Market Recap

The market slide continues in September with the SPDR S&P 500 Trust ETF (SPY) dropping by 4.74% last month. Vanguard’s High Dividend Yield ETF (VYM) posted a slightly better return, a loss of 3.35%. My watchlist on the other hand performed even worse, falling by 5.20%. Following September, year-to-date my watchlist remains positive, but not by much, with a return of 2.77%. SPY is still rocking a pretty decent 13.03% return while VYM descends into the red, down 2.32%. Since inception, November 2020, the watchlist continues to trail SPY by 1.09% and VYM by 2.61%, on an annualized basis.

Since I started tracking this list in November of 2020 it has generated an annualized rate of return of 10.29%. My watchlist has a bigger focus on growth and therefore tends to underperform when market sentiment is poor but it outperforms when market sentiment is favorable. Over the long term positive market periods last longer than negative market periods, therefore I am optimistic my watchlist will catch-up and surpass both SPY and VYM in due time.

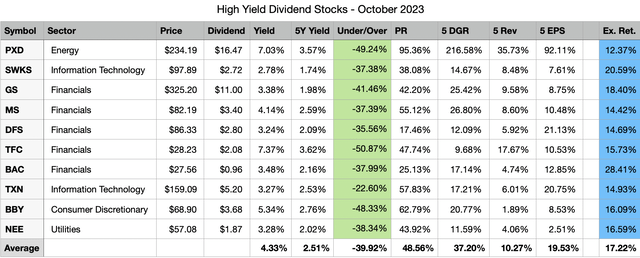

The main purpose of a high dividend yield portfolio is not to outperform the broad market but to generate a passive income stream that is relatively safe, reliable, and one that can grow in the future. The top 10 stocks on my watchlist for October 2023, collectively, offer a 4.33% dividend yield that is more than double the dividend yield of the S&P 500. These 10 stocks have also grown their dividends at a historical rate of 37.20% per year during the last five years. Collectively, all 10 stocks appear to be potentially about 40% undervalued right now based on dividend yield theory.

The best way to create a strong high yield dividend portfolio is with a buy-and-hold strategy. This strategy forces you to think about the stocks you decide to invest your capital into as the plan is to hold the positions indefinitely. Applying this approach over the long term while focusing on potentially undervalued stocks allows investors to generate alpha through capital appreciation. While this may not pan out for every position, diversifying your high-yield portfolio across 20 or more unique stocks will increase the odds of picking up shares of certain stocks when they are trading for bargain prices. The beauty of a long-term outlook is time; you can sit back and wait for the valuation to revert to historical norms, all the while collecting a generous passive income stream.

Watchlist Criteria

Creating the high yield watchlist, I had four areas of interest that I focused on: basic criteria, safety, quality, and stability. First off, the basic criterion aims to narrow down the list of stocks to those that pay a dividend, offer a yield above 2.75%, and trade on the NYSE and NASDAQ. The next set of criteria focuses on safety because that is a crucial part of a high yield investing strategy. The filter excludes companies with payout ratios above 100% and companies with negative 5-year dividend growth rates. Another level of safety can be associated with larger companies; therefore, the watchlist narrows in on stocks with a market cap of at least $10 billion. The next set of criteria set out to narrow down the list to include higher quality businesses.

The three filters for quality are: a wide or narrow Morningstar moat, a standard or exemplary Morningstar stewardship, and an S&P quality rating of B+ or higher. A Morningstar moat rating represents the company’s sustainable competitive advantage, the main difference between a wide and narrow moat is the duration that Morningstar expects that advantage to last. Companies with a wide moat are expected to maintain their advantage for the next 20 years, whereas companies with a narrow moat are expected to maintain their advantage for the next 10 years. The Morningstar stewardship evaluates the management team of a company with respect to shareholders’ capital.

The S&P quality rating evaluates a company’s earnings and dividend history. A rating of B+ or higher is associated with above-average businesses. The last set of criteria focuses on the stability of a company’s top-line and bottom-line growth. The filter eliminates companies with negative 5-year revenue or earnings per share growth rate. I believe a company that is growing both their top-line and bottom-line has the ability to provide growth to its investors in the future.

All of the stocks that pass the initial screener criteria (54 this month) are then ranked based on quality and valuation. Further, I sort the stocks in descending order based on the best combination of quality and value and select the top 10 stocks that are forecasted to have at least a 12% annual long-term return.

October 2023 Watchlist

Here is the watchlist for October 2023. There is only one change from the prior month: State Street (STT) drops out and is replaced by Skyworks Solutions (SWKS). The data shown in the image below is as of 9/30/23.

Created by Author

All of the selected stocks this month appear to be potentially undervalued based on dividend yield theory.

The expected rate of return shown in the last column is computed by taking the current dividend yield plus a return to fair value over the next 5 years and a discounted long-term earnings forecast.

Please keep in mind that my return forecasts are based on assumptions and should be viewed as such. I am not expecting that these 10 companies will hit the forecasted returns. What I do expect is that these 10 companies have the potential to offer better returns during the next 5 years compared to the 44 high yield stocks that passed my initial filters but ranked worse in quality and valuation.

Past Performance

The top 10 list for September performed rather poorly, collectively the 10 chosen stocks were down by 5.20%. This was 1.85% worse than VYM and 0.46% worse than SPY. Year-to-date the watchlist maintains a decent lead on VYM, +2.77% versus -2.32%, but trails SPY by a wide margin, +2.77% versus +13.03%. Since inception, which was 35 months ago, the watchlist trails VYM by 2.61% and SPY by 1.09%.

I do not expect that this watchlist will beat VYM or SPY every month. However, I believe that a buy-and-hold investing approach leveraging the stocks presented on this watchlist will generate long-term alpha compared to the broad market. I also have a personal target rate of return of 12% that I believe will be attained by this watchlist when measured over long periods of time.

Following September, the long-term annualized rate of return for the watchlist decreased from 12.71% to 10.29%. My target rate of return is 12% and this isn’t the first time the watchlist has dipped below this threshold. It may dip below this range in the short-term but over a longer period of time I believe it will meet this target.

|

Date |

Top 10 List |

ALL |

VYM |

SPY |

|

6 month |

-3.33% |

-3.96% |

-0.52% |

5.17% |

|

3 month |

-4.36% |

-4.52% |

-1.87% |

-3.23% |

|

1 month |

-5.20% |

-4.57% |

-3.35% |

-4.74% |

|

YTD |

2.77% |

-2.83% |

-2.32% |

13.03% |

|

Since Inception |

33.08% |

38.57% |

42.46% |

36.96% |

|

Annualized |

10.29% |

11.83% |

12.90% |

11.39% |

Individual watchlist returns for September 2023 were:

- Bank of America (BAC) -4.50%

- Best Buy (BBY) -7.95%

- Discover Financial Services (DFS) -3.82%

- Goldman Sachs (GS) -1.26%

- Morgan Stanley (MS) -4.09%

- NextEra Energy (NEE) -14.24%

- Pioneer Natural Resources (PXD) -2.79%

- State Street Corp. (STT) -1.59%

- Truist Financial (TFC) -6.35%

- Texas Instruments (TXN) -5.38%

Top 5 performing past and present watchlist stocks in September 2023:

- CVS Health (CVS) +7.14%

- Exxon Mobil (XOM) +5.75%

- Amgen (AMGN) +4.85%

- Progressive (PGR) +4.37%

- Enterprise Products Partners (EPD) +2.86%

Top 5 Stocks by total return since joining the watchlist:

- Principal Financial Group (PFG) +105.11% (35 months)

- Broadcom (AVGO) +95.54% (29 months)

- FedEx (FDX) +82.57% (12 months)

- General Dynamics (GD) +79.60% (35 months)

- Progressive (PGR) +63.59% (32 months)

Top 5 Stocks by Average Monthly return since joining the watchlist:

- FedEx (FDX) +5.14% (12 months)

- Pioneer Natural Resources (PXD) +2.69% (7 months)

- Broadcom (AVGO) +2.34% (29 months)

- Principal Financial Group (PFG) +2.07% (35 months)

- EOG Resources (EOG) +1.99% (7 months)

In total there have been 80 unique high yield dividend stocks that have appeared in the top 10 list during the past 35 months. Out of these 80 unique stocks 54 have a positive total return since first appearing on the top 10 list. The average total return for these 54 stocks is 27.49%. The average loss for the 26 stocks that have negative total returns is -18.57%. Here are all 80 stocks, their total return since inception and the number of months since they first appeared in the top 10 list.

|

Symbol |

Since Inception |

Count |

|

PFG |

105.11% |

35 |

|

AVGO |

95.54% |

29 |

|

FDX |

82.57% |

12 |

|

GD |

79.60% |

35 |

|

PGR |

63.59% |

32 |

|

CSCO |

62.69% |

35 |

|

JPM |

59.94% |

35 |

|

BMO |

58.65% |

35 |

|

MRK |

56.64% |

29 |

|

TD |

52.51% |

35 |

|

PAYX |

40.92% |

32 |

|

EPD |

40.82% |

26 |

|

PEP |

38.06% |

35 |

|

RY |

37.26% |

35 |

|

AMGN |

36.14% |

35 |

|

MTB |

34.28% |

35 |

|

BK |

33.85% |

35 |

|

CVS |

33.58% |

35 |

|

SNA |

28.11% |

20 |

|

SRE |

28.06% |

31 |

|

PM |

27.45% |

31 |

|

SO |

26.96% |

35 |

|

LMT |

26.85% |

35 |

|

CMCSA |

26.34% |

13 |

|

BNS |

25.26% |

35 |

|

STT |

24.83% |

35 |

|

ATO |

22.49% |

22 |

|

PXD |

20.45% |

7 |

|

CM |

19.49% |

35 |

|

SWKS |

18.50% |

12 |

|

CMI |

16.62% |

19 |

|

EOG |

14.80% |

7 |

|

HBAN |

14.67% |

35 |

|

HD |

13.89% |

15 |

|

K |

13.80% |

31 |

|

GIS |

13.06% |

26 |

|

QSR |

12.31% |

25 |

|

FAST |

10.21% |

8 |

|

XOM |

9.07% |

6 |

|

BLK |

8.06% |

17 |

|

TXN |

7.25% |

15 |

|

XEL |

5.83% |

31 |

|

CMS |

5.70% |

31 |

|

DRI |

4.97% |

26 |

|

TRP |

4.95% |

35 |

|

CPB |

4.52% |

24 |

|

DTE |

4.01% |

35 |

|

RCI |

3.61% |

35 |

|

EVRG |

2.74% |

35 |

|

OKE |

2.74% |

6 |

|

MDT |

2.56% |

10 |

|

KMB |

0.84% |

32 |

|

GS |

0.74% |

4 |

|

UL |

0.73% |

7 |

|

NTRS |

-2.85% |

35 |

|

DLR |

-3.46% |

19 |

|

DFS |

-3.82% |

1 |

|

USB |

-4.01% |

35 |

|

WEC |

-4.60% |

33 |

|

LNT |

-4.70% |

35 |

|

GLW |

-8.66% |

7 |

|

MS |

-9.07% |

26 |

|

BX |

-10.31% |

18 |

|

INTC |

-11.54% |

35 |

|

HAS |

-12.56% |

35 |

|

VZ |

-12.58% |

10 |

|

BAC |

-13.73% |

2 |

|

NEE |

-14.24% |

1 |

|

CLX |

-17.11% |

25 |

|

PNC |

-20.36% |

7 |

|

BEN |

-20.38% |

21 |

|

AMT |

-21.04% |

12 |

|

UPS |

-21.94% |

19 |

|

TFC |

-22.36% |

35 |

|

BBY |

-25.85% |

21 |

|

TROW |

-26.86% |

20 |

|

MMM |

-33.68% |

35 |

|

CMA |

-35.25% |

30 |

|

PARA |

-50.73% |

35 |

|

AAP |

-71.21% |

19 |

Closer Look At New Stock

Here’s a closer look at the new stock this month, Skyworks Solutions.

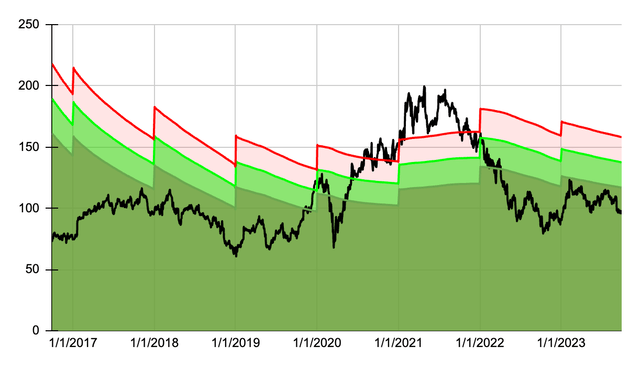

Let’s start with the 7-year dividend yield theory chart.

Created by Author

The share price peaked in mid 2021 and then tumbled straight down over a period of 12 months, bottoming out nearly as low as the 2020 pandemic crash level. Since late 2022 there has been some positive traction for Skyworks but it’s share price still remains deep in the undervalued zone based on dividend yield theory.

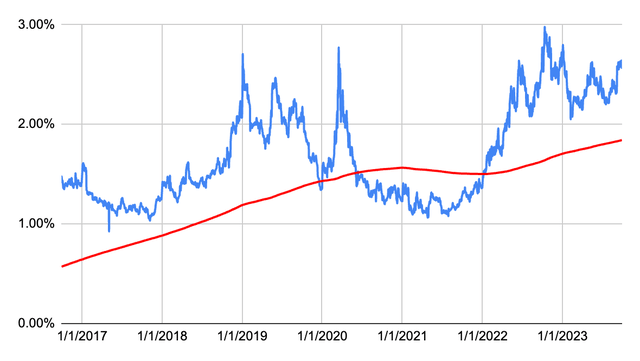

During the last 7 years investors could have initiated a position in Skyworks Solutions with a dividend yield ranging between 1% and 3%, a pretty wide range. Today the stock sits closer to its all time high dividend yield and I believe presents a good entry point. The 5 year trailing dividend yield has trended higher, partially driven by price volatility but also by strong dividend growth.

Created by Author

In the dividend growth department, Skyworks has consistently raised its dividend for 8 consecutive years now. In 2023 management raised the quarterly dividend rate from $0.62 to $0.68, or about 9.67%. If we impute the new dividend rate for quarter 4 we should see the annual payout for 2023 be $2.60. Compared to the 2022 annual payout of $2.36, we would see annual dividend growth of 10.1%. My table below shows the TTM dividend rate for 2023, not inclusive of the Q4 dividend payment.

| Year | Dividend | Growth | CAGR |

| 2023 | 2.53 | 7.20% | |

| 2022 | 2.36 | 11.32% | 7.20% |

| 2021 | 2.12 | 12.77% | 9.24% |

| 2020 | 1.88 | 14.63% | 10.40% |

| 2019 | 1.64 | 17.14% | 11.45% |

| 2018 | 1.40 | 16.67% | 12.56% |

| 2017 | 1.20 | 11.11% | 13.24% |

| 2016 | 1.08 | 38.46% | 12.93% |

| 2015 | 0.78 | 122.86% | 15.85% |

| 2014 | 0.35 | 24.58% | |

| 2013 | |||

| 2012 | |||

| 2011 |

Read the full article here