Investment Thesis

Lindsay Corporation (NYSE:LNN) faces near-term revenue headwinds from weakness in the irrigation segment as declining Agri commodity prices are negatively farmer sentiments. While the outlook for the infrastructure segment looks favorable, it is relatively smaller than the irrigation segment and should not be able to offset the decline in the irrigation segment. The margin outlook isn’t very encouraging either with volume deleverage due to declining sales impacting operating margins. While the valuations are lower than the historical average, I would prefer waiting for the bottom in the irrigation business before becoming more optimistic about the stock. For now, I have a neutral rating on the stock.

Revenue Analysis and Outlook

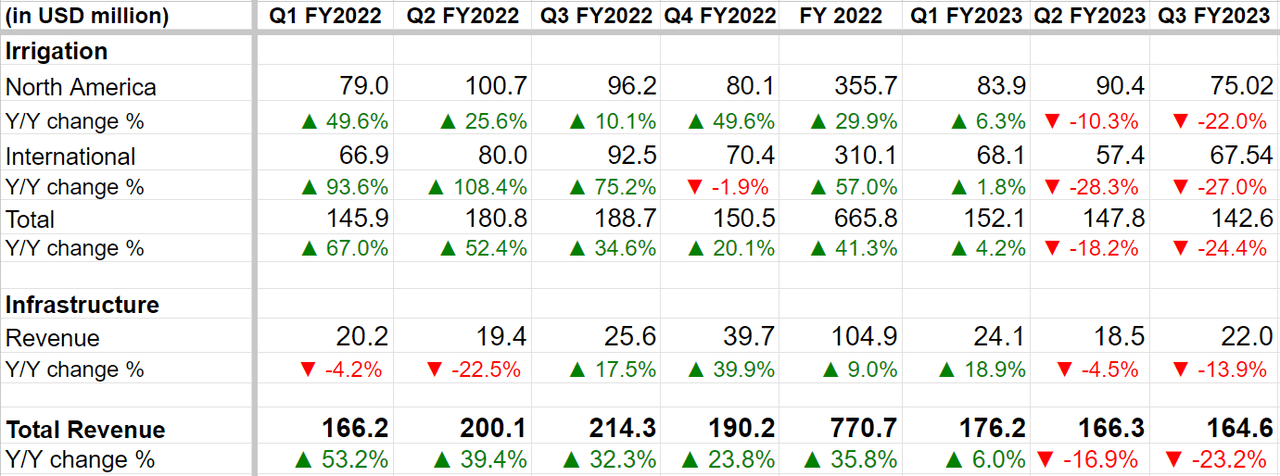

After seeing strong growth fueled by high agri commodity prices over the last couple of years, the company’s sales growth has turned negative in recent quarters as agriculture commodities have started seeing a decline in their prices.

In the fiscal third quarter of 2023, the company’s revenue declined 23.2% Y/Y to $164.6 million due to the weakness in the company’s irrigation segment as farmers delayed their investment decisions for irrigation equipment and projects. The Irrigation segment’s revenue decreased 24.4% Y/Y to $142.6 million with the North America irrigation revenues declined 22% Y/Y and the International irrigation revenue declining 27% Y/Y. In the Infrastructure segment, revenue decreased 13.9% Y/Y to $22 million due to lower Road Zipper System and road safety product sales, partially offset by an increase in Road Zipper System lease revenue.

LNN’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the company’s near-term revenue outlook for the irrigation segment is challenging. As explained earlier, last quarter’s sales were impacted as farmers delayed their capital investment decision and preferred a wait-and-see approach in response to macro uncertainty and falling crop prices. At the time of LNN’s last earnings call, management was expecting that this demand would not be lost and hoping for a pick-up near the fall harvest season, i.e., between late September and December.

However, if we look at the crop prices in recent months, all three major crops, Wheat (W_1:COM), Corn (C_1:COM), and Soybean (S_1:COM) prices have seen a correction and are trading lower than where they were at the time of Lindsay’s prior earnings call. So, the farmer sentiments have likely worsened and I don’t think we should see any pick up in investments near the year’s end.

Internationally, there is one catalyst in the form of the Brazilian government increasing the financing program for irrigation investments by 25%. Under this program loans are provided at 10.5% interest rates. However, I don’t think it should be able to offset the negative impact of the lower crop prices and the international market should also continue to see a Y/Y decline.

Things are much better on the Infrastructure side though given the Infrastructure Investment and Jobs Act (IIJA) funding which is expected to increase the demand for construction projects. Of late, the overall transportation and construction contract awards have seen a good increase driven by government funding. These awards are a leading indicator for LNN’s product sales which include Road Zippers (or movable barriers), crash cushions, road marking and road safety equipment, etc. In particular, management is optimistic about growing its Road Zipper leasing business and seeing a good sales funnel there. The use of Road Zipper facilitates construction programs and provides worker safety during road construction projects and management believes they can get good traction by leasing them for construction projects.

However, the company’s infrastructure business is relatively smaller compared to the irrigation business and the decline in irrigation revenues should more than offset any growth there. So, overall, the company’s near-term revenue outlook is not that great and revenues are expected to continue declining.

Margin Analysis and Outlook

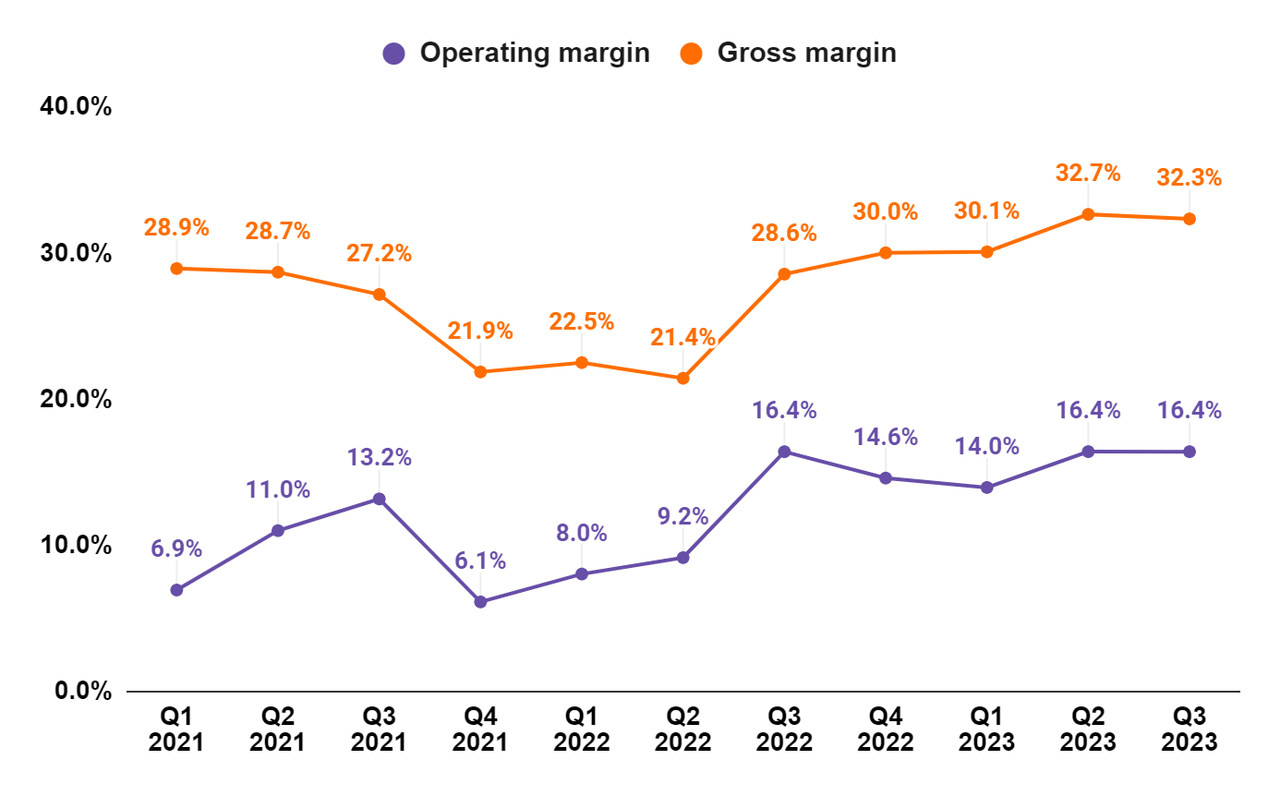

In Q3 2023, the company saw a 370 bps Y/Y improvement in the gross margin to 32.3%, attributed to improved price realization. The improvement in gross margin offset the volume deleverage, which resulted in a flat Y/Y operating margin of 16.4%.

LNN’s Gross margin and Operating Margin (Company Data, GS Analytics Research)

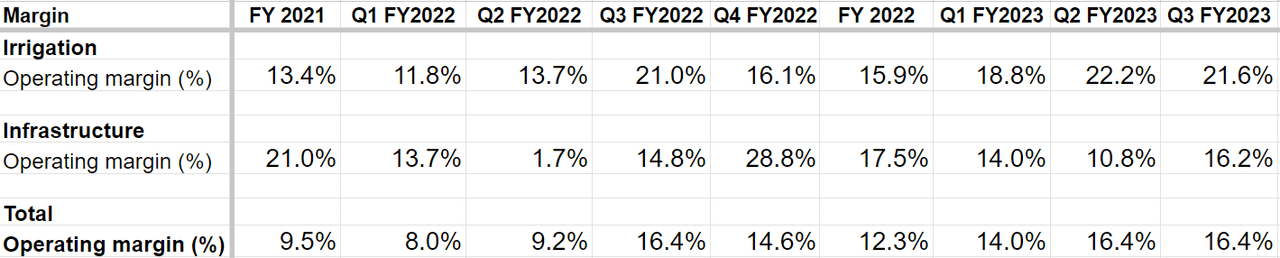

In the Irrigation segment, the operating margin of 21.6% improved by 60 bps Y/Y driven by higher price realization and operating performance. The Infrastructure segment’s operating margin increased 140 bps Y/Y to 14.8% due to improved price realization and a favorable mix.

LNN’s Segment- Wise Operating Margin (Company Data, GS Analytics Research)

While the company has maintained good pricing discipline so far, the continued slowdown in irrigation sales may put some downward pressure on the prices. Volume declines in the irrigation business should also result in SG&A deleverage. Over the last couple of quarters, the company’s margins have benefited from improving price realization, stabilizing inflationary environment, and easing supply chain constraints. This helped the company grow gross margins and maintain operating margins in Q3 2023 despite a sharp slowdown in sales. However, management noted that most of these positives were already fully realized last quarter. So, I am not expecting any incremental/sequential benefits from these factors in the coming quarters. So, with these tailwinds gone and volume-related heading continuing, I am not optimistic about the company’s near-term margin outlook.

Valuation and Conclusion

LNN is trading at 19.47x FY23 consensus EPS estimates and 18.04x FY24 consensus EPS estimates. While the valuation is at a discount to historical average and the outlook for infrastructure business is favorable supported by IIJA funding, the weakness in the irrigation business worries me. The margin is also likely to face headwinds from SG&A deleverage as the result of sales declines in the near term. So, I would prefer to wait on the sidelines for the irrigation business to bottom before becoming optimistic about the stock. Hence, I have a neutral rating on Lindsay Corporation stock.

Read the full article here