John Hess, CEO of Hess Corporation (NYSE:HES), recently presented his view as to why the company is investing in long-term projects like Guyana. Oil and gas has long predicted to die “shortly.” But the history has never worked that way, even when the market share of energy sources actually declines. The reason is that many of the optimistic energy transition goals are not backed with money behind a realistic plan to bring about that change. The result is an energy source like oil and gas continues to have growth in use even as preferred energy sources come online. In the short term, the Guyana project and the strong commodity prices give the company an optimistic outlook that is likely to remain in place a long time.

Supplier Outlook

I cover Chart industries (GTLS) (and have for about 40 years). This company sells to various energy and unrelated industries the equipment to handle any type of gas storage and transmission (usually bulk). This includes the booming hydrogen market, Carbon dioxide from carbon capture, and of course natural gas and related gases. They will tell you that business is booming. It has been for several years now, and the large long-term projects are not slowing down. The result is that this company has a large price-earnings ratio due to an excellent outlook for a major supplier of natural gas handling equipment.

Management reported a backlog that was up 24% for the newly combined company. Chart itself is a relatively small player, so its orders tend to be lumpy. But the backlog has shown steady progress despite the renewable transition.

Chart does handle several parts of the renewable markets, like the rapidly growing hydrogen market. But the oil and gas business remains a significant part of the business. Currently, that business is not slowing down due to the announced transition to renewables.

A supplier’s optimism, as is the case here, speaks volumes about the future of oil and gas.

John Hess

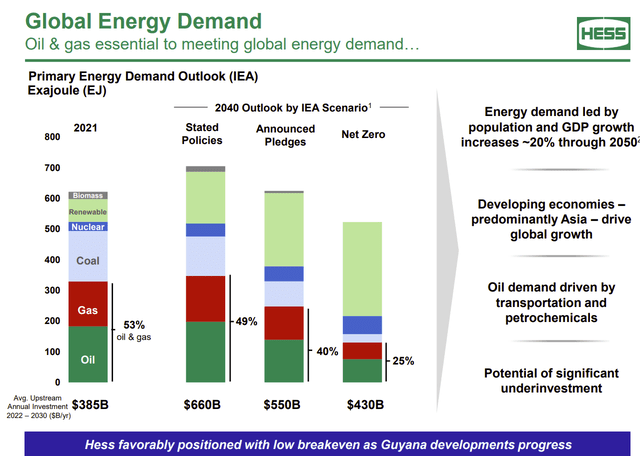

This backs up what John Hess states when he says we need to invest $4 trillion in renewable investment per year to bring about that energy change we talk about. But actual investment is about one third of that. There will not be a fast energy transition due to low investment levels in that transition. Therefore, the oil and gas business has a bright outlook with growth in use even if the market share of the energy source declines.

Hess Corporation Presentation Of EIA Data Under Various Scenarios (Hess Corporate Presentation At Barclays CEO Energy Conference September 2023)

As shown above, oil and gas needs considerably significant and continuous investment to meet the growing energy needs under any scenario. The industry view right now is that the “Net Zero” goal shown above is not realistic because the money is not there to bring that about. The industry does realize that could change. But there’s no sign it will change from really stated policies.

Actions are always more important than words. Obviously, as usual with politics, the actions do not come close to meeting the words because of the sheer magnitude of the cost. Some realism would help. But I’m not holding my breath for that realism.

Past History

There are plenty of changes in the past that serve as a guide as to what will likely happen with the transition to renewables.

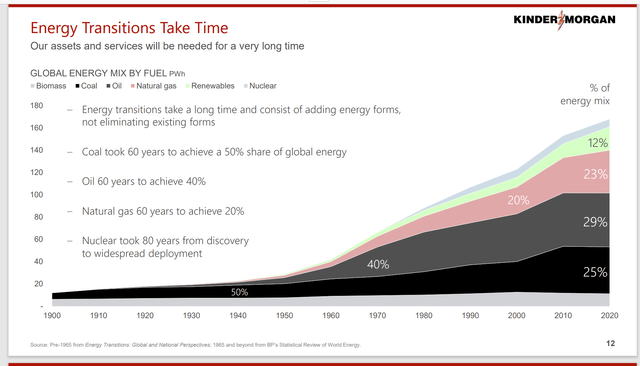

Kinder Morgan Presentation Of The Effect Of Introduction Of New Energy Sources (Kinder Morgan Corporate Presentation July 2023)

As can be seen above, even coal with all its disadvantages has grown in absolute terms until very recently. This history belies the argument that any new energy sources will render the use of an older energy source extinct. Instead, what it does do is give all consumers a choice of energy sources, and they pick the optimal source for them. That’s highly unlikely to change anytime soon.

As John Hess pointed out, even if oil and natural gas use remains steady, there’s plenty of declining production that needs to be replaced in the future. But the other issue for several of these sources is that they are used to make many products besides oil. For years, coal was necessary to make steel, for example. So even if the energy need eventually fades, then we would need new technology to replace the use of a lot of these energy sources elsewhere.

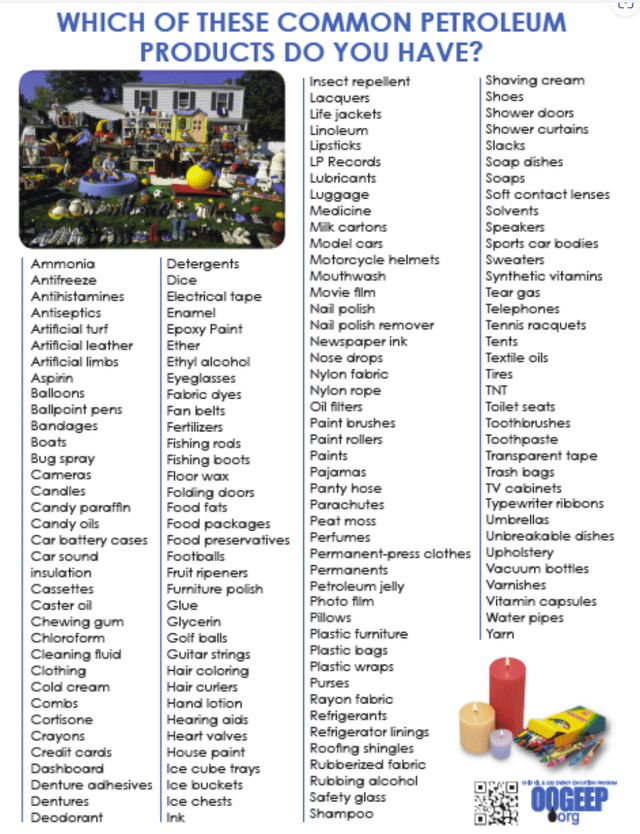

Products That Can Be Made From Oil And Gas (Energyresources.com September 27, 2023)

Even if we managed to get over the need to use oil and gas for energy, we would still need oil and gas for the products listed above and probably more because the list above gives you an idea but is probably not a complete list. There are industrial chemicals like Benzene, for example (from which aspirin can be made from) that are not on the list.

This means that the long-term outlook for oil and gas is bright, even with the emphasis on renewables.

Emissions

When it comes to reducing emissions, Hess is in the catbird seat.

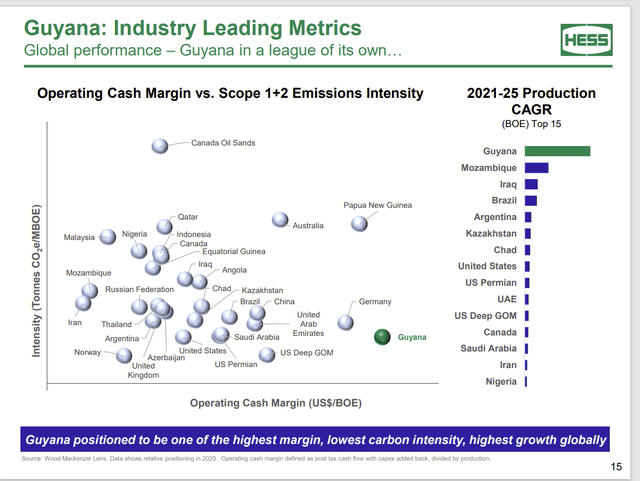

Hess Comparison Of Various Projects In Terms Of Pollution Emissions (Hess Corporation Presentation At Barclays CEO Energy-Power Conference September 2023)

Hess has been rapidly growing production from one of the lowest emission projects in the world. That’s automatically going to reduce average emission intensity the corporation reports just by growing production.

Offshore production is pollution friendly because operators often (as is the case here) reinject any natural gas produced (and related gases) back into the reservoir to maintain well pressure and enhance oil recovery. Exxon Mobil (XOM), the operator, intends to do that whenever possible well into the future. This makes not only Hess but a whole lot of offshore producers relatively environmentally friendly compared to just about any other project where the gas is not reinjected. This reinjection procedure is relatively new to the industry. It also gives the industry a way to tout low emissions.

Hess Outlook

Many state that Hess is one of the more expensive stocks. But Hess is the smallest player in the Guyana partnership. As such, it’s likely to become a takeover target (at the right price) in the future.

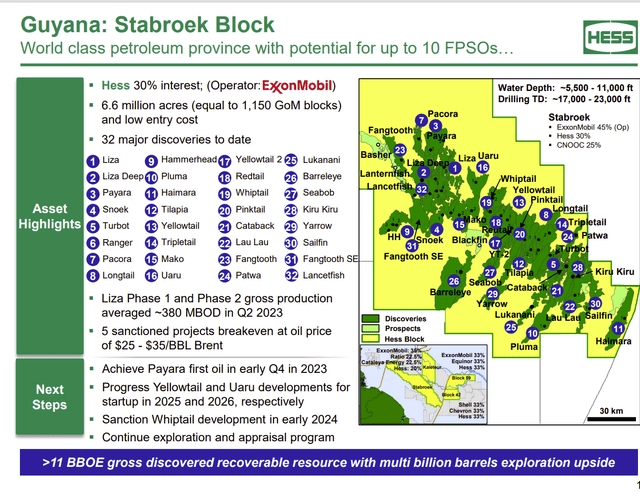

Hess Map Of Guyana Discoveries And Known Reserves (Hess Presentation At Barclays CEO Energy-Power Conference September 2023)

The current market value of the stock is in the $46 billion range. Hess has a 30% interest in the 11 BBOE which is worth about $10 in the ground in the current environment. This alone is worth roughly $33 billion.

But John Hess has mentioned several times that the partners “know” there’s oil at the 18,000-foot level, whereas most of the discoveries are at 15,000 ft. so many would double that first figure just from that statement.

The partners have not yet hit a series of dry holes and are testing some of the recent discoveries to update that figure.

In addition, John Hess updates the Total (TTE) and Apache (APA) discovery in Suriname because Hess is right next door to that discovery. Developments there are likely to soon influence the partnership decision (different partnership) to drill.

Also, John Hess mentioned that the partnership now has six ships active in the Guyana acreage. This gives them an advantage in the extra year, as the partnership only had three ships active in fiscal year 2020 when the pandemic stopped exploration cold. This extra year is meant to replace the time lost back then. Anything the partners can move to “developed acreage” is acreage that will not be part of the 20% giveback when that happens next year. Therefore, “the race is on” and now it is on with six ships.

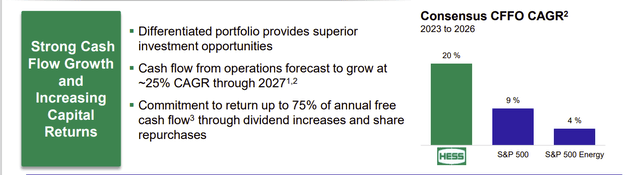

Hess Profit Growth Guidance (Hess Corporate Presentation At Barclays CEO Energy-Power Conference September 2023)

The above guidance puts a description to the expectations of John Hess that he expects profits to triple every five years. The margin will expand due to the unusual profitability of the Guyana partnership. So, profits will grow faster than production. After five years, most expect Hess to show growth from more than one lease in Guyana and Suriname, although timing is uncertain and depends upon what are now assumptions working out.

Key Takeaways

Optimism for Hess is building along with the reserve increase. The reason is that now the market can see the cash the Guyana project generates. Therefore, more reserves are not equated to “gold at the end of the rainbow.” It’s a very profitable rainbow, too. John Hess has promoted the company for three years, stating this was quite a find (and probably longer). But really no one paid much attention until the cash began to roll in.

Now, Hess may well become a concept stock with a concept valuation (like Tesla (TSLA) and Netflix (NFLX) were). But the difference here is the market can see a climbing pile of cash well into the future now that Guyana superior profitability is becoming apparent.

John Hess did mention that Exxon Mobil as the operator was changing manufacturing plans for the FPSOs (these are the ships that handle the oil and gas processing offshore and store the production as well) by doing pre-manufacturing to keep costs down so that the breakeven remains at world-class lows.

While Hess has certainly other assets that are doing well, all eyes are on Guyana as that production has come to dominate the future of the company.

Despite the price of the stock, it’s probably still a risky and volatile strong buy for those that can stomach the bumpy ride of oil and gas. Guyana is still in the early stages of development. This small company is likely to find ways to continue to triple production every five years for a while. Mr. Market loves stories like that. But the high price-earnings ratio is raising investment risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here