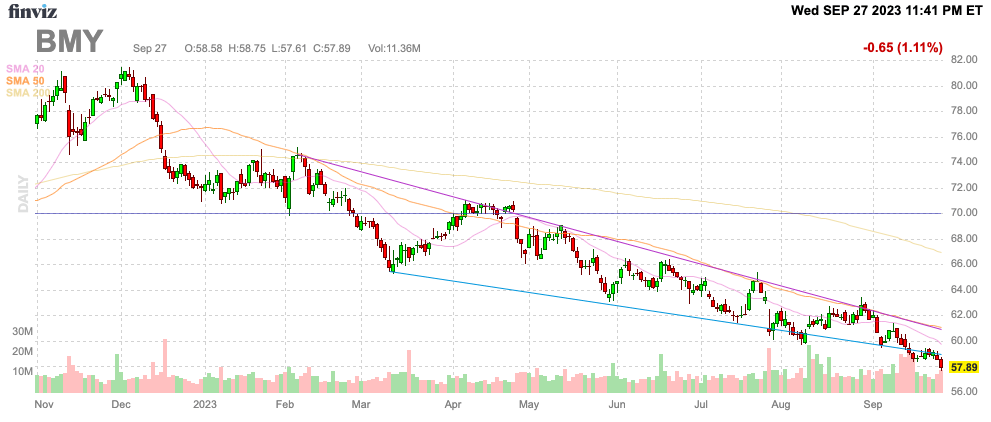

Just about every day for months, Bristol-Myers Squibb Company (NYSE:BMY) hits a new low. The biopharma continues facing pressure from the LOE of a key drug while trying to offset the lost revenues with a strong new pipeline. My investment thesis is now Bullish on the stock after the ongoing collapse after recommending an exit back in 2022, though Bristol-Myers doesn’t appear to have hit bottom yet.

Source: Finviz

Out Of Favor

As with any sector, a lot of the drug stocks are out of favor now. Bristol-Myers was an $80 stock towards the end of 2022 and now the stock sits below $60.

The biopharma had just guided to 2022 EPS of $7.44 to $7.74 per share for 2022 when the rally to $80 occurred. Now, Bristol-Myers is guiding to an updated 2023 EPS of $7.35 to $7.65 when the market was hoping for a target of $8.00 per share.

The stock topped $80 knowing the Revlimid issue was a big growth impediment for years ahead. Investors need to remember Bristol-Myers dipped to lower levels at the end of 2021 on similar fears surrounding this LOE.

The primary issue was the reduction in revenue targets for Revlimid. The cancer drug has long been known to be losing LOE with revenues more than cut in half in the last couple of years already.

Within a year starting in late 2021, the stock went from the low $50s to over $80. Bristol-Myers will come back in favor again providing a better point to exit the stock in the future.

De-Risked

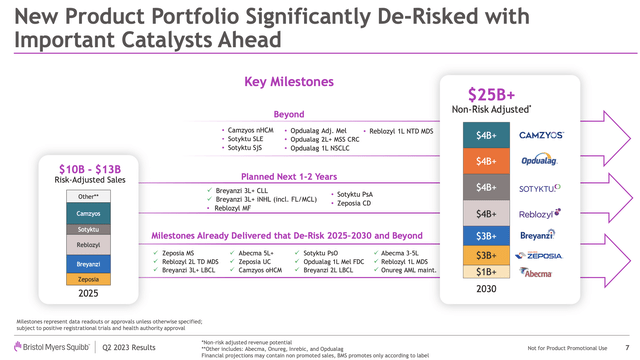

The key to the investment story has always been the transition from the LOE from Revlimid to a strong product portfolio of drugs with sales ramping up. A lot of the drugs are already de-risked with FDA approvals. Bristol-Myers has a goal for sales from the new product portfolio to grow from only a $3.5 billion run rate in Q2’22 to over $10 billion in 2025 and explode to a $25 billion revenue potential by 2030.

Source: Bristol-Myers Q2-23 presentation

Revlimid revenue is forecast to dip ~$1.5 billion in 2024 and another $2.0 billion in 2025. The drug would only have minimal remaining revenues in the $2.0 billion range going forward.

The biopharma forecasts total growth rates hitting mid-single digits despite the Revlimid dip, but the market doesn’t appear to agree to this forecast considering the current stock price. In addition, analysts estimates have sales dipping after 2025, but Bristol-Myers forecasts a robust pipeline of sales boosts to the magnitude of at least $12 billion in additional sales from 2025 to 2030.

The upside potential from the new drugs is over $20 billion in additional sales from the current levels versus only $5.5 billion in sales from Revlimid that could potentially be lost. Bristol-Myers will face other LOE issues over the years, but the current expectation is for the robust pipeline to lead to consistent revenue growth over the period once through the Revlimid pain coming slightly faster than expected.

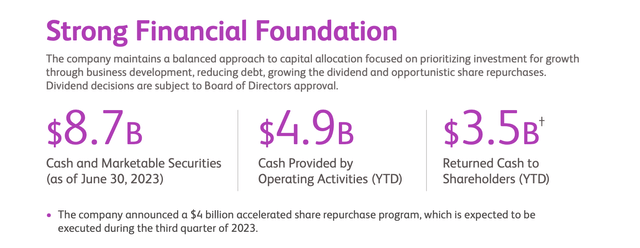

The stock trades at less than 8x 2023 EPS targets and the multiple dips to 7x 2025 EPS targets closer to $8. The company has a strong cash flow position with $4.9 billion generated in operating cash flows in the 1H’23 and $3.5 billion returned to shareholders

Source: Bristol-Myers Q2’23 earnings infographic

Management sees the stock as so cheap, the company approved a $4 billion accelerated share repurchase plan back in August when the stock traded above $60. Bristol-Myers only has a market cap of $122 billion providing substantial share reductions to provide a solid boost to EPS.

The only negative of this aggressive share repurchase plan is the net debt position of $29 billion at the end of Q2. Bristol-Myers should plan on lowering debt levels to provide the biopharma with more financial flexibility in the future while lowering interest expenses in a high-rate environment.

Takeaway

The key investor takeaway is that Bristol-Myers is currently out of favor, but the market will turn again in no time. The stock is crazy cheap at 7x 2025 EPS targets while the biopharma appears to have more growth upside than viewed by the market and confirmed by the big ASR.

Investors should continue holding onto Bristol-Myers looking for a better exit point.

Read the full article here