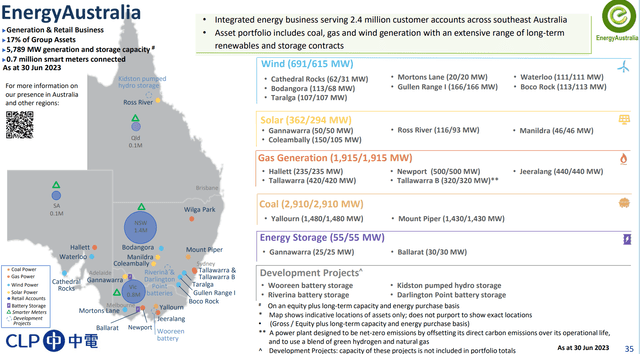

While CLP’s Hong Kong business is a virtual monopoly with fuel surcharges that protect profitability, the same cannot be said of its Australia Business. In Australia, CLP owns EnergyAustralia, a generation and retail business serving 2.4 million customers across southeast Australia, primarily New South Wales (Figure 7).

Figure 7 – CLP Australia overview (CLP investor presentation)

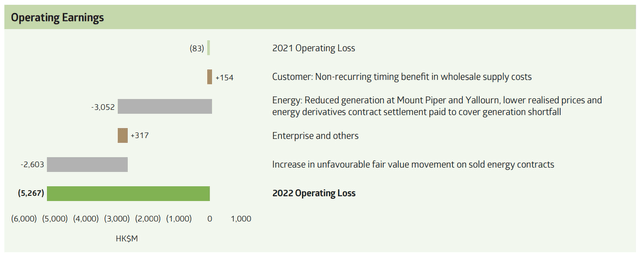

EnergyAustralia suffered historic operating losses in 2022 on a perfect storm of spiking wholesale power prices due to the Russia/Ukraine war, as well as reduced power generation at its Mount Piper and Yallourn power stations, which required CLP to buy power at wholesale prices to satisfy forward contracts (Figure 8).

Figure 8 – EnergyAustralia slipped to a historic loss in 2022 (CLP annual report)

Despite wholesale power prices calming down since the spikes in 2022, EnergyAustralia continued to record operating losses of $590 million in H1/23 as management tries to right the ship.

Looking forward, management does not expect operations to improve materially until 2024, when major maintenance work on the two power plants is completed to improve reliability and lower-priced derivatives contracts roll off.

Mainland China Is The Growth Engine

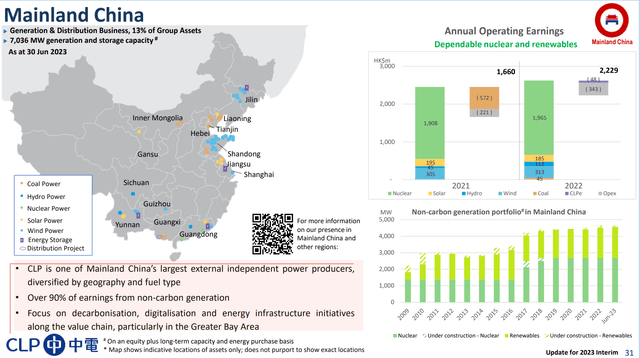

China is CLP’s growth engine, as the company is one of China’s largest external independent power producers diversified by geography and fuel type (Figure 9). Over 90% of CLP’s Mainland China earnings come from non-carbon generation like wind and solar, fitting nicely with China’s goal of growing low-carbon power generation.

Figure 9 – CLP China overview (CLP investor presentation)

Mainland China operating earnings were $1.4 billion in H1/23, up 11% from the same period in 2022.

CLP also has sizeable operations in India, Taiwan, and Thailand that contributed $0.5 billion in operating earnings in H1/23, a stark improvement from a small operating loss in H1/22.

Valuation Is Cheap

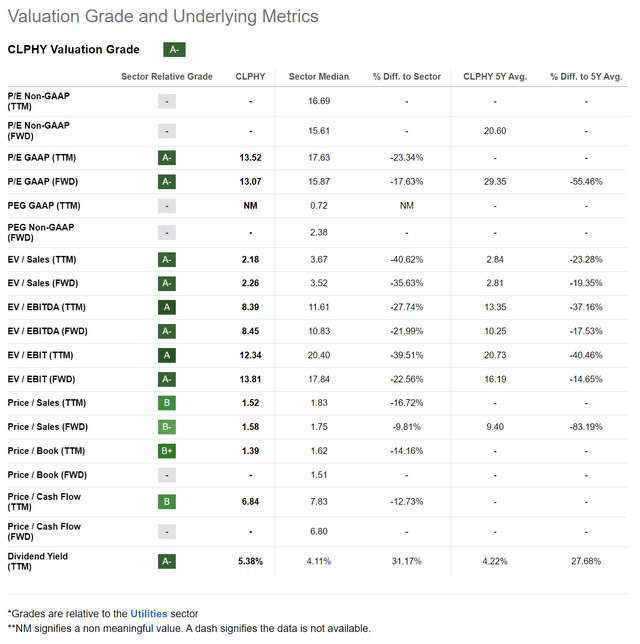

To my eyes, the main attraction of CLP’s shares is its monopoly in the stable Hong Kong market and cheap valuations. Currently, CLP is trading at only 13.1x Fwd P/E, a discount to the utility sector median’s 15.9x (Figure 10).

Figure 10 – CLP valuations (Seeking Alpha)

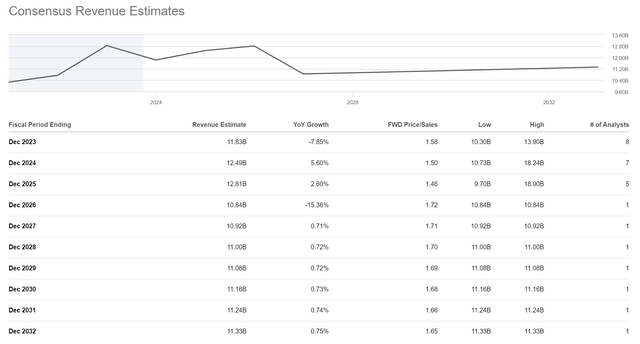

CLP’s depressed valuations can be explained by the company’s troubled Australian unit, which has recorded several years of operating losses and is not expected to materially improve until 2024. However, I believe analysts may be too pessimistic on CLP’s growth prospects, with consensus expecting revenues to flatline over the coming decade (Figure 11).

Figure 11 – Consensus too pessimistic on growth (Seeking Alpha)

While the Hong Kong market is mature and unlikely to grow very robustly, CLP’s Mainland China business continues to see robust double-digit growth. Furthermore, if the company is able to turn around the Australia business in the coming years, there is a lot of potential upside for CLP shares.

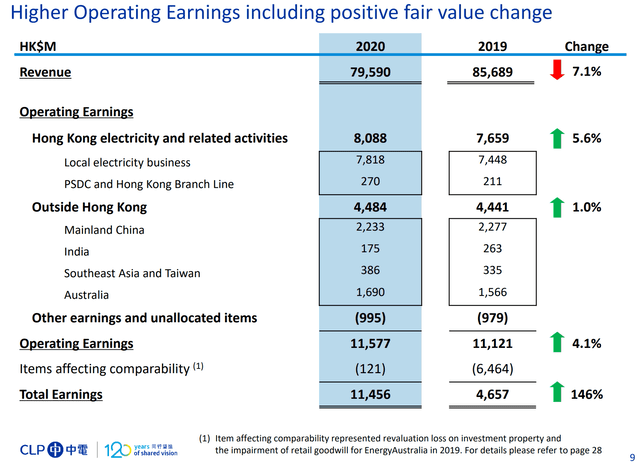

In 2019 and 2020, prior to EnergyAustralia’s troubles with energy derivatives, the Australian business provided $1.6-1.7 billion in operating earnings to the group (Figure 12).

Figure 12 – CLP annual operating earnings in 2020 (CLP 2020 annual report)

Even if CLP is not able to return EnergyAustralia to historic profitability, simply improving it to breakeven should add over $1 billion to the group’s earnings.

Furthermore, Australia accounts for 17% of the group’s assets, or $42 billion (Figure 2 above). If EnergyAustralia is unfixable, an exit from the Australian market may allow CLP to free up tens of billions in capital to reinvest in higher returning jurisdictions like Mainland China and India.

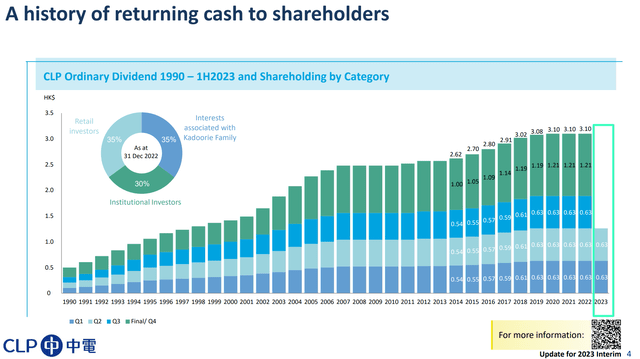

Long History Of Capital Returns

CLP has a long history of returning cash to shareholders that has made it a mainstay in many Hong Kong retirees’ portfolios and helped the Kadoorie family become one of the richest in Asia (Figure 13).

Figure 13 – CLP has a long history of capital returns (CLP investor presentation)

While investors await the company’s turnaround efforts in Australia, they are paid $3.10 / share in annual dividends or a 5.3% dividend yield.

Conclusion

CLP Holdings is a prominent player in the Asian energy sector. Its Hong Kong monopoly helps fund its international expansion efforts. While CLP has stumbled in Australia from derivatives losses, I believe the issues are ultimately fixable as low-priced forward contracts roll off in the coming years. In the meantime, investors are paid a 5.3% dividend yield to wait. I rate CLP a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here