Investment thesis

Our current investment thesis is:

- BRBR is benefiting well from a combination of industry tailwinds, as consumers increasingly seek a healthy lifestyle that incorporates exercise, as well as strong product and brand development. The expectation is that its low double-digit growth rate is sustainable going forward, as these factors continue to drive value.

- The broader nutrition industry looks to be growing well, with consumption data trending upward and BRBR’s development positively received.

- BRBR has higher margins than its peers and they are extremely attractive on an absolute basis. We believe the business is reinvesting to maintain its current trajectory, suggesting efficiencies in margins and cash flow are possible in the medium to long term.

- BRBR does appear expensive but we see sufficient upside, despite the risks of increased competition.

Company description

BellRing Brands, Inc. (NYSE:BRBR) is a prominent player in the consumer packaged goods industry, specializing in the development, marketing, and distribution of various nutrition products, including ready-to-drink protein shakes, powders, and bars. The company operates in the United States and has a notable presence in the health and wellness sector.

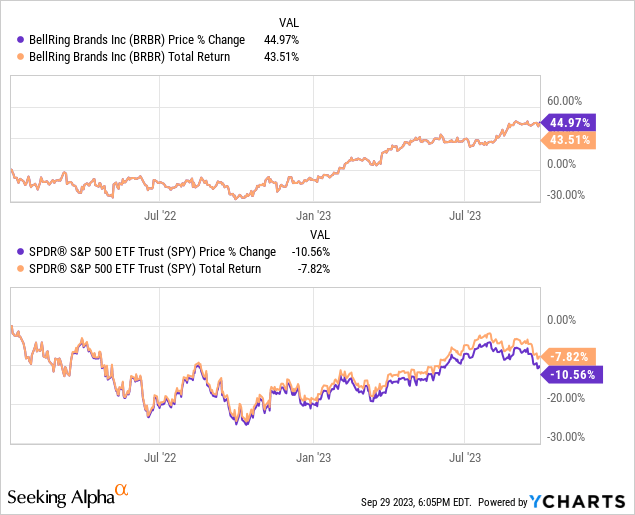

Share price

BRBR’s share price has performed well since the stock was listed, returning over 40% while the S&P has struggled. Although early to judge in detail, investors are broadly impressed by the financial development of the business thus far.

Financial analysis

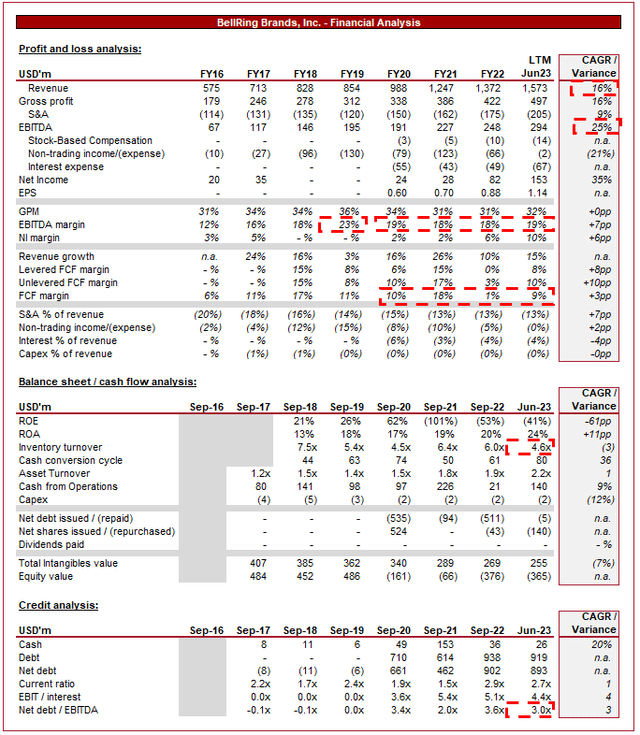

BellRing Brands Financials (Capital IQ)

Presented above are BRBR’s financial results.

Revenue & Commercial Factors

BRBR’s revenue has grown at an impressive CAGR of 16% during the last decade, with consistently strong results YoY, carrying into the LTM period.

Business Model

BRBR primarily specializes in protein-based products that cater to consumers’ health and wellness needs. These products include ready-to-drink (RTD) protein shakes, powders, bars, and other nutritional products.

The company operates under a range of well-known brands, including Premier Protein, Dymatize, and PowerBar. Each brand caters to different segments of the market, targeting athletes, fitness enthusiasts, and health-conscious consumers. The Dymatize brand has been growing extremely well in recent years, while Premier Protein and PowerBar remain strong.

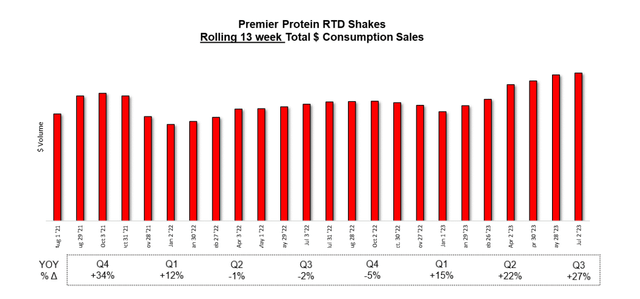

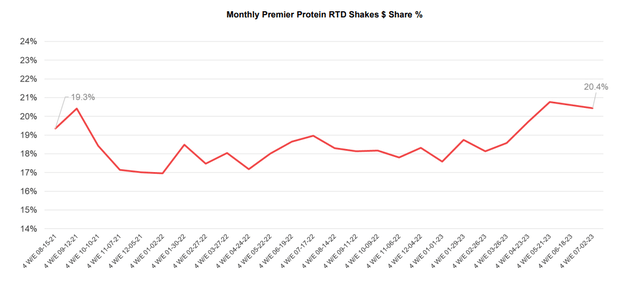

As the following graph illustrates, the consumption of Premier Protein has broadly remained resilient, despite uncertain conditions, contributing to an upward trajectory supported by pricing action.

Premier Protein (BellRing Brands)

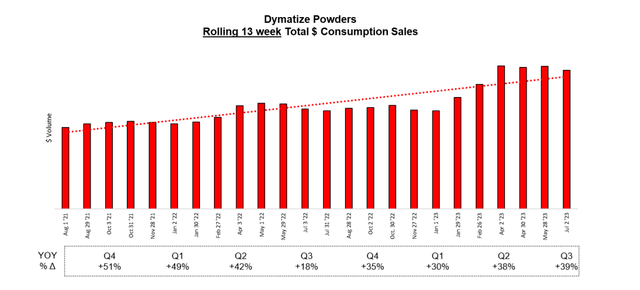

Further, the Dymatize brand is performing extremely well currently, with a strong double-digit upward growth trajectory. The expectation is for this to continue, as further brand development and consumer interest drive consumption.

Dymatize (BellRing Brands)

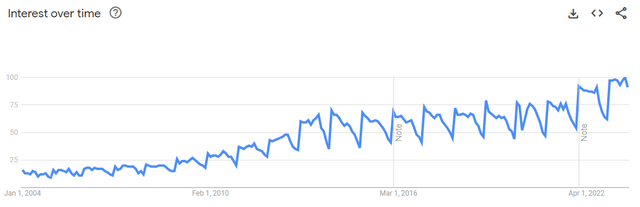

The following two graphs illustrate the commercial development that underpins the growth trajectory of its brands, with both Premier Protein and Dymatize seeing improved interest over time. The consistency of enhancement is critical as a key risk is that a short-lived trend is driving the uptick.

Premier Protein (Google) Dymatize (Google)

BRBR distributes its products through various channels, including grocery stores, convenience stores, online retailers, and specialty health stores. This diverse distribution approach ensures wide market reach and accessibility, seeking to exceed its competitors via exposure.

The company emphasizes product innovation, frequently introducing new flavors, formulations, and packaging to keep up with changing consumer preferences and trends. New flavors are key because the consumption of these types of products can be unsavory otherwise. Further, the continuous consumption of the products can lead to a lack of desirability and interest in new flavors. Additionally, fundamentally creating new product types is beneficial as it allows BRBR to utilize its brands to increase exposure to the industry. RTD protein shakes and bars provide consumers with convenience, resulting in increased demand. We see further opportunities in this segment.

This is a rapidly changing industry with consumer trends adapting rapidly to new product launches and new solutions. For this reason, this is highly important and a key strength of the business we feel, given its track record.

As the following illustrates, RTD Shakes share accelerates on flavor introduction, contributing to a broad increase during this period.

Share % (BellRing Brands)

Finally, the company leverages e-commerce and direct-to-consumer channels to connect directly with customers and offer a convenient way to purchase its products. This is increasingly becoming a key access point for consumers, as they seek convenience and have enough knowledge to go direct rather than to compare choices (such as through traditional retailers). This is beneficial for BRBR as the economics of each sale is higher, contributing to margin improvement.

Nutritional Products Industry

BRBR competes with other nutrition and snacking companies such as The Simply Good Foods Company (SMPL), Glanbia plc (OTCPK:GLAPF), and Premier Nutrition Corporation, among many others. Competition is based on brand strength, product quality, and innovation.

BRBR has capitalized on the growing consumer demand for health and wellness products, especially those that offer high-quality protein and nutritional benefits. This trend has been driven by greater awareness of the benefits of exercise and a healthy lifestyle. We suspect this will continue long term, primarily due to the marketing support by Governments and businesses to underpin the benefits to society.

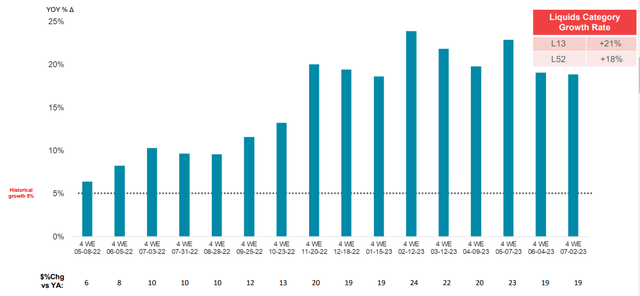

The following illustrates that the liquids category continues to outpace historical growth levels. The consistency of this is why we believe it has staying power.

Liquids growth (BellRing Brands)

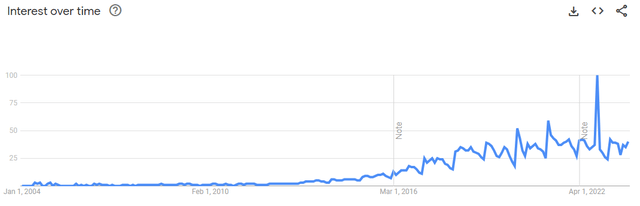

The demand for Protein, in particular, has substantially increased. Protein is a sought-after nutrient for muscle recovery, weight management, and overall wellness. As the following graph shows, the interest in “Protein Shakes” has consistently increased, underpinning the demand for related products. With the growth interest in healthy lifestyles, many are going down the route of exercise and the subsequent products that can enhance their returns from this. Supplementing protein from meals is an incredibly useful way to achieve this, making protein products sought after in increasing numbers.

Protein Shake (Google)

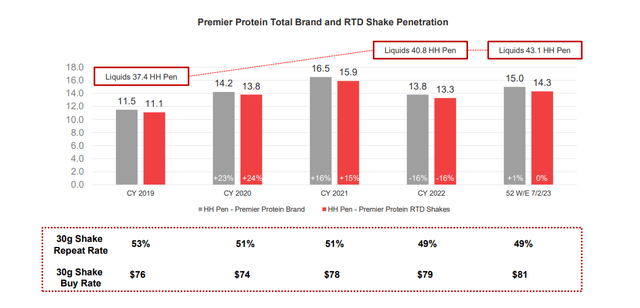

BRBR has responded to this trend well, with strong household penetration which remains on an upward trajectory. This is supplemented by product development, both flavors and formulation.

Market penetration (BellRing Brands)

Competitive Positioning

We believe BRBR’s key competitive advantages are:

- Well-Known Brands. The company’s portfolio includes reputable brands that consumers trust for quality and effectiveness.

- Innovative Product Offerings. Introducing new flavors, formulations, and packaging keeps the product lineup exciting and relevant to changing consumer tastes.

- Packaging and Branding. Attractive packaging and branding contribute to shelf visibility and consumer appeal.

- Retail Partnerships. Distribution through various retail channels ensures that BRBR’s products are accessible to a wide range of consumers and in conjunction with its brands allows for preferential shelf space.

Margins

BRBR’s margins are impressive, although have not materially improved in the last few years at an EBITDA-M level despite the increased scale. This is a reflection of competition with the industry and the need to reinvest in the company’s operations to drive future growth.

We suspect further improvement is possible with operating cost leverage, but is unlikely to be realized in the near term as BRBR’s growth trajectory is supported.

Balance sheet & Cash Flows

BRBR has utilized debt to support growth, with interest comprising 4% of revenue and an interest coverage ratio of 4.4x. This level is not overly concerning and we would expect future growth to dilute this ratio.

Inventory turnover has noticeably declined in at Jun23, implying a slowdown in demand. Although this has not yet been felt at a revenue level, this must be monitored as it could be the early signs of a slowdown in near-term growth.

Outlook

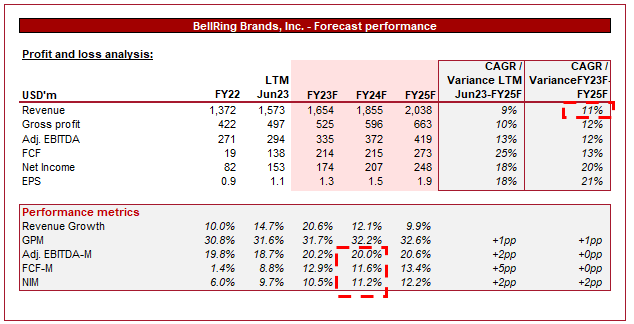

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a continuation of the company’s strong growth, with a CAGR of 11% into FY25. Further, margins are expected to incrementally improve, although not to the degree achieved in recent years.

The growth targets appear broadly reasonable, although we note significant scope for upside beyond this through new product launchings and M&A. Further, we believe the margin expectations lean toward conservative but given the natural expectation of growing competition and reinvestment, this is an understandable view.

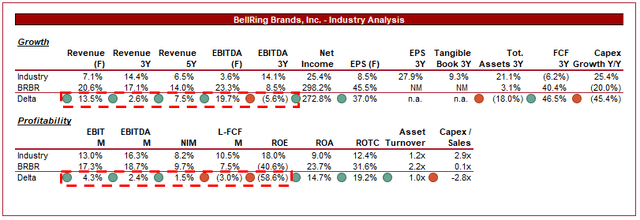

Industry analysis

Personal Products Stocks (Seeking Alpha)

Presented above is a comparison of BRBR’s growth and profitability to the average of its industry, as defined by Seeking Alpha (18 companies).

BRBR performs extremely well when compared to its peers. The company has achieved noticeably better growth across the period, in both revenue and profitability. This is primarily a reflection of the industry tailwinds experienced, in conjunction with the company’s strong market penetration. We expect this trend to continue into the medium term at a minimum.

Further, the company boasts superior margins, although slightly lacks in FCF. Again, with strong demand and an above-average trajectory, the business is positioned to price aggressively relative to costs. This should be a maintainable advantage that can be built on with further scale.

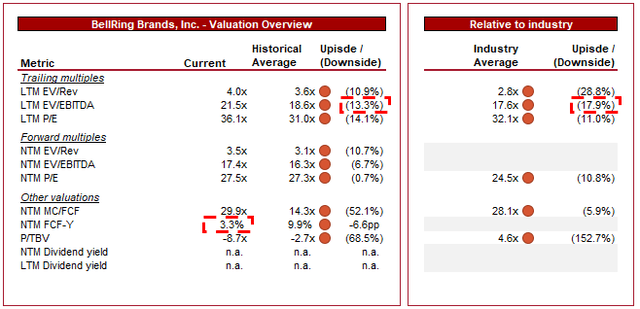

Valuation

Valuation (Capital IQ)

BRBR is currently trading at 22x LTM EBITDA and 17x NTM EBITDA. This is a premium to its historical average.

BRBR’s premium to its historical average is undoubtedly warranted, owing to the company’s increased scale, continuation of industry tailwinds, and financial/commercial improvement.

Further, a premium to its industry average appears reasonable, particularly due to the sustainability of its financial superiority and the attractiveness of the industry in the medium term.

We believe there is still value to be extracted from BRBR, as its growth rate appears sustainable. Further, as the business transitions toward maturity, operational efficiencies should allow for margin and cash flow improvements.

Key risks with our thesis

The risks to our current thesis are:

- Growth slowdown. BRBR’s valuation is noticeably above its industry average, with growth partially priced in by investors. This increases the risk of an adverse share price response to a weak quarterly result. We would not consider this an issue, and with inventory turnover declining and some weak periods for consumption, the chance of this is not minimal.

- Increased competition. Due to the high margins, this is a highly attractive industry and so the risk is that new entrants will drive prices down and slow growth. Our expectation is that brand building and product development will give the company a sufficient position that this risk is not a material concern.

Final thoughts

BRBR is an attractive business in our view. The industry is experiencing a substantial tailwind that we suspect will continue in the coming years. Although the company has materially benefited from this, much credit must be given to Management for brand building and product development. The company has a strong suite of brands and products, that we believe are positioned well to outperform in the coming years.

BRBR is not cheap but given its outperformance relative to its peers and its impressive margins, we believe investors are rewarded adequately.

Read the full article here