In mid-April, I wrote that BILL Holdings (NYSE:BILL) was an attractively valued growth name that has solid growth ahead of it as its network creates a flywheel effect. The stock is up about 30% since my original write-up, but down about -16% since my June follow-up. Let’s catch up on the stock.

Company Profile

As a refresher, BILL helps SMBs digitize and automate their financial operations around things such as accounts receivables and payables. About 65% of BILL’s revenue comes from usage-based transactional fees and interchange income. Subscriptions account for about a quarter of BILL’s revenue and are priced on a per user per month basis. The company also generates float revenue by holding customer money in interest-bearing accounts until it is paid out.

Fiscal Q4 Results and Guidance

After a strong fiscal Q3 sent the stock soaring, BILL followed that up with a solid fiscal Q4 showing.

Fiscal Q4 revenue grew 48% to $296.0 million, topping the $282.6 million analyst consensus. Core revenue, which comprises subscription and transaction fees, rose 33% to $259.5 million. Transaction fees climbed 38% to $196.2 million, while subscription fees jumped 21% to $66.9 million.

Float revenue soared to $36.5 million on the back of higher interest rates. Float revenue was a modest $5.4 million a year ago.

BILL standalone transaction fees rose 33% to $99.9 million, while Divvy transaction fees zoomed 44% higher. BILL standalone subscription fees rose 25% to $57.8 million.

Processed transactions rose 29%, with them up 11% on the BILL standalone platform and 56% on Divvy.

Gross margins improved 390 basis points to 82.2%, while adjusted gross margins rose 270 basis points to 86.9%.

BILL noted that it ended the fiscal year with 461,00 customers using its solutions. BILL standalone customers stood at 201,000, up 27% year over year. It has 61,600 customers in the FI channel, down 2,200 sequentially as it sunsets a legacy Bank of America (BAC) platform impacting 6,000 customers. Divvy added 2,200 customers in the quarter, bringing the total to 29,200.

The company generated $157 million in free cash flow for the year. The company had $2.7 billion in cash and short-term investments at fiscal year-end and about $1.8 billion in debt, most of which is from 0% convertible notes.

The company said its strong results came despite macro headwinds that were impacting SMBs (small and medium businesses). It noted that while its TPV (total processed volumes) was better than its expectations in the quarter, that TPV per customer declined -5% year over year, showing the pressure on its customer base.

Looking ahead, BILL guided to fiscal Q1 revenue of between $295.5-298.5 million, representing growth of 28-30%. Analysts were looking for $300.2 million in revenue at the time. It projected adjusted EPS of between 48-50 cents, which was above the 40-cent analyst consensus.

For the full year, the company projected revenue growth of between 22-23% to $1.2885-1.3065 billion. It expects adjusted EPS to come in between $1.82-1.97. The analyst consensus at the time was for revenue of $1.30 billion and adjusted EPS of $1.83.

On its FQ4 earnings call, CFO John Rettig said:

“The spend patterns we experienced in fiscal Q4 are an indicator that the sharp reduction in spending that occurred in the second half of calendar 2022, has now moderated though our customers are still in contraction mode. The trends pointing to payment volume stabilization are encouraging, that we are expecting continued TPV headwinds throughout the year, given higher interest rates, tighter credit conditions and an uncertain macro environment. While we expect approximately mid- to high single-digit growth in TPV in fiscal 2024, we anticipate that BILL’s stand-alone TPV per customer, excluding the FI channel, will decrease low single digits percentage for fiscal 2024, compared to a year-over-year decline of 5% in Q4. Near term, we expect Q1 to be a continuation of the trend we experienced in Q4. We also expect that near-term macro distractions will continue to impact SMBs. For the next couple of quarters, we expect BILL stand-alone net adds, excluding the FI channel, to be approximately 4,000 per quarter, excluding the impact of the expiration of our contract with Intuit. … We are enhancing and expanding our solution with Bank of America to serve their large installed SMB customer base in addition to their new SMB customers. Together with BofA, we will both be accelerating our investments to address this very large market opportunity. As a part of this initiative, we are restructuring the contractual minimums to push out subscription fees planned for fiscal 2024 to future years. While this impacts our fiscal 2024 revenue and profitability, we expect it to unlock a significantly larger revenue opportunity in the future and accelerate the adoption of financial operations for SMBs.”

Overall, BILL continued to show the strength of its offerings, generating solid growth despite the macro environment impacting its customer base. Divvy has notably been a strong addition and is performing well. Going forward, these macro challenges will persist, and the company has a slight headwind from the termination of a deal with Intuit (INTU), although these customers represent less than 1% of revenue.

One of the big takeaways though is that the company is pushing out some planned fees it was going to implement in the Bank of America channel, as it adjusted some contract terms. BILL thinks this will bring in more customers, but it will likely hurt revenue by between 8-10% in FY24 as a result. Without this change, BILL’s guidance would have been meaningfully above consensus estimates. We’ll have to wait and see if the company can implement these fees within the BAC channel at a later date and bolster growth in FY25 or FY26.

Valuation

SaaS companies are generally valued based on a sales multiple given their high gross margins and the companies wanting to pump money back into sales and marketing to grow.

In this regard, BILL is valued at a P/S ratio of about 8.1x based on the FY2024 consensus for revenue of $1.3 billion. Based on the FY2025 revenue consensus of $1.6 billion, it trades at a P/S multiple of 6.6x.

On an EV/S basis, it trades at 7.6x and 6.2x, respectively. Taking out float revenue of around $150 million, it trades at 8.6x and 6.8x, respectively.

Analysts are projecting the company will grow revenue 23% this fiscal year and next.

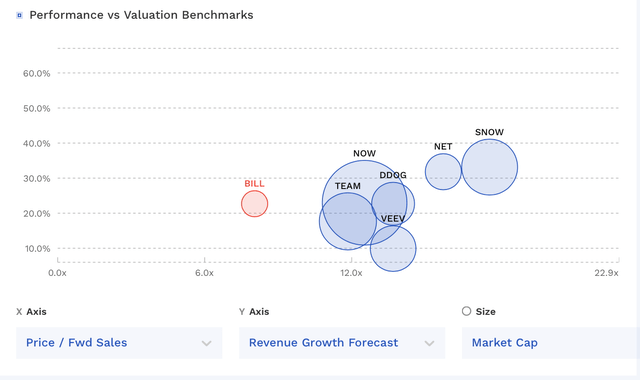

Among the faster-growing SaaS names, BILL remains one of the cheapest. The fact that much of its revenue comes from transactions is likely the reason behind that.

BILL Valuation Vs Peers (FinBox)

Conclusion

While it faces some macro headwinds, BILL remains among one of the cheapest high-growth SaaS names out there. While it does have some exposure to SMB transactions, these are largely for accounts payable and receivable transactions, and it has already felt some pressure here and has been able to grow through it.

The company is currently nicely benefiting from higher interest rates through its float revenue. However, if we want to exclude this windfall revenue and place a 10x multiple on EV to core revenue, it would be a $140+ stock, representing a nearly 40% upside. That’s good enough to keep the stock as a “Buy.” As seen in the graphic above, many SaaS names growing in the 20-30% range trade at about 12x forward sales. I’d discount BILL’s multiple just a bit due to the transactional nature of some of its revenue, but not by much, as it is still a high-margin consistent stream.

The biggest downside risk would be if the macro environment worsens into a large recession, putting further pressure on BILL’s customers. This could lead to less growth and multiple contraction as a result. SMBs traditionally come under more pressure during recessions as they do not have the same financial resources as enterprise customers. However, BILL has shown it can still grow strongly during these periods, generating revenue growth of 45.5% in fiscal 2020 during the midst of the pandemic.

Read the full article here