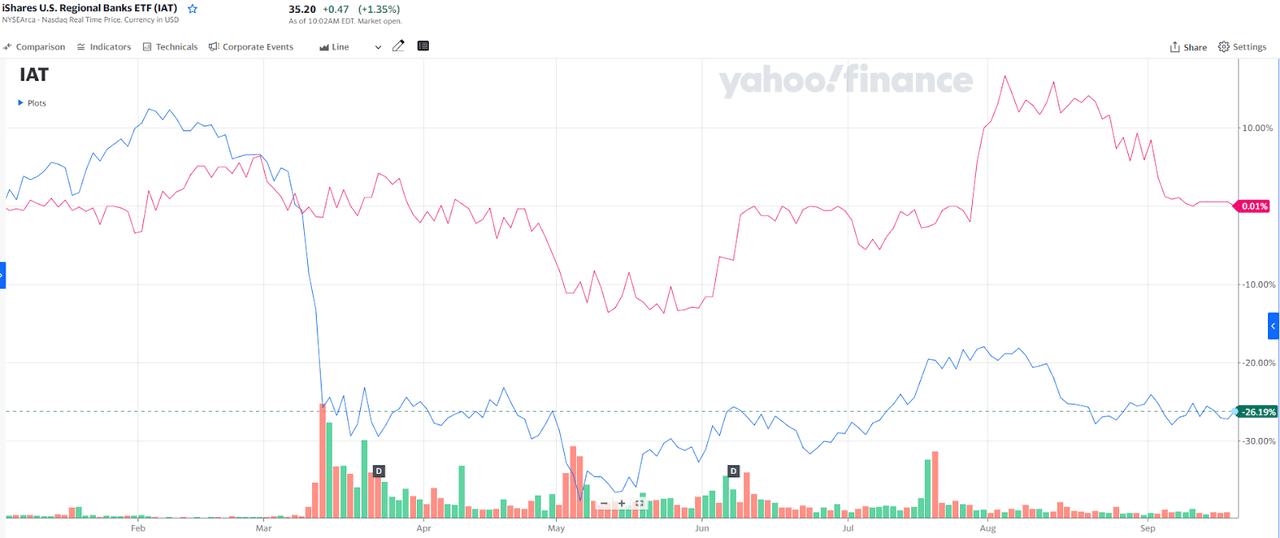

In a financial landscape fraught with uncertainty, volatility, and increasing interest rates, FinWise stood as a beacon of stability and growth. As the tumultuous winds of Silicon Valley Bank’s challenges swept through the industry, regional banks found themselves on shaky ground, some witnessing an erosion in deposits as clients sought refuge in larger institutions or products providing higher interest rates. The fallout was swift and severe, causing many regional banks to lose nearly a quarter of their value overnight (see chart below under “Macro Environment: Difficult but Stabilizing”).

However, amid this financial tempest, FinWise emerged unscathed, its foundation further fortified and its prospects brighter than before. In this update on FinWise, I’ll share why. It includes a breakdown of their loan portfolio, a potentially new LaaS partner and partner expansions, Cross River Bank troubles, and a new share price target based on the current macro environment.

Macro Environment: Difficult but Stabilizing

In the first half of the year, during Silicon Valley Bank’s turmoil, multiple regional banks witnessed a reduction in deposits as clients transferred their non-FDIC insured cash to banks deemed “too big to fail” or accounts offering higher interest rates. This resulted in regional banks losing nearly a quarter of their value overnight.

Yahoo Finance

FinWise, depicted by the pink line above, emerged from this scare unscathed and arguably stronger.

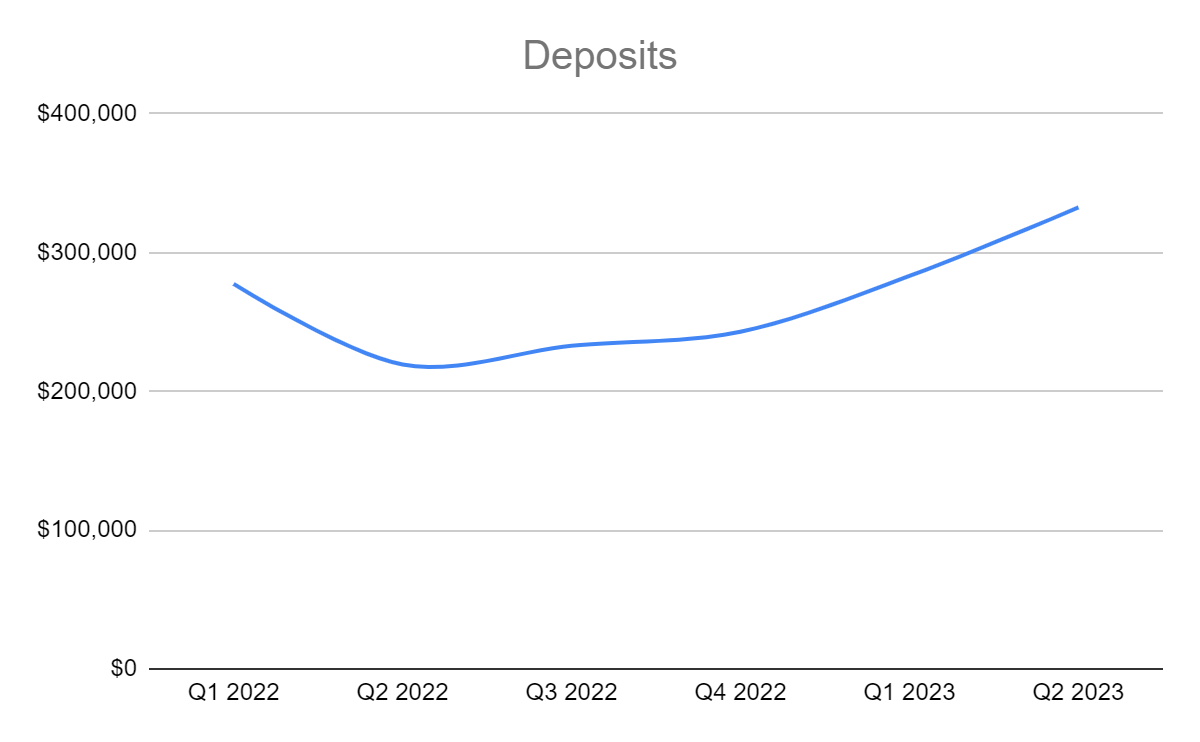

HIT Capital

The addition of Lively HSA funds has created a more stable and diversified deposit framework, further solidifying FinWise’s foundation. This enables FinWise to leverage its proprietary data and loan origination relationships to selectively pursue the best loans.

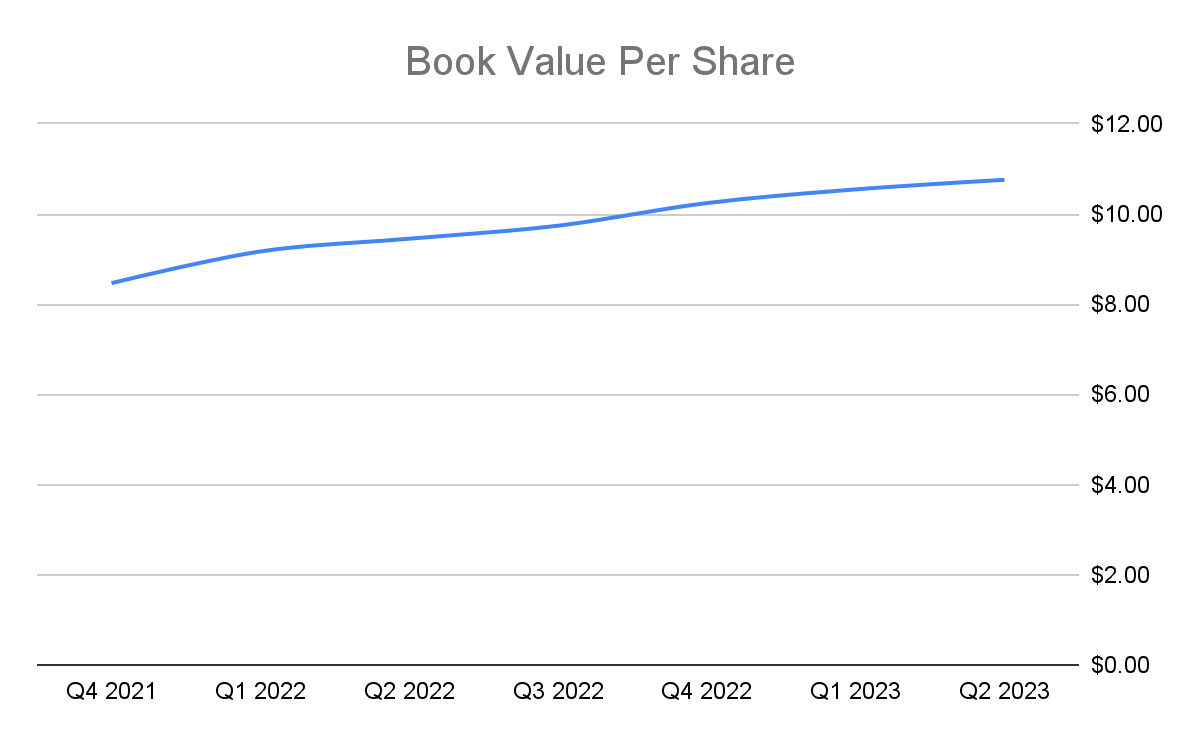

HIT Capital

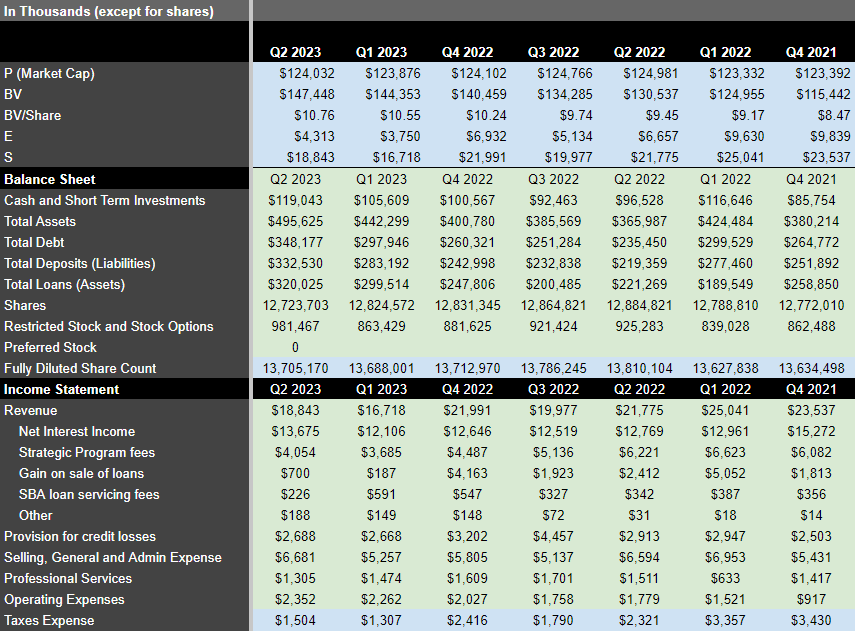

These are a few factors that have contributed to FinWise’s book value reaching $147 million, growing at a 15% CAGR since its IPO, resulting in a book value per share of $10.76 that I will dive deeper into below but first let’s start with their loan portfolio.

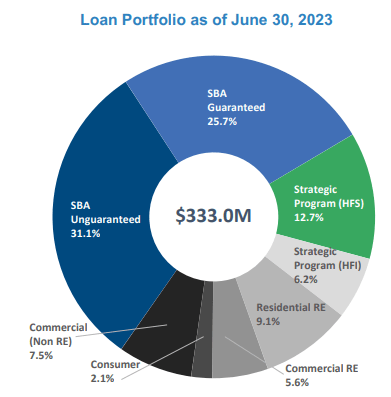

Loan Portfolio Update

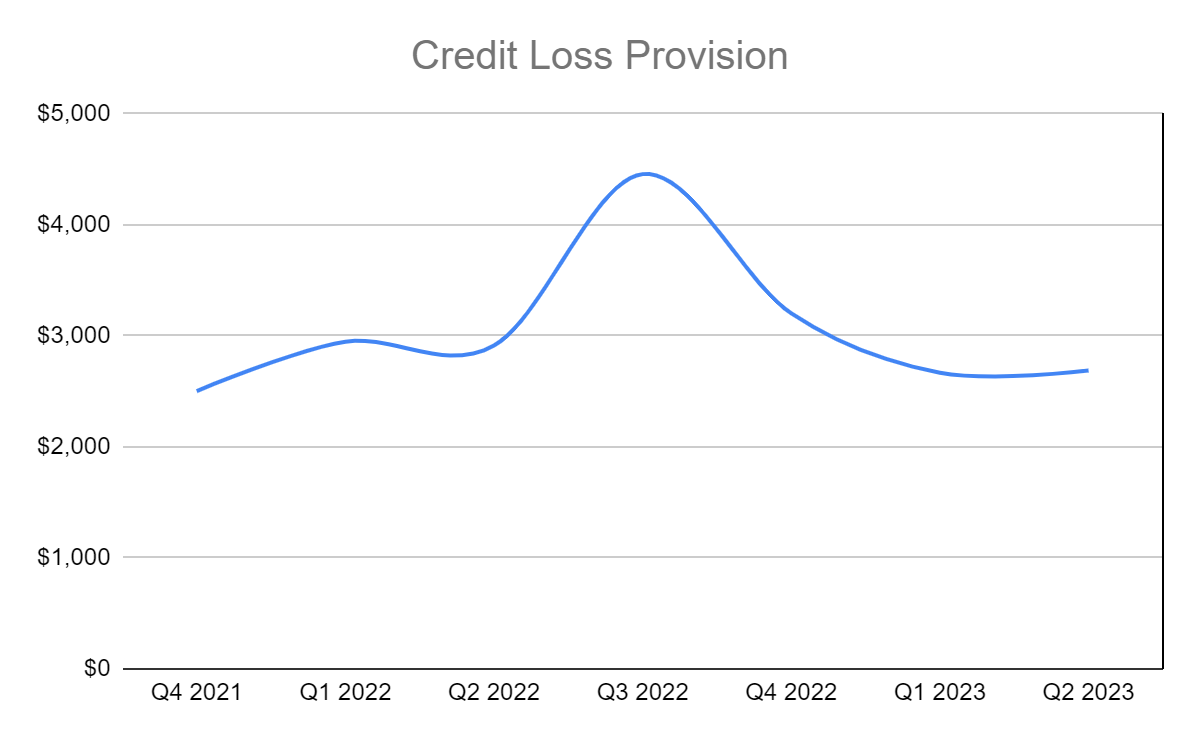

With FinWise’s stock price at approximately $9.00, the market is undervaluing their book value by 16%. While this discount might suggest an expectation of increased credit loss provisions, the past few quarters have shown the opposite trend.

HIT Capital

Three quarters may not be enough to establish a true trend or to raise allocation limits but it is possible that this is not a glitch and is due to FinWise’s competitive advantage lying in their careful selection of partner loans (they retain less than 2% of the partner loans they originate).

FinWise

The second noteworthy signal that FinWise’s loan portfolio risk has been reduced is the increase in SBA federally guaranteed loans. The SBA-guaranteed portion of their loan portfolio rose from 16.8% last September to 25.7% this June. This has resulted in less earnings selling off the SBA guaranteed portion of their loans, but a safer book and an increase in interest income.

HIT Capital

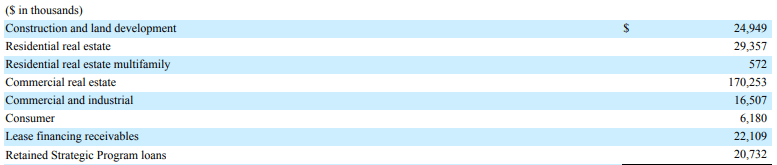

Now on the flip side, when I broke down FinWise’s loan portfolio by CECL methodology, it revealed an exposure of $170,253 in commercial real estate. The complete breakdown of categorized loans, excluding strategic program loans held for sale, is detailed below.

FinWise

My initial impression was that although FinWise is well capitalized at a CBLR ratio of 24%, they have a significant risk if commercial real estate takes a dive. There after I learned more of the underwriting requirements of SBA loans and management confirmed these were owner occupancy loans vs the typical commercial real estate loan where the owner may just be a landlord. FinWise commercial real estate loans and SBA loans in general are at least 51% owner occupied for existing buildings and at least 60% owner occupied for new buildings.

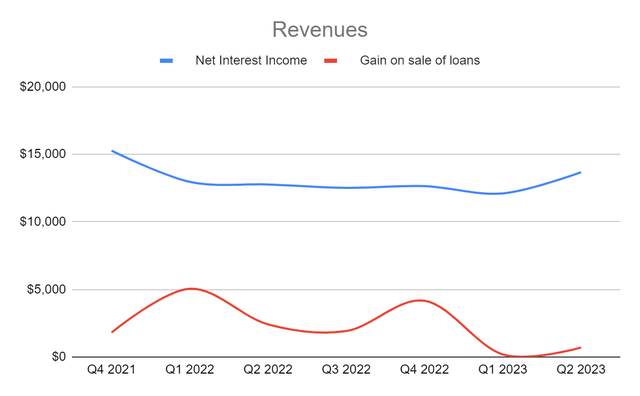

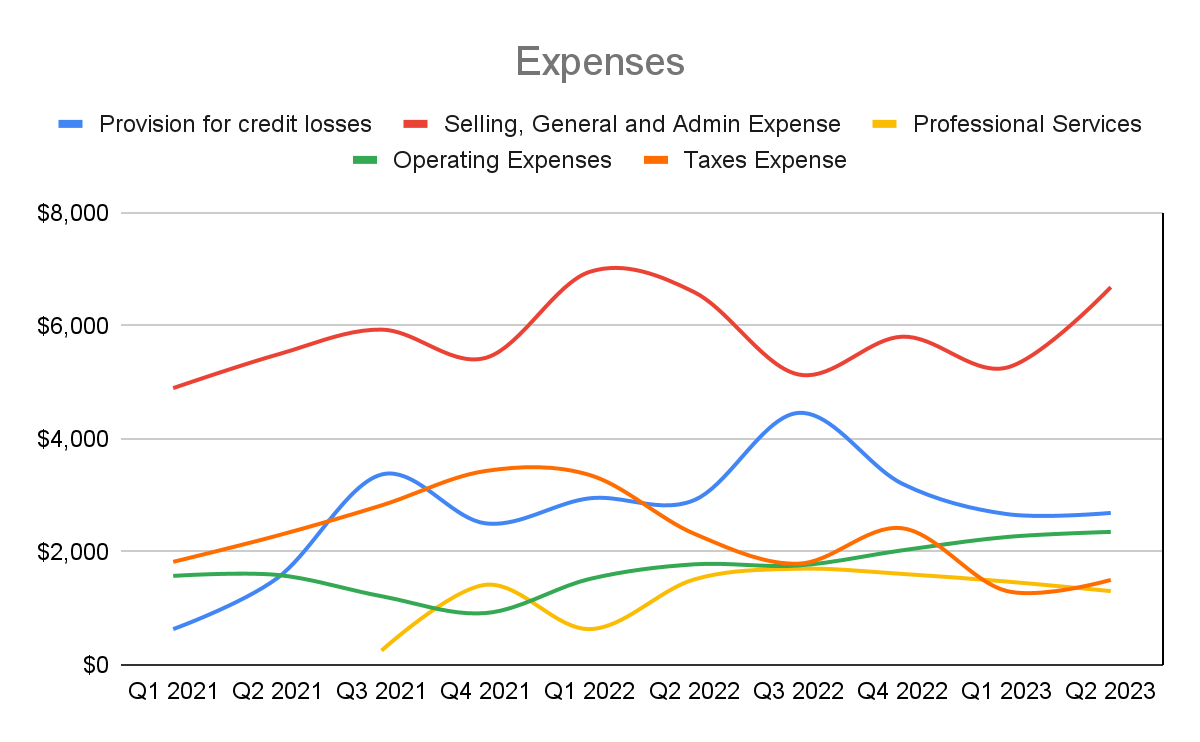

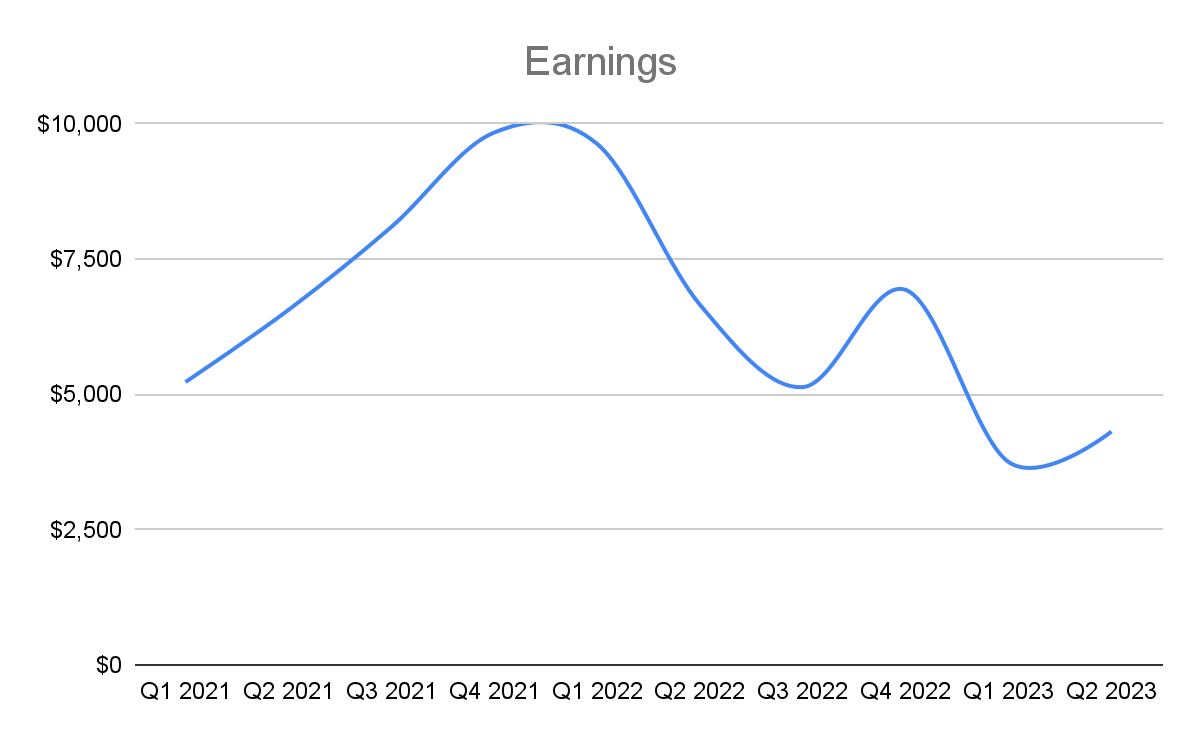

Financials

FinWise’s expenses, specifically G&A and operating expenses, have increased in tandem with the development of their Banking as a Service (BaaS) solutions. However, they have managed this growth sustainably and profitably, as evident in the following charts tracking their expenses and earnings over time.

HIT Capital HIT Capital

Fintech Platform Growth

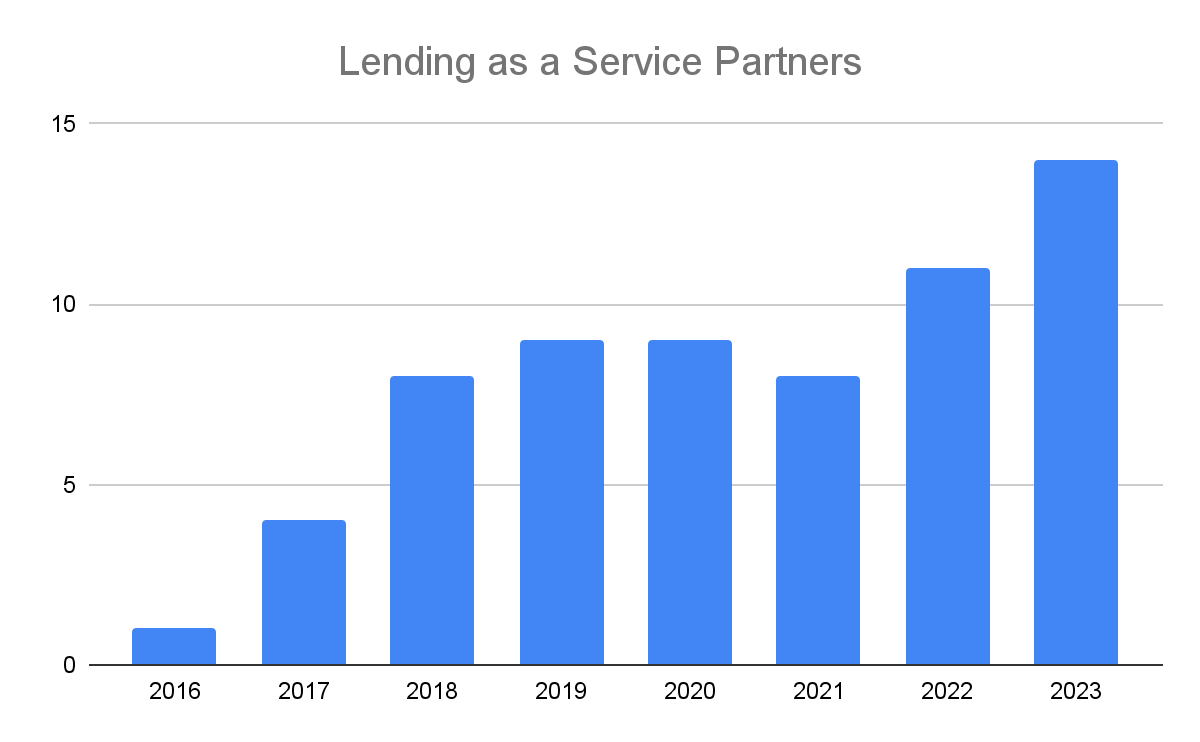

LaaS (Lending as a Service) Partner Growth

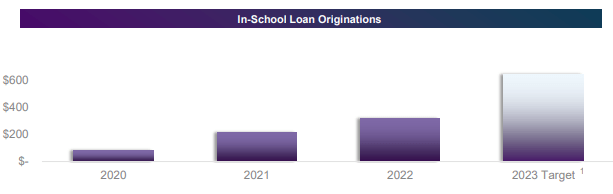

FinWise reiterated their guidance that they expect to add 2-3 more lending partners this year. As I looked around I found what appears to be one of them, Earnest, a subsidiary of Navient (NAVI). I also found Own.Lease, and Castle Credit of which Castle Credit is an expansion of Great American Finance. Each of these companies/subsidiaries identifies FinWise as a partner on their respective websites.

Earnest is a subsidiary of Navient (NAVI) and focuses on private education loan products and originated approximately $6 billion in student loans in 2021, with projected originations of around $1 billion in 2023. They anticipate their in-school loan program will drive the majority of their near-term loan originations.

Earnest

On Earnest’s website you can find the following statement relating to FinWise Bank “EARNEST LOANS ARE MADE BY EARNEST OPERATIONS LLC OR ONE AMERICAN BANK, MEMBER FDIC, OR FINWISE BANK, MEMBER FDIC.”

Castle Credit specializes in home improvement, remodeling, and products used inside and outside of homes. Their website states “Certain loans funded by FinWise Bank”

Own.Lease focuses on flexible lease payment options for various products, including furniture, tires, electronics, and jewelry. Their Privacy Policy lists FinWise Bank as a partner.

Partner Expansion

Based on my research, it appears that FinWise continues to on-board new LaaS partners and would bring FinWise’s total lending partners to 14. These partners include Upstart (UPST), Edly, American First Finance, Mulligan Funding, Great American Finance, OppLoans (OPFI), Lending Point, Rise, Reach Financial, Empower, Stride, Navient (NAVI), Company X, and Company Y.

HIT Capital

Empower – Partner Expansion Risk

Empower has been a longstanding LaaS partner of FinWise, and they have been promoting their new line of credit as “coming soon” for nearly a year, perhaps even longer. In my previous update, I viewed this as a positive indicator of future developments. However, as time passes, the failure to launch this new feature begins to transform into a risk. I reached out to Empower for more information, and they explained that it is currently in beta testing and is exclusively available to a select group of existing clients.

BaaS Development

FinWise has shifted its focus from expanding its point-of-sale product line to concentrating on its BaaS platform. They brought Robert Keil on board in Q1, who boasts over 20 years of experience in payments and BaaS as their Chief Fintech Officer. Robert’s interviews and our conversation confirmed that his team’s development focus centers on building a scalable payments hub. Initially, this hub will prioritize card payment programs followed by ACH, wires, FedNow, RTP, Visa Direct, and Mastercard Send payment rails. The expected launch of this platform is in Q1 2024 with FinWise beginning to onboard clients now.

Robert noted that there is substantial inbound demand from current and potential partners, and a successful BaaS arm could provide stability amidst the fluctuations from the LaaS platform, strengthening FinWise’s business model as a Bank + Fintech Firm and ultimately future proofing their business.

General Updates

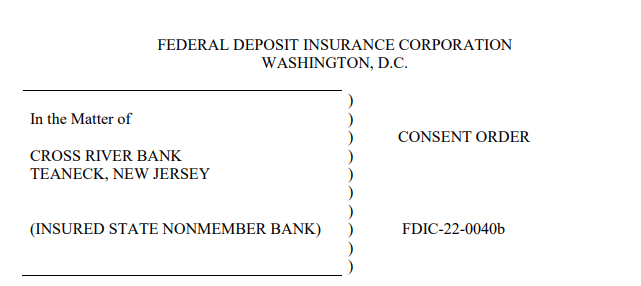

Cross River Bank – Regulatory Troubles

I believe Cross River Bank to be FinWise’s primary competitor and arguably one or two steps ahead of FinWise in the LaaS and BaaS space. For example, Upstart was originating the majority of their unsecured loans until FinWise took market share to bring their relationship to a more 50/50 split. Well the lead could be adjusting as FinWise’s technology catches up and their compliance record is clean (from what I’ve found). In March Cross River Bank received a consent order from the FDIC related to “failing to establish and maintain internal controls, information systems, and prudent credit underwriting practices”

FDIC

BFG Partnership Strengthens

On July 31st FinWise announced its intent to purchase an additional 10% stake in its strategic SBA loan partner, Business Funding Group (BFG), raising its total ownership up to 20%. According to FinWise’s latest 10 Q, the fair value estimate for this 10% stake is $4.5 million. Therefore, FinWise’s payment of 372,132 shares at $9/share = $3.3 million. This would represent a 27% discount to BFG’s fair market value. However, it was executed using FinWise shares that, in my opinion, are currently trading at a discount greater than 27% (see valuation below for more details).

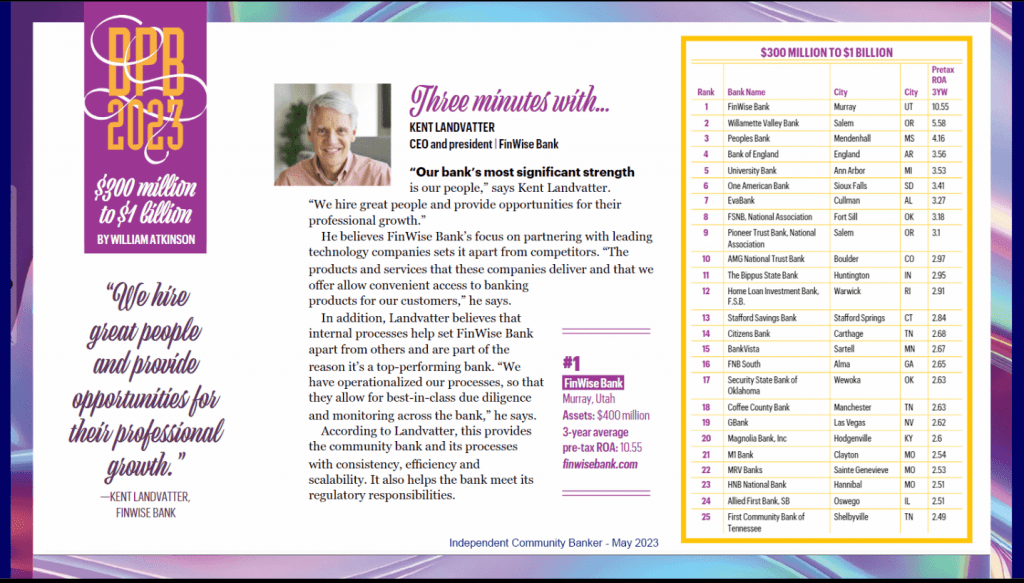

Best Bank Award

In April, FinWise earned the top spot in Independent Community Banker rankings of banks between $0.3-1B. FinWise’s three-year average return on assets (ROA) of 10.55% far outperformed other banks across all size classes, with an improvement ranging from 1.9 – 4.8 times better.

Independent Community Banker

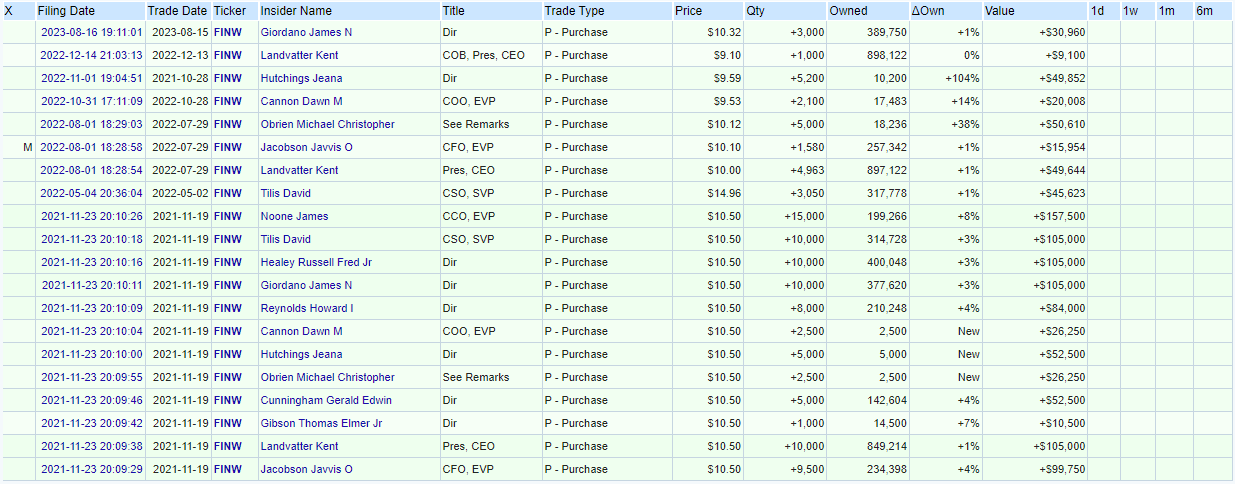

Insider Support

Insiders have consistently increased their shareholdings, with the most recent purchase made by director James Giordano on August 16th.

openinsider.com

Risks

Subprime Lending Lawsuits, Distractions, and Public Sentiment

Robert Keil has stated FinWise is not bringing on any more subprime lenders. However, this does not shield FinWise from its ongoing operations with American First Finance, Rise Credit, and Opportunity Financial, each of which has faced accusations of offering high-interest loans with widespread consumer issues. Through their LaaS partnership, a coalition of consumer protection groups has called for a downgrade of FinWise under the Community Reinvestment Act.

Comparing FinWise’s current CRA ratings with a few competitors, they currently hold a “Satisfactory” rating. Transportation Alliance Bank was downgraded to “Needs to Improve”, while Cross River Bank also maintains a “Satisfactory” rating.

Partner Losses & Bankruptcy Risk

In the current high interest rate lending environment, demand has waned, impacting FinWise’s earnings. Not all of FinWise’s LaaS partners may emerge unscathed and bankruptcies and industry consolidation could either benefit or harm FinWise. Similar to their lending partners, FinWise also holds unsecured loans and faces similar default risks. While FinWise’s loan provision losses have normalized in recent quarters, this trend could change, especially if unemployment rises or commercial real estate experiences a downturn.

FinWise’s risk ratios are well above average. First, its Community Bank Leverage Ratio is at 24%, more than two times the CBLR “well capitalized” standard of 9%. Second, its loan to deposit ratio (LDR) is 96%, 59% above the average US Banking LDR ratio of 60.2%. While CBLR and LDR signal FinWise is well capitalized, FinWise is still a bank and not without insolvency risk.

Management Transparency

Since going public in November 2021, management has not yet established a reputation for openly sharing detailed information with the street on their quarterly calls. This lack of transparency may contribute to FinWise remaining relatively unknown and, in my view, undervalued. While I haven’t observed significant changes in this regard on the quarterly updates, I do believe they are trending in the right direction. Robert Keil has done multiple interviews since joining FinWise in Q1, the leadership team is meeting with investors, and has been engaging in my calls.

Generic MicroCap Risk

With a market capitalization of $124 million, FinWise carries unique risks associated with microcaps, including heightened volatility, illiquidity, large buy and sell spreads, lack of analyst coverage and management oversight, and potential fraud or price manipulation. Therefore, microcap investing should be approached with caution and thorough due diligence.

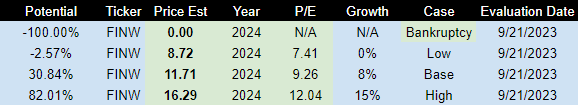

Valuation Update

The assumptions that went into the 1-3 year share target prices for FinWise include:

-

26.85% tax rate.

-

9.26 average regional banking P/E.

-

20% discount due to commercial real estate exposure.

-

Annualized 1H of 2023 earnings (the last half year provides a more accurate and conservative reflection of the current interest rate environment than TTM, in my opinion). The financials used to calculate the annualized Q1 and Q2 earnings are below.

HIT Capital

The ultimate low case is $0 due to bankruptcy.

The low case uses no growth and the assumptions above.

The base case uses a 20% fintech premium, 7.5% growth from 50% of FinWise’s book value CAGR, and the assumptions above.

The high case uses a 50% fintech premium, 15% annual growth from FinWise’s book value CAGR, and the assumptions above.

The Results

FinWise’s low case results in a 3% discount and the base and high case result in a 31% and 82% premium to the current share price of $8.95.

HIT Capital

FinWise’s new share price estimate is based on the current interest rate environment where there is less LaaS revenue than my target price one year ago. The 2022 estimate I put together here was significantly higher due to lower interest rates, higher LaaS demand, and was not adjusted for the financial environment we find ourselves in today.

If you believe interest rates will be headed lower in 2024, similar to what we experienced in 2021, FinWise’s share price could reasonably double in the upcoming year. On the flip side, if interest rates rise further, lending demand decreases and defaults rise, FinWise’s stock price could decrease accordingly.

In the current environment, FinWise is an a-typical bank growing deposits, loan book, BaaS functionality, and LaaS partnerships, all the while being priced at a discount to typical regional banks.

Read the full article here