Today, we are back to comment on Kering (OTCPK:PPRUF, OTCPK:PPRUY). Since our latest update, the company’s stock price has declined by more than 25% (Fig 1). Here at the Lab, we updated our internal estimates following the H1 earning release. Over the past weeks, the luxury powerhouse announced vital changes that are a positive long-term catalyst for Kering’s equity story: Valentino (minority) and Creed (majority) acquisitions and a new management shake-up. Here at the Lab, we like this proactive M&A strategy and Kering attitude to better address Wall Street’s concerns regarding Gucci’s development.

Mare Past Analysis

New Acquisitions

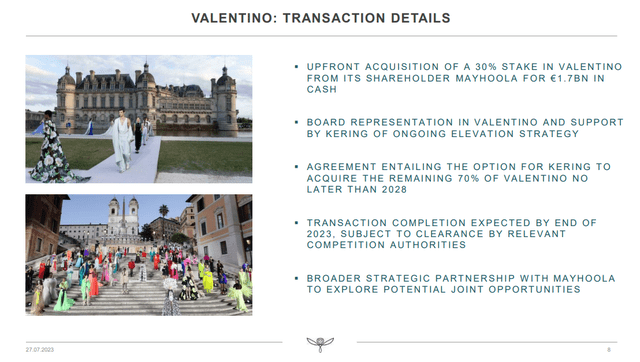

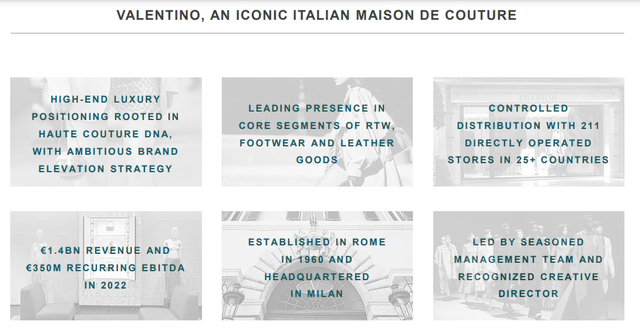

Starting with the latest M&A development, according to rumors, Kering paid €3.5 billion to acquire the high-end fragrance label Creed. Part of the reason why details were not released was due to Creed’s strong profit margins. The company closed the financial year (in March 2023) with over €250 million in turnover. In August, the French luxury giant also acquired 30% of Valentino for a cash consideration of €1.7 billion (Fig 1). Valentino is the historic Roman Maison controlled by Mayhoola Investments. The agreement includes an option to acquire 100% of Valentino’s share capital by 2028. It would be the first Maison De Couture to enter Kering’s portfolio conglomerate. Here at the Lab, we believe this operation is part of a broader strategic partnership between Kering and Mayhoola. This could lead to the Qatari fund becoming a major Kering shareholder. Valentino brand is one of the most internationally recognized Italian luxury players. A Maison De Couture with a strong heritage, a high-end luxury positioning with a portfolio of iconic creations today has 211 directly managed boutiques in more than 25 countries and delivered a turnover of €1.4 billion with an EBITDA of €350 million in 2022 (Fig 2). At this stage, we are not incorporating Valentino and Creed’s financials into our internal model as accounting and terms have not yet been fully disclosed.

Kering Valentino transaction details

Fig 1

Valentino in a Snap

Fig 2

H1 Results and Milan Fashion Week Implications

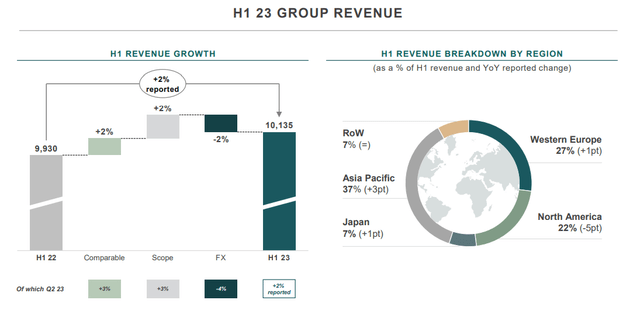

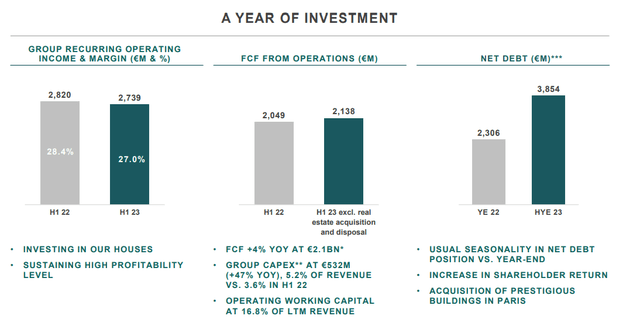

Very briefly, in H1, the company delivered a revenue increase of 2% to €10.1 billion, thanks to solid performance in APAC, a reasonable growth rate in Western Europe, with sales declining in the North American region (Fig 3). Kering recurring operating profit reached €2.74 billion, with a margin of 27%, and free cash flow from operations, excluding real estate acquisitions, remained at the high end of €2.1 billion, signing an increase of 4% vs. last year (Fig 4). Despite that, we believe there are some execution risks at this stage. In particular, our attention is focused on Gucci. In H1, the leading brand generated top-line sales of €5.1 billion (-1%), with wholesale revenues decreasing by 3%. However, the brand’s recurring operating profit stood at €1.8 billion, which equates to a margin of 35.3%. Even if we believe that ‘Gucci Is Here To Stay,‘ brand visibility remains low.

Kering Sales Evolution

Fig 3

Kering margin, FCF and net debt

Fig 4

Post H1, we continue to anticipate an underperformance vs. the market as the brands need to find a new repositioning. The market positively received the spring-summer 2024 show staged at Milan Fashion Week last week; however, De Sarno and Gucci’s new identity is being observed with caution. The new collection seems to have received mixed reviews from Western social media and Chinese press. Reviews praised the garments’ wearability compared to Alessandro Michele’s previous “more extravagant” designs. However, looking at the critics, social media seem slightly disappointed that the collection was not bold enough. Here at the Lab, at the moment, we prefer to remain cautious about performance. This collection will begin to be sold in stores in 2024, the next critical test for the brand.

We believe Kering should be prepared to invest more in the brand. Furthermore, improving retail performance through greater integration between verticals and internal production, as brands such as LVMH, could also improve the house’s flexibility and efficiency.

As already reported, the CEO, Marco Bizzarri, will be replaced by Jean-Francois Palus (ad interim). During H1 earnings, the company didn’t mention how long this transition period will end. While Kering’s management team raised expectations for a Gucci margin reset, we believe the new interim CEO still needs an action plan, as the company already invested in the business. Looking ahead, we forecast a Gucci EBIT margin at 35.3% in the short-time horizon, aligned with Kering’s internal guidance that implied a minus 30 basis points from last year. For 2024, we anticipate a flattish recurring operating profit.

The other Kering brands were a supportive plus last year; however, after analyzing H1 results, we decided to cut Saint Laurent’s organic growth estimate due to a higher level of wholesale rationalization. This is also supported by lower sales in the United States and a potential consumer slowdown. In numbers, we believe that Saint Laurent will likely grow by 5% (from a previous estimate of 6.5%). While, the Balenciaga brand saw improvements in the EU and US following the advertising controversy. The Other House brands maintained their strong growth trajectory, posting double-digit growth with a lower margin.

New Estimates and Valuation

Considering that, our internal team still anticipated that Kering organic growth would reach a plus 3% and 5% in Q3 and Q4, respectively. In numbers, our 2023 Kering sales reached €20.5 billion with a net income of €3.6 billion.

Despite that, we previously anticipated a Gucci higher margin contribution for the entire year. We are now aligned with the management team and therefore decided to decrease the following years’ EPS and our target price by approximately 3% from €660 to €640 per share. This is a limited change in our internal estimates; however, we still maintained our buy rating target. The company trades at an 18x P/E compared to a sector average of 26x. This implied a 43% P/E discount, which is not justified. Looking at the P/E historical average discount, Kering was in a 20%-35% range. In the meantime, we appreciated the company’s management changes and a more encouraging approach to new and vital acquisitions.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here