Investment Thesis

I saw Chipotle Mexican Grill’s (NYSE:CMG) FW PE ratio and it raised suspicions of whether it’s justified. From a value standpoint, the company is very overvalued, and I will not be starting a position any time soon. However, from a historical standpoint, the company’s FW PE ratio seems to be trading at the lowest the company has seen in a while. The financial health of the company is great, with decent metrics all around, but I am assigning a hold rating since from the value perspective it’s expensive.

Financials

Just to note one thing, most of the graphs below will be as of FY22, as this way I can see the overall trend of the company’s financial health and where it may be heading. Q/q numbers tend to fluctuate and do not give a clear indication; however, I will include some of the numbers from the latest results if needed for extra color.

As of Q2 ’23, $504m in cash and equivalents against zero debt. This is a great position to be in, as it allows for flexibility in how the company can spend its cash, whether that would be to further growth of the company via growth initiatives or to reward shareholders through share buybacks (if it is opportune to do so), or dividends. The company doesn’t have the burden of putting away some cash to pay off annual interest on debt.

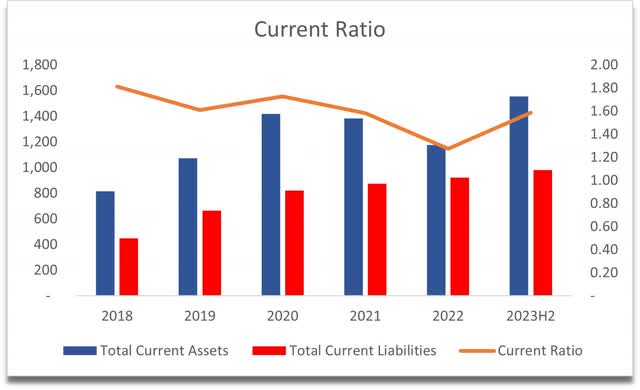

The company’s current ratio is decent enough and is hovering around the range which I call efficient, that is a range of 1.5-2.0. As of Q2 ’23, it stood at around 1.6, which tells me that the company isn’t hoarding cash or has too many inventory costs that could have been used for further expansion of the company and has enough liquidity to cover all its short-term obligations. So, it’s safe to say that the company has no liquidity issues and is at no risk of insolvency.

Current Ratio (Author)

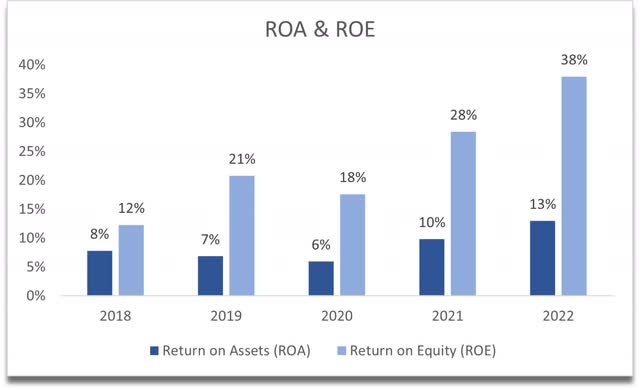

In terms of efficiency and profitability, the company’s ROA and ROE are great too. I usually look for at least 5% on ROA and 10% for ROE, and historically, these numbers were well above my requirements, which tells me that the management is adept at utilizing the company’s assets and shareholder capital, thus creating value. It is also important to note that the trend is very positive here.

ROA and ROE (Author)

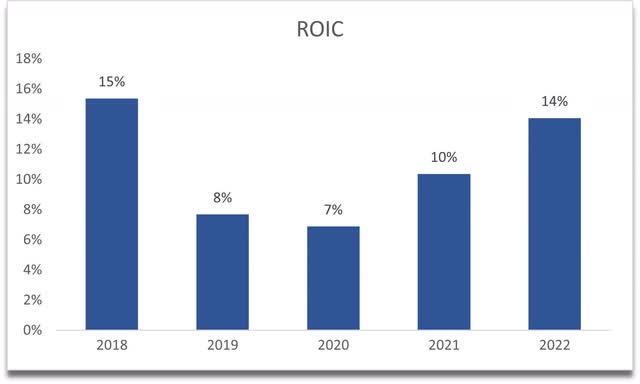

A similar story can be seen in the company’s return on invested capital or ROIC. During the pandemic, the return went as low as 7%, which is still not the worst, and ever since then it has climbed well over my minimum of 10% and stood at around 14% as of FY22. This tells me the company has some sort of a moat and a competitive advantage, however, if we look at some competitors like Taco Bell (YUM), Domino’s (DPZ), or McDonald’s (MCD), these have higher numbers, 36.5%, 46.41%, and 16.36%, respectively.

ROIC (Author)

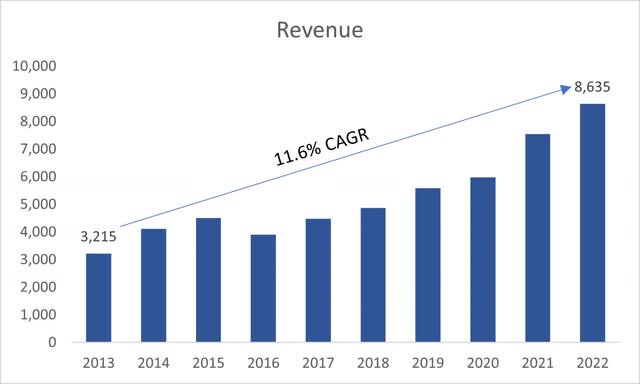

In terms of revenues, the company has been growing at a decent pace over the last decade and the analysts are still estimating similar growth for the next couple of years. I will anchor my growth expectations to the analysts’ views for at least a couple of years and after that, it’ll be reasonable assumptions on where the company is going to go.

Revenue Growth (Author)

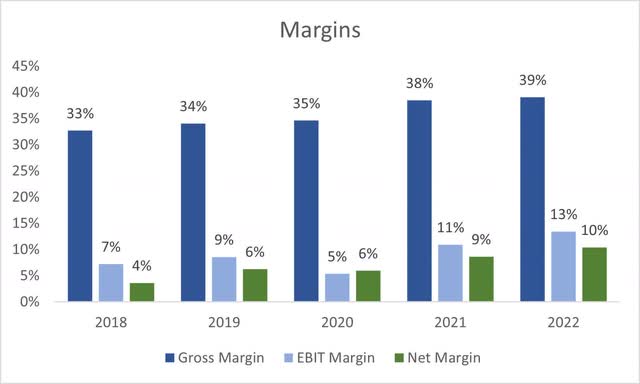

In terms of margins, these also have improved vastly in the last couple of years, and they seem to be continuing their upward trajectory. Q2 ’23 numbers showed around 41% gross and 17% operating margins. But as I said earlier quarterly reports tend to fluctuate a lot more, so I would have to see full-year results before assuming the upward trend is in place.

Margins (Author)

Overall, the company seems to be operating commendably. I haven’t found anything that would deter me from investing in the company, except that if we compare ROIC to the competitors mentioned, then CMG wouldn’t be my top choice. All graphs show a positive trend so far with decent revenue growth; however, it doesn’t mean it’s a good time to invest, especially when looking at what the company’s intrinsic value is, which I’ll cover momentarily.

Valuation

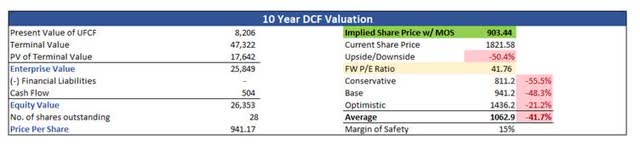

There’s no reason to assume that the company is going to outperform its historical average when it comes to revenue growth. As I mentioned earlier, not only I will anchor my assumptions for the first 3 years to what analysts are estimating, but I’ll also be more optimistic and add a couple of extra percentages to my base case revenue projections. With that said, the base case scenario will see around 12% CAGR over the next decade. For the optimistic case, I went with around 14% CAGR, while for the conservative case, I went with a 10% CAGR. This is more optimistic than I usually like to approach these valuations, however, the outcome as you will see won’t be different in the end.

In terms of margin and EPS, I have improved gross margins by around 600bps or 6% over the next decade, while also improving operating margins by around 500bps from FY22 figures. This way my EPS estimates will be around $44 a share in FY23 and around $52.8 a share in FY24, which is very close to what the analysts assumed. From then on, the EPS figures will increase by around 17% CAGR until FY32. By then, the company will earn $181.6 a share and will be at a FW PE ratio of around 10.

On top of these estimates, I will add a 15% margin of safety for extra cushion. The financials are decent, so I think 15% is more than enough and to be honest, it won’t change the outcome of the calculations too much. With that said, Chipotle’s intrinsic value is around $900 a share, which means it’s very overpriced and I’m not going to touch this for a while.

Intrinsic Value (Author)

Closing Comments

The company seems to be very overpriced, and I had a suspicion that it would be once I saw the FW PE ratio on the website to be around 43. I didn’t think the revenue growth could justify such a PE ratio and when looking at the earnings, I also saw these to be underwhelming in my opinion. Even in the optimistic case with better margins and better revenue growth, the company is overvalued.

The company hasn’t seen multiples below 40 since the beginning of 2016, which is impressive, to say the least. From a value perspective, this is not a deal I’m willing to take on, as risk/reward is not enticing. If the company goes below 35, then in broad terms it would be considered cheap. As for me, it seems like it will never be an investment, since I don’t believe the multiple is justified with such a revenue and EPS growth, so I’ll pass.

Read the full article here