Investors should hold shares of the Bank of Montreal (NYSE:BMO).

2023 has been a tough year for many firms in the banking industry. BMO has not been immune to this trend as its shares are down six percent year-to-date. The key question examined throughout this article is whether or not BMO provides a suitable investment opportunity for value-oriented individuals. Moreover, investors looking for dividend opportunities have also come to the right place. BMO currently boasts a dividend yield above five percent, and has grown its dividend over the past seven years. The effects of this trend will be thoroughly analyzed in the context of BMO’s valuation. Finally, investors will also receive insight into how BMO stacks up compared to its competitors.

Catalysts and Outlook

There are several catalysts that prospective investors should consider prior to making an investment in BMO:

1. Bank of the West

Founded in 1874, Bank of the West grew to be California’s 11th largest bank with much of its business centered in the Silicon Valley. French-based BNP Paribas (OTCQX:BNPQF) acquired Bank of the West’s 50 branches in 1979 to strengthen its existing operations across California. Bank of the West grew immensely under the BNP Paribas umbrella. By 2002, Bank of the West consisted of nearly 500 branches spread across six states. Operations would continue to be relatively robust, and BNP Paribas exited its ownership stake in Bank of the West in late 2021. BMO purchased Bank of the West and, upon closure in early 2023, announced:

Over Labor Day weekend later this year, we expect to complete uniting our networks, resulting in more than 1,000 BMO branches across the U.S. and an active presence in 32 states.

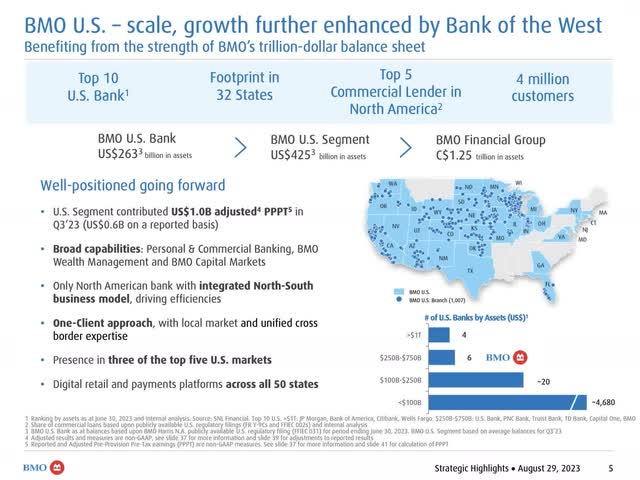

The proliferation of BMO’s commercial banking operation across the United States has been a major growth catalyst. BMO’s U.S. Segment, with $425 billion in assets, adds considerable diversification to the firm’s total operations.

BMO 3Q 2023 Quarterly Presentation

2. Digital First

Many banks have outlined strategies to capitalize on consumer’s desires for streamlined banking processes. BMO offers V-Payo:

This product offers clients greater automation, process efficiency, and digitization through an integrated payables experience utilizing a virtual card optimization process for B2B payments.

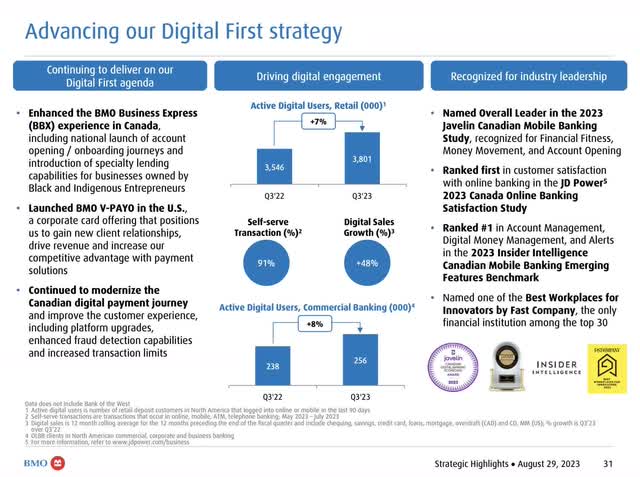

This financial technology is an effort to capitalize on the popularity of technological innovation, and BMO has been recognized by several agencies for its industry leadership. In addition, the firm has experienced a 7% and 8% year-over-year growth rate in the number of its digital retail banking users and commercial banking users, respectively. If BMO can continue optimizing its digitization, and utilize this process to supplement its existing operations, then the firm will likely experience improved margins and operating metrics.

BMO 3Q 2023 Quarterly Presentation

3. Interest Rates

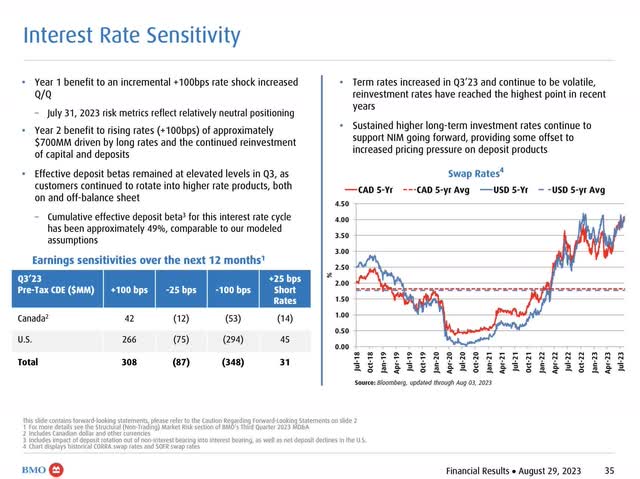

Global inflationary pressures have led to many central banks raising interest rates in an effort to cool overheating economies. BMO is particularly sensitive to the actions of the Federal Reserve and Bank of Canada. Analysts at the firm have modeled that continued rate hikes would benefit the firm, while falling rates would likely be detrimental. Investors concerned with BMO’s net interest margin may be interested in the outlook that Federal Reserve Chairman Jerome Powell offered during the Jackson Hole Economic Symposium a few weeks ago. Powell seems to believe that continued rate hikes may be necessary, but it is likely that significant slowdowns in GDP will trigger cuts in interest rates. Any of these macroeconomic events will have far-reaching events on BMO and other banks.

BMO 3Q 2023 Quarterly Presentation

4. Credit Quality

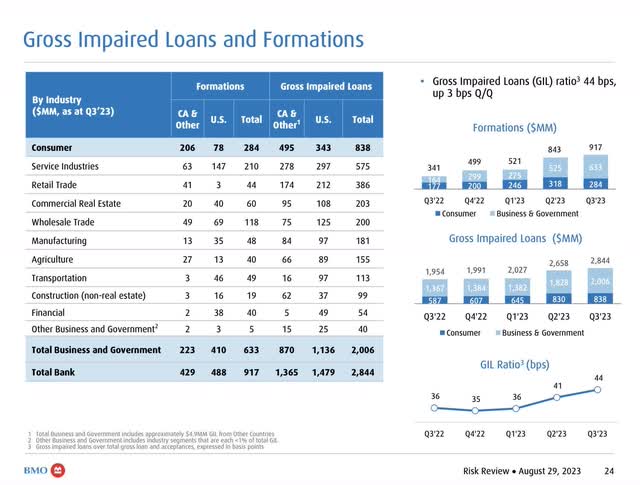

Rising interest rates have contributed to existing challenges for borrowers. As the cost of debt has risen, it is not surprising that many lenders have reported increases in non-performing loans. BMO has not been immune to this trend, and has experienced a considerable year-over-year increase in gross impaired loans. Ideally, BMO’s loan officers and financial managers have accounted for this risk and tailored their operations to meet the rise in delinquency. However, investors must consider the negative effects of this trend on BMO’s bottom line and imagine the struggles that could materialize should a recession occur.

BMO 3Q 2023 Quarterly Presentation

Valuation

Companies in different industries require distinct valuation methods. While a discounted cash flow model may be appropriate for firms in high-growth industries, banks are generally valued based on balance sheet multiples. Issues with U.S. GAAP accounting are partially to blame for this distinction, but this is remedied by the fact that the majority of a bank’s assets are carried on the balance sheet at their fair values. Therefore, BMO was valued through a combination of a peer group price to tangible book value multiple and a dividend discount model.

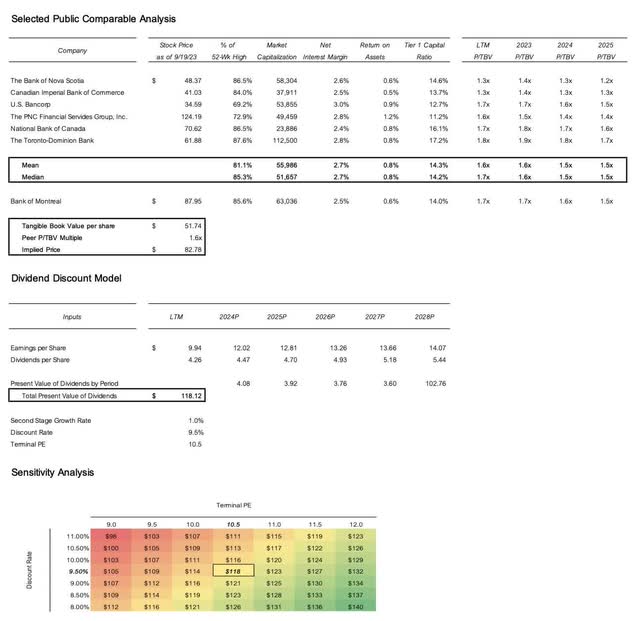

Several considerations were made when selecting an appropriate peer group for BMO. Market capitalization based on share price multiplied by shares outstanding was the main criteria applied to potential comparable companies. Moreover, the geographic distribution, total deposits, and number of branches were also considered. A selected peer group of the Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CM), U.S. Bancorp (USB), PNC Financial Services Group (PNC), National Bank of Canada (OTCPK:NTIOF), and Toronto-Dominion Bank (TD) was formed. This seems to be an appropriate peer group given the similarities in each firm’s business model and strategic objectives.

S&P Capital IQ provided relevant net interest margin, return on assets, tier 1 capital, and price to tangible book value data. Moreover, the average and median of these values for the peer group was calculated to provide a good relative comparison to BMO. The results are mixed with respect to whether BMO is overvalued or undervalued. The 1.6 times price to tangible book value peer multiple implies that BMO is worth $83 per share instead of $87. However, multiples valuation alone is not sufficient to prove whether a firm is fairly valued since forming a peer group is quite subjective.

A dividend discount model was used to find the firm’s intrinsic value. BMO has a history of paying dividends to shareholders, and these cash flows were used to value the firm. The inspiration for using a DDM was taken from David B. Moore, a CFA with Marathon Capital Holdings in San Diego, California. Mr. Moore published a guide on valuing community banks whereby he argues the merits of using a DDM to price bank stocks.

Based on the firm’s future discounted dividends, BMO has an intrinsic value of $118 per equity share. This can be further amended to a target range of $98 to $140 per share, which implies significant upside. With respect to assumptions included in the base-case model, a 9.5% discount rate was used in addition to earnings and dividends estimates taken from Capital IQ. Moreover, a second-stage growth rate of 1% was used along with a terminal price to earnings ratio of 10.5. Please remember that these are estimates and are meant to illustrate a reasonable base case that does not consider a significantly negative or positive event.

Author’s Model

Summary

BMO is a strong bank with a proven track record of success. However, key valuation indicators point to the firm being fairly valued at the present moment. There is not a suitable margin of safety to justify an investment in BMO because the current market is still far too uncertain. If BMO can demonstrate a continued commitment to profitability through technological transformation, then the firm likely represents a suitable investment option. Perhaps, BMO preferred shares (BMO.PR.F:CA) are a better choice at present. This security has less price volatility and still pays a yield in excess of five percent.

Read the full article here