Investment Thesis

Having skipped the expected wild ride shortly after its US stock market debut, I am finally ready to start looking at VinFast (NASDAQ:VFS) stock. It is currently down about 85% from its highs, but that on its own is never a reason to think that a stock is a bargain. Several factors make VinFast perhaps a long-shot investment but with some potential advantages relative to other startup EV makers. Some of those advantages include perhaps some aspects that few may have thought about, such as a potential geopolitical edge. For instance, while EV makers that call either China or the US-led Developed World alliance their home face having the other side’s market restricted to their cars, Vietnam and by extension VinFast are sitting pretty, potentially being able to access all major markets, with few barriers, since no one wants to alienate a rising neutral middle power country in Asia, thus gain a new potential enemy.

There are of course also endless potential pitfalls along the way, including risks related to the execution of its expansion in foreign markets, questions about the quality of its cars, as well as EV market risks, with growing signs that we may be getting close to the point where EV adoption may slow down dramatically, even as the global car industry keeps ramping up EV production. This is therefore a highly speculative investment opportunity, and I intend to treat it as such, as part of my overall portfolio.

VinFast sees decent growth in revenues, and it is looking to expand into major markets

For the second quarter of this year, VinFast saw a significant increase in revenues to $334 million, up from $145 million for the same quarter from a year earlier. Its quarterly net loss has been more or less steady at $527 million, versus a loss of $574 million for the second quarter of last year. Even as its R&D costs are declining it is incurring higher costs due to its efforts to scale up production and sales. Capital expenditures increased from $131 million in Q2, 2022, to $341 million for the same quarter of this year.

The reason why it needs to spend far more on capital costs is because it is investing in an assembly plant in North Carolina, which is set to eventually produce 150,000 units/year. Reports that it also wants to enter the EU market suggest that we will see a significant need for cash for the foreseeable future, which means probably more debt and stock dilution to finance it all. This phase will probably last for years, with steady profits, if the company will ever reach that stage, which is a reality that we will only reach in a very distant future. In the meantime, regardless of its overall trajectory in terms of stock price, this will be a wild rollercoaster ride for investors.

Geopolitical realities may be VinFast’s greatest advantage over EV peers

Just recently, The EU announced that it intends to investigate China’s EV industry over unfair subsidies, whatever that may mean within the context of most major economies being engaged in lending support to their domestic EV industry. The US & China are likely to mutually undermine each other in this respect as well. There are even grounds for the US & the EU to come to blows. Such is the nature of great powers’ economic competition that we see unfolding before us.

Within this context, Vietnam finds itself in what I see as a geopolitical sweet spot. It has strong economic ties with the US, China, and the EU, but it is not allied with any of them and it successfully managed to avoid getting sucked into any alliance against other powers. It is somewhat similar to India’s non-aligned position, where no one wants to antagonize them too much for fear of pushing them into the other camp. We are going through a phase in the global great power competition game, where countries that still exercise a certain extent of sovereignty and independence have a great deal of leverage. What this means for Vietnam’s VinFast is that it is unlikely to be met with similar levels of hostility.

It might even be the case that VinFast will be met with favorable conditions as a way to draw Vietnam into one of the opposing camps. In other words, while most of the automakers are caught in the crosshairs of other major economic powers, VinFast might benefit from the geopolitical desire to tie a middle power like Vietnam in Asia to one camp or another economically.

The global EV market might face an oversupply issue, due to high production growth, and slowing sales growth, making VinFast’s timing for expansion less than ideal

Not all the external factors affecting VinFast’s future outlook are necessarily bright.

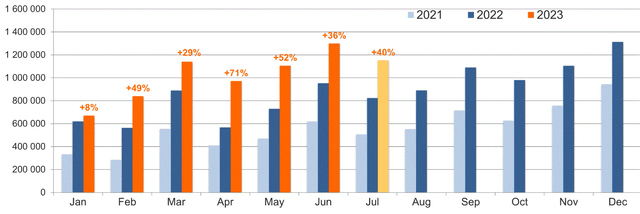

EV-Volumes

As we can see, global EV sales growth continues to be robust. On the face of it, VinFast is entering a booming market. Taking a step back, keeping in mind that much of the global car industry is transitioning to mostly producing EVs, sales growth is arguably lagging what might be needed to transform most global conventional car sales into EV sales.

Global car sales are around 70 million units per year. As we can see, this year it might be on pace to sell about 10 million EVs, which is impressive. Based on some very recent reports, however, there is starting to be an EV inventory overhang, as EV makers are now producing more EVs than there are buyers, at least in the US. This in my view shows that we are starting to reach the point where we are running out of potential buyers who are willing to give EVs a chance, most likely because for them, it does not meet their needs. VinFast wants to produce and sell 150,000 EVs in the US in a few years. It is far from certain whether the demand will be there.

VinFast is facing some quality issues

VinFast’s VF8, an SUV which is currently its calling card, has an EPA range of 207 miles, which is far below similar EVs priced in the $50k range. There are SUVs with a lower starting price, like the Fisker Ocean that offers a 350-mile range and has a significantly lower starting price. The VF9, with an EPA range of over 300 miles has the range to make it practical for most drivers, but the price is far from being accessible to most consumers since it starts at over $80k. There are also apparently some serious electronic and other deficiencies that need to be addressed, which will make these cars, that are far from being cheap, a hard sell if they are not resolved.

This is important because as long as the quality/price offer is not there, it matters very little that the major EV markets of the world are likely to remain open due to Vietnam’s favorable geopolitical positioning, as long as what they have to offer is not an attractive concept overall, it is likely to face difficulties selling its cars, even if it does manage to ramp up production. This is especially the case, given that we are no longer in the era of waiting times for people to get their EVs. The price/quality competition is just starting to heat up, therefore companies like VinFast are likely to struggle to gain market share from already-established carmakers.

Investment implications

It is important for investors not to lose sight of what it means to invest in this stock. It is a startup, within the context of a booming industry, namely EVs. I bought some shares at $12/share when the market cap was at around $30 billion even though fundamentally, perhaps $8/share makes more sense. I am still prepared to buy at least as many shares if it reaches about $8/share as I did with my first initial investment. I do believe that the odds of this stock reaching that price are high, but not guaranteed, which is why I decided to take a nibble at current price levels.

Even assuming that I will buy more of this company’s stock at a much lower price, VinFast will only make up around 1% of my total portfolio. This is very much a high-risk, high-potential reward opportunity, therefore it does not fit my overall more conservative investment strategy to invest a high proportion of my portfolio in such a company. While VinFast’s success has the potential to yield very high rates of return for investors from the current stock price, as I explained in this article, there are plenty of potential pitfalls along the way, that can wipe this company out within the next few years. There are internal pitfalls, such as quality issues, as well as external, such as the increasingly oversaturated EV market. I am approaching this investment having in mind the need to be prepared for either of the two potential scenarios playing out.

Read the full article here