Investment Thesis

In my previous analyses for Seeking Alpha, I discussed the acquisitions of Schwab U.S. Dividend Equity ETF (SCHD), Realty Income (O), Philip Morris (PM) and Royal Bank of Canada (RY) for The Dividend Income Accelerator Portfolio. Those picks were the first four acquisitions for the portfolio.

The Dividend Income Accelerator Portfolio aims to blend dividend income and dividend growth while emphasizing a reduced risk level and striving for an attractive Total Return.

In my opinion, The Dividend Income Accelerator Portfolio represents an ideal opportunity for investors to benefit continuously from increasing dividend payments of companies that pay sustainable dividends. This investment approach allows you as an investor to steadily increase your wealth while investing with a reduced risk level.

At the same time, it ensures that you can steadily become more independent from price fluctuations of the broader stock market due to the continuously increasing dividend payments of the companies included in The Dividend Income Accelerator Portfolio.

In this investment analysis on Apple (NASDAQ:AAPL), I will show you why I have decided to add the company to The Dividend Income Accelerator Portfolio. The Apple position has the strategic role of reducing the portfolio’s risk level while helping to increase its expected Total Return (when investing over the long term). This makes Apple the ideal risk/reward choice for The Dividend Income Accelerator Portfolio.

Apple has an enormous financial health (underlined by its Aaa credit rating from Moody’s and its Return on Equity of 160.09%), and disposes of a current Free Cash Flow Yield [TTM] of 3.64%, which serves as an indicator that the company is attractive in terms of risk and reward.

In addition to that, it can be highlighted that Apple has significant competitive advantages such as its own ecosystem, its loyal customers, and a long track record of successfully launching new products as well as integrating new acquisitions into its existing business units. These significant competitive advantages raise my confidence that the risk level for Apple investors is relatively low.

My DCF Model currently indicates an Internal Rate of Return of 9% for Apple at the company’s current price level. This makes Apple an attractive investment, particularly when taking into consideration its reduced risk level for investors.

With the strategic acquisition of Apple, I believe that The Dividend Income Accelerator Portfolio is now even better positioned when it comes to risk and reward.

The Dividend Income Accelerator Portfolio

The Dividend Income Accelerator Portfolio’s objective is the generation of income via dividend payments, and to annually raise this sum. In addition to that, its goal is to attain an appealing Total Return when investing with a reduced risk level over the long-term.

The Dividend Income Accelerator Portfolio’s reduced risk level will be reached due to the portfolio’s broad diversification over sectors and industries and the inclusion of companies with a low Beta Factor.

Below you can find the characteristics of The Dividend Income Accelerator Portfolio:

- Attractive Weighted Average Dividend Yield [TTM]

- Attractive Weighted Average Dividend Growth Rate [CAGR] 5 Year

- Relatively low Volatility

- Relatively low Risk-Level

- Attractive expected reward in the form of the expected compound annual rate of return

- Diversification over asset classes

- Diversification over sectors

- Diversification over industries

- Diversification over countries

- Buy-and-Hold suitability

Apple’s Competitive Advantages

One of the reasons for including Apple in The Dividend Income Accelerator Portfolio is the company’s enormous competitive advantages. Below you can find a summary of these advantages, which help to build an economic moat over competitors. This raises my confidence that Apple is an excellent risk/reward choice to be part of The Dividend Income Accelerator Portfolio.

Apple’s financial strength

Apple has an enormous financial strength, which is underlined by the company’s Aaa credit rating from Moody’s, its high EBIT Margin of 29.23% and Return on Equity of 160.09%. The company’s current Cash Position of $62.48B further underscores its enormous financial strength.

Apple’s financial strength is also underlined by its Free Cash Flow Yield [TTM] of 3.64%, which strengthens my theory that the company is an excellent risk/reward choice and therefore matches strongly with the investment approach of The Dividend Income Accelerator Portfolio.

Apple’s attractive Free Cash Flow Yield shows that its current stock price is not based on high growth expectations, thus indicating that the risk level for investors is relatively low.

Apple’s own ecosystem

Apple has managed to build its own ecosystem, meaning that customers benefit when using different Apple products at the same time and when combining their functionalities. Apple’s ecosystem provides the company with the potential for cross-selling services, which can serve as a catalyst to increase its revenue and profits in the long term.

Apple’s long track record of successfully launching new products

Within the past decade, Apple has been able to successfully launch new products such as its iPhone series, iPads, MacBook Air, Apple Watch, Apple Music, Apple TV, and more, thus increasing my confidence that the company will continue to launch new products in the future.

Apple’s ability to integrate new companies into their units after their acquisition

Apple has further demonstrated that it has been able to acquire companies and integrate them successfully into their already existing business units, providing another competitive edge over its rivals.

Apple’s loyal customer base

Apple’s extremely loyal customers generate repetitive income streams for the company. At the same time, its loyal customer base help build a barrier for companies that could potentially enter Apple’s business field.

Apple’s high brand value

With a brand value of $297,512M, Apple is currently ranked as the 2nd most valuable brand in the world (after Amazon (AMZN), which has a brand value of $299,280M) as according to Brand Finance. Apple’s competitors such as Alphabet (GOOG)(GOOGL) (with a brand value of $281,382M), Microsoft (MSFT) ($191,574M) and Samsung (OTCPK:SSNLF) ($99,659M) are in 3rd, 4th and 6th place as according to the same ranking. Apple’s high brand value allows the company to charge premium prices.

Apple’s increasing revenue of their Service Category and its increasing percentage of the overall revenue

Lately, Apple has managed to continuously increase its revenue generated by its Services Category. This implies that the company is getting more and more independent from the revenue generated by iPhone sales.

Apple’s Valuation

Discounted Cash Flow Model for Apple

At Apple’s current stock price of $174.79, my DCF Model indicates an Internal Rate of Return of 9% for the company. In the table below you can find the Internal Rate of Return for Apple as according to my DCF Model when assuming different purchase prices for the company’s stock.

For the calculation of my DCF Model, I have assumed a Revenue and EBIT Growth Rate of 7% for Apple for the following 5 Years, followed by a Perpetual Growth Rate of 4% afterwards. These Growth Rates are conservative estimates, based on Apple’s 5 Year Average Revenue Growth Rate [FWD] of 8.04% and its 5 Year Average EBIT Growth Rate [FWD] of 9.11%.

|

Purchase Price of the Apple Stock |

Internal Rate of Return as according to my DCF Model |

|

$150.00 |

13% |

|

$155.00 |

12% |

|

$160.00 |

11% |

|

$165.00 |

10% |

|

$170.00 |

10% |

|

$174.79 |

9% |

|

$180.00 |

8% |

|

$185.00 |

7% |

|

$190.00 |

7% |

|

$195.00 |

6% |

|

$200.00 |

5% |

Source: The Author

In my opinion, an Internal Rate of Return of 9% is attractive for Apple. This is particularly the case when taking into account that an investment in the company comes attached to a relatively low risk level (which I will further demonstrate in the risk section of this analysis), meaning that it should be possible to reach this Internal Rate of Return with a relatively high probability when investing over the long term.

Apple’s Dividend and Dividend Growth and the Projection of its Yield on Cost

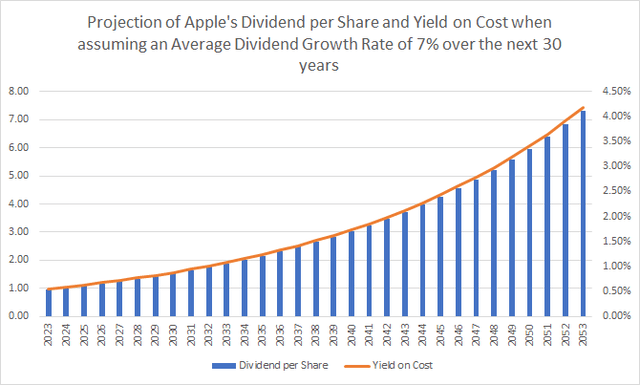

In the graphic below you can find a projection of Apple’s Dividend and its Yield on Cost when assuming an Average Dividend Growth Rate of 7% for the next 30 years. This Dividend Growth Rate is based on the company’s Dividend Growth Rate 10Y [CAGR] of 8.73% (I have made a slightly more conservative assumption).

Source: The Author

Even though the benefits for dividend income investors do not seem to be high, the company’s repurchase program of its own shares convinces me that it’s an excellent risk/reward acquisition. In May 2023, Apple authorized another $90B for share repurchases from which you will benefit significantly as an investor.

Apple Compared to its Peer Group

In the table below you can find a comparison of financial metrics in order to compare Apple to competitors such as Samsung, Alphabet, Microsoft and Amazon.

Apple is in front of its competitors in terms of Market Capitalization: Apple’s current Market Capitalization stands at $2.73T, while Microsoft’s is $2.36T, Alphabet’s is $1.65T and Amazon’s is $1.33T. Samsung’s Market Capitalization is significantly lower ($341.55B).

Moreover, Apple also stands out due to its enormous Profitability when compared to these competitors: while Apple has a Return on Equity of 160.09%, Samsung’s is at 10.64%, Alphabet’s at 23.33%, Microsoft’s at 38.82% and Amazon’s at 8.71%.

It can further be highlighted that Apple has a higher EBIT Margin compared to most of these competitors: while Apple’s EBIT Margin is 29.23%, Samsung’s is 6.08%, Alphabet’s is 26.44% and Amazon’s is 3.29%. Only Microsoft has a higher EBIT Margin than Apple (41.77%).

Apple’s superiority in terms of Profitability when compared to these competitors underlines its excellent competitive position and has contributed significantly to my decision to add the company to The Dividend Income Accelerator Portfolio.

In terms of Valuation, it is worth mentioning that Apple’s P/E [FWD] Ratio of 28.85 is currently slightly higher than the one of Alphabet (which has a P/E [FWD] Ratio of 23.30), but below the one of Microsoft (P/E [FWD] Ratio of 29.00) and significantly below Amazon (P/E [FWD] Ratio of 58.73).

These metrics demonstrate that Apple is currently at least fairly valued. I believe that the company should be rated with a premium when compared to Alphabet, especially due to its broad and diversified product portfolio and its even higher brand value.

|

AAPL |

SSNLF |

GOOG |

MSFT |

AMZN |

|

|

Company Name |

Apple |

Samsung |

Alphabet |

Microsoft |

Amazon |

|

Sector |

Information Technology |

Information Technology |

Communication Services |

Information Technology |

Consumer Discretionary |

|

Industry |

Technology Hardware, Storage and Peripherals |

Technology Hardware, Storage and Peripherals |

Interactive Media and Services |

Systems Software |

Broadline Retail |

|

Market Capitalization |

2.73T |

341.55B |

1.65T |

2.36T |

1.33T |

|

P/E GAAP [FWD] |

28.85 |

– |

23.30 |

29.00 |

58.73 |

|

Dividend Yield [FWD] |

0.55% |

– |

– |

0.95% |

– |

|

Dividend Growth 5 Yr [CAGR] |

6.69% |

-53.34% |

– |

10.12% |

– |

|

Consecutive Years of Dividend Growth |

9 Years |

0 Years |

– |

18 Years |

– |

|

Revenue 3 Year [CAGR] |

11.92% |

5.59% |

20.37% |

14.01% |

18.69% |

|

EBIT Margin |

29.23% |

6.08% |

26.44% |

41.77% |

3.29% |

|

Return on Equity |

160.09% |

10.64% |

23.33% |

38.82% |

8.71% |

|

60M Beta |

1.27 |

0.89 |

1.06 |

0.90 |

1.24 |

Source: Seeking Alpha

Why Apple is an Attractive Risk/Reward Choice and Aligns with the Investment Approach of The Dividend Income Accelerator Portfolio

- I believe that an investment in Apple comes attached to a relatively low risk level, to which the company’s strong competitive advantages and wide economic moat significantly contribute. This helps us to achieve an attractive Total Return with a relatively high probability, matching the investment approach of The Dividend Income Accelerator Portfolio.

- Apple’s broad and diversified product portfolio also aligns with the investment approach of The Dividend Income Accelerator Portfolio to provide you with a broad diversification and reduced risk level.

- My DCF Model indicates an Internal Rate of Return of 9% for Apple at the company’s current stock price. I believe that this Return is relatively attractive, particularly when taking into account that it can be reached with a relatively high probability when investing over the long term (due to its low risk level).

- Therefore, I believe that Apple continues to be an excellent risk and reward choice for investors, making its acquisition a strategic buy that strongly aligns with the investment approach of The Dividend Income Accelerator Portfolio.

- Apple’s attractiveness in terms of risk and reward is further underlined by its Free Cash Flow Yield [TTM] of 3.64%.

- Apple’s strong financial health, its significant competitive advantages, and its wide economic moat as well as large share repurchase program strengthen my belief that the company is an excellent risk/reward choice for investors.

- All of these characteristics raise my confidence to overweight the Apple stock in The Dividend Income Accelerator Portfolio.

Investor Benefits of the Dividend Income Accelerator Portfolio After Investing $100 in Apple

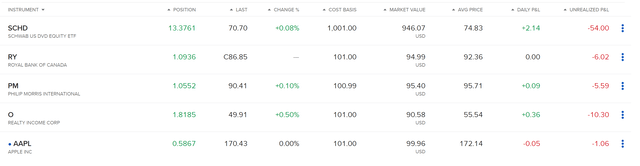

After the acquisition of Apple shares for the total amount of $100, I see The Dividend Income Accelerator Portfolio as being even better positioned when it comes to risk and reward.

Source: Interactive Brokers

However, due to Apple’s inclusion, The Dividend Income Accelerator Portfolio’s Weighted Average Dividend Yield [TTM] has slightly decreased to 3.66% and its Weighted Average Dividend Growth Rate over the past 5 years now stands at 11.40%.

I believe that The Dividend Income Accelerator Portfolio is now even more attractive for long-term investors, due to its optimization in terms of risk and reward.

With the inclusion of Apple, I believe that we could be able to achieve an even more attractive Total Return when investing over the long term. The company’s inclusion helps us to prioritize the achievement of an attractive Total Return (taking into consideration dividends and capital gains), thus providing Apple with an important strategic role within The Dividend Income Accelerator Portfolio.

Risk Factors

Even though I believe that Apple is an excellent choice in terms of risk and reward, there are several risk factors that should be taken into consideration before making the decision to invest in the company.

Apple’s Growth Rates are not as high as they have been in the past

Apple investors should be aware of the fact that the company’s growth rates are not as high as they have been in the past decade: proof of this is the company’s Revenue Growth Rate [FWD] of 3.53%, which is significantly lower than its Average over the past 5 years (which stands at 8.04%). The same is shown when looking at the company’s EPS Diluted Growth Rate [FWD] of 5.32%, which is significantly lower than its Average over the past 5 years (which is 14.18%).

However, I don’t see this as being a significant problem for long-term investors. This opinion is particularly based on Apple’s Free Cash Flow Yield [TTM] of 3.64%, which indicates that its current stock price is not based on high growth expectations.

The same is shown by the results of my DCF Model, which shows an Internal Rate of Return of 9% for Apple at the company’s current stock price (for my DCF Model I have assumed a Revenue and EBIT Growth Rate of 7% for Apple).

Apple’s dependency on its iPhone Revenue

I see the fact that the largest part of the company’s revenue is generated by its iPhones as an additional risk factor for investors.

In 2023, 53.36% of the company’s net sales were generated by its iPhone Category (this Category generated net sales of $156,778M compared to Apple’s total net sales of $293,787M).

However, it is worth mentioning that Apple’s revenue generated by its Service Category is increasing year over year, indicating that this dependency is getting lower: while Apple’s net sales from its Services Category were $58,941M in 2022, they have increased to $62,886M in 2023. This means that the proportion of the net sales of Apple’s Services Category on its total net sales increased from 19.38% to 21.41%, underlying the theory that Apple’s Services Category plays an increasing role. The Services Category currently represents Apple’s second largest, behind the iPhone Category.

Apple’s dependency on the Chinese Market

Apple’s China dependency represents another risk factor for investors, since the Greater China Segment accounts for 19.56% of the company’s net sales.

Investors should be aware that changing regulations in China could have a negative impact on the company’s revenue and profits, particularly in the short term. This risk factor leads me to suggest that you only invest in Apple with a long investment-horizon. Since the investment approach of The Dividend Income Accelerator Portfolio is to invest over the long term, the acquisition of Apple matches with its investment approach.

Resuming the company’s Risk Factors

Resuming, I continue to believe that Apple is an excellent choice for investors when considering risk and reward and when investing over the long term.

The company’s Free Cash Flow Yield [TTM] of 3.64% indicates that its current price level is not based on high growth expectations, thus supporting my theory that it’s an attractive risk/reward choice for investors. Therefore, I have decided to make Apple one of the largest individual positions of The Dividend Income Accelerator Portfolio.

Conclusion

With the acquisition of Apple for The Dividend Income Accelerator Portfolio, we have managed to reduce the portfolio’s risk level. At the same time, we have managed to raise the expected Total Return of the portfolio. This makes Apple the perfect strategic acquisition for The Dividend Income Accelerator Portfolio.

Apple’s attractiveness in terms of risk and reward is one of the principal reasons for which I have overweighted its position within The Dividend Income Accelerator Portfolio and for which the company is the largest position of my personal investment portfolio.

I strongly believe that Apple is an excellent choice in terms of risk and reward. This theory is underlined by the company’s Free Cash Flow Yield [TTM] of 3.64%, and its significant competitive advantages (such as its loyal customer base, its own ecosystem, its high brand value, and its long track record of successfully launching new products and integrating new acquisitions into the company’s existing business units, etc.).

After the acquisition of Apple for The Dividend Income Accelerator Portfolio, the portfolio’s Weighted Average Dividend Yield [TTM] stands at 3.66% and its Weighted Average Dividend Growth Rate [CAGR] is at 11.40%.

I believe that The Dividend Income Accelerator Portfolio is now even better positioned when it comes to risk and reward. This makes it an ideal choice to combine dividend income with dividend growth, while helping investors invest with a reduced risk level and to strive for an attractive Total Return.

In both bullish and bearish market scenarios, The Dividend Income Accelerator Portfolio provides you as an investor with stability and protection, as well as steadily increasing dividend payments and the potential to accumulate wealth (via dividends and capital appreciation). Have you already started to implement the investment approach of The Dividend Income Accelerator Portfolio?

Author’s Note: Thank you for reading! I would appreciate hearing your opinion on my selection of Apple as the fifth acquisition for The Dividend Income Accelerator Portfolio. I also appreciate any thoughts about The Dividend Income Accelerator Portfolio or any suggestion of companies that would fit into the portfolio’s investment approach!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here