Real estate investment trusts, or REITs (VNQ), are today offering a historic opportunity for contrarian investors.

During most times, you would expect them to be priced at a small premium relative to their net asset value given all the advantages that they offer relative to private real estate:

| Private Real Estate | Public REITs |

| Illiquid | Liquid |

| Concentrated | Diversified |

| Costly and work-intensive management | Cost-efficient professional management |

| Unlimited liability | Limited liability |

| Limited access to capital | Superior access to capital |

| Discount valuation | Premium valuation |

In an efficient marketplace, investors should get a lower price and expect to earn higher returns when buying a private property because those are far riskier, illiquid, concentrated, and management-intensive investments. If the real estate is worth $100, then perhaps, the REIT should be priced at $110-120.

However, because REITs are publicly listed, they will behave like stocks in the short run, and the intense volatility may at times cause their prices to deviate materially from the fair value of their real estate.

In fact, there have been quite a few instances in history when REITs were priced at substantial discounts relative to their net asset value, allowing investors to buy real estate at pennies on the dollar.

This was the case following the stock market crashes of 2008 and 2020 to give you two recent examples.

How did REITs perform in the following periods when they were discounted?

They were exceptionally rewarding.

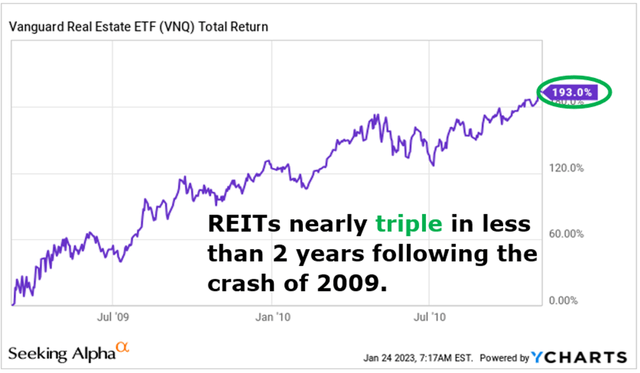

Following the great financial crisis, REITs tripled in just two years as their valuations recovered and the discounts disappeared:

YCHARTS

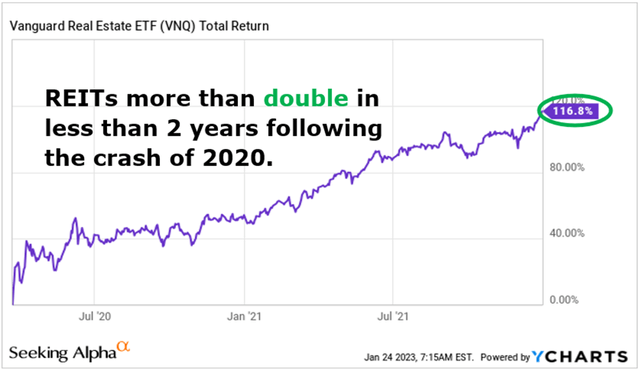

Similarly, REITs doubled in just over a year following the pandemic crash. Early into the pandemic, REITs were hated by everyone and I saw many comments claiming that “this time is different” and REITs would never recover from here:

YCHARTS

It turns out that buying good real estate at a large discount to its fair value was a great investment. How surprising!

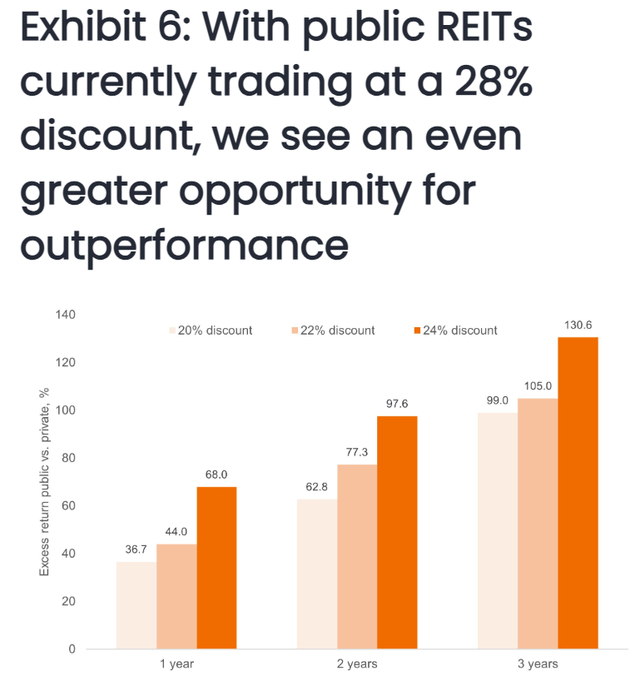

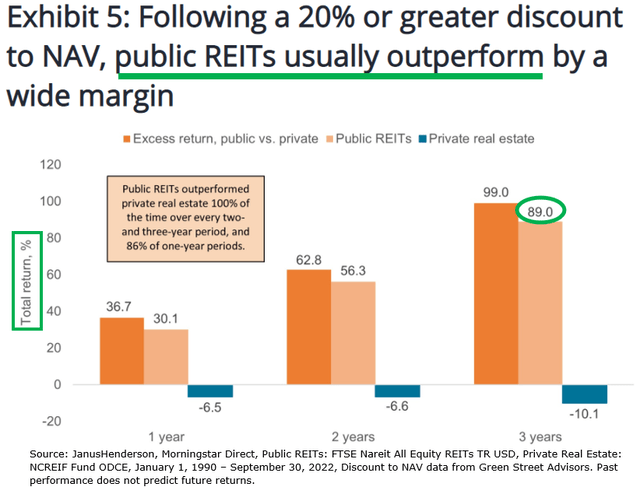

Going back a bit further, we find that REITs have generated a 130% average total return in the following 3 years after they had been priced at a 24% discount to their net asset value. That’s far more than what most other stocks (SPY) have generated:

Janus & Henderson

This brings us to today.

REITs are now priced at a roughly 28% discount to their net asset value according to the investment firm Janus & Henderson. Moreover, that’s just the average of the sector. There are many individual names that trade at materially lower valuations:

- Crown Castle (CCI) owns cell towers all over the country and it is priced at an estimated 38% discount to its net asset value.

- BSR REIT (OTCPK:BSRTF) owns apartment communities in Texas and it is priced at a 41% discount to its net asset value.

- Vonovia (OTCPK:VONOY) owns apartment communities in Germany and it is priced at a 62% discount to its net asset value.

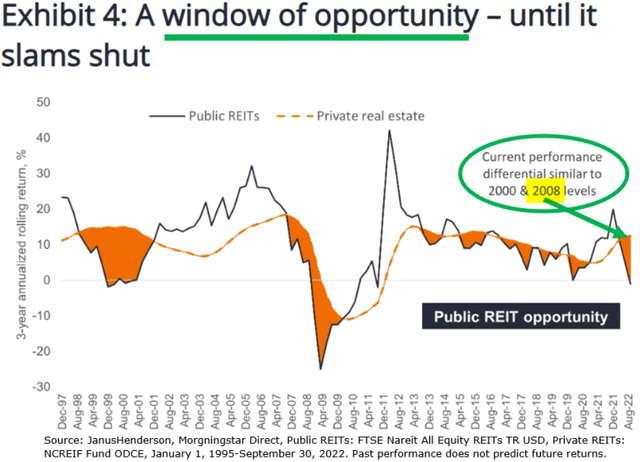

- These are the lowest valuations since the great financial crisis:

Janus & Henderson

Once more, investors have panicked and run away from REITs, thinking that they are now unattractive and will never recover.

This time, the main reason for the drop is the recent surge in interest rates. Investors fear that this will cause a significant drop in REIT cash flows and dividends – justifying much lower valuations.

But I strongly disagree and think that this is a historic buying opportunity.

So much so that I today invest about 50% of my net worth in REITs and I expect them to deliver strong returns in the coming years as they recover from their recent crash.

How confident am I in this outcome?

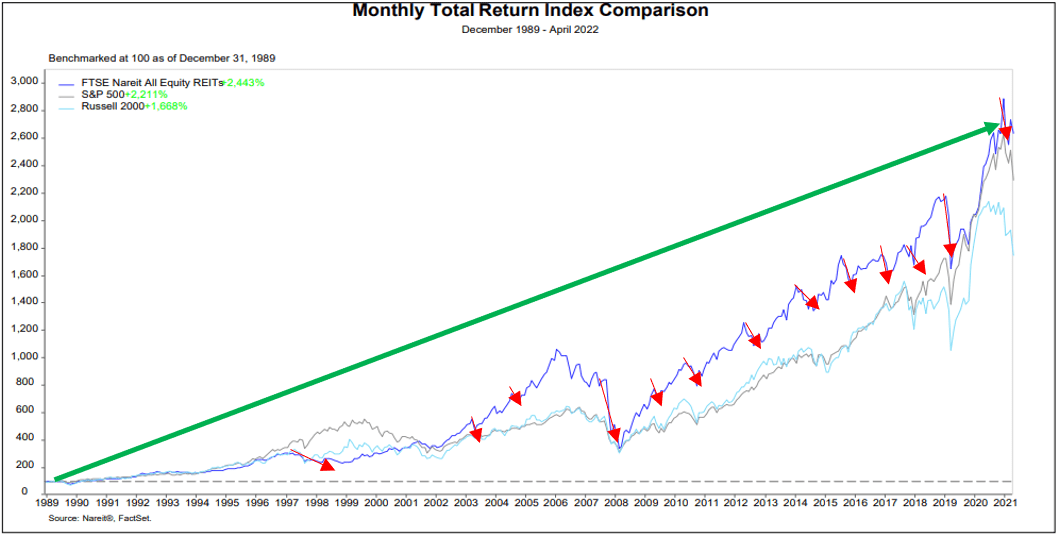

Well, let me start by showing you that historically, REITs have always fully recovered from every past crash, and typically, they have recovered rapidly:

NAREIT

So buying REITs following a crash has generally been a great idea over many decades.

Will this time be different?

Well, the truth is that every single crisis is somewhat different, but the end outcome has always been the same: a recovery.

The pandemic was different… the great financial crisis was different… the dotcom crash was different… but REITs always recovered and delivered strong returns to those who had the courage to buy them when no one else wanted to touch them.

This time, REITs are down primarily because of rising interest rates.

It caused investors to panic and run away.

But the impact really isn’t nearly as significant as the market makes it seem to be. Here are 3 simple reasons why:

- 1) Strong balance sheets: REIT balance sheets are the strongest they have ever been with low debt levels at 30% on average and long debt maturities at about 8 years. With such low debt and long maturities, the amount of debt that needs to be refinanced at higher rates each year is very manageable.

- 2) Rapid rent growth: Meanwhile, rents are rising at a rapid pace. Investors have forgotten that interest rates surged because of the high inflation, which has led to materially higher rent growth. The rent growth impacts 100% of the assets each year, but the surge in interest rates only impacts a very small portion of the balance sheet. If you have a 30% LTV with an 8-year term and well-staggered maturities, you only need to refinance ~3% of your capital stack each year. Yes, interest expense is rising on that 3%, but rents are rising on 100% of your assets to compensate for it. This explains why REIT cash flows and dividend payments have kept rising in most cases, despite the recent surge in interest rates. I would add that the high-interest rates and inflation have also put on halt most new real estate development projects, resulting in much slower supply growth, which will only accelerate rent growth further in the coming years. Moreover, it has also made property ownership less affordable thereby growing the pool of renters, increasing demand, and leading to faster rent growth.

- 3) Lower interest rates will return: But most importantly, we strongly believe that today’s high interest rates won’t last. The market has now repriced REITs as if these high rates are here to stay forever, but that makes very little sense to me. The high interest rates served the purpose of cooling down the high inflation that resulted from the pandemic and Russia’s brutal invasion of Ukraine. But the inflation has now already returned to the Fed’s 2% target rate if you adjust for real-time shelter data. The Fed is of course playing tough and saying that the high rates will remain for a while, but remember that their job is to manage expectations to avoid a second spike in inflation. Everything that the Fed said over the past 2 years was wrong, but for reasons that I ignore, investors are still falling for it and closely listening to Powell.

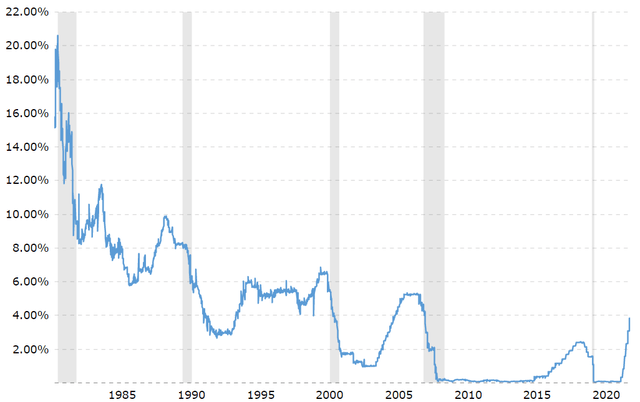

The reality is that the high inflation is now essentially over, and if you look back at the past 40 years, you will see that periods of surging interest rates have always been followed by sharp interest rate cuts:

Fed

Will this time really be different?

Each and every time, people claimed that this was the “end of low rates,” they were proven wrong in the end. This is because there are strong deflationary forces that are pushing rates lower, and these forces are today stronger than ever. They include the aging demographics, the high debt loads, income inequality, and technological innovation.

These deflationary forces explain why interest rates have been trending lower for so long and these forces are still here.

Today, everyone still talks about inflation, but I predict that in the not-so-distant future, investors will turn their focus to recession and deflation fears.

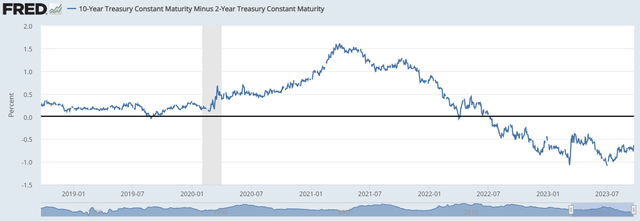

The yield curve is more inverted than ever, and this has been a near-perfect predictor of a coming recession in the past:

Fed

Moreover, China, one of the world’s biggest economies, is already dealing with deflation as their CPI fell by 0.3% year-over-year in July.

How long will it be before today’s high-interest rates in the U.S. will push our economy into a recession and inflation fears turn into deflation fears?

I can’t predict exactly how long. It could be 6 months. 12 months. 24 months or more…

But my point is that this is likely what will happen, and I think that it will mark an end to today’s high interest rates and lead to an epic recovery across the REIT sector.

Here’s the kicker: eventually interest rates will return to lower levels, but the higher rents will remain. The inflation “rate” is cooling down, but the inflation itself won’t be canceled.

This is the ultimate catalyst that should push REIT share prices to new all-time highs and unlock substantial upside for those who buy REITs at today’s low valuations.

Quite a few REITs have 50-100% upside just to get back to where they were in early 2022 and while you wait, you earn high dividend yields.

But even if you don’t buy into this thesis, simple logic would tell you that buying good real estate that’s growing in demand at a steep discount to its fair value and replacement cost should eventually result in strong returns over time. Studies also prove this point. Historically, whenever REITs were priced at a large discount relative to the value of the real state they own, they generated very high returns in the following periods:

Janus & Henderson

Currently, our Core Portfolio is priced at a 10%+ cash flow yield and an estimated 40% discount to net asset value so we don’t need anything spectacular to happen to earn good returns.

- If interest rates remain high, we should do well over time.

- If interest rates return to lower levels as we expect, we should do even better, a lot better.

The market will be volatile over the short run, of course, but that’s just another advantage of REITs for long-term oriented investors. This volatility allows us to accumulate larger positions at heavily discounted prices and that is precisely what I have been doing.

Closing Note On Risks To The Thesis

The market sentiment of REITs is today very negative and it could remain so for a long time to go, especially if interest rates remain at these levels or keep rising higher.

In presenting this thesis, I am not making any predictions as to how REITs will perform over the short run, and they could well drop lower before they recover. In full disclosure, I have been bullish since higher levels already, and the market has kept moving against me.

If rates remain high, or worse, if we get a second spike in inflation and this forces the Fed to push for more rate hikes, we could see more volatility in the near term.

But I am comfortable with this risk because REITs now offer an exceptional margin of safety relative to other investments. This risk is not unique to REITs by any means, but at least, REITs are discounted, which is not the case for most stocks.

Could prices drop further from here? Sure, they could and I don’t pretend to know how to time a bottom. I don’t think that anyone can.

But are REITs likely to generate strong returns over the next 5 years as our thesis plays out? I strongly believe so, and I am putting my money where my mouth is.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here