We passed on Granite Real Estate Investment Trust (NYSE:GRP.UN) (TSX:GRT.UN:CA) back in June of this year, since we expected a slowdown in the industrial sector. We preferred to hold out for a dip in the more favorably valued Dream Industrial Real Estate Investment Trust (OTC:DREUF) (DIR.UN:CA). Even then, Dream Industrial traded at a deeper discount to NAV, commanded a lower FFO multiple and had a higher yield, but it was not time to pull the trigger in our opinion.

We think both sets (for Dream Industrial and Granite) of cap rate assumptions, are on the optimistic side. As we go through the next 12 months, Dream Industrial has more mark to market upside on rents as it is placed within some of the hottest markets. Granite’s properties are more specialized and it also has longer leases lengths. So it will have a slower jump in rents. Combining this information with the NAV discount gets us to heavily favorite Dream Industrial here. While we closed out our position in Dream Industrial after a great rally, we would look to buy this on the dip first.

Source: Granite REIT: Solid Performance But Still Not Our First Choice

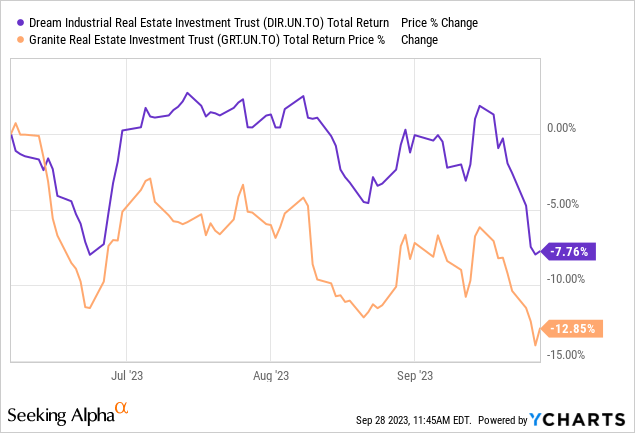

The three months since that piece have not been kind to either REIT, but Dream Industrial has comfortably come out ahead of Granite.

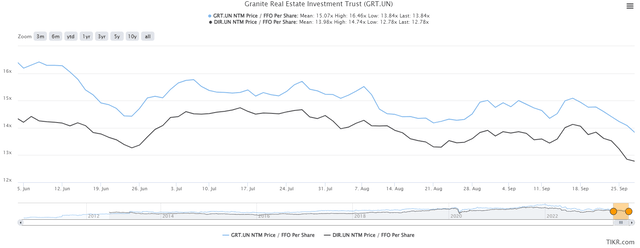

The FFO multiples for both these REITs have declined further since then.

TIKR

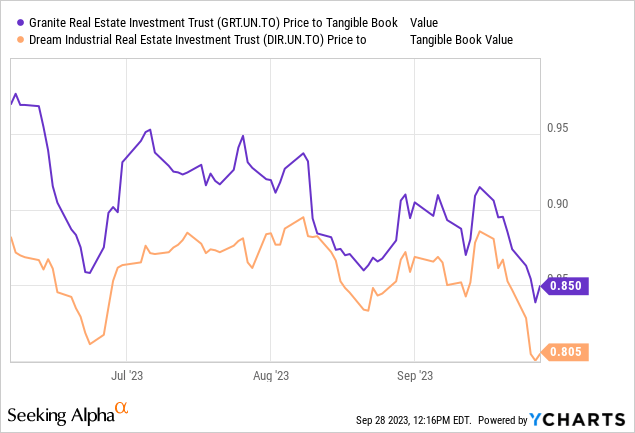

Dream Industrial continues to provide the higher yield (5.54% versus 4.47%) and while the spread has narrowed, it continues trade at a deeper discount compared to our protagonist.

For inquiring minds, while we are close to it, we have not bought the dip in Dream Industrial as yet. The trade will likely be via defensive covered call options.

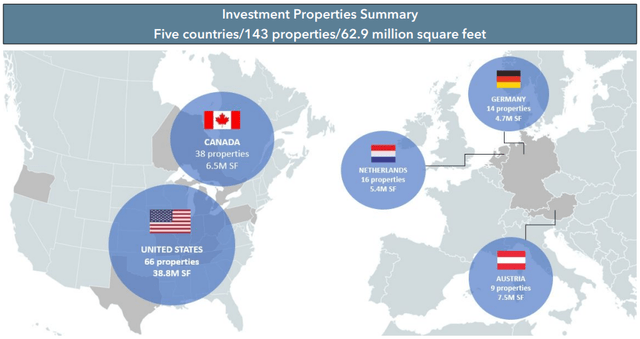

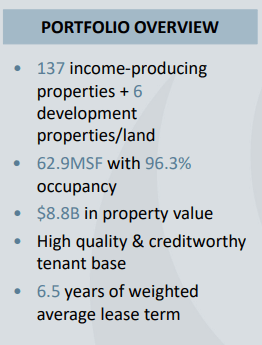

Today though is about Granite. For the uninitiated, this REIT holds a portfolio of logistics, warehouse and industrial properties. At last count, these spanned 62.9 million square feet and were spread across five countries.

Q2-2023 Financial Report

We have provided a more thorough background on Granite in several of our previous articles, even the one that is linked in the beginning of this piece. Rather than repeating ourselves, we will jump right into the numbers.

Q2-2023

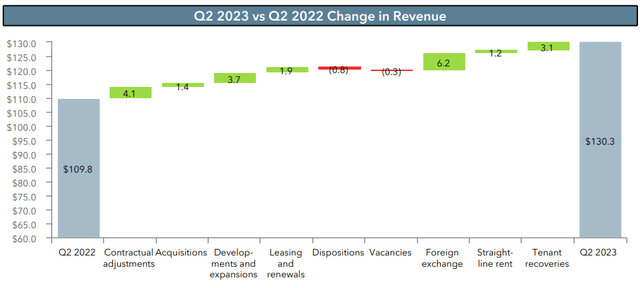

Just like in case of Q1, the role of MVP was again played by foreign exchange. The US Dollar and Euro strength relative to the Canadian dollar translated into a higher bottom line for Granite.

Q2-2023 Financial Report

As we can see above, while foreign exchange led the charge, other factors like contractual rent increases, developmental activity, and tenant recoveries played solid supporting roles.

Q2-2023 Financial Report

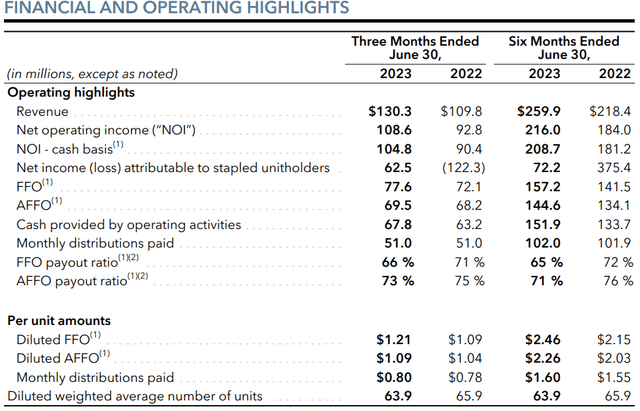

The total funds from operations (FFO) increased by around 7.6%, whereas the per unit amounts of the same metric increased by over 11%. This is the magic of units buybacks by the REIT in 2022 which amplified the FFO growth.

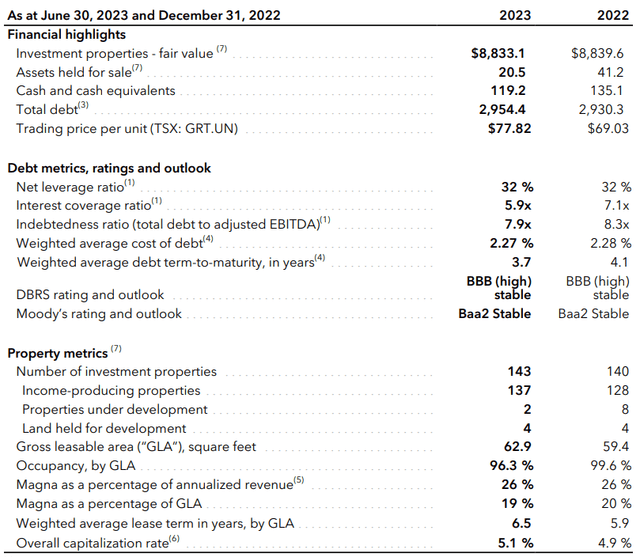

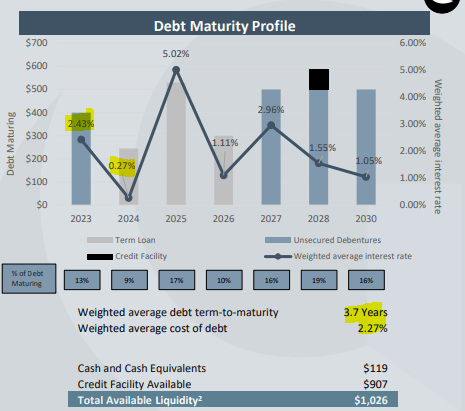

Moving on to the balance sheet, Granite continues to have a firm grasp on its leverage (debt to assets) at 32% . The weighted average interest rate actually decreased slightly, which is a rare sight in today’s times.

Q2-2023 Financial Report

Another noteworthy item in the graphic above is the decline in occupancy from 99.6% to 96.3%. This was already on its way down in Q1, which it ended at 97.8%. This was addressed by the CEO in the earnings call.

Matt Kornack

Okay. That makes sense. And then, I mean, you made an interesting comment. You guys have been at 99% occupancy. I don’t know if we should view 99% occupancy as a stabilized occupancy figure for any real estate portfolio. But as you think out — like is the goal to get back to that? Or is there always going to be kind of a bit of vacancy and then pricing [indiscernible]?

Kevan Gorrie

I’m glad you mentioned it because I think some people have been critical with 99% being too high and all we care about is occupancy. And I would kind of tend to agree with that. I think the nature of our portfolio is very stable. We have newer assets. We have major tenants, Magna is a tremendously stable tenant. So — if a normal portfolio — logistics portfolio is 97%, we should probably be 98% to 99%, just based on the stability characteristics of our portfolio. That being said, occupancy is not a driver for us. It really is growing NOI and then effect of rent growth, that’s really a driver. And so do we need to be 99%? Absolutely not. Where will we kind of shake out? Probably more in the, as I said, more than 98% range just because of the nature of our portfolio and really — you’re absolutely right. I think 99% plus is just an arbitrary number and very hard to attain over a long period of time.

Source: Q2-2023 Earnings Call Transcript

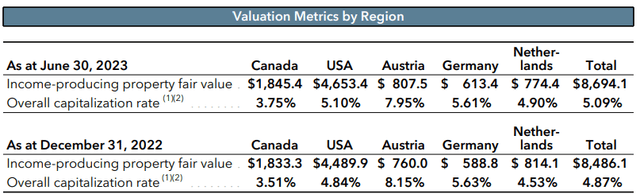

The REIT continues to mark its portfolio at higher capitalization rates, with Austria and Germany going the other way.

Q2-2023 Financial Report

Investors in Canada can get over 5.5% in Guaranteed Investment Certificates or GICs, and Granite expects them to vie for a stake in its Canadian properties for 3.75%. In this case, we could argue that we need higher capitalization rates rather than more cowbell. On the other hand, you don’t get 7.7% same property net operating income (NOI) growth and 15% leasing spreads on your GICs.

During the second quarter of 2023, Granite achieved average rental rate spreads of 15% over expiring rents representing approximately 1,936,000 square feet of renewals completed in the quarter.

Source: Q2-2023 Financial Report

Verdict

Granite trades at $72.08 at the time of writing this piece. The market estimates the NAV to be in the range of $81.60 to $95, with the average being around $90. This is one of the few REITs, where the analyst estimate of the NAV ($90 average) is higher than its own internal valuation of around $85. The weighted average lease term is about the right size that it can benefit from good spreads but can also buffer through a recession.

Granite Presentation

Prologis Inc. (PLD) is another industrial REIT that we wrote about recently. That trades at about 20X FFO versus 14X for Granite. So while we said no to that one, we can say yes to this. We have quality assets that offer enough of a buffer and the dividend yield is also now relatively competitive at 4.45%.

Whichever way you cut it, this REIT is undervalued and has become a good value prospect at this time. We accordingly, rate it a buy and give it a 4 on our potential pain scale.

Author’s Pain Scale

Some might argue that this is a table-pounding buy for ultra-high quality assets at a cheap multiple. We get that logic, but one reason we just have this at “4” on our scale and not at a “1”, is the debt maturity profile.

Granite Presentation

While not as poor as some of the Canadian REITs we have seen, it does present some headwinds. Rollovers in 2023 and 2024 will be at a far higher rate and that will crimp some growth prospects. Overall, we are still starting a position in the coming days, likely with covered calls.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here