How do you limit operational uncertainty when you operate in an industry that’s dependent on volatile commodity prices? You own oil-rich land and charge oil drillers to extract it. Indeed, this is what Texas Pacific Land Corporation (NYSE:TPL) does. By not being involved in the drilling process, it is able to significantly reduce risk and earn high-margin income that is resilient throughout boom and bust cycles. Nevertheless, we remain neutral as the valuation is not very attractive at the moment.

TPL Generates Strong Free Cash Flow

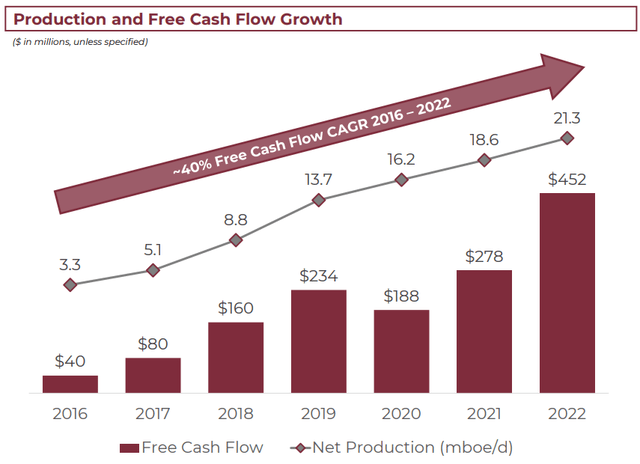

The lifeblood of any business is cash, and TPL is able to convert a lot of its revenue into free cash flow. Indeed, the firm regularly maintains FCF margins in the 50% to 70% range. However, what truly separates good companies from bad is how well they perform during periods of stress.

For energy-related companies, we simply need to look back to 2020, where a once-in-a-lifetime event sent oil prices below zero. Many companies had to suspend dividends or take on large sums of debt to simply survive, let alone generate profits. However, TPL was not one of those struggling. Instead, the firm earned $188 million in free cash flow, which was less than 2019’s $234 million but still more than 2018’s $160 million.

Investor Presentation

In addition, not only was TPL profitable, but it also paid out a special dividend at a time when investors likely needed it the most.

Is TPL Stock Undervalued?

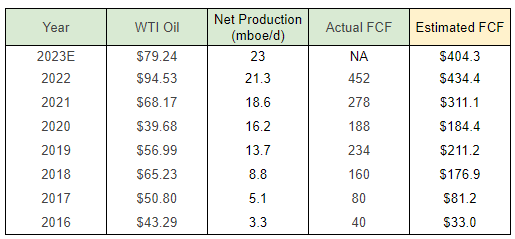

To value TPL, we will have to consider the price of oil and the production level on their land. To do so, we ran a multiple regression where we used average historical WTI oil prices and average daily production to predict TPL’s annual free cash flows.

The regression formula was:

Estimated FCF = 3.38 (WTI Oil) + 12.68 (Net Production) – 155.17

This yielded the following results in yellow:

Created by the Author

As you can see, the formula does a fairly reasonable job predicting free cash flow, with an average error of $23.8 million. In addition, it explains roughly 97.98% of the factors that influence free cash flow.

For 2023, we assumed that WTI oil will average $79.24 per barrel, which is based on the Energy Information Administration’s forecast. We also assumed a slight increase in production that we believe to be reasonable compared to historical growth. As a result, we estimate free cash flow to be around $404.3 million, or in the range of $380.5 million to $428.1 million when adjusting for the average error.

With a market cap of $11.6 billion, TPL has a forward free cash flow yield of 3.49%. Given that its cost of equity is 10.6% (as per FinBox), this suggests that TPL might be overvalued under current market conditions.

Risks

The main risk for TPL is obvious – the price of oil. The higher the price of oil, the more money it makes, and vice versa. Although OPEC+ looks intent on keeping oil prices elevated through production cuts, an economic slowdown could outweigh these cuts.

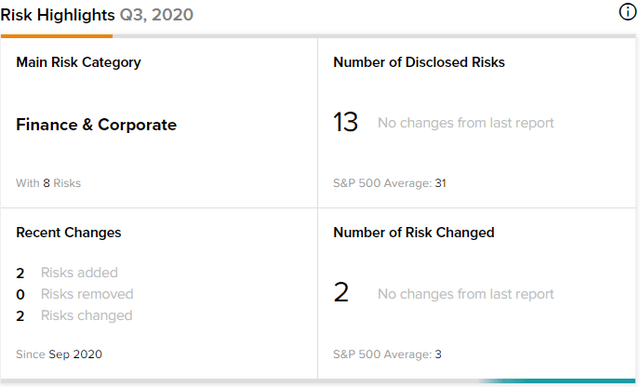

Nevertheless, the company has significantly fewer risk disclosures than the average S&P 500 stock.

TipRanks

As per the image above, the average is 31 risk disclosures versus TPL’s 13, which mostly come from the Finance & Corporate category. However, it’s worth noting that the firm’s balance sheet is very strong, with $511 million in cash and no debt. As a result, TPL appears to be a much safer bet on the oil industry from an operations perspective.

However, its valuation might make it a riskier investment in terms of share price, especially when compared to energy stocks like Canadian Natural Resources (CNQ).

Final Thoughts

TPL is a very stable energy stock with high-margin profits thanks to its royalties-based business model. Nevertheless, this stability appears to currently come at a premium. Thus, it’s likely not a buy just yet.

Read the full article here