Article Thesis

Suncor Energy Inc. (NYSE:SU)(TSX:SU:CA) is one of the largest oil sands players in Canada. The company reported its most recent quarterly results on Monday, easily outperforming expectations and showing strong profitability while producing massive cash flows. Thanks to asset transactions and sizeable shareholder returns, Suncor could be a rewarding investment going forward.

What Happened?

Suncor Energy Inc. announced its first-quarter earnings results on Monday evening, following the market close. The headline earnings number can be seen here:

Seeking Alpha

While it was pretty clear that Suncor Energy would report profits below the previous year’s level, the company nevertheless was able to beat estimates easily. The company’s adjusted (non-GAAP) net profit was down 34% year over year, while adjusted earnings per share declined by 29% over the same time frame — the difference can be attributed to the decline in Suncor’s share count due to the buybacks the company has done over the last year. The profit decline was caused by weaker energy prices, as both oil and gas prices have pulled back from the very high levels seen in 2022.

Compelling Underlying Performance, Asset Deals, And Shareholder Returns

The good news is that Suncor still was highly profitable during the period, despite the earnings pullback that was caused by commodity price movements. This can be explained by the fact that its most important assets, its oil sands operations, have relatively low break-even costs. Starting up these assets requires hefty upfront investments, but those were already paid for in the past. Now, proportional or variable costs are pretty low, meaning Suncor still is generating sizeable margins with oil prices in the $70 to $90 range. The Q1 earnings pace of C$1.81 billion, which is equal to around US$1.36 billion, makes for annual profits of C7.2 billion, or US$5.4 billion. For a company that is valued at around US$39 billion, that’s pretty attractive.

The picture gets even better when we look at Suncor’s cash flows, however. While the investments for its oil sands assets were made in the past, the company still accounts for these investments via depreciation on its earnings statement. Depreciation is a non-cash cost and does not impact Suncor’s cash flows, however. Like most other oil sands players, which all benefit from low capital expenditure requirements and low break-even costs, Suncor thus generates cash flows that are substantially higher than its profits.

Operating cash flows can be lumpy due to working capital movements, which is why Suncor also uses a metric that backs out the impact of working capital builds and releases. Its adjusted funds from operations (basically operating cash flows adjusted for non-cash working capital movements) totaled C$3.0 billion during the quarter, or C$12 billion on an annual basis. This is equal to around US$2.25 billion and US$9 billion, respectively — again, Suncor is valued at just around US$39 billion today. Suncor can’t return all of that to its owners, as maintenance and growth capital expenditures have to be financed from its funds from operations as well. That being said, Suncor’s potential for shareholder returns is still massive. The company has guided for sustaining capital expenditures of around C$3.3 billion this year, which translates into distributable cash flows of around C$8.7 billion for the current year at the Q1 cash flow pace. If Suncor would not pursue any growth, that’s what the company could spend on shareholder returns via dividends and buybacks and on debt reduction. Suncor will spend some money on growth projects (what it calls economic capital), via organic expansion, and via M&A, but even after that, its free cash flows should be pretty strong:

The company forecasts economic capital spending of C$2.2 billion for the current year, which means that its free cash flows will total around C$6.5 billion this year before accounting for dispositions and acquisitions. For a company valued at C$52 billion, that’s pretty strong, as it makes for a free cash flow yield of around 12.5%, with some growth spending already being accounted for.

Suncor has, in the recent past, made some moves to simplify its operations and to refocus the company on its core assets centered on Canada’s oil sands. During the most recent earnings call, the company’s CEO Richard Kruger stated [emphasis by author]:

My overriding objective for Suncor is to deliver industry-leading performance. I believe we can achieve this by driving clarity and simplification throughout the organization, and by instilling a laser-like focus on the fundamentals of safety, operational excellence, reliability, and profitability.

This will be done via several asset transactions that Suncor has closed during the first quarter or that it plans to close during the remainder of the year. The company has, for example, agreed to an asset purchase of TotalEnergies’ (TTE) Canadian oil sands assets in a C$5.5 billion deal (around US$4.0 billion). This includes TotalEnergies’ stake in the Fort Hills oil sands play. The company explains [see link above; emphasis by author]:

Upon closing, Suncor will be the sole owner and operator of Fort Hills. This transaction, in addition with the previous acquisition of 14.65% interest in Fort Hills from Teck Resources Limited (TECK) in the first quarter of 2023, adds approximately 163,000 bbls/d of bitumen production capacity to Suncor’s portfolio.

For a company the size of Suncor, a ~160,000 barrels of oil per day increase is hefty — the company generated around 740,000 barrels of oil equivalent per day during the most recent quarter. On top of that, the acquisition of TotalEnergies’ oil sands assets will also give Suncor a 50% stake in the Surmont in site asset, which will be jointly owned with ConocoPhillips (COP). In order to (partially) finance the TTE asset deal and the previous Teck Resources asset deal, Suncor has agreed to some asset sales. This will also make Suncor’s portfolio less complicated and more focused and could bring down management, general, and administrative expenses. Suncor sold its wind and solar assets for C$730 million during the first quarter and agreed to the sale of its E&P assets in the United Kingdom for a total of C$1.2 billion. Due to the UK’s windfall taxes, that seems like an appropriate move to me.

These asset deals will be accretive to Suncor’s cash flows, according to management, which is why the company plans to hike its dividend by 10% following the closing of the TTE asset deal. With a current dividend yield of 5.3%, that will make for a nice jump in the income investors will receive from SU.

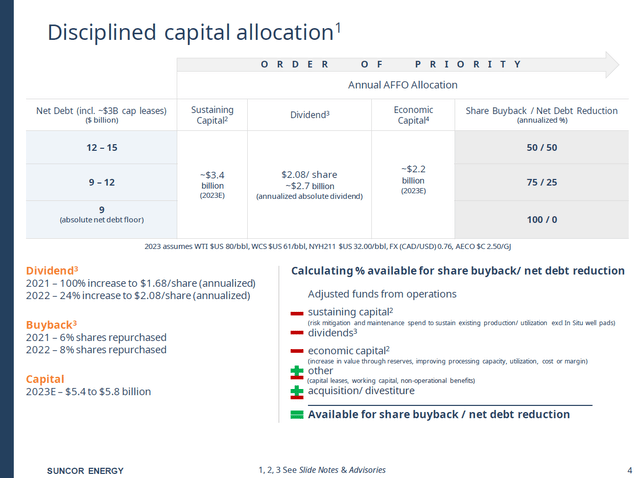

Suncor Energy’s strong free cash generation is used according to the company’s capital allocation strategy which is explained in the following chart:

Suncor presentation

Depending on how high SU’s net debt is, the company will use a changing portion of its free cash flows for debt reduction. With net debt north of C$12 billion, 50% of free cash flows are used for debt reduction, with the remainder used for buybacks. Note that the company means post-dividend free cash flows, thus dividends are accounted for before the 50%/50% split. When net debt declines to less than C$12 billion, the company will put more focus on buybacks — and once net debt has hit a floor of C$9 billion, debt levels will not be reduced further, as Suncor plans to put all of its excess free cash flows towards buybacks at that point.

Despite the fact that Suncor is still pushing for debt reduction at a sizeable pace, it still has lowered its share count drastically over the last two years — the reduction totaled 14% in that time frame. While free cash flows will likely be lower this year, due to lower energy prices, the company should still be able to buy back a very meaningful portion of its shares. During the first quarter alone, Suncor spent C$870 million on buybacks, which is good for a ~7% buyback pace. Following the TTE asset deal, when cash flows will most likely be higher, the buyback pace could accelerate further.

Takeaway

Suncor Energy stock is a compelling energy investment, I believe. Long-life, low-decline, low-cost assets, a low valuation, hefty shareholder returns, and upcoming benefits from recent asset transactions could make for attractive total returns going forward.

Read the full article here