Bloom Energy (NYSE:BE) is primarily in the business of engineering, manufacturing, and distributing large-scale solid oxide fuel cell power (SOFC) generation modules for customers who demand highly resilient and reliable power. Their “energy servers” produce electricity at high efficiency from natural gas, hydrogen, or even biogas. The same SOFC platform can be run in reverse as an electrolyzer to produce hydrogen, helping to make use of intermittent solar or wind power. Both SOFCs and electrolyzers are anticipated to grow very rapidly (~30% CAGR) over the next decade. While Bloom Energy is firmly embedded in these rapidly growing markets, the company needs to prove they can grow revenue and improve their profit margin for their stock to appreciate.

The Beauty of Fuel Cells

A fuel cell encapsulates a simple and beautiful concept that forms the basis of modern electrochemistry. To appreciate what Bloom Energy is trying to do, I will briefly compare what physically happens in a conventional chemical reaction, like combustion, to what happens in an electrochemical fuel cell.

Combustion is a process for converting a fuel, like natural gas, into products such as water and carbon dioxide while releasing a significant amount of heat. On an atomic scale, molecules collide with one another, chemical bonds are broken, and electrons are transferred to create new chemical bonds that hold together newly formed molecular products. Together, these events release a significant amount of heat that is used to drive turbines to produce electrical power. Chemical combustion of coal and natural gas is how we produce most of our electrical power. The energy that we harness is stored in the chemical bonds of the carbonaceous fuel and is released upon combustion.

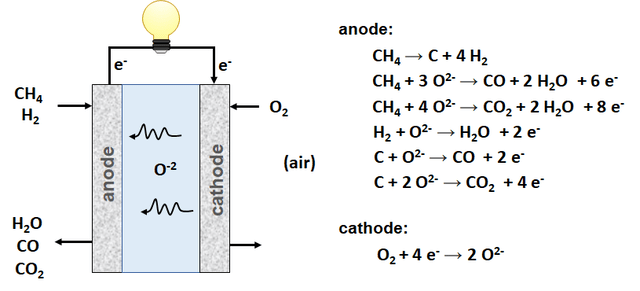

A fuel cell represents a completely different approach to making electricity. One or more chemical reactions occur in a fuel cell, but the reactions are split into two parts. In one compartment, molecules are oxidized, and electrons are liberated; and, in the other compartment, molecules are reduced, and electrons are consumed. Together, these two half-reactions form the same products as a conventional chemical reaction like combustion, but, in a fuel cell, the electrons are forced to flow through an external circuit. A SOFC running off of methane is shown in Fig 1. Consequently, instead of releasing a significant amount of heat, the device produces some heat but, more importantly, it produces electrical current.

Fig. 1. Schematic showing a solid-oxide fuel cell powered by methane (Figure created by Absolute Valuation, Seeking Alpha author)

Bloom Energy’s Value Proposition

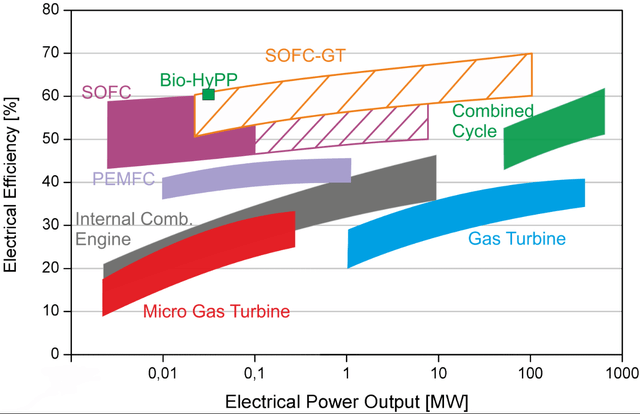

There are distinct advantages in using solid oxide fuel cells (SOFCs), like Bloom’s, to generate electricity. First and foremost, producing electricity via SOFCs completely avoids the need to build and design gas turbines, enabling more efficient electrical power generation. Figure 2 shows a comparison of technologies that generate electrical power from fuels. While individual SOFC modules have limited to power outputs (solid purple area in the figure), they can be run in parallel, and they are more efficient than gas turbines. Further, since SOFCs run at high temperature and are exothermic, waste heat can be used for other purposes, to achieve Combined Heat and Power (CHP) with even higher efficiencies. Hybrid systems that combine SOFC’s with gas turbines are also very efficient and can operate at higher powers.

Figure 2. Comparison of efficiency for different technologies that use combustible fuels. (www.dlr.de)

Another key advantage of Bloom Energy’s systems is that their SOFCs are modular and can be placed off-grid. Electrical power plants are only efficient when run at large scale, and they produce hundreds of MWs of electricity for large communities. On the other hand, SOFCs typically run at only 100 kW but can be placed right where electricity is needed. SOFCs completely avoid the need to be connected to a large power plant by transmission lines. This makes SOFCs ideal for applications where power loss could be catastrophic.

Bloom Energy manufactures modular ‘Bloom Boxes’ which are prefabricated and pre-wired on skids for efficient delivery and installation. On one of Bloom’s recently published brochures, Bloom claims to be able to ship their power delivery systems within 50 days of placing an order, and a typical installation consisting of multiple modules can produce between 100 kW and 1 MW of continuous power.

The main drawback of using SOFCs to supply electrical power is that components deteriorate due to continuous operation under harsh conditions including high temperatures (often over 800 °C) and oxidative/reductive environments. All major parts of the SOFCs are vulnerable including the cathode, electrolyte, and anode; but also interconnects and sealants. (

Golkhatmi et al, Renew. Sust. Energy Rev., (2022), 112339) Degradation results in efficiency losses. The Bloom Box efficiency generally starts out between 60-65%, but efficiency decreases at a rate of 1-2% each year. Often, the SOFC cells must be replaced at some point between five and ten years.

Strong SOFC Market Growth

The solid oxide fuel cell market size is poised for very strong growth from 2023 to 2030. Four different market reports (MarketsandMarkets, Grand View Research, Fortune Business Insights, and Bloomberg) predict that the market CAGR will be somewhere between 11% and 41%. SOFC Growth has been strong in the Asia-Pacific with its epicenter is in Japan. Future growth is expected to surge globally but especially in North America, Asia-Pacific, India, and in Europe. Bloom Energy is one of several companies seeking a piece of this growing market. Competitors include Mitsubishi Power Ltd., Convion, FuelCell Energy (FCEL), Bosch, Cummins (CMI), Ceres, General Electric (GE), Kyocera, Sunfire GmbH, and AVL.

Large Potential in Electrolyzer Market

Bloom is engineering high efficient electrolyzers that are essentially SOFCs running in reverse, and this represents another potentially large market. These units use excess electricity to produce hydrogen, and this hydrogen can be stored and later converted into usable electricity. In principle, Bloom’s SOFCs could work hand-in-hand with electrolyzers to provide a way to store excess energy produced by wind and solar. This is a compelling vision, and Bloom is ideally situated to make that happen. However, Bloom is not producing electrolyzers at scale, and, like with SOFCs, there is risk in counting these eggs before they hatch. With that, investors should definitely keep an eye on the electrolyzer market, the technical problems that they face, and evidence of successfully integrating electrolyzers with SOFC systems.

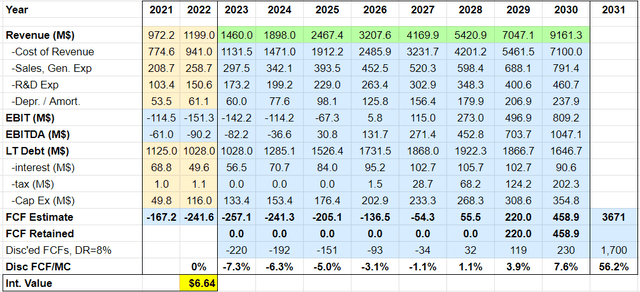

Discounted Free Cash Flow Model

To estimate Bloom Energy’s intrinsic value, I built a simplified discounted cash flow model. A table showing results is shown in Fig. 3. Inputs are shown as green cells, and blue cells are calculated values. The model is based on Bloom’s prior financial statements and on two key assumptions: (i) an assumed CAGR of Bloom’s top-line revenue into the future, and (ii) an assumed value for Bloom’s gross profit margin. All other fields are derived from these two assumptions. The ‘cost of revenue’ is calculated based on the assumed profit margin, and both ‘sales & general expenses’ and ‘R&D’ are assumed to grow at half of revenue’s CAGR. Depreciation is estimated to be 1/5 of the prior five years of cap ex investment, and cap ex also is estimated to grow at half of the assumed CAGR. EBIT is calculated as the remaining revenue, and EBITDA is calculated by adding back depreciation to EBIT. Interest is assumed to be 8% of long-term debt, compounded annually, and tax is 25% of EBIT. The resulting free cash flow is calculated by subtracting interest, tax, and cap ex investment from EBITDA. If free cash flow is negative, then debt is increased, if free cash flow is positive, then it is used to reduce long term debt. All future cash flow streams are discounted at a rate of 8%, and the result is used to estimate the company’s intrinsic value per share. If we assume a gross margin of 22.5% which is close to the prior two years, and we assume a CAGR of 30%, then the intrinsic share value is about $6.60 per share, and this indicates that currently shares are significantly overvalued.

Fig. 3. Results from simplified discounted free cash flow model that assumes a gross margin of 22.5% and a CAGR of 30% for revenue growth. (Figure Created by Absolute Valuation (SA Author))

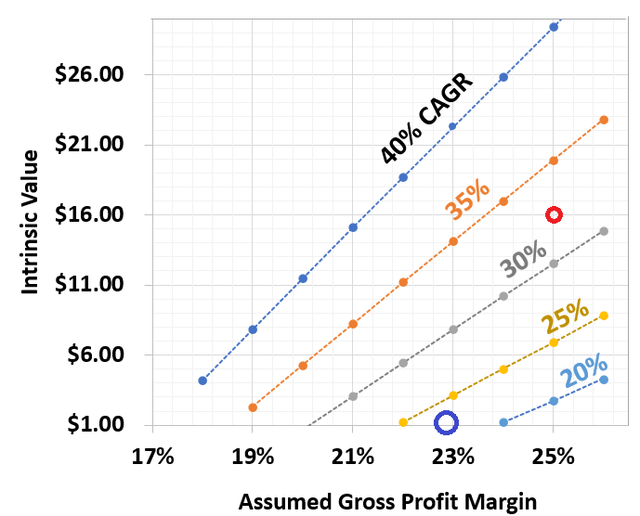

The model was run for different values of the assumed gross profit margin and the assumed top-line revenue growth (CAGR). Results are shown in Figure 4. The estimated intrinsic value is very sensitive to both assumed values. Based on Bloom’s numbers for the past year (indicated by the red dot in the figure), the analysis suggests that Bloom is currently overvalued by over a factor of two. To be fairly valued, Bloom must boost both their revenue growth rate and their profit margin.

The blue circle shows Bloom’s predicted price point based on their 2022 gross margin, and the calculated revenue CAGR assuming they make their revenue target of 1.4 billion for this year. The red circle shows their long-term ambitions and guidance of 30-35% revenue CAGR with 25% gross margins. The current share price of about $15 is roughly in-line with their guidance forward.

Fig. 4. Plot of predicted Bloom Energy’s intrinsic share value based on assumed revenue growth rate and profit margin. The red circle shows management revenue and profit margin targets, and the blue circle shows Bloom’s delivered revenue and profit margin over the past year. (Figure created by SA author Absolute Valuation)

One way to evaluate Bloom’s projected revenue is to tally their announced partnerships and sales agreements, and they do have some positive news that covers future contracts. In February, Sridhar, the founder and CEO, claimed to have a backlog of $10 billion. It’s tough to come to that number using press announcements, but there are significant press releases. For example, their SK Ecoplant project time runs from 2022-2025, and they expect over $400M in revenue from this project alone. They also have new announced initiatives in Europe including Belgium, Germany, and England, but these are small compared to their SK activity. One really needs to see a continuous stream of announcements to become a believer that they can sustain this level of CAGR.

Risks

Bloom Energy has been in business for over two decades. They possess valuable technology and are arguably a ‘growth’ company. However, Bloom Energy has never generated positive free cash flows; they have never been, and may never be, profitable. A lot needs to happen for them to succeed in delivering both growth and profit margin; some investors have been waiting for this for over a decade.

The two greatest risks are, in my opinion: (i) Bloom may not be able to realize the materialization of orders that they anticipate, i.e. the market may not fully accept their products; (ii) degradation of fuel cell components may be too big of an issue and may be too costly, keeping Bloom and all of their competitors from realizing high profit margins.

Summary

To conclude, Bloom Energy is an industry leader in a large and emerging market. If Bloom could maintain a high growth rate that parallels the predicted SOFC market growth rate and, at the same time, deliver high (25%) gross profit margins, then their stock should be worth about what it sells for today. However, this is a best-case scenario, and a lot can go wrong. Historically, they have not delivered, and there is not enough margin-of-safety for one to feel comfortable investing at the current price level.

Read the full article here