Investment Thesis

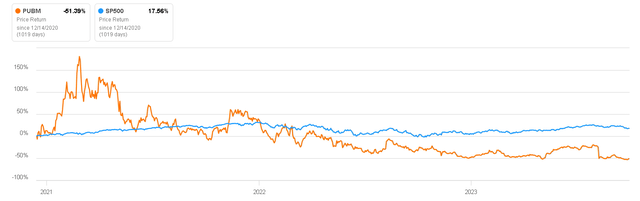

PubMatic (NASDAQ:PUBM) is a company that went public in 2020, capitalizing on the strong appetite for risk in the market at the time. However, since its IPO, the share price has declined by 50%, primarily due to the overvaluation at which it was initially listed, compounded by its poor performance in recent quarters due to the slowdown in the digital advertising sector.

Despite operating in a market poised for double-digit growth in the coming years and achieving solid returns with Net Income margins of 12%, I believe the company faces a challenging task in maintaining or gaining market share. This is especially true given that some of its key competitors include industry giants like Google, Amazon, and Meta.

In this article, we will delve into the composition of the digital advertising ecosystem, provide a valuation of PubMatic, and outline the reasons behind my decision to assign it a ‘hold’ rating.

Price Return vs S&P500 (Seeking Alpha)

Business Overview

PubMatic is a company that operates in the digital advertising technology industry. It provides a platform that enables publishers to automate and optimize the management of their digital advertising inventory. This includes tools for programmatic advertising, real-time bidding, and other solutions to help publishers maximize their advertising revenue.

Understanding the Digital Marketing Ecosystem

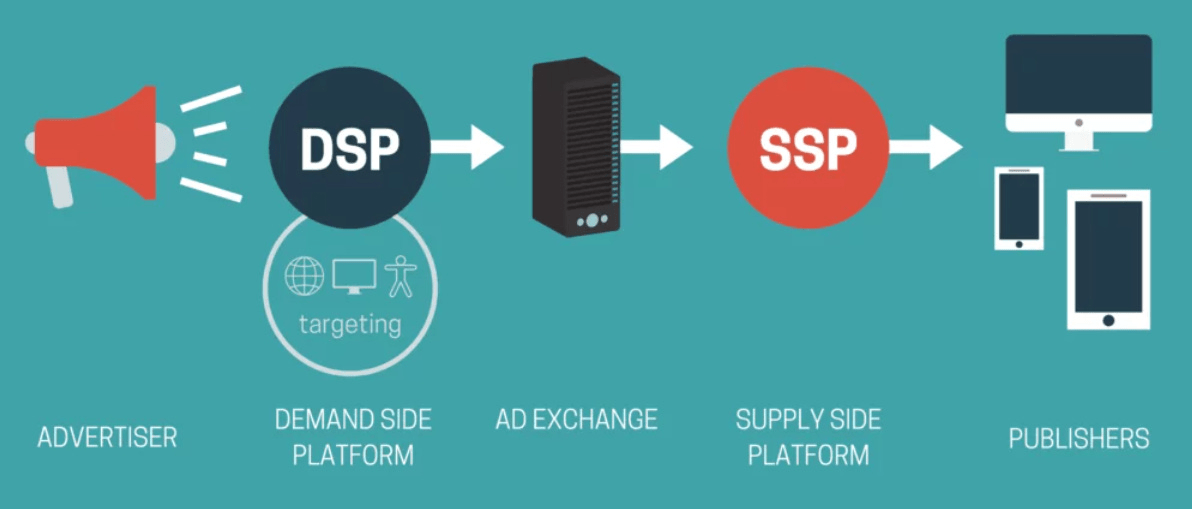

At the heart of Digital Marketing are Ad Exchanges, which serve as the bridge between supply and demand, acting as the meeting point for Advertisers and Publishers. For instance, when brands like Coca-Cola or Nike (the Advertisers) want to conduct digital advertising – that is, to occupy digital spaces with images and videos of their products – they must purchase ad space from Publishers. In our example, this Publisher would be a digital newspaper like The Wall Street Journal. These ad spaces in the newspapers are obtained through the aforementioned Ad Exchanges. However, it’s important to note that Ad Exchanges don’t directly sell ad spaces to Advertisers; rather, they auction them. As a result, if Advertisers want to secure ad placements in these newspapers, they must compete with each other to place the highest bid.

Digital Marketing Ecosystem (MediaVine)

These Ad Exchanges charge a commission for each closed exchange operation, and some examples include Google’s AdX, OpenX, and Xandr. Essentially, this is the technology where the auction and sale of impressions, also known as ‘inventory,’ take place. This inventory can come in various formats, including display, video, ads in apps like Facebook and Instagram, and other types of digital advertising that we are all familiar with.

The ad spaces offered by the Publishers contain valuable information for the Advertisers, such as the type of device where they will appear, the time of day, the location of the ad, the geographical location of the user, website information, and more. Now, while Advertisers could manually evaluate each auction one by one, as you can imagine, this would be very labor-intensive and resource-intensive. This is why there are tools called DSPs (Demand-Side Platforms) that automate the process of evaluating the conditions proposed by the Publishers. They use algorithms to search and aggregate rates from different networks into a single platform and determine the optimal price to offer in the auction. Some well-known DSPs include The Trade Desk, Meta DSP, or Amazon DSP.

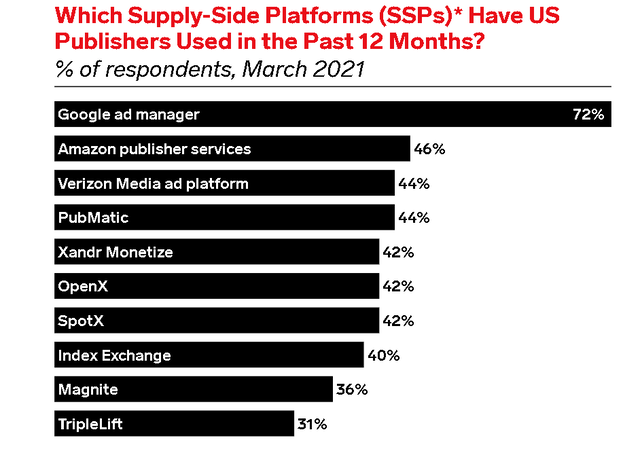

Just as Advertisers use DSPs to evaluate multiple rates offered in Ad Exchanges like Google Ads and OpenX, Publishers like The Wall Street Journal have tools called SSPs (Supply-Side Platforms) to connect with multiple Ad Exchanges instead of offering their inventory on just one platform. This strategy allows them to generate greater competition for their ad space, potentially leading to higher selling prices. SSPs help Publishers manage and optimize their ad inventory by providing tools to control and analyze the performance of their digital advertising. And it’s in the SSP space where PubMatic’s services are positioned. However, it’s worth noting that there are enormous competitors in this space, such as Google, Amazon, and even Verizon, as can be seen in this 2021 survey of SSPs used by US publishers.

This complicates the task of gaining market share, given that Google and Amazon have almost complete vertical integration within the ecosystem. They function as DSPs, SSPs, Ad Exchanges, and even Publishers when digital ads are intended for platforms like Google Search or Amazon. Consequently, it may be more straightforward for clients to collaborate with these industry giants, renowned for their excellent reputation, rather than taking the risk of trying PubMatic’s services.

Insider Intelligence

Key Ratios

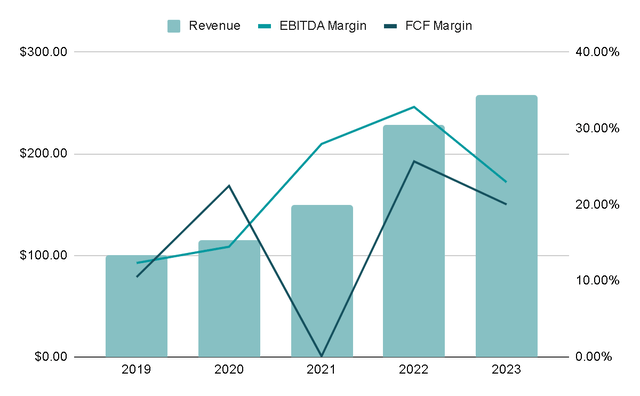

In the last 5 years, the company’s revenues have experienced extraordinary annual growth of 28%, while maintaining high profitability, with the FCF margin averaging around 15%. However, in FY2022, it reached 20%.

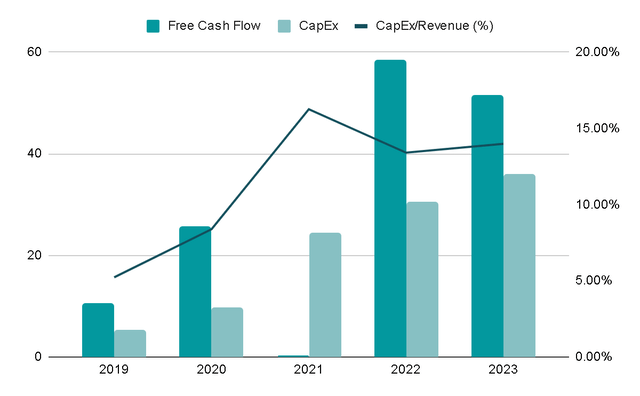

One positive aspect contributing to the company’s cost control is its ownership of its own servers. Several years ago, the management team recognized that, to become a serious player in the industry, they should build their own servers rather than opting for the traditional approach taken by many technology companies, which is to outsource to Amazon AWS. This strategic decision has allowed them to maintain a relatively stable cost base and has been a key driver of operating leverage.

Author’s Representation

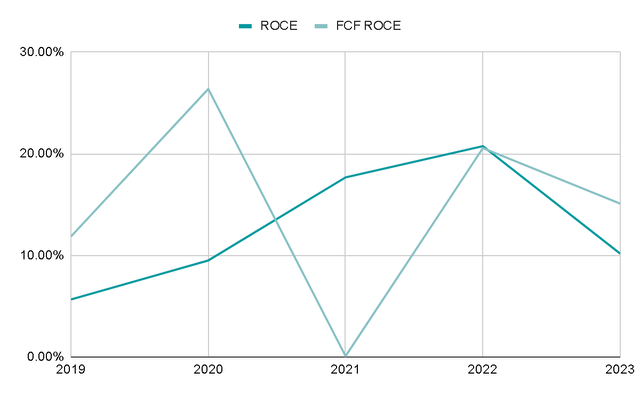

In addition, the company has consistently maintained returns on its capital employed at around 15%. This suggests that a significant portion of profits can be reinvested into the company, as each investment generates a more than satisfactory return. The fact that the company is achieving substantial returns on its investments is particularly significant, given that it is allocating a significant amount of CapEx to the continued construction of its own data centers, as we will explore later.

Author’s Representation

Since 2020, at least 10% of revenues has been allocated to CapEx, as mentioned earlier. This investment is primarily directed toward constructing their own data centers and gaining better control over their costs. As the company continues to scale and establish more data centers, it is likely that this CapEx spending will decrease, potentially impacting the Free Cash Flow Margin as it expands.

Author’s Representation

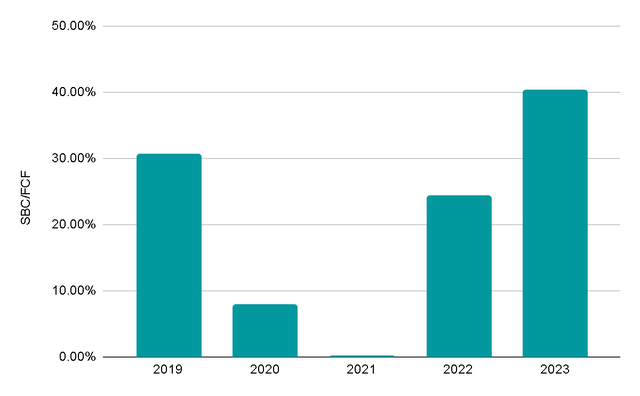

Something I consider negative is that PubMatic faces the typical silent killer of technology companies: Stock-Based Compensation (SBC). In recent years, SBC has accounted for more than 20% of Free Cash Flow. This is a substantial amount, and I would prefer to deduct it from Free Cash Flow since it doesn’t represent an actual cash inflow. SBC primarily serves as a means to attract talent without the need for cash payments.

If PubMatic were to cease issuing shares as part of employee compensation, it could result in either the loss of employees or the necessity to pay them with cash. Neither of these scenarios seems positive, so it’s common for SBC levels to be maintained in the medium and long term. By subtracting SBC from Free Cash Flow, the margin would be around 12%, which is quite a distance from the 20% seen in FY2022.

Author’s Representation

Valuation

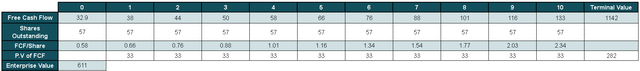

For the valuation, I will perform a Reverse DCF analysis to determine the implied growth rate in the current share price based on FY2022 data. Here are the relevant figures:

- Free Cash Flow: $32.9 million

- Cash: $92.4 million

- Debt: $27.2 million

- Shares Outstanding: 56.9 million

- Desired Annual Return: 15%

- Terminal Growth Rate: 3.00%

Using this data and the stated assumptions, achieving a 15% compound annual growth rate on the current share price would require Free Cash Flow to grow by 15% annually. This growth rate appears quite realistic and could be realized through a combination of revenue growth and an expansion in the FCF margin, as discussed in the Key Ratios section.

Reverse DCF Results (Author’s Representation) Reverse DCF Model (Author’s Representation)

Risks

Market Competition: The digital advertising technology space is highly competitive, featuring numerous established players and startups. As we’ve observed, Google, Amazon, and Meta are dominant figures across a significant portion of the ecosystem. Consequently, this intense competition can result in pricing pressures and diminished profit margins. Furthermore, the industry has been witnessing a trend toward consolidation, with larger companies acquiring smaller ones. PubMatic may face the risk of being acquired by a larger competitor or ceding market share to companies with greater resources.

Technological Changes: Rapid advancements in technology, including changes in ad formats, tracking regulations (such as GDPR and CCPA), and shifts in consumer behavior like the use of ad-blockers, can impact PubMatic’s ability to provide effective advertising solutions. For instance, the Apple IDFA and Cookies issue emerged unexpectedly and temporarily disrupted the digital advertising industry. This is a highly dynamic industry that, as history has shown (with traditional advertising), can render businesses obsolete in a matter of just a few years.

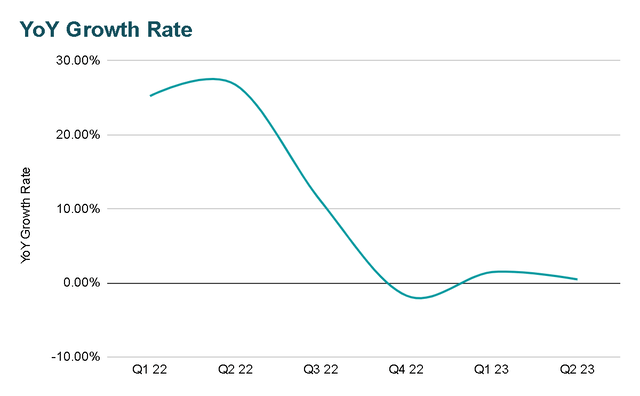

Economic Downturns: Economic downturns can result in reduced advertising budgets, directly impacting PubMatic’s revenues as advertisers scale back their spending. In fact, we have already observed this trend over the last few quarters, with YoY growth slowing to less than 1% since Q4 2022.

Author’s Representation

Final Thoughts

While PubMatic’s role within the digital advertising ecosystem appears attractive, I find it challenging for PubMatic to emerge as the ‘winning horse’ when competing against giants like Google and Amazon. The fact that it ranked as the fourth most used SSP in 2021 is a positive sign. Additionally, the digital advertising market is expected to grow by around 13% in the coming years, which should provide tailwinds for the company. However, I remain uncertain about how PubMatic will sustain relevance in an industry where differentiation relies on easily replicable technology, especially when it is not even the largest competitor.

Therefore, despite the current valuation not being unfavorable, I have chosen to assign it a ‘hold’ rating. I believe that there are better options available in the current market, some of which may be equally or even more affordable, particularly outside of the United States.

Read the full article here