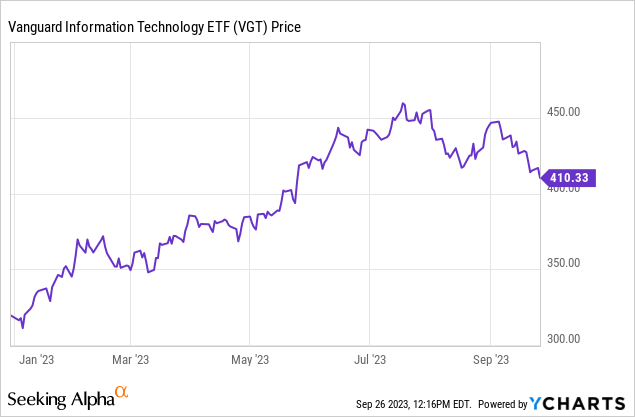

At about $408.7, the Vanguard Information Technology ETF (NYSEARCA:VGT) is trading at about $26 above my target of $382.48, established when I last covered this IT fund on March 16. At that time, I was optimistic despite uncertain macros highlighted by the collapse of a major bank, because of Generative AI-related opportunities.

Now, given that the current price is 11% below its end-of-July peak of $459.6, the aim of this thesis is again to highlight an investment opportunity, especially given that amid all these talks about inflation, the market seems unaware of Generative AI’s ability to improve workforce productivity.

Moreover, based on VGT’s performance last year, inflation fears are justified, but there is also the fact that, on average, September tends to be the weakest month for equities, with the economy remaining resilient and technology companies having considerably reduced their cost base by laying off thousands of employees since the beginning of this year.

I start by painting a picture of how interest rates and inflation constitute volatility risks for the IT sector.

Higher Rates Mean Volatility and a Stronger Dollar

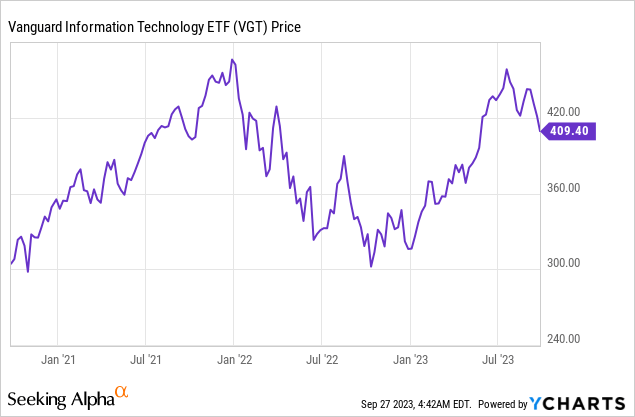

First, interest rates and stocks appear to have a negative correlation as When one rises as was seen from March 2022, the other falls. Thus, When the Federal Reserve decided to raise the Fed funds rate to fight inflation, there was a reversal of the uptrend on Wall Street, which particularly impacted Technology stocks. These are particularly sensitive to changes in interest rates and fell sharply. At that time, VGT, fell by more than 20% after a peak in November 2021, putting it into a bear market phase.

Now, the Fed funds rate is one of the main tools used by the U.S. Central Bank to fulfill its dual mission of controlling employment and inflation. This rate is used by financial institutions when they lend money to borrowers. Thus, when this policy rate is raised, it increases the cost that banks incur when borrowing from other banks. This increase is then reflected in the cost that businesses and households incur when they borrow. This means that consumers then see higher rates on their credit cards and mortgage payments, which in turn decreases the purchasing power of households. Now, when consumers spend less, business revenue declines and declining corporate profits tend to cause their stock prices to fall.

However, things do not play out the same way for tech as Gartner predicts IT spending to increase by 4.3% over 2023 and this does not account for Generative AI’s productivity gains.

Second, there is inflation, and, coming back to early September when the latest downturn in VGT’s share price started, investors became disillusioned by the ISM services PMI for August which was highest since February at 54.5 points thereby reversing the July dip and also higher than the 52.9 expected. This created doubt that inflation would pursue its downtrend and put into question the ideal scenario of a soft landing for the economy.

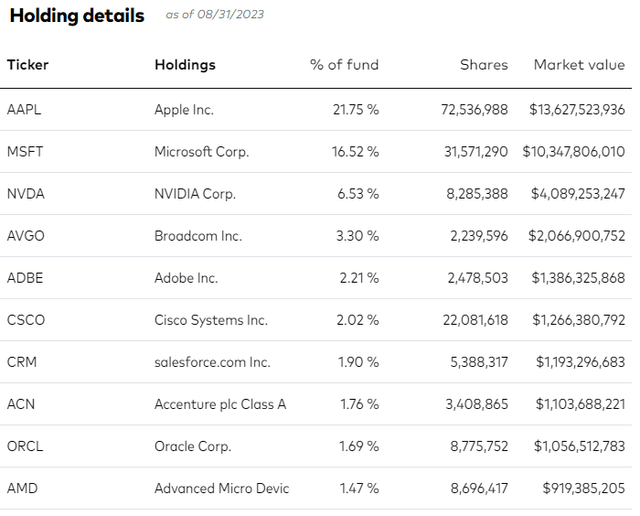

On top, for the technology sector, the rise of the greenback against other currencies lowers revenues in dollar terms since the largest tech companies generated 58% of sales in the rest of the world in October 2022 with Apple (AAPL) having seen 6% of currency headwinds in sales last year. Microsoft (MSFT), as VGT’s second holding (table below), was impacted too.

Portfolio composition, Top Holdings (investor.vanguard.com)

Therefore, in case the Fed continues carrying out further monetary tightening, the dollar could continue to climb. However, the U.S. Dollar Index remains well below its October 2022 highs and the current inflation rate being much lower than last year signifies that the Fed is not likely to raise rates at the same accelerated pace as last year.

Generative AI Comes into Play

Moreover, between the 2021/2022 period and today, there has been the emergence of ChatGPT, powered by Generative AI which in view of its rapid adoption within a short period seems to have taken the world by storm. Noteworthily, while some consider this innovative technology to be hype, it does come with productivity improvement potential. Now, productivity is about delivering more output, but, using less labor and technology can help corporations improve operational efficiency, for example using intelligent software for a higher degree of automation. This raises productivity, which can help to mitigate the effects of higher wage inflation.

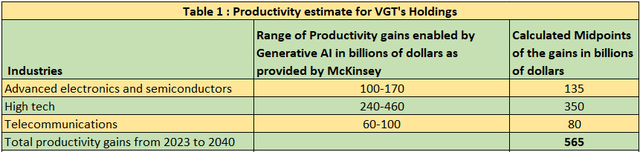

According to a study by McKinsey focusing on the productivity aspect of Generative AI, its use in functions such as software engineering, product R&D, sales and marketing and customer operations represents 75% of the annual economic impacts of $2.6 trillion to $4.4 trillion by 2040. This is an enormous figure and looking for more precision in the same study, I identified three industries that are particularly relevant to VGT’s sector exposure as pictured below. These are Advanced Electronics and Semiconductors, Telecommunications, and High Tech which in this context includes everything from the use of AI, robotics, and software development together with cloud computing.

Table built using data from (www.mckinsey.com)

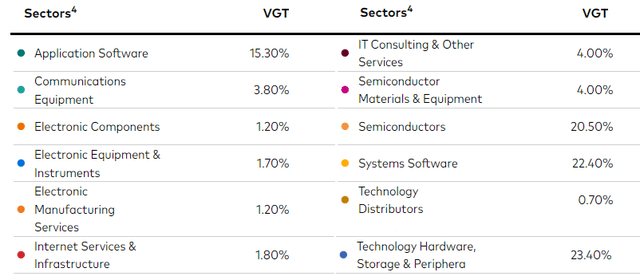

For investors, the ETF’s sector exposure is shown below, and this includes Software, Semiconductors, and Telecommunications which are in pole position as AI beneficiaries. As for hardware, it can be argued that it will see the same benefits, but, let us not forget that storage devices and electronics in general now tend to be more software-driven and have more chips embedded in their design.

Sector Exposure VGT (investor.vanguard.com)

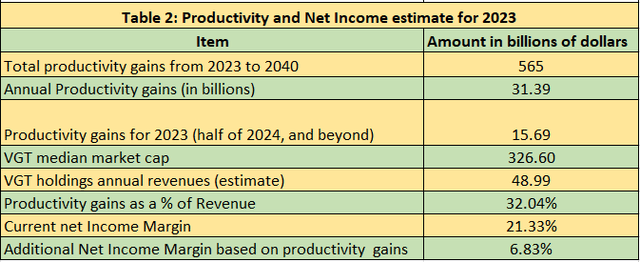

Adding the midpoints of the Generative AI-enabled productivity in the above table, I estimate $565 billion of gains from 2023 to 2040, or within an 18-year period. Dividing by 18, I obtained $31.39 billion of annual productivity gains, which is tabled below. However, for this year, I have halved this amount due to the time it may take to build up the AI infrastructures, especially after seeing the record number of orders that Nvidia (NVDA) is seeing for its GPUs and the unavailability of data center space as I covered in a recent thesis.

Table built using data from (www.seekingalpha.com)

Now, the median market cap of VGT’s holdings is $326.6 billion, and this is indicative of the total market value of the fund’s holdings. Now, a calculation, based on VGT’s first ten holdings which constitute about 50% of its total assets, leads to an average ratio of Annual Revenues to Market Cap of 0.15 or 15%. Therefore, applying 15% on $326.6 billion gives $48.99 billion as an estimate for VGT’s annual revenues according to the weighted exposures. Dividing the productivity gains of $15.69 billion by $48.99 billion, productivity as a percentage of revenues is 32%, which is significant, and when employees are more productive, this naturally leads to better profit margins. For this purpose, since on average, the average net income margins are around 21.33% (again for VGT’s first ten holdings), it means these could improve by 6.83% (32.04 x 0.2133) as the revenues trickle down the income statement.

Valuing in Light of Productivity Gains

Now, this remains an estimate but has the merit of translating the billions of dollars of productivity gains into profitability, a metric that can be compared to FactSet’s latest earnings insights. These stipulate that the wider IT sector has recorded an increase in estimated earnings since the start of the third quarter of 2023 at 4.0%. As a result, the YoY estimated earnings growth rate for this sector has increased to 4.4% on September 22, from 0.4% on June 30.

Therefore, the margin gains from the productivity standpoint and earnings growth from FactSet’s insights both show that despite inflation-related pains, there should be gains, which means that VGT deserves to be valued better. Now, based on the current P/E of 33.1x which is lower than the P/E of 36x at the beginning of September, I have a target of $447.8 (36.3/33.1 x 408.7) based on the current share price of $408.7.

To further support this moderated 9.6% upside, there is some uncertainty with the slowdown in cloud sales for providers like Oracle (ORCL) which has less exposure to AI compared to Microsoft, or Salesforce (CRM). Moreover, higher oil prices could cause inflation to linger above the Fed’s rate of about 2%, which could trigger further rate hikes, in turn adversely impacting spending. Therefore, revenues could be impacted, and this may translate into volatility for some of VGT’s holdings during the earnings season, but I remain optimistic for the sector as a whole in view of the Gartner report on IT spending.

Furthermore, tech has been quick to embark on the AI adoption path while at the same time collectively proceeding to over 170,967 job cuts so far in 2023 according to Crunchbase with some of the largest workforce squeeze coming from Microsoft or Salesforce. Also, while the software giant’s $13 billion stake in OpenAI is well publicized, less known are Apple’s high number of AI-related acquisitions since 2017 and its devices, whether an iPhone or MacBook, remain gateways for people to access applications based on intelligent algorithms.

Now, for those looking for an alternative, there is the Fidelity MSCI Information Technology Index ETF (FTEC) which charges less than VGT’s 0.10%, or only 0.08%. However, the Vanguard ETF is more liquid with a higher AUM and its higher number of holdings confers to it less concentration risks.

In conclusion, while acknowledging that volatility will continue for tech as the Fed remains hawkish, this thesis remains bullish on VGT as a 7% improvement in net margins enabled by Generative AI can go a long way in offsetting certain inflation of rate-related headwinds. To this end, as evidenced by their relative resiliency compared to the broader market during the banking turmoil, tech stocks could again act as a safe haven in case further cracks appear in the liquidity front.

Read the full article here