British American Tobacco (NYSE:BTI) has had a rough few quarters.

Since the start of 2022, the multinational tobacco, vape, and nicotine product producer has seen its stock tumble more than 30%, from ~$47 per share 18 months ago, to just above $30 per share now:

TradingView

In that time, there’s been countless digital ink spilled on the company and its murky prospects, including negative regulatory updates, new product analysis, and broader concerns about the combustibles market.

However, zooming out, we think that BTI presents a strong opportunity for income investors right now, for 3 key reasons that are so simple as to be overlooked by a majority of market participants:

- BTI sells an addictive product.

- The dividend is incredibly robust.

- The valuation is historically and relatively attractive.

Combined, we think that BTI’s value proposition to income investors has never been stronger and that the stock is poised to continue paying strong dividends well into the future.

Let’s dive in and examine each point in detail.

BTI’s Addictive Product

A compelling product is at the center of any good business, and there’s no better product than something that is 1.) consumable and 2.) addictive.

That way, consumers keep coming back for more.

The ideal product would also be an incredibly high margin so that each consumable is cheap to produce but sells for a considerable markup.

Thankfully, BTI’s product portfolio hits all the aforementioned points, and consists of three main categories:

- Combustible products: These are traditional tobacco products that are burned, such as cigarettes, cigars, and roll-your-own tobacco. BTI’s combustible brands include Newport, Camel, Kent, Dunhill, and Lucky Strike.

- Reduced-risk products: These are tobacco and nicotine products that are designed to be less harmful than combustible products. BTI’s reduced-risk brands include Vuse (vaping products), glo (tobacco heating products), and Velo (modern oral products).

- Non-tobacco products: These are products that do not contain tobacco, but may contain nicotine. BTI’s non-tobacco brands include NyQuil and Nicorette.

BTI’s addictive products drive solid business.

First, nicotine is a highly addictive drug. Once a person becomes addicted to nicotine, they are very likely to continue using it.

Second, BTI’s products are widely available and affordable.

Third, BTI spends billions of dollars each year on marketing and advertising its products. This helps to create a positive image of smoking and nicotine use, and it encourages people to begin using.

Added up, these key factors create an extremely inelastic product.

What do we mean by inelastic? In short, inelastic means that demand doesn’t change much, even if prices change drastically. For example, caviar is elastic, but bread is inelastic.

Thus, since nicotine use is an addictive lifestyle, consumers/adherents are extremely price insensitive.

Taken together, BTI’s products are high margin and addictive, and consumers are predictable and price insensitive.

This dynamic leads to stable financial results, revenue power, and baked-in profitability.

Some have worried about the decline of the combustible market, but nicotine behaviors aren’t changing, they’re simply shifting to vapes and other electronic products, to which BTI has considerable exposure.

BTI’s Healthy Dividend

As a result of BTI’s product portfolio, the company maintains significant pricing power and strong financial results.

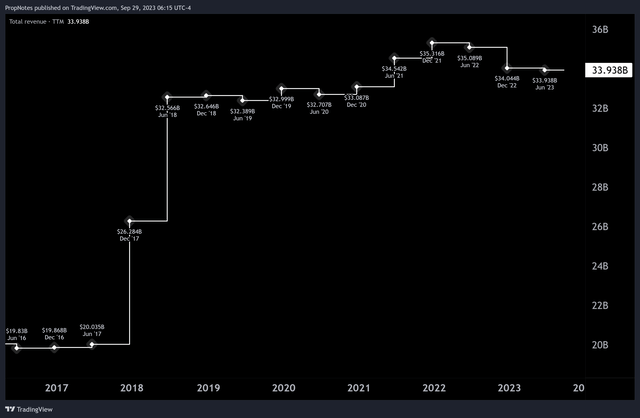

In the last twelve months, BTI produced ~$34 billion in revenue, which is stable and growing (the jump is from the Reynolds American deal in 2017):

TradingView

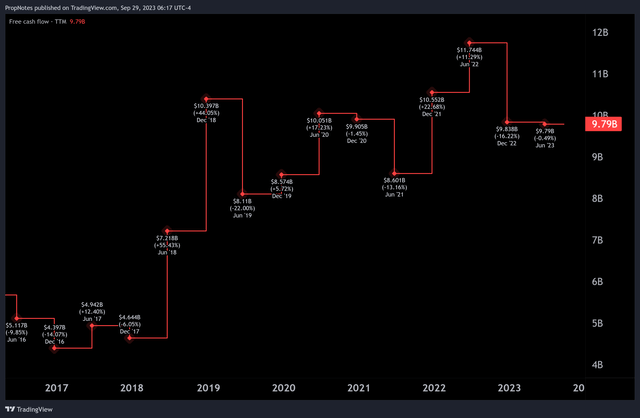

This revenue growth has also led to significant free cash flow, and FCF margins of 28%:

TradingView

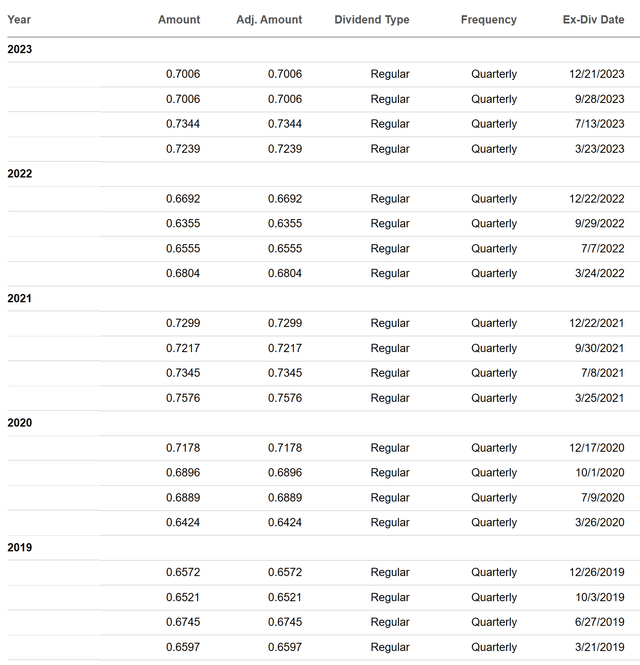

As a result of this strong and growing cash flow, BTI pays a considerable dividend of ~70 cents per quarter *per share*, which calculates to an annualized dividend of about 9%:

Seeking Alpha

The yield is strong, but what about the safety?

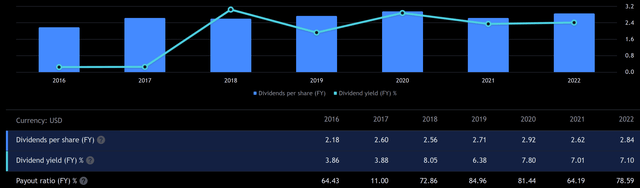

Thankfully, BTI’s payout ratio is stable and safe, averaging an annual payout ratio of 74%:

TradingView

While this is high, this is not a dividend growth play; if you’re buying this, you’re buying it for the yield.

Given the proven demand for BTI’s product, we expect this yield will stay safe and consistent as the company continues to conduct business over time.

BTI’s Attractive Valuation

Finally, while the company continues to pump out cash, the stock has taken on a sort of “value trap” perception. Many view the company as such a case given the secular global decline in combustibles, which some view as the end of an era, and the beginning of the end for the company.

However, given BTI’s wide portfolio of products, we think this fear is largely overblown.

Thus, the company’s deeply discounted valuation looks highly attractive.

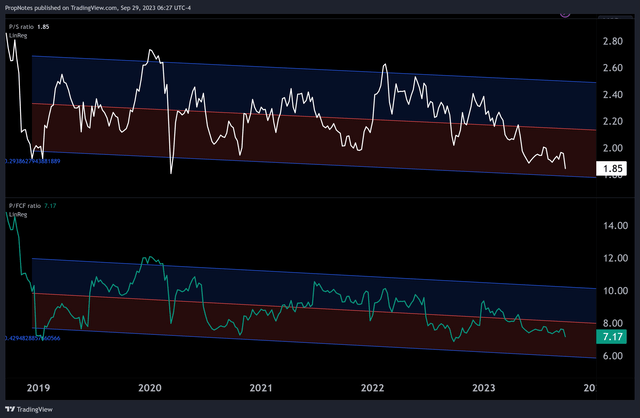

On a historical basis, shares are trading in the proverbial gutter:

BTI’s sales multiple sits at a measly 1.85x, and the company’s FCF multiple sits at 7x:

TradingView

Each of those valuations place the present ‘deal’ firmly in the ‘historically attractive’ camp, as you can see above as each multiple lands firmly in the red “attractive” area of the linear regression.

The sales multiple in particular is really scraping the bottom of the standard derivative channel.

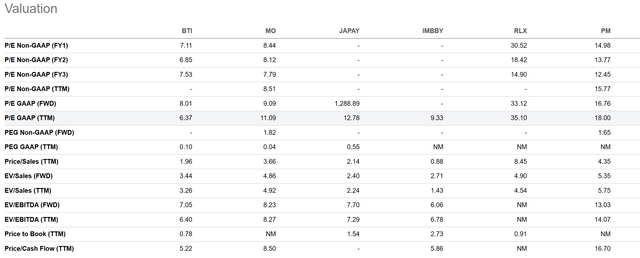

The company looks cheap on a comparative basis as well:

Seeking Alpha

Trading at only 6.3x TTM GAAP P/E, BTI is consistently cheaper than other global peers across the board.

To us, given our confidence in the company’s product portfolio, this makes the current price a steal and a great time to begin building a passive income stream.

Summary

All in all, BTI represents a great opportunity for income investors at the present price. Ignore the noise and buy the stock for the long term because of the three basic reasons we outlined:

- Addictive Product.

- Solid dividend.

- Attractive valuation.

We’re confident that over time these key points will outweigh any negative narratives, and that long-term returns should be robust.

Cheers!

Read the full article here