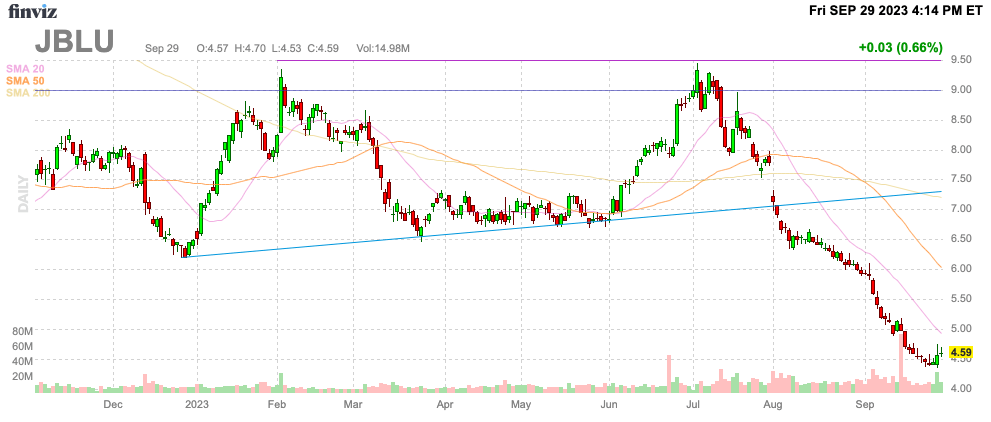

JetBlue Airways Corporation (NASDAQ:JBLU) warned the market regarding Q3’23 results sending the stock to new lows. The airline stock has been crushed so extensively, JetBlue now trades below even the Covid lows when the stock traded at a low of $7. My investment thesis is now Bullish on the airline stock after initially taking a more negative view on the stock due to the debt-fueled Spirit Airlines (SAVE) merger.

Source: Finviz

Q3 Guidance Cut

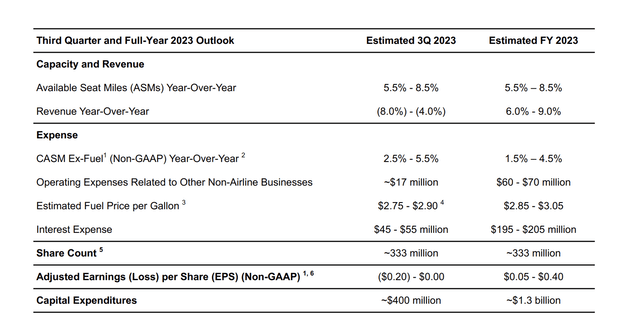

Since most airlines cut Q3 numbers, JetBlue coming out with cuts this week wasn’t a huge surprise. The airline didn’t provide any specifics, but the revenue target is now trending toward the lower end of guidance at revenues dipping 8% YoY. At the same time, costs are up at the high end of the range due to flight disruptions and higher fuel costs.

JetBlue had originally guided to these Q3’23 numbers with the best possible outcome of breakeven earnings. The airline earned $0.21 last Q3 and the consensus estimates are now forecasting a $0.18 loss and some analysts probably haven’t updated numbers for the quarter yet following the recent corporate update.

Source: JetBlue Q2’23 earnings release

The airline appeared on pace for a $1+ EPS trajectory for at least 2024, if not by 2023. JetBlue is involved in the DoJ lawsuit over the merger with Spirit Airlines and the case isn’t exactly hurt by reporting a quarter with large losses. The DoJ case weakens substantially when the merger partners are able to argue the market is too competitive and a merger is needed to reduce costs to generate profits.

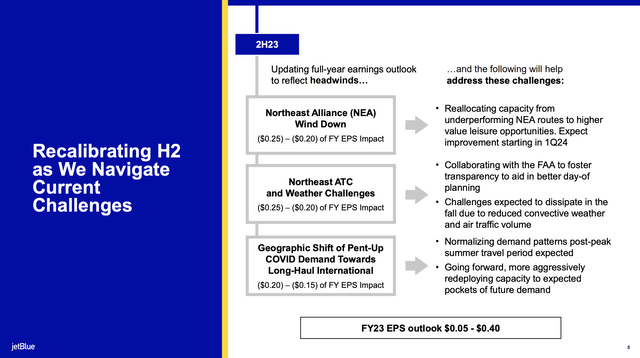

As most investors know, the biggest problem facing JetBlue is the sudden market shift to international travel depressing some of the domestic routes. In addition, the airline had already warned on the issues hitting earnings for the 2H’23. Both the Northeast ATC/Weather issues and the short-term geographic hit combined to reduce EPS by anywhere from $0.35 to $0.45 in Q3 alone.

Source: JetBlue Q2’23 presentation

The other issue hitting profits is the end of the Northeast Alliance costing another $0.20 to $0.25 in the quarter. JetBlue will need to reallocate capacity to improve these related numbers going forward.

Without all of these issues, JetBlue would’ve hit a $1 EPS for a stock now trading below $5. All of these issues are solvable in 2024 when fuel costs will likely normalize, or the airline sector will charge appropriately higher fares to cover the extra costs.

Spirit Merger

The DoJ has sued JetBlue to block the merger with Spirit Airlines. The company goes to court in October to battle regulators and the current weakness in domestic travel should help the case of JetBlue.

Considering the airlines just went through a debt-fueled period from Covid, the merger never made a lot of sense, at least optically. The market fears airline debt and JetBlue is going from negligible debt levels to a ~$7 billion level on closing this deal.

The company originally guided to EBITDAR of at least $2 billion once 50% of the merger synergies are achieved. The goal was total synergies of up to $700 million.

The stock is only worth $1.5 billion now and the merger is all cash with no stock dilution. Even using the $7 billion debt level, the new airline will only trade at 4.5x EV/EBITDAR targets.

The airline sector has a lot to shake out over the next few quarters as the market sentiment is already assuming the worst for the sector when the biggest issue is the shift in demand dynamics and temporary fuel costs. Ultimately, the market will shift back to more normal traffic, though with a huge upside for GDP growth since 2019 and the potential for higher travel levels from the WFH crowd.

Takeaway

The key investor takeaway is that JetBlue was on a path to a $1+ EPS in 2023 and more than a $1.50 EPS in 2024 before the airline sector ran into a whole host of financial hiccups. The Spirit Airlines merger is forecast to be accretive from the start.

Investors should use the current extreme weakness in the stock to buy JetBlue. The airline stock probably isn’t the preferred stock considering the ongoing merger, but JetBlue is just too cheap to ignore here.

Read the full article here