Black Stone Minerals (NYSE:BSM) primarily produces natural gas and is also partially hedged for 2024, but it should still benefit a bit from improved oil prices. I now project Black Stone’s 2024 distributable cash flow at $1.81 per unit at current strip prices. This would improve to $1.94 per unit in 2025 with flat production growth, as its below-market value hedges roll off and natural gas prices improve.

I continue to believe that Black Stone can maintain its current common unit distribution, which is $0.475 per quarter or $1.90 per year. However, its preferred units may now see their distribution rate adjusted to 10+% in November 2023, potentially leading Black Stone to work on at least a partial redemption of those units in late 2025 to early 2026. This is something to keep an eye on in the future.

Preferred Units

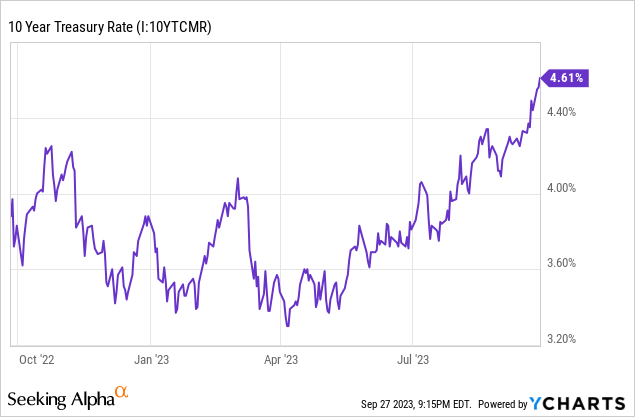

Black Stone has 14,711,219 Series B Cumulative Convertible Preferred Units outstanding with a par value of $300 million. These preferred units have a 7% distribution rate currently, resulting in $21 million per year in preferred distributions. However, the preferred units will see their distribution rate adjusted on November 28, 2023 to the greater of its current distribution rate and the 10-year Treasury Rate + 5.5%.

The potential challenge for Black Stone is that the 10-year Treasury Rate is currently the highest it has been since 2007. This would result in the preferred units (at the current 4.61% 10-year Treasury Rate) ending up with a 10.11% distribution rate, leading to $30.33 million per year in preferred distributions.

While the distribution rate gets re-determined every two years, the formula calls for the new distribution rate to be the greater of the current distribution rate and the 10-year Treasury Rate + 5.5%. Thus, if the distribution rate changes to 10.11% in November 2023, that becomes the new floor for the distribution rate going forward.

The Series B preferred units may be converted by holders into common units on a one-for-one basis, which results in an effective price of $20.3926 per unit. Black Stone’s common units are trading around 14% below that price currently.

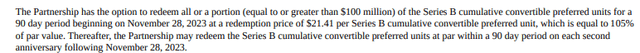

Black Stone also has the ability to redeem the Series B units at 105% of par value during a 90-day period beginning November 28, 2023. It may later redeem the Series B units at 100% of par during a 90-day period beginning November 28, 2025.

Series B Preferred Unit Redemption (blackstoneminerals.com)

The interest rate for Black Stone’s credit facility appears to be around 7.8% to 8.8% currently, depending on borrowing base utilization. Thus, it appears to make more sense financially for Black Stone to wait until November 2025 to potentially redeem at least some of its Series B units at par, rather than pay a 5% premium in a couple of months.

Updated 2024 Outlook

Oil prices have improved a decent amount since I last looked at Black Stone, with the 2024 WTI oil strip up approximately $5.50 to $82.50 per barrel. This adds approximately $21.5 million to Black Stone’s unhedged revenues for 2024.

The 2024 Henry Hub strip has gone down slightly by $0.10 per Mcf over that same time frame, reducing Black Stone’s unhedged revenues by approximately $6 million.

Black Stone has around 46% of its 2024 oil production hedged, and the value of its 2024 oil hedges has decreased by another $10 million. Around 67% of Black Stone’s 2024 natural gas production has been hedged, and those hedges have gained around $4 million in value.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

3,914,260 |

$80.50 |

$315 |

|

Natural Gas [MCF] |

60,391,440 |

$3.50 |

$211 |

|

Lease Bonus and Other Income |

$11 |

||

|

Hedge Value |

-$18 |

||

|

Total |

$519 |

I now project Black Stone’s distributable cash flow at $1.81 per unit for 2024, resulting in 0.95x distribution coverage at its current $0.475 per unit quarterly distribution.

This assumes the production of 38,300 BOEPD (72% natural gas in 2024) for Black Stone.

|

$ Million |

|

|

Lease Operating Expense |

$12 |

|

Production Costs And Ad Valorem Taxes |

$52 |

|

Cash G&A |

$43 |

|

Cash Interest (Including Commitment Fees) |

$1 |

|

Preferred Distributions |

$30 |

|

Total Expenses |

$138 |

Notes On Distribution And Valuation

Looking forward to 2025, it appears that Black Stone’s distributable cash flow could improve due to higher natural gas prices and a lack of below-market value hedges.

The current strip for 2025 is approximately $76 WTI oil and $3.95 Henry Hub natural gas. Black Stone currently does not have any 2025 hedges. If Black Stone’s production remains at 2024 levels, the improved natural gas prices in 2025 more than offsets the impact of weaker oil prices.

Thus, at current 2025 strip and flat production growth, Black Stone is projected to generate $1.94 per unit in distributable cash flow in 2025, resulting in 1.02x distribution coverage at a $0.475 per unit quarterly distribution.

I continue to believe that Black Stone is likely to maintain its quarterly distribution at $0.475 per unit based on current strip prices. However, Black Stone may want to redeem some of its Series B preferred units in late 2025 to early 2026. In that case, it may aim for a higher distribution coverage at some point to allow it to fund part of that redemption with cash on hand or to help pay down the credit facility debt from the redemption.

My estimated value for Black Stone remains at $18.50 to $19.00 per unit at long-term (after 2024) $75 WTI oil and $3.75 Henry Hub gas, although Black Stone’s decision on how to deal with its Series B preferred units may affect its estimated value.

Conclusion

Black Stone Minerals is benefiting from improved oil prices, boosting its projected 2024 distributable cash flow to $1.81 per unit at 38,300 BOEPD in production and current strip. This would increase to $1.94 per unit in 2025 at the same production level and 2025 strip prices.

Black Stone had zero credit facility debt and $47 million in cash on hand at the end of Q2, 2023, so it appears capable of maintaining its current $1.90 per unit annual distribution rate for its common units.

The distribution rate for its preferred units may potentially be adjusted to 10+% in November 2023 though, which would likely prompt Black Stone to consider redeeming at least part of its $300 million in Series B preferred units in late 2025 to early 2026, when it can redeem those units at par though.

Read the full article here