Investment Thesis

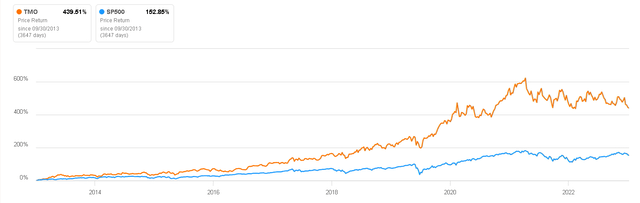

Thermo Fisher (NYSE:TMO) has consistently outperformed the market and has now established a revenue base that is largely recurring and predictable.

In this article, I would like to discuss the business model, provide an overview of its capital allocation policy, and finally, I will perform a valuation. This valuation has led me to assign a ‘hold’ rating based on the seemingly unattractive return it offers at current prices, despite the 25% drop it has experienced since reaching its all-time highs in 2021. However, these types of quality businesses are worth having at the top of any watchlist.

Price Return vs S&P500 (Seeking Alpha)

Business Overview

Thermo Fisher Scientific is well known for its laboratory instruments, reagents, and consumables used in various scientific research and analytical applications that support researchers, scientists, and healthcare professionals in their work across a wide range of industries, including life sciences, healthcare, pharmaceuticals, biotechnology, environmental monitoring, and industrial applications. I would like to name some examples of who uses these products and what is the purpose behind them, so we will have a clearer picture of Thermo Fisher’s relevance to its customers.

- Genomic Sequencing: Thermo Fisher offers a range of products and technologies for genomic sequencing, including the Ion Torrent sequencing platform. Researchers in genetics and genomics use Thermo Fisher’s sequencing instruments, reagents, and software to analyze DNA and RNA samples. These tools are crucial to study genetic mutations and variations associated with cancer. This information can lead to the development of targeted therapies and personalized medicine approaches.

- Drug Discovery and Development: Thermo Fisher provides a wide range of solutions for pharmaceutical and biotechnology companies involved in drug discovery and development. Their products and services play a pivotal role in mass spectrometry instruments that are used to analyze proteins and biomolecules. This is vital for understanding disease mechanisms, identifying biomarkers, and developing new therapeutic agents.

With these examples, we can say that Thermo Fisher provides the ‘picks and shovels’ to the ‘miners’ seeking progress in the field of medicine and life sciences. This market anticipates a growth rate of 9% in the coming years, a rate similar to the organic growth projected by the management team for the long term (between 7% and 9% annually).

Recurring Revenues

In the pharmaceutical industry, there is a significant trend towards the use of single-use systems instead of the traditional reusable stainless steel and glass instruments. Single-use systems promote sustainability by eliminating the need for chemicals and resources, such as water and energy, required to sterilize reusable systems. Perhaps most importantly and crucially, this is achieved with minimal cost and processing time, virtually eliminating the risk of cross-contamination, as the product flow path is discarded and replaced after each batch.

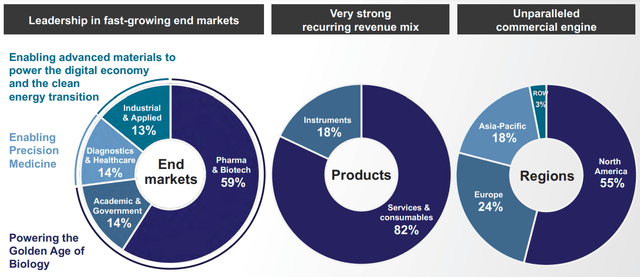

This means that Thermo Fisher customers now need to consistently order instruments to perform their jobs. Along with other services the company provides, this generates recurring revenue, increasing the company’s predictability while reducing the inherent cyclicality of depending on laboratories to purchase more instruments. According to the company, currently more than 80% of its revenue is recurring.

Revenue Mix (Thermo Fisher)

Key Ratios

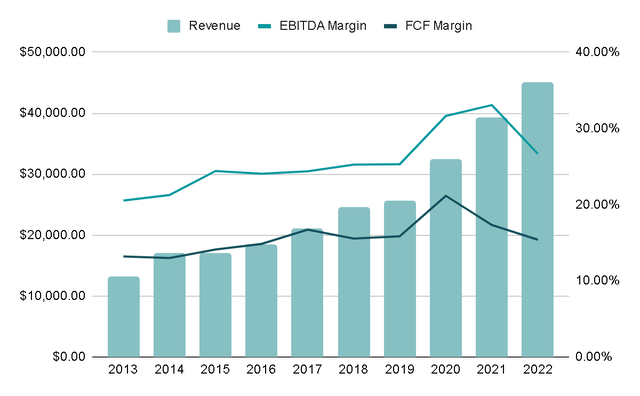

Thermo Fisher’s revenues have grown at an excellent rate of 15% annually over the last decade, while EBITDA has grown at 18% and FCF at 17%, reflecting improved margins.

In the following image, you can observe that although the company was already expanding its margins, there was a disproportionate expansion during 2020 and 2021. This expansion has been gradually normalizing in 2022 and 2023. This improvement was primarily driven by large orders for COVID-19 identification tests, which led the Life Sciences Solutions segment’s EBIT margins to increase from 35% to 50%. However, during FY2022, the margin for this segment dropped to 41%, and I anticipate it may decrease slightly further. Nonetheless, these levels are now closer to what we can expect in the coming years.

Author’s Representation

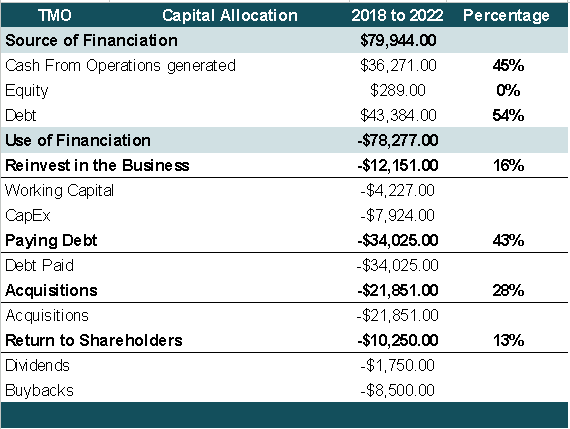

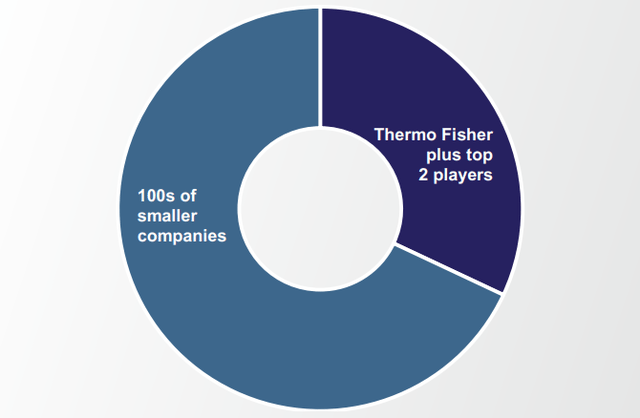

Thermo Fisher’s capital allocation strategy has been consistently clear since its inception: leverage the fragmentation of its market to make acquisitions that accelerate its growth. This approach led to the formation of the company’s current name when Thermo Electron Corporation merged with Fisher Scientific International in 2006. Notably, one of its main competitors, Danaher (NYSE:DHR), follows a similar strategy. Given the sector’s ongoing opportunities, it seems likely that this trend will continue.

Most of these acquisitions are typically financed with debt. Consequently, we will soon examine the company’s leverage levels and the returns it has achieved on its investments to assess whether these acquisitions have added value for shareholders. Additionally, Thermo Fisher regularly returns capital to its investors through dividends and, notably, buybacks. Over the past five years, they have repurchased 3% of the outstanding shares and maintain a modest dividend yield of 0.26%. However, the low payout ratio of 8.5% suggests that this dividend is sustainable and could potentially increase if the company exhausts its acquisition options and decides to adjust its capital allocation policy.

Author’s Representation Market Fragmentation (Thermo Fisher)

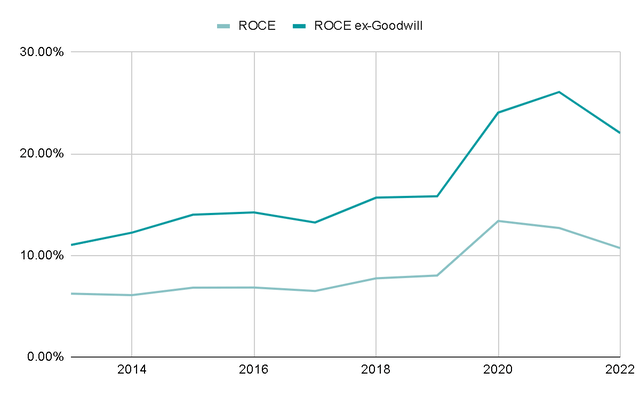

When we calculate the Return on Capital Employed (ROCE) as EBIT divided by Capital Employed, we observe a relatively low ratio that has averaged 8.5% (7% if we exclude 2020 and 2021). However, Capital Employed is somewhat distorted by the numerous acquisitions made by Thermo Fisher, which generate Goodwill. In 2022, Goodwill represented 51% of the Capital Employed.

For this reason, I believe that a more accurate way to measure the underlying profitability of Capital Employed is to exclude Goodwill from the calculation. This adjustment yields a ROCE that has averaged 16% (14% excluding 2020 and 2021). This metric reflects the value creation resulting from acquisitions and organic growth when we remove the noise generated by Goodwill.

While it is true that Thermo Fisher will likely remain active in terms of mergers and acquisitions, and ROCE may stay relatively low for an extended period, this adjusted metric helps us understand the potential return on capital that the company could achieve if it reduces its pace of acquiring businesses at some point in its lifecycle.

Author’s Representation

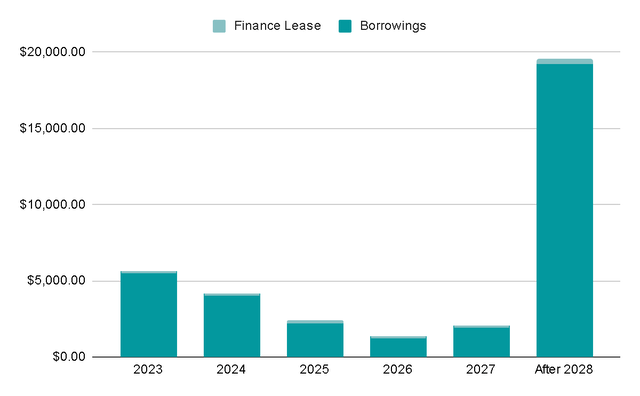

In terms of debt, the company currently maintains a Net Debt/EBITDA ratio of 2.6x, which closely aligns with the average ratio the company has maintained since 2010. A closer examination of the debt maturity schedule reveals that almost a third of it matures between 2023 and 2024. This could be a concern as it will require refinancing at potentially higher interest rates, which will directly impact the net income for FY2023.

However, the company’s debt levels remain somewhat manageable, and I believe that if the situation starts to get out of control, the company can take measures such as reducing M&A activity, buybacks, and dividends. Since most shareholders do not rely heavily on buybacks and dividends, such actions should not exert a significant influence on the stock price.

Author’s Representation

Valuation

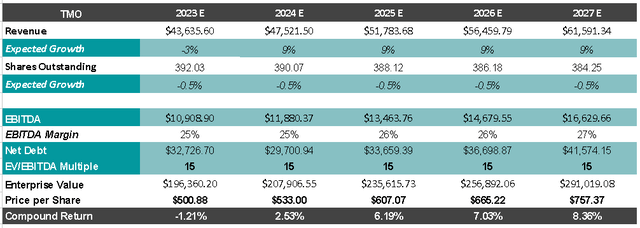

For the valuation, I decided to normalize the EBITDA margins since the COVID-19 tests caused the Life Sciences segment to experience higher margins than usual. From there, I believe that as the company gains scale and creates synergies with acquisitions, it can continue to slightly expand margins, as it had been doing in the years prior to 2020. The decrease in FY2023 revenues would align with the guidance shared by the board.

The 9% annual growth rate makes sense, considering the company’s organic growth, overall market growth, and the likelihood that TMO will continue making acquisitions. Furthermore, I find it feasible for the company to maintain its share repurchases at a rate of 0.5% annually. Lastly, I anticipate the Net Debt/EBITDA ratio will rise to 3x during FY2023 as margins tighten, and they have to refinance debt. After this, I intend to maintain the ratio around the historical level of 2.5x.

With a multiple of 15x EV/EBITDA, this would yield a price per share of approximately $750 by 2027, representing an annual return of 8.5% when factoring in the dividend. Although I typically seek returns of 10-12% per year for this type of business due to its quality, the current 8.5% seems unattractive to me. I would prefer to wait for $450 to have a margin of safety and an estimated return of 10% per year. However, if the price remains stagnant for a while and profits continue to grow, the current price could become attractive. Nevertheless, it’s uncertain whether this scenario will ever materialize.

Author’s Representation

Average EV/EBITDA of 15x (Seeking Alpha)

Risks

Acquisition Integration Risks: Thermo Fisher has a history of growth through acquisitions. Successfully integrating newly acquired companies can be challenging, especially when the company makes larger acquisitions due to its bigger size. Integration issues, unexpected costs, or difficulties in realizing anticipated synergies can pose risks to the company’s profits. This could even lead to an impairment if the company overpays for an acquisition or incorrectly estimates the synergies that would be created.

Short-Term Debt Issues: As we mentioned in the Key Ratios section, the company will need to refinance approximately one-third of its debt between 2023 and 2024. This will inevitably lead to an increase in interest expenses. Coupled with the fact that margins are normalizing, the leverage ratio is expected to significantly rise, potentially causing unease in the market.

I believe that the company can navigate this challenge due to the high level of experience within its management team. However, it’s a risk that should be taken into account, particularly in the short term.

Final Thoughts

The company has a remarkable history of delivering substantial returns to its shareholders, and at this point, its quality and capability are undeniable. Additionally, they have been successful in establishing recurring revenues, which provide greater predictability to their income.

The current valuation does not provide me with a sufficient margin of safety. While I acknowledge that I might be taking a very conservative approach with the multiples applied or the EBITDA margins, I believe that being conservative is especially relevant in the current complex macroeconomic environment. Therefore, I am assigning it a ‘hold‘ rating for now. However, without a doubt, this is one of the companies at the top of my watchlist, and I consistently keep it in mind.

Read the full article here