Editor’s note: Seeking Alpha is proud to welcome Michal Bartos as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Thesis

The Federal Reserve has recently signaled that they intend to hold interest rates elevated until at least the end of 2024. This is in contrast with what the market expects at the moment, which is that rates will be cut significantly by the middle of next year. In light of this uncertainty, I like to look for investment that are well positioned to outperform in a high inflation and high interest rate environment. I think Agree Realty Corporation (NYSE:ADC) is an example of such company. The REIT owns best-in-class big box stores leased to investment grade tenants, is able to raise rents reasonably fast in an inflationary environment and most importantly has a fortress balance sheet with minimal interest rate risk.

Macro Outlook

REIT (VNQ) valuations have declined meaningfully over the past year and a half as the Federal Reserve has increased interest rates by over 5%, in an effort to fight inflation.

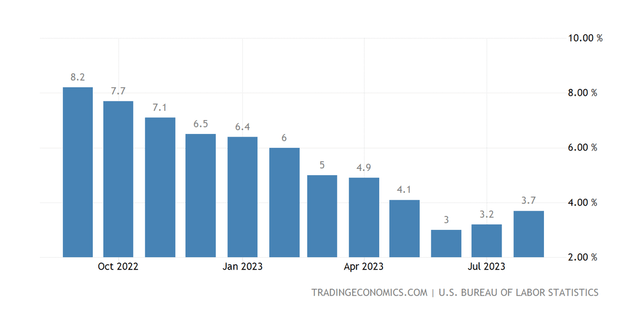

Most recently, August CPI was reported at 3.7%, driven by (a) energy which has accelerated meaningfully with prices increasing by 5.6% month-over-month and (b) shelter which continues to be reported at 7.3% year-over-year despite real time housing data showing no real inflation.

Going forward, it’s likely that energy will continue to put upward pressure on inflation as the oil price continues to be in a strong uptrend and Russia and Saudi Arabia have recently stated that they plan to restrict supply in the near future. On the other hand, shelter CPI is likely to decline in the following month, as we work through the lag in this indicator and as the year-over-year numbers start to lap last year’s already high prices.

While it’s unlikely what the end result will be, one thing is clear. The CPI has broken the multi-month downtrend it has been on since last fall, which increases the chances that the Fed will decide to stay its course longer and keep interest rates elevated.

Tradingeconomics.com

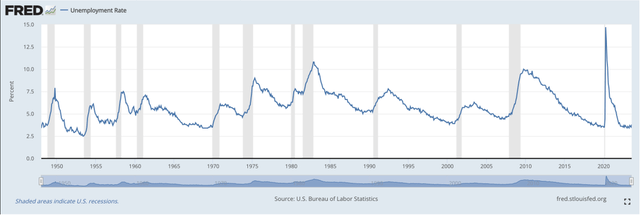

The Fed has a dual mandate of maximum employment and price stability. Historically, once the Fed has increased rates, a sharp rise in unemployment followed soon after, which eventually made the Fed cut interest rates to comply with both mandates.

Right now, however, employment remains at historical lows which means that the Fed can do anything and everything to tackle high inflation. That likely means keeping rates elevated for a prolonged period of time.

FRED

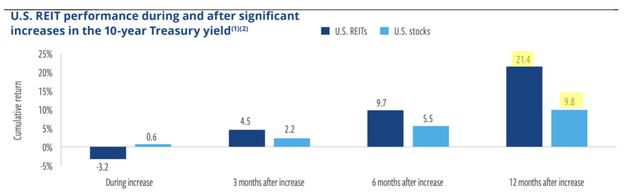

That brings me to my thesis for REITs which I’m quite bullish on. The thing is that, contrary to popular belief, REITs tend to outperform after the Fed is done hiking rates. And the important part is that this is true regardless of how high interest rates are.

Cohen & Steers has done a study which showed that during the 12 month following the end of rate hikes, REITs have, on average, returned 21.4%, more than double U.S. stocks which returned just 9.8%, on average.

Cohen & Steers

I think that the Fed is much closer to the end of their hiking cycle then the beginning. The yield curve which is the most inverted it has been in recent history would certainly confirm this view. This means that now may be a good time to load up on some REITs.

But here’s the thing. The study attributed most of the REIT outperformance to (a) the REIT’s ability to raise rents in a high inflation environment and (b) low interest rate risk of their balance sheet.

Having researched a number of REITs, I must say that Agree Realty Corporation seems very well positioned for what’s to come, which is why I want to present my bullish take in the company below.

Agree Realty Corporation

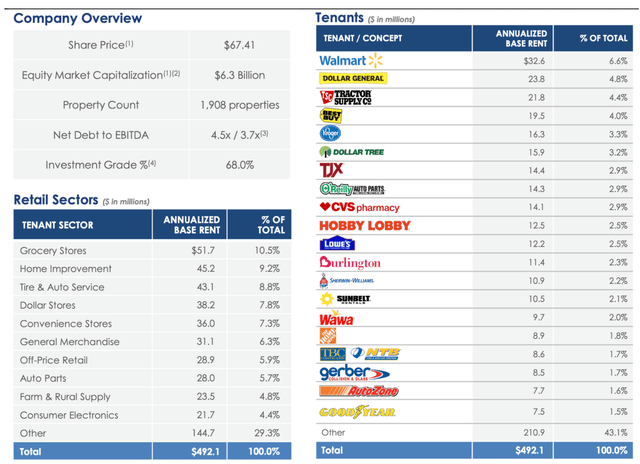

ADC is a REIT focused on single-tenant net lease properties. The company specializes in big box store leased to some of the most established retailers in the world, such as Walmart (WMT), Home Depot (HD) or Dollar General Corporation (DG).

Such a strong tenant roster brings a lot of advantages. Most of them have to do with safety. The company has a very high portion of investment grade tenants at 68%. Moreover, tenants are very well diversified between sectors, led by grocery stores at 10.5% of rental revenue. Importantly, many of these sectors could be considered staples, which means that they will be very resilient to recession risk.

ADC Presentation

ADC rents to strong tenants which have average rent coverage of >3x. As a result of this and a near percent 99.7% occupancy, the REIT’s cash flow is very predictable. The company has low collection and re-leasing risk, which in turn makes valuation quite straight forward.

In addition, the REIT also generated about 12% of their overall rental revenue from ground leases which is a unique structure which is arguably even safer than property ownership. The way it works is simple. The landlord (ADC) owns the land and leases it to the tenant, usually for a period of 99 years and the tenant builds his own building on the land. This is great for the tenant, because they don’t have to spend a lot of money upfront to purchase land. It is also great for the landlord, because he gets a very reliable stream of cash flows and if the tenant defaults on his payments, the landlord gets to keep the property for free. As a result, rent defaults on land leases are extremely rare.

So, cash flows are highly visible. Moreover, most recent results show the resilience of earnings, which I really like, as the company has managed to grow its AFFO per share by 1.1% YoY to $0.98.

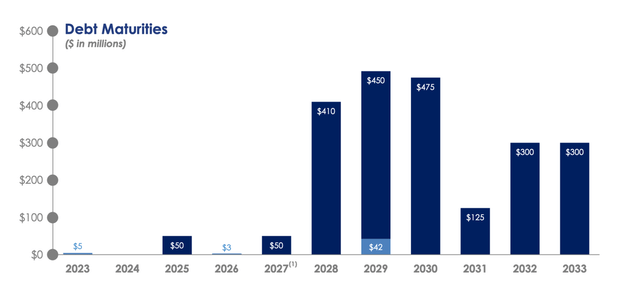

What about the balance sheet? Well, ADC has one of the strongest balance sheets in the whole sector. Leverage is low at 4.1x EBITDA and interest rate risk is almost non-existent over the next 5 years. This is because all outstanding debt is fixed-rate and the REIT has no material debt maturities to refinance until 2028. This makes the company very well positioned for a prolonged period of high interest rates, because their interest expense will not materially increase until 2028, regardless of the level of rates between now and then. The balance sheet is one of the primary reasons why I think ADC is well positioned to withstand a long period of elevated interest rates.

ADC Presentation

In the meantime, their rental revenue will continue to grow, though likely not as fast as some other REITs. The thing is that the safety of leasing to established investment grade tenants has its drawbacks. In particular, these tenants hold large bargaining power, which means that the lease terms are often quite favorable to the tenant, with lower-than-average rent escalators of around 1.5% per year (vs an industry standard of 2%).

Of course, on top of this, the REIT is able to increase rents on rent renewals and new leases, but since lease expirations in the following years are relatively low (only 10% before 2026), total internal growth for the REIT is likely to stand at only 2-3% over the next few years.

Externally, the REIT is able to generate further growth through acquisitions at cap rates above their cost of capital. Most recently, during the first half of this year, the company has been able to acquire several new properties at excellent lease terms at an average cap rate of 6.7%. These acquisitions are what will generate the remaining growth to the current consensus of 3-4% per year.

Valuation

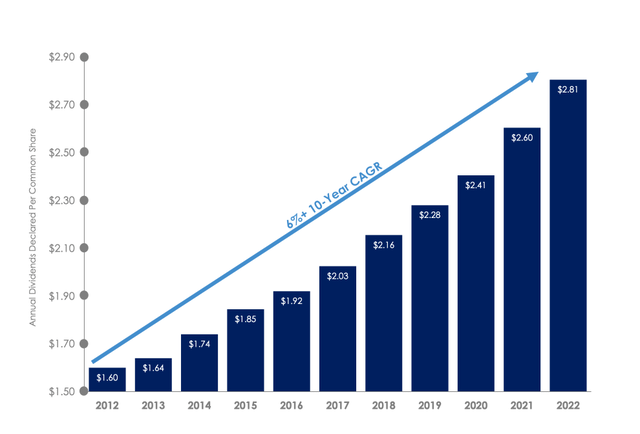

REITs are a lot of investors’ favorites, because of their high dividends. ADC shines on this front with a monthly dividend which yields 4.9% and has grown at a historical CAGR of 6% over the past 10-years.

ADC Presentation

Going forward, I think a similar level of dividend growth is possible as (a) the company grows its FFO by 3-4% annually and (b) as management increases the payout ratio from 73% which is below the low end of their target of 75-85%.

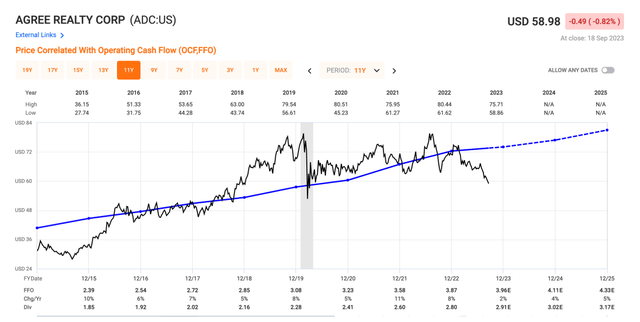

In addition to the dividend, the stock can also generate upside from today’s levels. Currently the stock trades at a P/FFO of 15x, which is below its historical average of 18.7x.

FAST Graphs

Relative to peers, Realty Income (O) and NNN REIT (NNN) trade at 13x FFO and 12x FFO, respectively, but I see the premium as justified, given the higher level of safety that ADC enjoys.

Going forward I see three possible scenarios:

Soft-landing: In this case the stock will likely re-rate back to its historical average of 18.7x and therefore return 25% upside from multiple expansion, on top of the 5% dividend and 3-4% FFO growth. Assuming a 3-year investment horizon the expected annual return = 16%.

Higher for longer: In this case FFO will grow by 3-4% per year as interest expense is largely fixed and investors will enjoy the 5% dividend, but there will likely be no upside from multiple expansion until rates drop. That translates into an expected annual return of 8%.

Recession and rise in unemployment: In this case, the Fed will most likely cut rates, resulting in multiple expansion. I would, however, expect a lower exit multiple than in the soft-landing scenario, say 17.5x. Assuming a 3-year investment horizon the expected annual return = 13%.

Risks

As with any investment, there are certain risks to my thesis. First and foremost, I want to emphasize that this is a long-term thesis with a two-to-three-year minimum horizon. I cannot time the market and anything can happen over the short to medium-term.

As far as specific risks, I believe ADC is better positioned than most for the usual interest rate and recessionary fears, but of course further rate hikes by the Fed will most likely to a lower price as the market re-prices the stock.

Moreover, some of the smaller tenants could struggle to stay in business during a really deep recession, which could jeopardize ADC’s occupancy. But I consider this risk very small and unlikely to materialize.

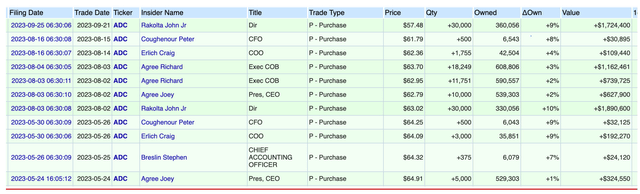

Finally, by far the biggest potential risk, which could make me abandon my thesis, is the management’s ability to navigate the future. I will be watching management closely to ensure that they have the shareholder’s best interest at heart and will reconsider my stance if they start with questionable policies, such as the widely covered recent spinoff of W. P. Carey (WPC). So far, I have seen no indication of this and on the contrary, there have been significant multi-million recent insider buys which increase my confidence in management ability to drive growth for the shareholder’s benefit.

Openinsider

Conclusion

Despite a lot of uncertainty around interest rates in the future, I think ADC is well positioned to deliver solid returns. Depending on the scenario, the stock offers solid return potential between 8% and 16%, which is likely to beat the broader market return and therefore leads me to rate Agree Realty as a Buy. I suggest investors consider adding ADC to their portfolios to add income and safety, regardless of what course interest rates take in the future.

Read the full article here