Costco: (NASDAQ:COST) reported fourth-quarter earnings per share (EPS) of $4.86, beating analyst expectations by $0.07. Revenue came in at $78.94 billion, also beating expectations by $1.22 billion.

Comparable sales increased 1.1% year-over-year, excluding gas and foreign exchange effects. However, comparable sales in the United States were flat, as gas deflation and foreign exchange fluctuations had a negative impact.

Although I believe Costco’s stock is unlikely to outperform the market in the near-to-mid term due to the inflationary environment, I am rating it a Buy for patient long-term investors. Costco has a great business model with a unique membership strategy, and I believe it will outperform the market over the long term.

Background

In my previous article on Costco, Costco: A Stock That’s Too Hot To Handle, I explained why the company trades at low margins compared to its competitors, covered its corporate strategy, detailed my investment work, and went over its key risks. In short, I believe Costco is a great, stable business with a unique corporate strategy, but its current valuation is a bit high. I changed my rating to Buy because of the fact that Costco members continue to renew their memberships at high rates, demonstrating their strong loyalty to the brand.

Let’s see if our investment thesis remains valid in light of the fourth quarter results.

Costco’s Fourth Quarter 2023 Operational Performance

Costco ended the quarter with 861 warehouses, including 591 in the United States and Puerto Rico, 107 in Canada, 40 in Mexico, 33 in Japan, 29 in the United Kingdom, 18 in Korea, 15 in Australia, 14 in Taiwan, five in China, four in Spain, two in France, and one each in Iceland, New Zealand and Sweden. In the fourth quarter’, Costco opened nine net new warehouses including five new buildings in the U.S., two in China, and one each in Japan and Australia. For the full fiscal ’23 year, Costco finished with 23 net new units.

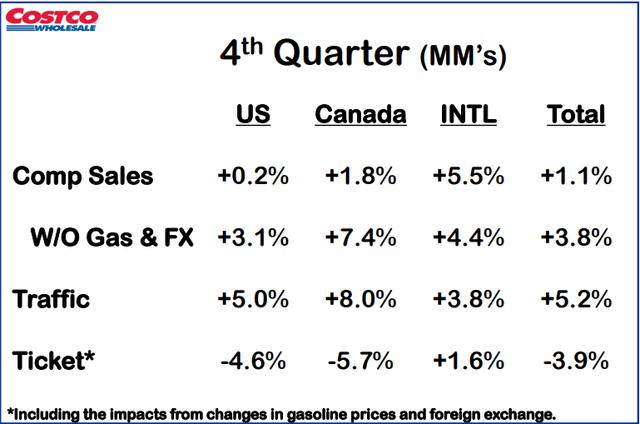

4th 2023 Quarter Results (Costco’s presentation)

We can see, above, that Costco’s comparable sales growth in the fourth quarter was 1.1%, but traffic growth was 5.2%. This suggests that customers are still shopping at Costco warehouses, despite the inflationary environment.

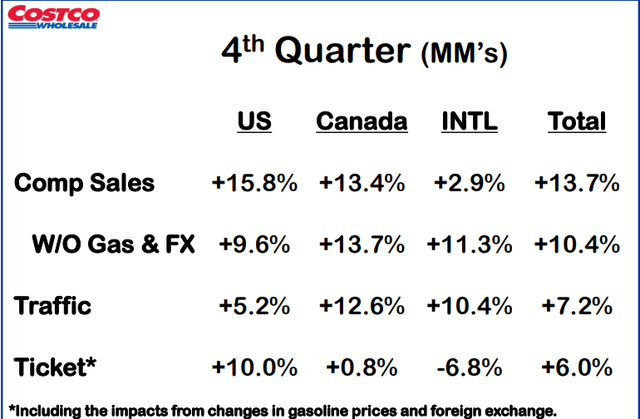

4th 2022 Quarter Results (Costco’s presentation)

Compared to the fourth quarter of 2022, Costco’s comparable sales growth declined sharply from 13.7% to 1.1%. However, traffic growth remained steady, at 5.2% compared to 7.2% in the fourth quarter of 2022. This suggests that Costco was significantly impacted by inflation and the rising cost of goods sold.

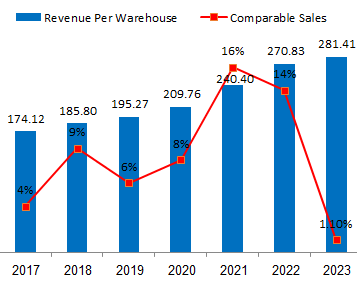

Revenue Per Warehouse (Compiled by the author using data from Costco financial reports)

Comparable sales are one of the most important metrics for a company like Costco. While comparable sales growth declined sharply in Q4 2023 due to inflation, I am optimistic that we will see an upward trend in comparable sales growth in the coming years. Costco is well positioned to weather the current inflationary storm and benefit from a number of growth drivers, the company has a strong business model, a loyal customer base and a number of growth drivers. These include strong corporate growth, an expanded product selection and favorable economic conditions. Costco is also well positioned to benefit from a number of long-term trends, such as the aging population, the growth of the middle class and the increasing urbanization of the world.

Important Notes

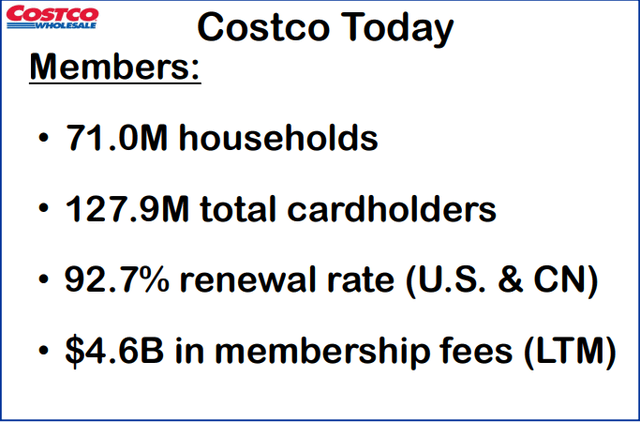

Q4-23 Costco’s members (Costco’s presentation)

Costco’s household membership growth continued to trend upwards in the fourth quarter of 2023, increasing by 53,100, or 33.71%, from the end of 2022. Total cardholder growth also remained strong, increasing by 7.57% to 118,900 at the end of 2022. This demonstrates the strength of Costco’s membership program and consumers’ continued desire to join and renew their memberships.

In terms of renewal rates at Q4 end, our U.S. and Canada renewal rates stood at 92.7%, which is up 0.1% from the 92.6% figure as of the end of Q3. The worldwide rate came in at 90.4%, down 0.1%, reflecting the impact of increasing penetration of memberships from international, which renew at a lower rate, in large part because of new openings internationally.

Richard Galanti, CFO, Q4-2023 Earnings Call

As we discussed in the previous article, membership income is one of the most important metrics for warehouse clubs, and Costco in particular, as it is the main driver of profits. The best thing to watch in this regard is renewal rates, which were at 90.4% in the fourth quarter of 2023, down 0.1% from the same period in the previous year. This is still a good result considering the current environment of inflation, price increases, and consumers trying to cut costs. It demonstrates the strength of Costco’s membership program.

Why hasn’t Costco raised its membership fees yet?

Well. My pat answer, of course, is a question of when, not if. It’s a little longer this time around, since June of ’17. So we’re six years into it and – but you’ll see it happen at some point. We can’t really tell you, if it’s in our plans or not. We’ll let you know when we know. We feel good. These say about all the attributes of member loyalty and member growth. And frankly, in terms of looking at the values that we provide our members, we continue to increase those. It’s certainly a greater amount than even more than if and when an increase occurs. So stay tuned. We’ll keep you posted, but there’s not a whole lot I can tell you about that.

Richard Galanti, CFO, Q4-2023 Earnings Call

Costco has not announced an exact date for a membership fee increase, but it has been six years since the company last raised its fees. Given that management has expressed interest in raising fees, I believe that a fee increase is likely in the mid-term. This would be good news for Costco’s investors, as it would boost the company’s profitability.

A few other items of note, in the fourth quarter, we opened nine net new warehouses, including five new buildings in the U.S., two in China, and one each in Japan and Australia. For the full fiscal ’23 year, we finished with 23 net new units, as well as we did three relocations. And for the first quarter, the first 12 weeks of fiscal ’24, we plan on opening 10 net new units, as well relocating one unit.

Richard Galanti, CFO, Q4-2023 Earnings Call

Costco continues to expand its physical presence, opening nine new warehouses in the fourth quarter of 2023. The company plans to open 10 net new units in fiscal 2024 and is on track to meet its goal of opening 18 net new units over the next two years, as I mentioned in my previous article.

Valuation

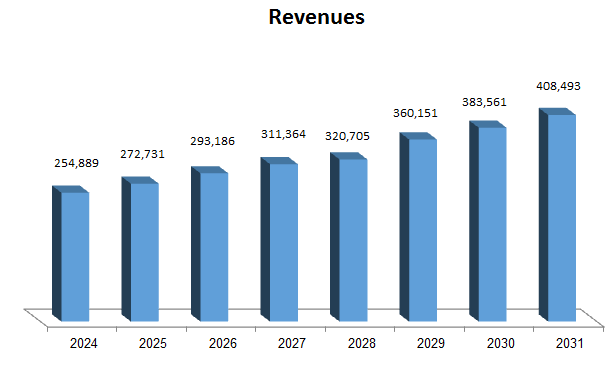

Cost’s Estimates Revenue (Authored using Costco financial data and the author’s projections)

I used a discounted cash flow (DCF) methodology to estimate Costco’s fair value. I assumed that the company would grow its revenue at a compound annual growth rate (CAGR) of 7% between 2024 and 2031, based on its warehouse expansion plans and potential membership fee increases. Using a weighted average cost of capital (WACC) of 6.5% and factoring in Costco’s net debt position, I estimated the company’s fair value to be $600 per share.

For those who have been following my work, my price target has not changed significantly since my last article.

Risks & challenges

- Inflation: Costco is facing the same inflationary pressures as other retailers. This is impacting its costs and may lead to lower margins.

- Competition: Costco faces competition from other warehouse clubs, such as Sam’s Club, as well as from traditional grocers and e-commerce retailers.

- Supply chain disruptions: Costco’s supply chain could be disrupted by factors such as natural disasters, transportation disruptions, or supplier bankruptcies.

- Membership renewal rates: Costco’s membership renewal rates are a key driver of profitability. If renewal rates decline, it could have a negative impact on the company’s bottom line.

Conclusion

Costco’s fourth quarter results were mixed, with comparable sales growth declining sharply to 1.1%, but traffic growth remaining steady at 5.2%. I believe that the inflationary environment played a major role in the decline in comparable sales growth, but I am optimistic that we will see an uptrend in comparable sales growth in the coming years.

Despite the near-term challenges, I upgrade my rating to a Buy on Costco for long-term investors. Costco has a great business model with a unique membership strategy. The company’s membership renewal rates remained strong in the fourth quarter of 2023, demonstrating the strength of its membership program. Costco is also continuing to expand its physical presence. I believe that Costco will outperform the market over the long term, but investors should be prepared for some volatility in the near-to-mid term due to the inflationary environment.

Read the full article here