Earlier this year, I would have described my outlook on the home building market as being bearish in the short run and bullish in the long run. Inflationary pressures and high interest rates caused a decline in new orders and a spike in cancellation rates. Ultimately, this would prove painful for any companies that operate in this market. However, it’s also true that this nation continues to experience a housing shortage, with one estimate that I saw recently pegging it at 3.8 million homes. Over the past few months, my view has evolved, with the timeline of a bullish outcome for these companies moving closer to the present day. This is because we have already started seeing a recovery in orders at many of these firms. But one player that I still cannot get behind is LGI Homes (NASDAQ:LGIH). I wouldn’t go so far as to say that I’m bearish about the business. Rather, I recognize that the firm is seeing some meaningful improvements. But simultaneous to that, its overall track record leaves much to be desired. You add both of these facts together, and I believe that a ‘hold’ rating makes more sense than something more bullish at this moment.

A homebuilder with a history

For those not terribly familiar with LGI Homes, it might be helpful to discuss a bit about what the company does and how it operates. According to the management team of the firm, the company operates as a designer, builder, and seller, of new homes. It operates in multiple states, including some of the most desirable such as Texas, Florida, Washington, and California. In fact, it has operations in 35 different markets spread across 20 different states.

Management has made it a point to build homes that cater to a wide spectrum of potential buyers. Some are small as 1,000 square feet, while some can be 4,100 square feet or more. Sales prices typically range between $190,000 and $1.2 million. However, as of the end of the most recent quarter, the average price for a home was $348,042. It is important to point out that the company has not always sold homes at this price point. Back in 2014, for instance, the weighted average sales price of a property that it built was around $163,000. But with home prices continuing to appreciate, it’s not surprising to see this trend.

LGI Homes

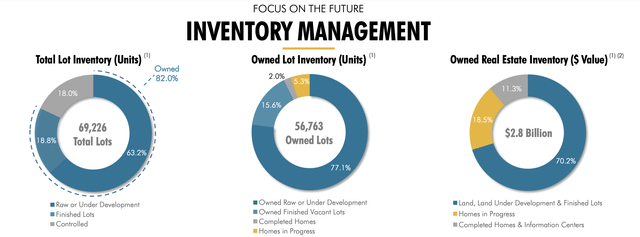

As with many homebuilders, it has inventory in the form of lots of land at its disposal. It’s on these lots that the company builds the properties before ultimately selling them. As of the end of the most recent quarter, it had 69,226 lots on its books, with 63.2% of them as raw or under development land. 18.8% were finished lots, with the other 18% not currently owned but controlled by the company. Controlled lots are often ones where the company has the right to acquire them. Of the 56,763 lots that it currently owns, 5.3% involved homes that are in progress, while another 2% involved homes that are completed but not yet sold. All combined, management estimates that the real estate that it owns, which consists largely of land, but also includes some homes in progress, as well as completed homes and information centers, is worth about $2.8 billion. That compares to the market capitalization of the company of $2.4 billion as of this writing.

Author – SEC EDGAR Data

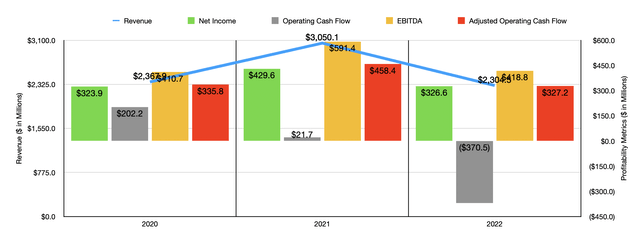

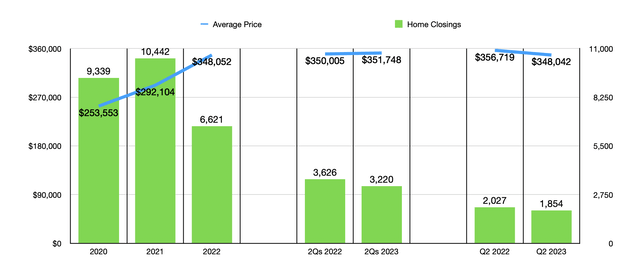

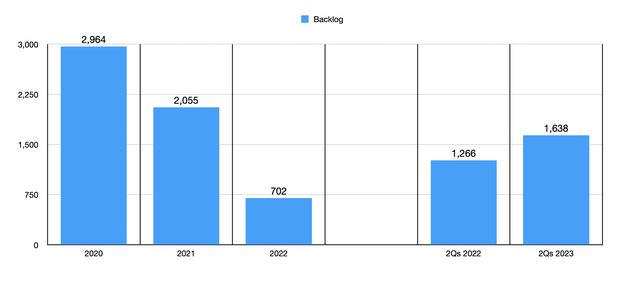

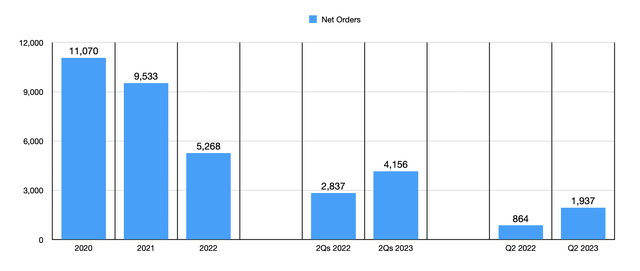

Over the past three years, the financial trajectory of the company has been quite volatile. After seeing revenue jump from $2.37 billion in 2020 to $3.05 billion in 2021, we saw a decline to $2.30 billion last year. This occurred even as the average home price continued to grow. In 2020, for instance, the average price of a home closing was $253,553. That grew to $292,104 in 2021 before hitting $348,052 last year. The pain for the company, then, came from a decline in the number of homes closed. In 2021, the company sold 10,442 properties. That number was cut to 6,621 in 2022. From 2021 to 2022, the cancellation rate on its backlog grew from 19.3% to 24.4%, while the number of new orders coming in shrank from 9,533 to 5,268. That took the company’s backlog down from 2,055 to 702. But that was not the first year that LGI Homes experienced a decline in backlog. It ended 2020 with 2,964 units in its backlog.

Author – SEC EDGAR Data Author – SEC EDGAR Data

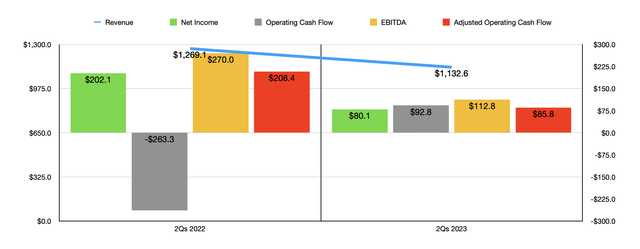

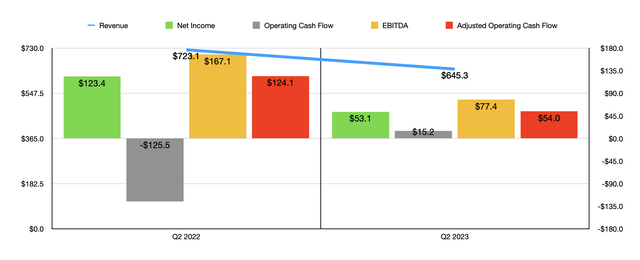

This drop in revenue brought with it a decline in profits as well. After peaking at $429.6 million in 2021, profits fell to $326.6 million last year. Operating cash flow declined from $21.7 million to negative $370.5 million. Though if we adjust for changes in working capital, we would have gotten a more modest fall from $458.4 million to $327.2 million. Even EBITDA took a hit, dropping from $591.4 million to $418.8 million. As you can see in the two charts below, financial performance for the first half of the 2023 fiscal year, as well as for the most recent quarter on its own, continued to deteriorate.

Author – SEC EDGAR Data Author – SEC EDGAR Data

What we see here is revenue, profits, and cash flows, all declining year over year. And a good chunk of this has to do with a continued drop in home closings. In the most recent quarter, for instance, the company saw 1,854 closings. That’s down from the 2,027 reported the same time last year. And during the second quarter, the company also saw a modest decline in the average price of homes sold. This drop was from 356,719 to 348,042. This is not to say that everything was bad. There was one bright spot. And that is that net new orders are actually coming in quite strong. For the first half of the year, net orders totaled 4,156. That’s up significantly compared to the 2,837 the company reported one year earlier. And for the most recent quarter, the 1,937 net orders that the firm experienced dwarfed the 864 reported for the same time of the 2022 fiscal year.

Author – SEC EDGAR Data

The net orders figure is the best leading indicator that I can think of that helps us determine where the future path for a company like LGI Homes is. It also matches up what I have seen with many other home builders in recent months. Obviously, the state of the economy is still uncertain. Its possible interest rates will continue to climb, though I think we are near the top on that. It’s also possible that we could go into a nasty recession. I would also say that is unlikely. But investors would always be wise to plan for the worst and hope for the best.

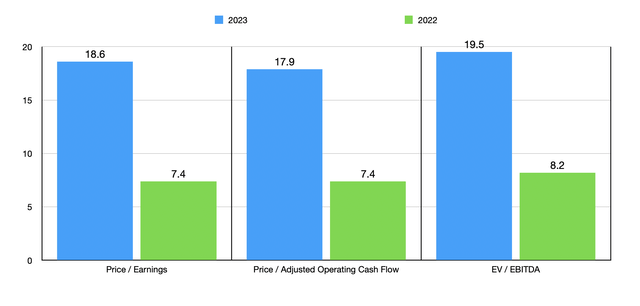

Author – SEC EDGAR Data

Realistically speaking, the worst case scenario would be that financial performance continues to look weak throughout this year. If it does, we should expect net profits for the enterprise of around $129.4 million. Adjusted operating cash flow would be $134.7 million, while EBITDA would come in at about $175 million. Using these figures, I was able to price the company as shown in the chart above. As you can see, on a forward basis, shares look anything but cheap. But if we assume that financial performance will eventually revert back to what we saw in 2022, then the picture doesn’t look so bad. The problem though is that shares don’t look all that appealing relative to similar firms. In the table below, you can see what I mean.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| LGI Homes | 7.4 | 7.4 | 8.2 |

| Meritage Homes (MTH) | 5.3 | 4.6 | 4.1 |

| Beazer Homes USA (BZH) | 4.0 | 2.2 | 6.3 |

| Century Communities (CCS) | 6.8 | 3.8 | 7.1 |

| Skyline Champion (SKY) | 10.7 | 8.1 | 6.1 |

| Dream Finders Homes (DFH) | 8.8 | 9.4 | 7.0 |

Laying out five different companies that are similar in nature to LGI Homes, I then compared the pricing of those firms to our target. If we use the forward estimates to match with the trailing 12-month figures reported by each of the above enterprises, we would find out that, using all three valuation metrics, LGI Homes is the most expensive of the group. But even if we use the figures from 2022, we see that, using both the price to earnings approach and the price to operating cash flow approach, three of the five companies ended up being cheaper than our target. And it’s actually the most expensive of the group when we use the EV to EBITDA approach.

Takeaway

From what I can see, LGI Homes is not a bad company. But it’s also not a great one. The business started showing weakness in its financial performance in 2021 and that weakness persists to the present day. The drop in orders from 2020 to 2021, as well as the decline in backlog during that time, is not confidence inspiring. We are starting to see some really great signs of a turnaround. But we are early in that process. If shares were on the cheap side of the spectrum relative to similar enterprises, I could probably be more bullish about the firm. But given how the stock is currently priced, as well as the other aforementioned factors, I have decided that a ‘hold’ rating makes more sense at this moment.

Read the full article here