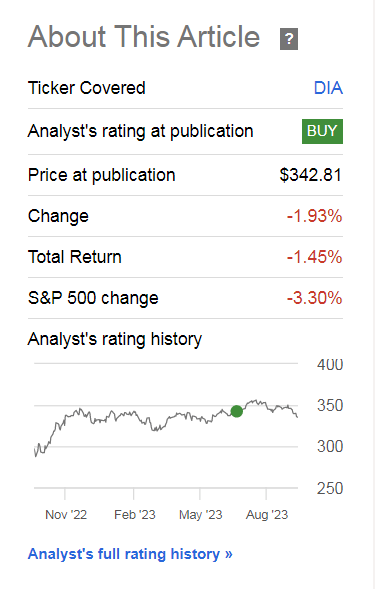

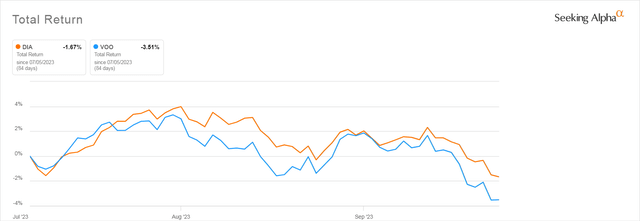

Back on July 5, 2023, I explained in the article, Why I’m Buying DIA This Month Instead Of VOO that I was buying the SPDR Dow Jones ETF (NYSEARCA:DIA) with investments I made going forward because I expected I’d soon be getting some tax loss harvest opportunities. I believed that in a declining market DIA might decline less than the Vanguard S&P 500 ETF (VOO), given its lack of most of the Tech-related stocks that were dominating VOO and causing VOOs surprise surge over the first half of 2023. I figured that if interest rates stayed high, which I believed would be the case, the Tech stocks would suffer and DIA, with its preponderance of more mature, slow growing, not-very-popular holdings would slightly outperform.

I’m updating that recommendation now for the benefit of anyone who followed the strategy I outlined in that article.

DIA Did Turn Out to Be A Superior Investment To VOO Over the Short term

My plan has worked out very well.

Seeking Alpha

As you can see from the chart above, though DIA has dropped since I published that July article, it did not drop as much as the S&P 500 over the same period. And since I bought it as a tax loss harvest partner for the Vanguard S&P 500 ETF, VOO, I was glad to see that even including dividends, the total return for DIA was superior to that of VOO.

DIA vs VOO July 5 – Sept 28, 2023

Seeking Alpha

Investing in DIA since July Did Provide a Fine Tax Loss Harvesting Opportunity

As I explained in that July article, DIA made sense as a short-term investment for me and anyone else investing in a taxable account because it looked like it could be a superior tax loss harvesting partner if the handful of Tech-related stocks that were driving VOO’s gains over the first half of the year were to falter.

Tax Loss Harvesting Makes Sense If You Have Taxable Gains

There are two reasons why an investor in a taxable account might want to take advantage of a tax loss harvesting opportunity. One was, obviously, if they had significant taxable gains from selling investments that had been great investments during the low interest rate years but which were likely to do poorly if fixed income rates stayed at their current, very appealing level.

I have gains from selling the Vanguard Utilities Index Fund ETF (VPU) which provided me with a nice bond proxy in the near-0% rate environment we had in 2019, and because I bought quite a bit of it in March of 2020 that had given me some nice capital gains, too. But by summer I had seen its share price dropping almost daily and got out while I still had a significant gain. VPU’s dividend was not high enough to compete with what was available from fixed income and I wasn’t happy with what massive fires were doing to utility earnings.

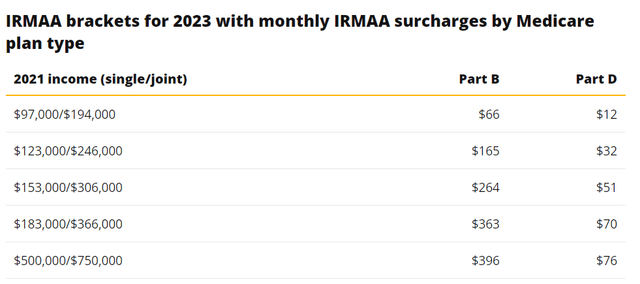

Tax Loss Harvesting Also Makes Sense If Gains or Income Are Bumping Up Against a Medicare IRMAA Cut Point

IRMAA is short for ” Income-Related Monthly Adjustment Amount” and refers to means-tested extra charge for Medicare’s monthly payment that retirees are assessed if their taxable income from two years before the current year exceeds a certain set dollar amount.

The specific boundary that applies to you depends on whether you file as a single or married couple and is tiered. The income numbers used are those from your income tax return from two years before the current year. You can see the current cut points below.

valuepenguin.com

As you can see, If you exceed the cut point you can find yourself paying a significantly larger monthly payment. What is really nasty about the IRMAA boundary is that if you make just $1.00 more than the cutoff number, you have to pay the same extra $1,428/month – or more – as someone pays who is single earning $25,000 more than that cut point or a couple pays that is earning an extra $51,000 over the cut point.

I’ve been stung by this in the past–having my taxable income exceed the IRMAA cut point by only a few hundred dollars. And because my taxable income this year is again a very small number of dollars away from a cut point for 2025 I am doing all I can to keep that taxable income under that cut point.

How Tax Loss Harvesting Works

Tax loss harvesting lets me use the capital losses my stock and ETF investments have made to offset taxable capital gains I’ve generated over the year. Short-term losses are applied to my short-term gains and long-term losses to my long-term gains, but if I have more of one kind of gain than of the other, I can use any remaining gains to offset gains of a different type.

Once you have offset all your gains from selling stocks, bonds, or ETFs, an additional $3,000 of capital losses can be used to offset other kinds taxable income. Since I still earn money from my business, I will use up to $3,000 of additional loss to keep the same amount of my business income from being taxed. Any extra gains are carried over and can be used in subsequent years. My tax software, the downloadable form of HR Block, can keep track of this for me.

Best of all, though I decrease my taxable income with realized losses from selling stocks and ETFs, the whole idea of Tax Loss Harvesting is that I still stay fully invested in stocks so if they were to surge the day after I harvested my losses, I wouldn’t lose out.

That’s because minutes after I sell a losing investment I put the proceeds into another, not-identical but very similar investment. That way, if I pick the right tax loss harvest partners I don’t lose money though I generate a taxable capital loss.

I had intended to tax loss harvest any losses from DIA into VOO, as VOO (or any other S&P 500 ETF with a low expense ratio like the iShares Core S&P 500 ETF) is my preferred investment vehicle. However, I am still not happy with how top-heavy VOO remains. The “Magnificent Seven” still influence its ups and downs very strongly. So I spent some time considering other ETFs that might be good Tax Loss Harvest partners for DIA.

An obvious one is the Vanguard Large Cap ETF (VV), which holds just a few more stocks than VOO. But I currently also have made some recent investments in VV, which, as you would expect, have dropped in sync with VOO. So I didn’t want to buy more shares of VV as I would like to hold open the possibility of selling my whole holding of VV at any time to provide more tax losses.

The reason you have to be careful not to buy shares of a stock or ETF you already own if you intend to tax loss harvest it is because if you add shares to an existing investment, you can’t claim a tax loss if you sell them within 30 days after buying shares of the same investment or if you buy more shares for 30 days afterwards. That is considered a Wash Sale. That means you don’t get to deduct the loss from your taxes. Instead the amount of your loss is deducted from the cost basis of your remaining shares. The only way you can avoid a wash sale if you have bought shares of a stock within 30 days of the date of sale is to sell all the shares you hold of the investment. I do not want to sell all my shares of VV.

Why I Chose Not to Invest the Sale Proceeds in VOO

Today I tax loss harvested all of my shares of DIA. I did so because I had hit a dollar amount of losses which I had decided would be where I would sell that investment. I had originally intended to move the proceeds back into VOO, because it is my intention to make it my primary investment vehicle. I hadn’t bought any VOO in more than 30 days.

However, because there is still the possibility of more tax loss harvest opportunities appearing over the rest of this year, and because I had been buying VOO through the first half of 2023 if I bought new shares of VOO now I would have to wait 30 days after my last purchase to tax loss harvest any of my VOO shares purchased over the previous few months. The alternative would be to sell all my VOO shares, but I have a lot of them some bought fairly recently, which would mean that to tax loss harvest VOO within 30 days I would have to sell all of it, buy a huge amount of something else, and run the risk of getting trapped in that something else if the market suddenly surges, as it is prone to do.

Why I Chose to Put My Money into VTI Instead

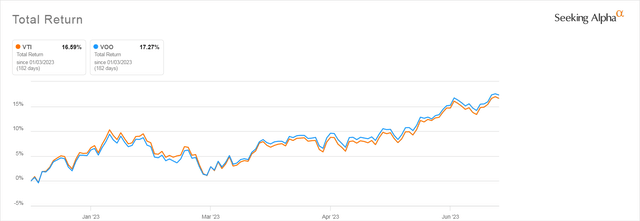

It’s been several years since I invested any money in the Vanguard Total Stock Market ETF (VTI). VOO does outperform it in a bull market. But since my shares are very old, the stock market would have to drop by a very large amount to make it possible for me to tax loss harvest any of my many older shares.

Therefore, putting the relatively small proceeds from DIA into VTI made more sense for me than putting them into VOO. All I have to do now is wait 30 days, which is very reasonable, and then I can sell my not-very-big slug of new shares if I want to.

VTI has the advantage that if we get into a recession that lasts more than a few months it is likely to outperform the more-top-heavy S&P 500. It is not quite as dependent on the so-called “Magnificent Seven” stocks, Apple (AAPL), Microsoft (MSFT) etc. It also has the advantage that if the market does surge it will rise in harmony with the S&P 500 just not quite as much.

Below you can see how VTI performed compared to VOO during the brief “Magnificent Seven” bull market that prevailed during the first half of 2023.

VTI and VOO Total Return During The First Half of 2023

Seeking Alpha

However, if the market does experience a period of disappointing returns, VTI is likely to outperform VOO, as it has in past flat markets.

As you can see, over the past week when market declined sharply, as the reality that the Fed was going to keep rates high for at least another year set in, VTI not only held up better than VOO. It also did better than DIA.

VTI, VOO, and DIA in A Very Worried Market

Seeking Alpha

If the money I just invested does get “trapped” in VTI, that’s fine too. VTI is suitable for a long-term investment and has a history of performing better than VOO during recessionary periods and stagnant markets over the past decades. I have documented its better performance during such periods in detail in a previous article, Is VTI a Better Investment than VOO After 2022’s Big Correction.

DIA Is Only Suitable for a Short-Term Investment Aimed at Providing a Good Tax Loss Harvest Partner to the S&P 500 In Certain Situations

Because I did issue a “Buy” recommendation for DIA in July I want to reiterate that I made it clear in that article that DIA was being bought to provide a tax loss harvesting partner should VOO decline due to challenges posted by high rates to its top stocks. If the market turns around sharply, DIA will lag, as it usually does during bull markets. I do not recommend buying it as a long-term holding.

Right now we’ve had significant adjustments in some of the more overvalued leaders in VOO and the other ETFs tracking the S&P 500 like the SPDR S&P 500 ETF Trust (SPY) or the iShares Core S&P 500 ETF (IVV), making VTI a more reasonable tax loss harvest partner for VOO or other ETFs tracking that index. For those looking for an alternative that is not identical to any of the S&P 500 ETFs, VV is also a suitable choice for an S&P 500 ETF alternative, as it almost always tracks the S&P 500 very closely but not exactly.

Read the full article here