Fashion brand Tommy Hilfiger recently collaborated for a Formula 1 themed collection. This is almost symbolic of its parent company, PVH Corp.’s (NYSE:PVH) the need for speed. Last year, the company embarked on an ambitious plan to accelerate growth and expand margins. And frankly, one look at the numbers revealed that it actually needed this kind of speed.

Weak long-term performance

Over the past 10 years, PVH Corp. has seen an underwhelming compounded annual growth rate [CAGR] of 4.1%. The number is even smaller at just 0.2% over the last five years. Further, in the last financial year ending January 2023 (referred to as 2022 from now on, in line with how the company refers to it), the company actually showed a revenue decline of 1%.

For a company that houses brands like Tommy Hilfiger and Calvin Klein, which can be seen as premium fashion if not affordable luxury, its operating margins are also low at 9.7% for 2022. In fact, the margin has ranged between 8% and 10% over the past decade, save for 2020, when it clocked an operating loss during the pandemic.

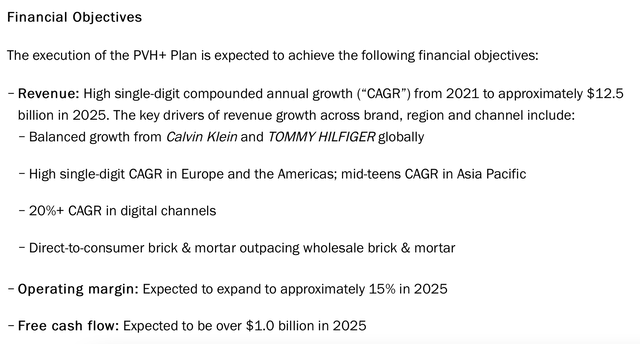

None of this needs to matter for its stock, however, if the company can indeed accelerate going forward. It is in this context that I analyze it here. Specifically, the focus is on how far it has been able to achieve the targets set out in the PVH+ Plan (see chart below), which focuses on driving more customer engagement, increasing digital sales and developing efficiencies.

Source: PVH Corp.

Performance against the PVH+ Plan

First, let us look at revenue growth as against the target. By the end of the 2025, the company expects to reach a revenue of USD 12.5 billion, which translates into around an 8% CAGR from 2021 onwards.

It has been less than a year since, but so far the performance does not match up. As mentioned earlier, in 2022 revenue actually declined by 1%. Though, this was not all down to weak demand, to be fair. A strong US dollar affected growth at market exchange rates [MER], as evident from a 4% rise in constant currency [CC] terms. Further, PVH Corp saw 7-8% growth at CC in three of the four quarters last year and was flat in just one quarter. This indicates that in times when the MER is more favourable, higher revenue growth is indeed possible.

But 2023 is not expected to be that year, either. It expects growth to range between 3% and 4% during the year. This is not surprising considering that 80% of PVH Corp.’s revenue comes from the US and Europe, which are expected to slow down this year. It also means that it does not have the support provided to other luxury fashion companies by the expected growth in China this year, even though it hopes to show “mid-teens CAGR in Asia-Pacific” as per the plan.

Further, going by its past year’s record of reduced revenue guidance over the course of 2022, I would take the projections for 2023 as well. In 2022, it reduced growth projections to 3-4% at MER, from the initially expected increase of 1-2% and to an increase of 3-4% in CC from the earlier projection of a 6-7% rise.

Even then, assuming that 2023 growth comes in at the midpoint of the projected 3-4% range, the company will now have to show 15.75% revenue growth in 2024 and 2025 to reach its target level. At this time, it sounds quite ambitious.

Operating margin can improve

On the operating margin, the company expects the figure to rise to 15% in 2025. So far, the results are not encouraging here either. In 2022, the figure was at 9.7%, which was a decline from the 10.1% seen the year before. To give PVH Corp its credit though, the company saw a decline of 3.4% in operating expenses this year. If it had not been a year of high inflation, which has impacted consumer discretionary demand and quite likely the company’s costs, it may well have at least maintained its margin.

Further, assuming that it maintains its gross margin at 56.8% in 2023 from the year before and continues to reduce operating income at the same rate as last year as well, its operating margin will rise to 12.8% this year, if its revenue growth comes in at the midpoint of its projected range in this financial year. This makes me hopeful that it can reach its target in 2025.

What the market multiples say

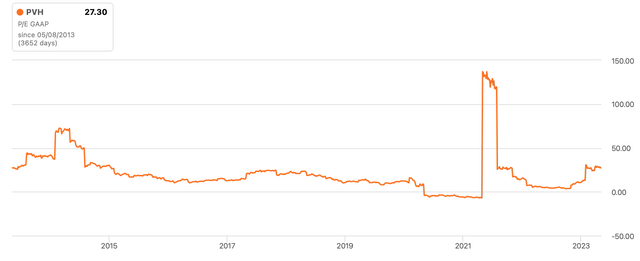

We have just one year of numbers since the launch of the PVH+ Plan, but in sum, so far it looks hit and miss. The operating margin looks more achievable right now, but the revenue target, not so much. This brings me to the company’s valuations. Its trailing twelve months [TTM] GAAP price-to-earnings (P/E) ratio is quite steep at 27.3x compared to both the consumer discretionary sector at 15.2x and even its own historical average of 18.1x.

Source: Seeking Alpha

But its forward P/E is quite another matter. At 8.3x, it is significantly lower than that for the consumer discretionary sector at 14.4x. The sharp difference in the company’s TTM and forward ratios is of course because of the big gap in the EPS for 2022 compared to the projections. The company expects a massive improvement in EPS to USD 10 this year after it showed a sharp fall to USD 3.3 in 2022 due to an unfavourable exchange rate, an exit from its Russia business and a significant goodwill impairment charge.

What next?

For now, however, the stock can continue to look pricey. It expects an EPS of USD 1.9 in Q1 2023 from USD 1.94 in Q1 2022, which will increase its TTM P/E further. As it is, revenue growth is not expected to grow significantly this year. At this point, it is hard to see any particular upside to the stock, though if it has robust guidance for EPS in Q2 2023, there may well be a jump in the stock. This means it is strictly a speculative buy for short-term investors.

Going by its forward P/E for the year, backed by the likelihood of a rise in operating margin and sustained revenue growth from 2022, there is a likelihood that its price can rise over the course of the year. At the same time, the reductions to its guidance last year, including that for the EPS, leave me with questions. I would put a Hold on the stock until at least the first quarter results are released to get a better sense of how it is performing.

Read the full article here