Introduction

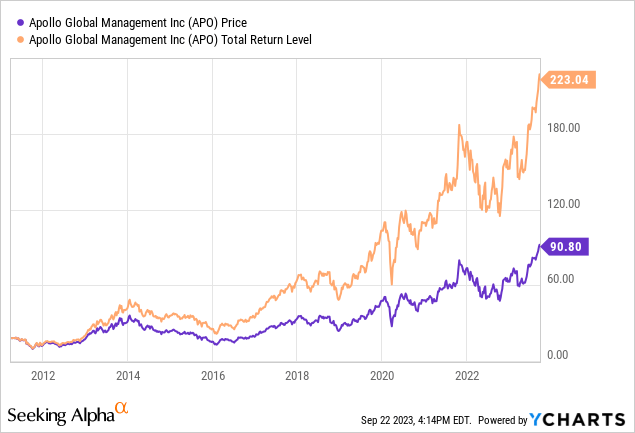

Apollo Group Management (NYSE:APO) recently issued the 7.625% Fixed-Rate Resettable Junior Subordinated Notes due 2053 (NYSE:APOS). For investors liking a 7.3% yield with five years of call protection from a solid company, this long-life Note gets a Buy rating. In this article, I will briefly review APO and then the APOS Note. Under Portfolio strategy, I compare the Note’s features to Preferreds issued by APO.

A quick overview of the Apollo Group Management

This is how they describe themselves:

Since our founding in 1990, we have established a notable record of success in alternative investments. Apollo now serves institutional and individual investors across the risk-return spectrum—in Yield, Our Hybrid Business and Our Equity Business strategies.

Our asset management business provides companies with innovative capital solutions and support to fund their growth and build stronger businesses. Our retirement services business, Athene, provides a suite of retirement savings products to help clients achieve financial security.

Across all parts of our business, we invest alongside our clients and take a responsible, knowledgeable approach to drive positive outcomes. At Apollo, Expanding Opportunity is core to our values, and we are dedicated to creating opportunities for more companies, employees and communities to build a more inclusive and sustainable economy.

Source: apollo.com

As of last March, the Apollo Global Management had $598 billion in assets under management, and Apollo’s credit business had $438 billion in assets. The stock currently yields 14.18%.

Junior Subordinated Notes review

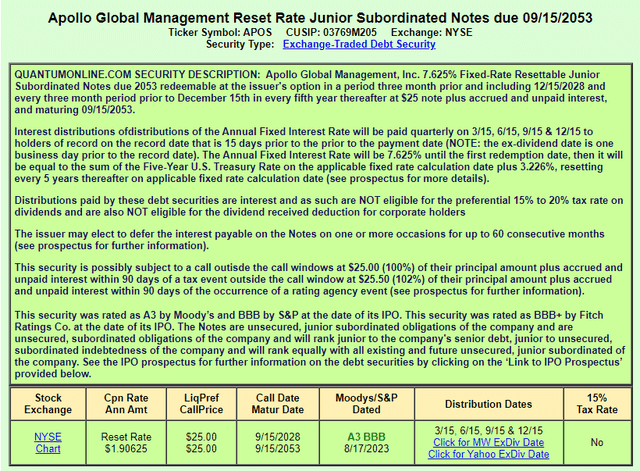

quantumonline.com APOS

Important features include:

- The Notes are Callable after five years but do not mature until 2053.

- The initial coupon is 7.625%. On 9/15/2028 and every five years thereafter, the new coupon will be equal to the 5-yr TSY rate + 3.226%. If done today, the coupon would be up slightly.

- Current ratings are A3/BBB. Combining this with the coupon reset rule, investors are getting 3.226% extra yield for owning a Note with a low investment-grade rating versus a 5-yr TSY Note with high investment-grade rating.

- The Issuer may, on one or more occasions, defer interest payments on the notes for one or more optional deferral periods of up to five consecutive years without giving rise to an Event of Default under the terms of the notes. All deferred interest must eventually be paid. Dividends cannot be paid on the common shares while interest payments are being deferred and Noteholders made whole.

- The Notes rank below senior debt, equal with other subordinated debt, and above all classes of stock.

Portfolio strategy

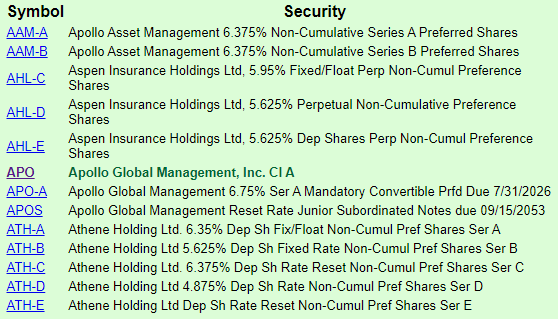

These are all the currently issued Preferred stocks and one Note that APO is now obligated for. With both the AAM-A and AAM-B getting Called recently (9/22/23), that only left one APO-issued preferred. I will compare the 2053 Note against the remaining that APO PFD and one from each of the acquired company issued PFDs, those being:

- Aspen Insurance Holdings Limited PFD SHS 5.95 (NYSE:AHL.PR.C)

- Athene Holding Ltd. 7.75%DP RT PFD E (NYSE:ATH.PR.E)

QuantumOnline.com

| Factor | APOS | APO-A | AHL-C | ATH-E |

| Issued | 8/16/23 | 8/7/23 | 4/29/13 | 12/5/22 |

| Coupon | 7.625% | 6.75% | 5.95% | 7.75% |

| Price | $26.24 | $55.74 | $25.30 | $25.39 |

| Yield | 7.3% | 6.1% | 9.5%** | 7.6% |

| Reset rule | 5Yr+3.226% | NA | 3Mo+4.06% | 5Yr+3.962% |

| Reset freq | 5 years | NA | quarterly | 5 years |

| Callable | 9/18/28 | 7/31/26* | 7/1/23 (past) | 12/30/27 |

| Tax Pref | No | Yes | Yes | Yes |

| YTC | 6.5% | NA | NA | 7.3% |

* Mandatory conversion into the APO common shares.

** first floating payment set at $.5996 and resets each quarter now.

The APO-A can be looked at as a 3-year Call option on APO. The estimated premium of 11% is based on the current APO price and is partially offset by the extra 4.5-5% yield advantage the PFD has over the common shares, though my math could be off. Now Callable, I would expect the AHL-C to be redeemed soon as its coupon (9.5%) jumped as the 3-month SOFR is 5.4%.

Of the other two shown above, and after looking at the other traded issues, the Athene Holding Ltd. 7.75%DP RT PFD E is the closest to the Notes, but not a perfect match. While maybe not an issue, ATH’s payments are listed as non-cumulative. It has a slightly higher coupon and also has better tax treatment. Once resets start, ATH-E also has the advantage. The Notes come with an additional ten months of Call protection. Compared to risk-free 5-yr CD rates, both offer a nice bonus yield for the risk taken by either issue. I suspect the closer Call date has pushed up the YTC compared to the Notes.

Conclusion

- APOS: With the caveat that this could be Called in five years, that event only can happen every five years. ATH-E provides some Call protection with its higher floating component.

- APO-A: For those who want to own the common, the mandatory convertible preferred, is an income producing means to that goal.

- AHL-C: I would not buy this issue over Par+accrued as its new 9.5% cost to APO might result in a Call very soon. I was surprised it wasn’t Called on the first day it could have been.

- ATH-E: Except for AHL-C, it has both the highest Yield and highest YTC, plus the second longest Call protection. Its “negative” is I would think it would be Called before the APOS is.

- Potential investors should look at the other preferreds outstanding under the APO umbrella before making their final decision. There could be better features amongst those I did not cover in this article.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research – including reports that are never published elsewhere – across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

Read the full article here