In commodities, when prices go up, demand goes down. In stocks, when prices go up, demand goes up. – Rakesh Jhunjhunwala.

Investing in commodities has always been a part of a diversified approach to wealth creation, although admittedly it hasn’t created much wealth broadly for nearly a decade (pretty much the definition of diversification). I’m a believer in the long-term secular argument for commodities here, given years of underinvestment. But investing in the space is challenging given how futures work for most commodities. Exchange-traded funds, or ETFs, can be a good way to get exposure, but there are nuances. From that standpoint, let’s take a look at the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (NASDAQ:PDBC).

PDBC is an exchange-traded fund that offers investors exposure to the world’s most heavily traded commodities. It’s designed to suit investors who wish to diversify their portfolio beyond traditional asset classes like stocks and bonds. PDBC aims to provide economic exposure to a diversified group of commodities. It achieves this objective by investing in commodity-linked futures and other financial instruments. This active management strategy allows the fund to adjust its holdings based on market conditions, thereby offering a dynamic investment vehicle for commodities.

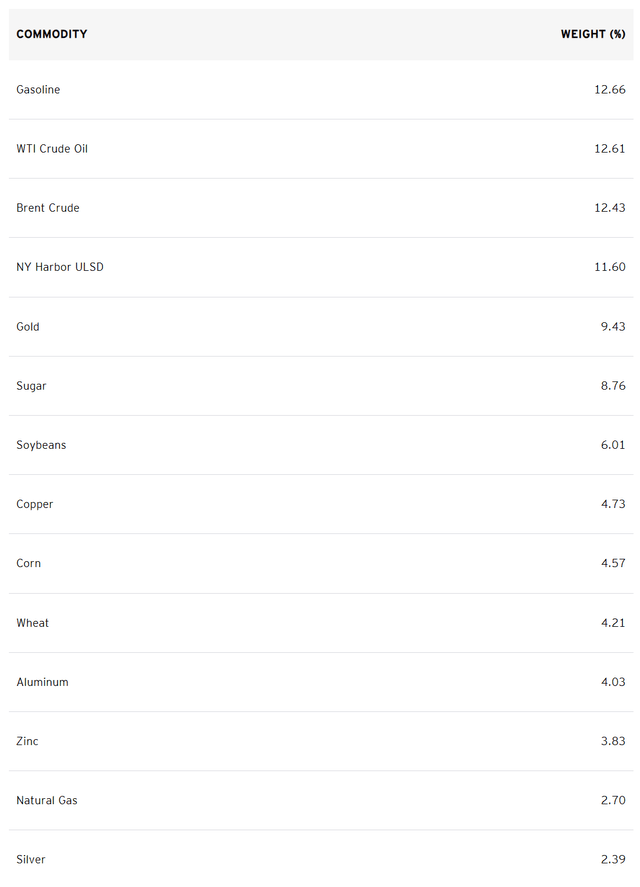

ETF Holdings

PDBC offers exposure to 14 commodities, adjusting its weighting as per the prevailing market conditions. The fund’s portfolio primarily includes energy commodities, with gasoline, WTI crude oil, and Brent Crude taking the top spots. The fund’s exposure to these commodities has significantly contributed to its recent strong performance.

invesco.com

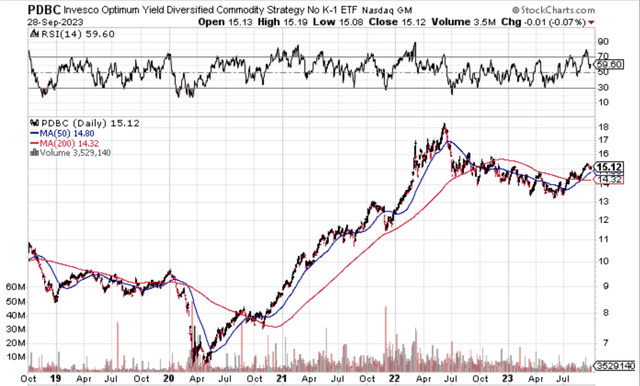

Performance and Asset Management

With assets under management (“AUM”) amounting to around $5.7 billion, PDBC stands as the largest commodity ETF available to investors. The fund has seen substantial net inflows, particularly in 2022. No surprise given the narrative around Oil shifting to a more bullish one and given performance chasing off the prior year.

stockcharts.com

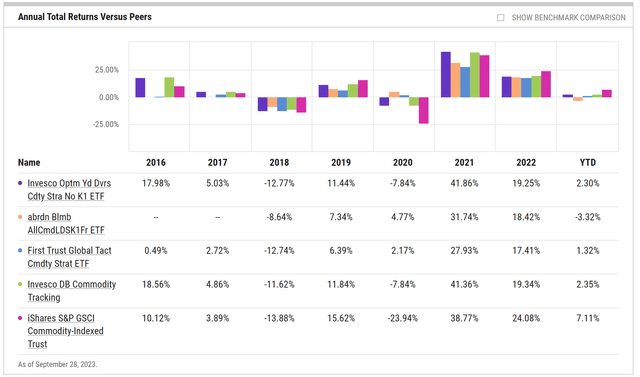

Peer Comparison

ETFs such as the Aberdeen Standard Bloomberg All Commodity Longer Dated Strategy K-1 Free ETF (BCD), and the Invesco DB Commodity Tracking (DBC) can be considered as peers. Performance has been roughly in line with other comparable commodity funds, but clearly PDBC is emphasizing the “no K-1” aspect of the fund for individual investors and advisors.

YCharts.com

The Argument for PDBC

Despite the volatility in the broader market, PDBC makes a strong case for inclusion in a diversified portfolio. Here’s why:

- PDBC provides exposure to a range of commodities, thereby offering a diversified investment vehicle within the commodity space. This diversification can help mitigate risks associated with investing in a single commodity.

- PDBC does not issue a K-1 tax form, a feature that is likely to appeal to investors wary of the tax complications associated with commodity ETFs.

- The fund is actively managed, allowing it to adjust its exposure based on market conditions. This dynamic approach can provide advantages in a fluctuating commodity market.

However, it’s worth noting that the fund’s exposure to energy-related commodities could be a double-edged sword. While this has contributed to its recent strong performance, it also exposes the fund to the volatility inherent in the energy sector.

A Word of Caution

While there are solid arguments for investing in PDBC, potential investors should also be aware of the risks. Commodities can be highly volatile, and the fund’s performance is heavily tied to the energy sector. This concentration could lead to significant fluctuations in the fund’s value. Moreover, commodities may not perform well in all economic conditions.

Given near-term market volatility, it might be prudent to hold off on any immediate investments and keep a close watch on market trends. Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF is a good fund regardless.

Read the full article here