Introduction

The healthcare sector is often perceived as a defensive sector and is supposed to be more resilient in an economic recession. However, this is not always the case with all healthcare ETFs. In this article, we will analyze Fidelity MSCI Health Care Index ETF (NYSEARCA:FHLC) and provide our insights and recommendations.

ETF Overview

FHLC owns a portfolio of about 400 healthcare stocks in the United States. The fund generally performed in line with the broader market in the past, but should benefit from rapid growth in the healthcare sector in the next few years. However, its valuation appears to be rich already. Given its portfolio also includes some small-cap and mid-cap stocks that are usually more vulnerable in an economic downturn than large-cap stocks, the fund appears more vulnerable than the broader market and other healthcare ETFs that focus on large-cap stocks. Therefore, we think investors may want to patiently wait for a better entry point.

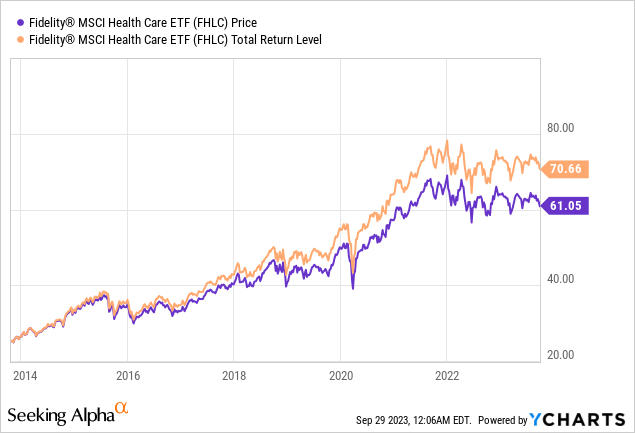

YCharts

Fund Analysis

FHLC has been in range bound in 2023

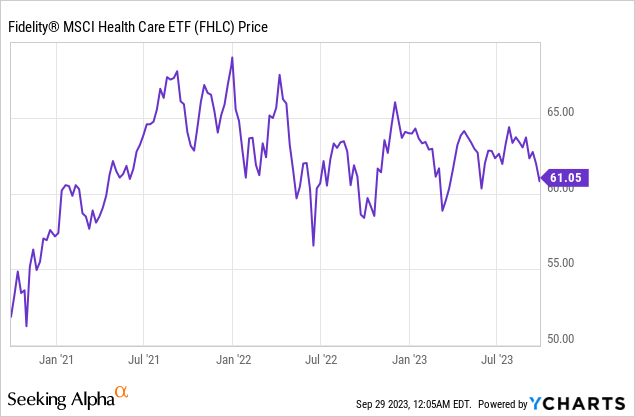

Like many other equity funds, 2022 was a year of negative return for FHLC. However, it has outperformed the market by a good margin. The fund’s 16% decline from the peak to the trough was better than the S&P 500 index’s decline of about 25%. From the second half of 2022 till now, FHLC has been in range bound. Its fund price typically falls in the range of $60 and $65 and appears to steadily climb higher.

YCharts

FHLC has comparable results to the S&P 500 in the long run

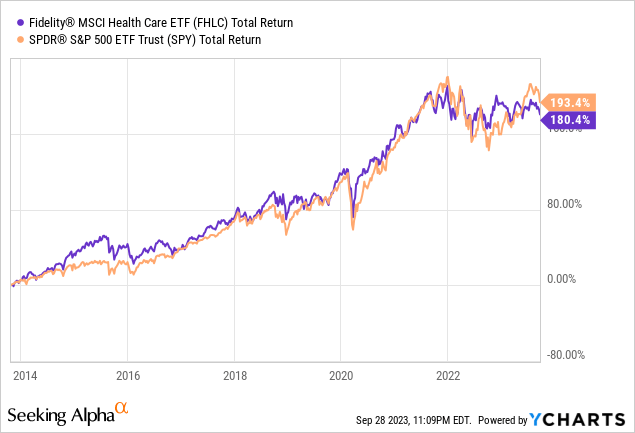

Let us take a look at FHLC’s performance. As can be seen from the chart below, the fund has generated a total return of 180.4% since 2013. In contrast, the S&P 500 index has delivered a total return of 193.4%. As the chart below shows, FHLC’s total return closely tracks the S&P 500 index for most of the time. Therefore, its long-term return appears to be comparable to the S&P 500 index.

YCharts

FHLC should benefit from long-term structural growth in the healthcare sector

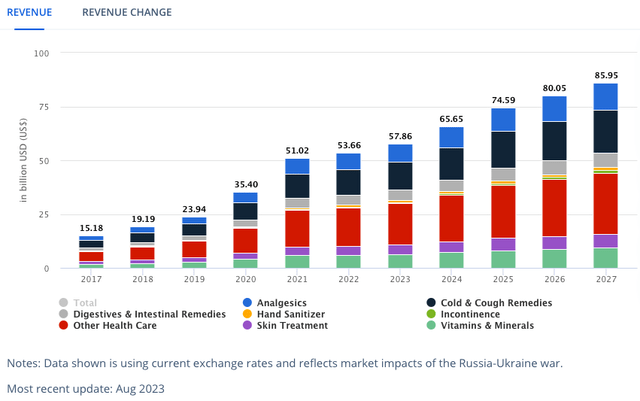

FHLC should benefit from the long-term structural growth in the healthcare industry. The aging global population and advancement in biotechnology should help the sector to deliver solid total returns in the long run. In fact, research firm Statista has estimated that the global healthcare industry is expected to grow at a rapid compound annual growth rate of 10.4% between 2023 and 2027. As can be seen from the chart below, the total revenue in the global healthcare industry is expected to reach nearly $86 billion in 2027. This is much higher than the $53.66 billion revenue in 2022. Therefore, stocks in FHLC’s portfolio should greatly benefit from the expected rapid growth in the industry.

Statista

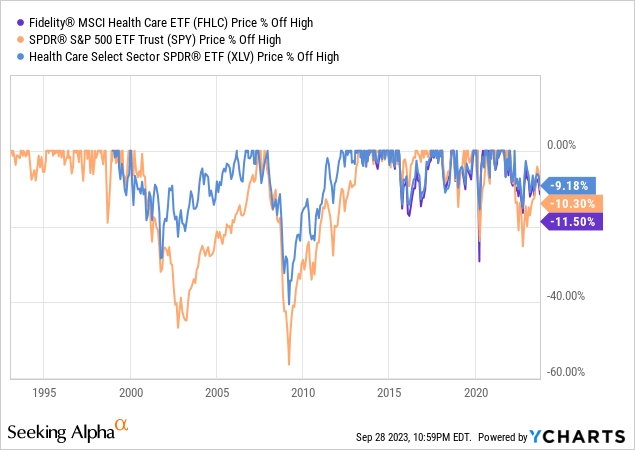

Will FHLC perform better than the market in an economic downturn?

Since the healthcare sector is often being perceived by investors as a defensive sector, we will analyze whether this is true for FHLC. As can be seen from the chart below, FHLC’s fund declined by nearly 30% during the initial outbreak of the pandemic in 2020. This appears to be greater than the S&P 500 index’s 25%. FHLC’s peer, The Health Care Select Sector SPDR Fund (XLV), declined by only about 15%. Unfortunately, we do not have the information of how FHLC will perform during the Great Recession in 2008 and 2009 as the fund’s inception date was back in 2013.

YCharts

Why is there such a big discrepancy between FHLC and XLV in the initial outbreak of the pandemic in 2020? The answer appears to be related to how the fund constructs its portfolio weighting. FHLC has a portfolio of about 400 stocks. This is significantly higher than XLV’s portfolio of 65 stocks. Therefore, FHLC includes both large-cap, mid-cap and small-cap stocks. On the other hand, XLV’s portfolio includes only large-cap stocks. We know that large-cap stocks tend to be in better positions to weather a big storm than mid-cap and small-cap stocks. Therefore, it is not surprising to see that XLV outperformed FHLC during the downturn in 2020.

Valuation reasonable, but not cheap

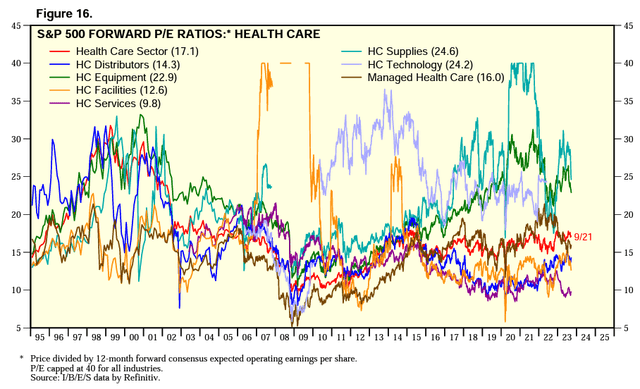

Let us now evaluate FHLC’s downside risk from a different perspective. This time, we will look at the forward P/E ratio of these healthcare stocks. Since we do not have the historical valuation of FHLC in the past, we will look at the valuation of the stocks belonging to the healthcare sector in the S&P 500 index. Although FHLC’s portfolio also contains small-cap and mid-cap stocks, large-cap stocks represent over 74% of its portfolio. Therefore, examining the average valuation of large-cap healthcare stocks in the S&P 500 index does give us a good insight into FHLC’s valuation.

As the chart below shows, the average forward P/E ratio of healthcare stocks in the S&P 500 index is currently about 17.1x. In the past two decades, the average forward P/E ratio of these stocks typically swung between 12x and 18x. Therefore, its current valuation of 17.1x is towards the high end of this valuation. There were times that the average forward P/E ratio reached 18x, such as in 2014/2015. There were also times that the average forward P/E ratios were below 13x, such as during the Great Recession in 2008/2009 and in the initial outbreak of the pandemic in 2020. Based on past history, if an economic recession does arrive in the future, the healthcare sector is likely going to experience valuation compression as well. Hence, investors should not ignore this downside risk.

Yardeni Research

Investor Takeaway

While FHLC may have a good growth profile in the next few years, there is also substantial downside risk if an economic recession arrives. This is especially the case given that its valuation is already high and that its portfolio also includes small and mid-cap stocks, which are more vulnerable in an economic downturn. Since the Federal Reserve is likely going to keep the rate elevated for a lengthy period, an economic recession may be inevitable. Therefore, we believe investors may want to wait patiently on the sidelines.

Read the full article here