I’ve been watching, buying and writing about short-term US Treasury ETFs since I debuted on Seeking Alpha just over 12 months ago. During that time, the case for making them a core, or “anchor” part of my portfolio kept building. And as the fourth quarter of 2023 dawns, I can truly say I’ve gone from encouraged, to very positive, to where I am now: UTWO is a table-pounding Buy for me. I just added to my existing position. I have held it in my retirement income account, the one that drives my non-working income. But last week, I added it to one of my growth accounts, for several reasons:

1. It is only owns US Treasuries, at a time when I believe a credit event/crisis/crash or whatever one wishes to call it, is a very high risk. I’ll stick to the folks with the printing press, thank you. That’s the US Treasury.

2. It occupies a sweet spot on the US Treasury curve, right at the juncture between bonds that are too short-term, and thus may not deliver a 5% yield for very long, and longer-term bonds, which I think still have a ways to go (up in yield, down in price).

3. In the not too distant future (Q4 2023 or sometime in 2024), I think UTWO can do something I’ve only seen short-term US Treasury ETFs do once, back during the pandemic crash in early 2020: make a few percentage points of profit on top of the yield I earn. That’s rare for short-term bonds, since their prices do not fluctuate very much. But the spike in short term rates, now leveling off, and the eventual Fed cuts I’d expect once some form of economic disaster hits are the perfect storm for UTWO…in a good way. I am raising it from Buy to Strong Buy here.

Background: bonds are more interesting than stock right now

The bond market is driving the stock market. That’s how I see it. What else would you expect when investors, including a new generation of retail investors jacked up on meme stocks and “buy the dip,” encounter rising interest rates for the first time?

Furthermore, those rates are not dropping immediately. There is no immediate gratification. It was reported recently that a significant amount of assets have been flowing into the iShares 20+ Year Treasury Bond ETF (TLT), which has become a popular trading vehicle for traders who want something other than SPY and QQQ and ARKK in their diets. I’m all for a balanced diet, so to speak. TLT is now a $38 billion ETF, and trades around $2 billion a day in volume. That makes it a proxy for the “bond market,” in a trader sense.

And while that creates some massive opportunity to, as I say, “play offense and defense at the same time” using TLT, options around it, TBF and other ETFs to trade or invest around the US Treasury yield curve, I just wrote about that about a week ago. So today, my focus is on the US Treasury 2 Year Note ETF (NASDAQ:UTWO), a fairly new ETF with just over $300 million in assets, that is as simple as its name sounds. It buys and holds the current 2 year US Treasury note.

Those are issued once each month, and each time, UTWO sells the bond it owns and buys the new one in its place. So as opposed to buying and holding a bond for 2 years directly, UTWO stays current with the 2 year bond and what it yields. Some investors prefer the former approach, some the latter. I prefer both. I own some 2 year Treasury notes directly in my retirement income account, and I also own UTWO. In fact,

Why I just added some UTWO to one of my tactical portfolios

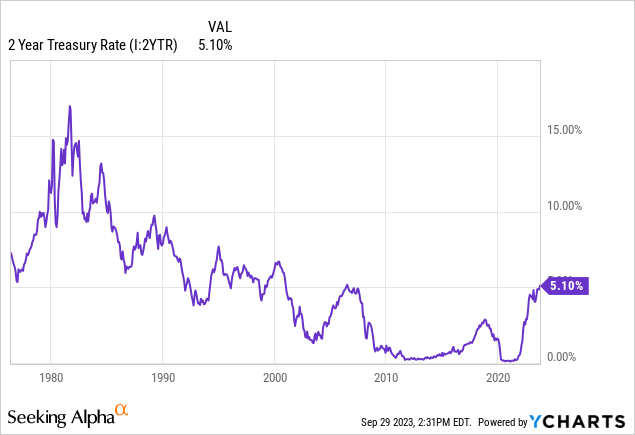

Below is a chart of the 2-year yield going back to the 1970s. You can see that the yield has not been at this level since the Global Financial Crisis, over 15 years ago. More important to market psychology today, getting ANY return on a bond like this has not even entered many investors’ vocabulary, ever. That’s a game changer, and highlights the attractiveness of UTWO, which was started in August of 2022 as part of a series of single-holding ETFs that each target a different part of the Treasury yield curve.

The other key observation in this chart is the part many investors may not remember. Interest rates at the current level used to be considered LOW, not high. Look at the 2 year from the late 1970s through the end of last century. 5% was nearly the trough in rates, whereas today it is making headlines for how high it has climbed.

While I think the more likely case is that long rates will rise and short rates will moderate, as the yield curve “steepens,” one of the benefits of UTWO is that is doesn’t leave you far behind if 2 year rates to move up a bit more. Each month, it resets to own only the current “on the run” (Wall Street lingo) 2 year US Treasury note. There might be a bit of price slippage there, but not a ton.

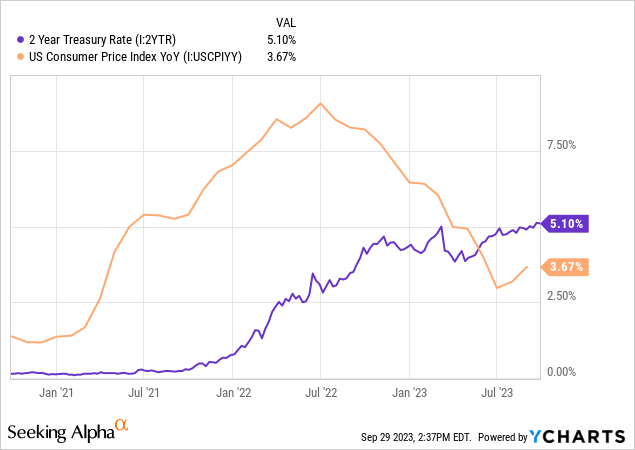

Below I show you a chart of the 2 year Treasury again, but over just the past 3 years, alongside the trailing 12 month rate of inflation Consumer Price Index – the full version, not that silly Core version that excludes food and energy, yet seems to be closely-followed by many on Wall Street. I eat and buy gas for my car, so to me, you can keep an eye on Core, but the full version is a better gauge.

When you have a spike in yield like that, unless you must have the income for the next 2 years and beyond (in other words, your focus is total return like mine is), then owning UTWO when rates drop is ideal. You get the yield and you also get price appreciation from a part of the yield curve that is way less volatile than TLT, yet still has potential to add a few percentage points to your return on UTWO.

The correct yield

I have received many comments in past articles about short-term bond ETFs, questioning why one would own something like UTWO, since “its yield is only 3.68% according to Seeking Alpha’s profile page. The answer: because that’s not the yield. It is the total income paid over the past 12 months, divided by the current price of the ETF. That is NOT what you get if you buy UTWO today. To figure that out, just look at the current yield of the 2 year and take off a few basis points for the expense ratio of the ETF.

Or, as a proxy, take the last few monthly dividend payments – UTWO pays income monthly, even though the underlying bond does not – add them up, multiply by 4 to get a closer proxy for the annualized yield. Either way, its right around 5% now, not 3.68%. That latter figure is for legal, reporting and accounting purposes, yet most databases use it as a standard item. Hopefully this clears up confusion about this ETF and others I have written about this year.

The times they are a-changing…for bond ETF investing and trading

A 40-year bond bull market ended a couple of years ago. This changes EVERYTHING that investors have been taught about bonds, diversification, “balanced” portfolios, target date funds, etc.

So, like I said above, EVERYTHING investors have come to assume about bonds has changed. It may reverse the other way a little in the coming years, but I don’t expect it to change dramatically. Higher rates are good for savers, if inflation doesn’t screw it up too much, and bond prices will at some point rise as rates moderate and eventually fall. But I’m not one of those investment strategists that sees that happening so quickly.

It has been decades since investors could allocate a part of their portfolio to an investment that can potentially earn more than a 5% return for the next two years. Not long ago, the 2-year yielded practically nothing.

What about inflation? Its high and could re-accelerate. But as I see it, 5% is better than zero, which is about the same gain the S&P 500 has earned the past 2 years.

A 2-step simplified portfolio model, using UTWO or similar Treasury ETFs

The other way to think of this in a portfolio context is as follows:

If you invest, for example, $90,000 out of a proverbial $100,000 portfolio in an investment that yields just over 5% for 2 years, your $90,000 grows to about $100,000. The other $10,000 out of the original $100,000 can be used to invest for growth, without much concern that losses on that will drop your 2 year total return below the $100,000 you started with.

That’s just one example, but the concept can be applied to any combination of something like UTWO and a “growth” investment. $70,000 out of $100,000 invested in the 5%-ish vehicle (as long as it is not something with lots of credit risk or a dividend stock) turns into about $77,000. The other $30,000 of the starting $100,000 could drop to $23,000 and you still would expect to be about break-even. That implies a decline in the “growth” investment of 23% over 2 years. Hopefully, these 2 examples communicate the concept.

This is something I used to do when I was an investment advisor AND when rates were high enough to justify it. I found it to be a nice, easy to understand 2 year portfolio plan for some situations. The only problem was, for the last 12 years of my advisory career (nearly half of the 27 years I spent in that industry before semi-retiring, and retiring fully from 1:1 client advice), bond rates were not even close to being high enough to make the strategy work. But the times have-a-changed!

So I’m excited to be able to strategize in this 2-step manner in parts of my own portfolio, and pass along my experience to the Seeking Alpha audience. It is not a complex strategy, yet I find that many people have never been presented with it. Investing can actually be straightforward sometimes!

Read the full article here