One of the most solid oil plays in the Canadian oil industry right now. The profit elves for Canadian Natural Resources Limited (NYSE:CNQ) break even at very low oil prices which means that CNQ is hedged very well against lower commodity prices and can through the cycle deliver sound and reliable earnings potential.

The company may be trading at a slight premium to the rest of the sector but I think we are going to have a tough time finding any more solid dividend opportunity in the space right now than CNQ. This leads me to rate it a buy.

Business Performance

CNQ stands as one of the leading and financially robust oil companies in Canada. It possesses an extensive asset portfolio comprising long-lasting, slowly declining oil and gas wells. While the majority of CNQ’s productive assets are situated in Canada, the company also maintains ownership of offshore wells located off the coast of Africa and in the North Sea, further diversifying its geographic presence.

CNQ primarily focuses on the production of synthetic crude oil (“SCO”) through its oil sands mining segment, which constitutes its largest commodity by production volume. Following SCO, the company’s production lineup includes heavy oil, natural gas, and, lastly, light oil and natural gas liquids. This diversified portfolio allows CNQ to efficiently tap into various segments of the energy market, contributing to its resilience and adaptability in response to changing market conditions.

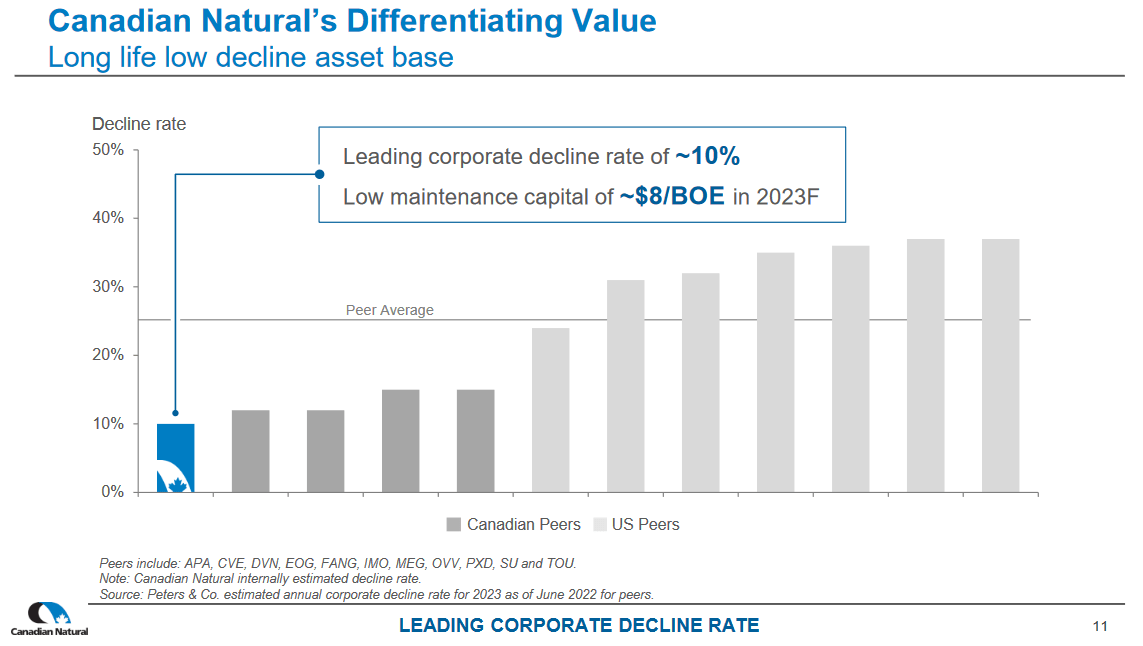

Value Prospects (Investor Presentation)

With CNQ you are getting an extremely profitable company in the energy space that doesn’t require a significant amount of capital to maintain operations. The low amount of maintenance costs for the company has been a major beneficial factor to the higher multiple the company is receiving in my opinion.

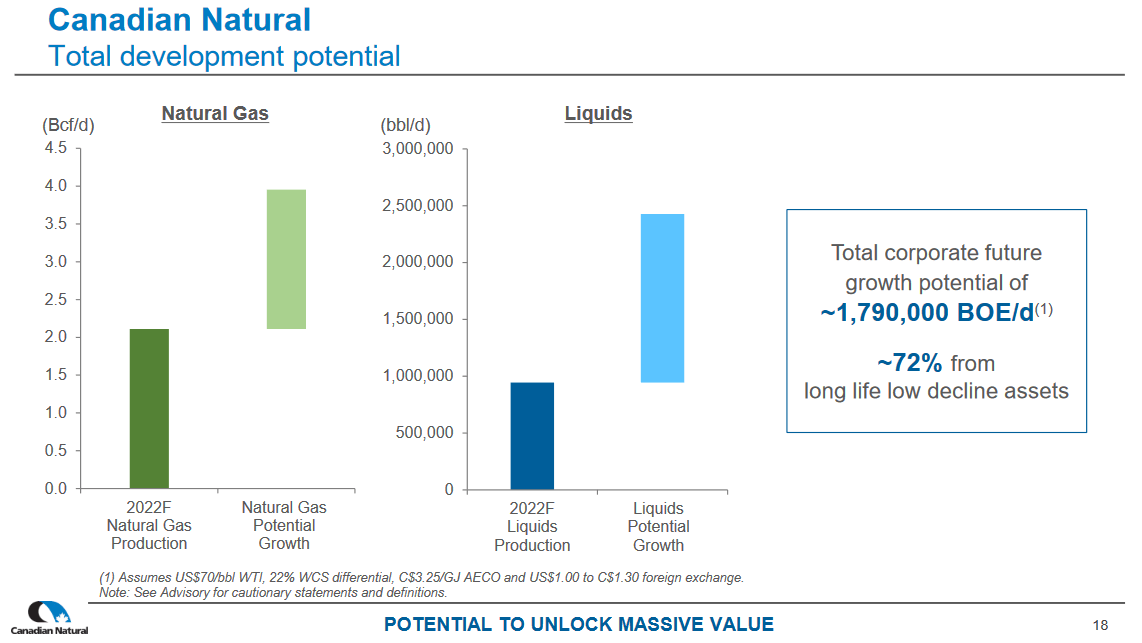

Total Developments (Investor Presentation)

Looking ahead the company seems to have a strong set of growth potential still in the pipeline. The natural gas part for example still has nearly 2x potential growth opportunities right now for CNQ. Besides this, CNQ has done a very good job at properly leveraging their long life and low decline assets which make up 72% of the productions right now.

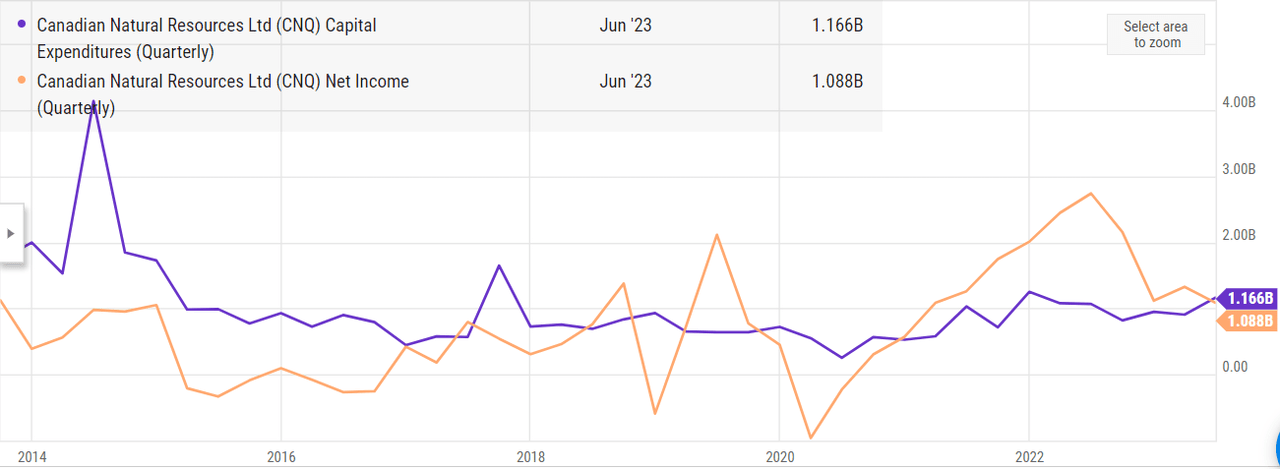

Company Growth (Ycharts)

For CNQ the company has done a very good job growing the bottom line, but we can see from the chart above here that even as capital expenditures may be stable, CNQ is still largely driven by volatility commodity prices for oil. With maintained levels at $8 per barrel though CNQ has been very much able to grow through the cycles and not risk having a negative bottom line. Back in 2016 the last time the company had a negative bottom line. The oil price was around the $30 mark and for the entire year, it averaged $43. This was a threshold for the company, but it’s reassuring that since then the operations have improved and the profit line is lower right now too.

Dividend Evaluation

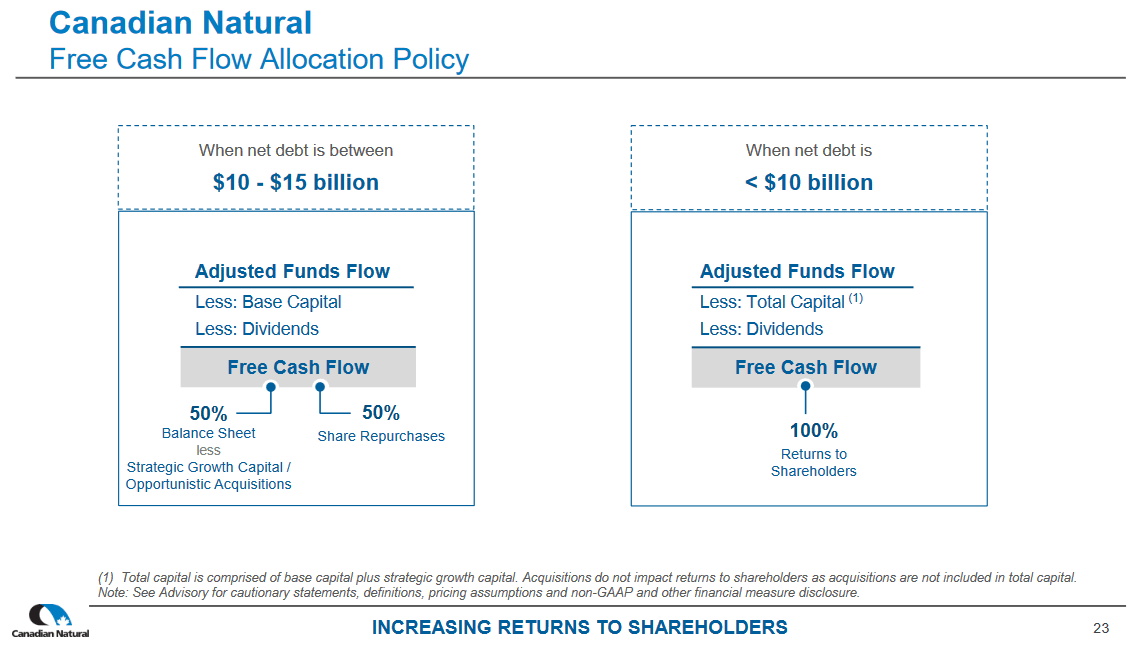

FCF Overview (Investor Presentation)

Looking at the picture above here we can see the capital allocations for the company right now. Right now the net debt for the company is below $10 billion so the capital allocations fall in the left part of the graph above here. This means 100% of it is being returned to shareholders. The company has been able to raise the dividend for 23 years in a row right now with a 21% CAGR since the beginning of it. What has been different in the last few years as the price of oil has greatly increased is more capital going to buying back shares instead. I think this is a very promising move from the company as it will result in a premium being applied as higher ROI is greater.

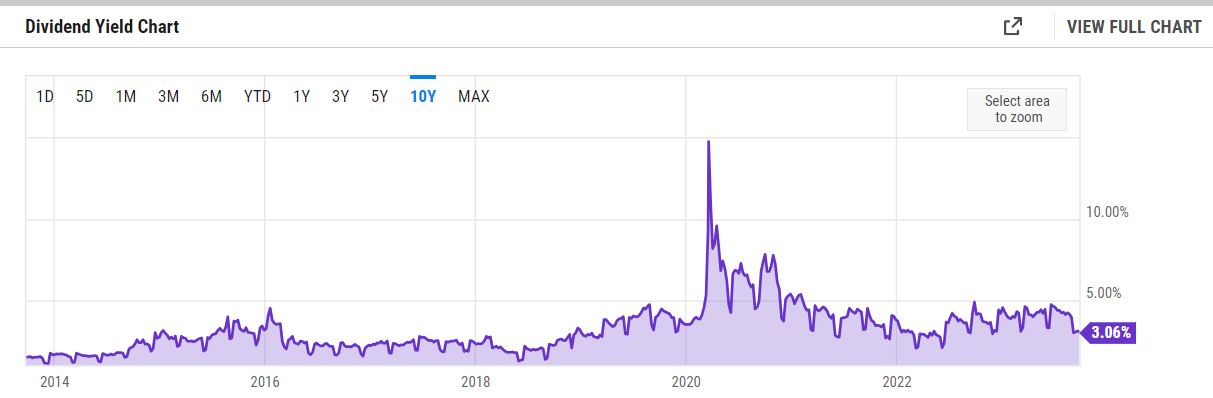

Dividend Yield (Ycharts)

Looking at the dividend yield for the company over the last couple of years it has grown a fair bit as CNQ delivers more and more capital to shareholders instead. Right now the FWD yield is at 4.15% for CNQ and together with the company also spending nearly $3 billion in the last 12 months on buying back shares I think they are in a confident financial position to raise the dividend further. Allocating more capital to the dividend may be a risky bet as if the price of oil rapidly declines the company may be forced to cut it. But in all honesty, with nearly $7 billion in TTM FCF, there is a significant possibility of raising the yield. In 2022 CNQ paid out $1.5 billion in dividends and I think it can be raised to $2 billion for sure. That would net a FWD yield of around 5.5%.

Risk/Reward

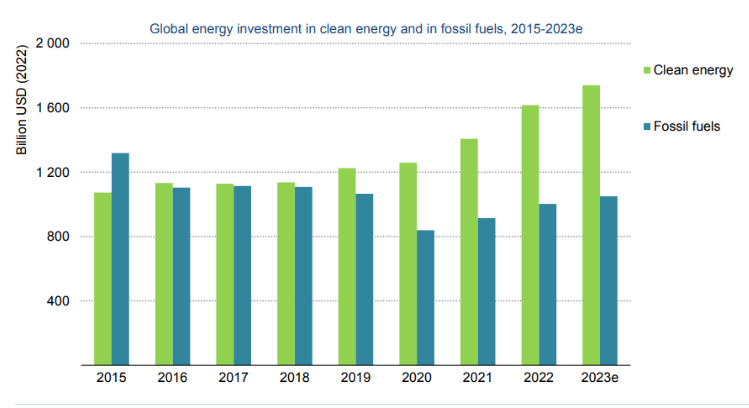

One of the key concerns some investors may have regarding CNQ is the shift towards increased spending and the growing emphasis on renewable energy generation, as opposed to traditional commodities such as gas and oil. While there is a growing focus on renewables, it’s important to recognize that gas and oil will continue to be essential energy sources for the foreseeable future. However, this changing landscape has indeed impacted the overall sentiment and perception of companies like CNQ in recent years.

Global Investments (Statista)

In addition to the regulatory challenges and the prevailing negative sentiment towards nonrenewable energy sources, CNQ faces the risk of a price correction, particularly because it is currently trading above the sector average based on both earnings and cash flows. A potential trigger for such a correction could be a significant decline in oil prices, potentially falling to levels lower than those observed in recent years. This price volatility in the oil market could have a notable impact on CNQ’s valuation and share price. What I think has contributed to CNQ trading at a higher multiple is the fact they have solid profit margins and oil has to reach quite worrisome low levels before CNQ would have a negative bottom line.

Key Notes

Right now I think that CNQ is one of the best possible companies in the oil industry if you want a strong dividend-paying addition to your portfolio. The company has a low bar for where profitability is reached and a maintenance cost of $8 per barrel. Reaching those low levels is unlikely and this just means that CNQ is cushioned somewhat against the downside. I think there is a significant chance that CNQ will raise the dividend further and a potential yield of over 5% is certainly there. Given the sound business model and reliable FCF, I am rating CNQ a buy now.

Read the full article here