Investment Thesis: I take the view that Host Hotels & Resorts will continue to see modest growth due to plateauing RevPAR performance and higher operating expenses.

In a previous article back in February, I made the argument that Host Hotels & Resorts (NASDAQ:HST) may see modest growth going forward, with signs of slowing demand in the face of price increases.

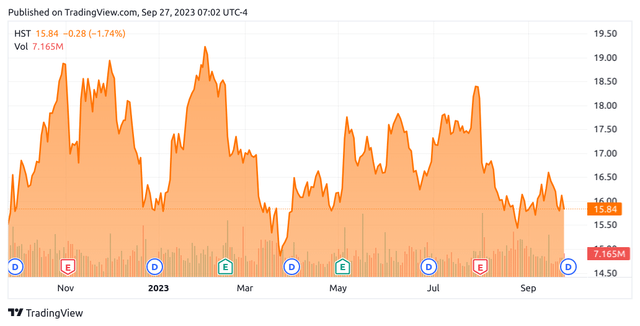

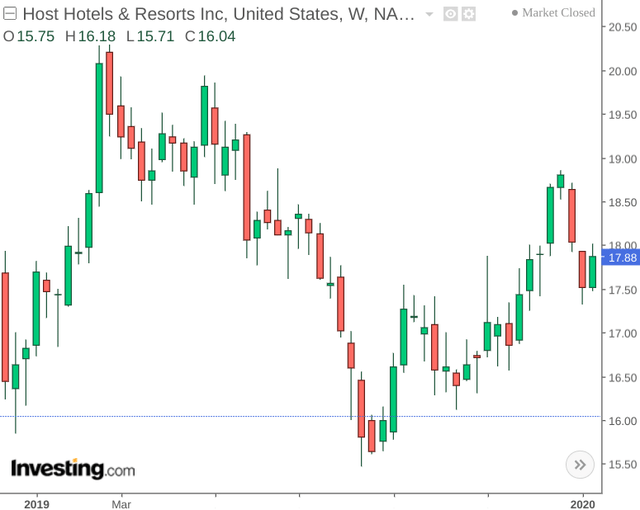

Since my last article, the stock has descended to a price of $15.84 at the time of writing:

TradingView.com

The purpose of this article is to elaborate on why I continue to rate Host Hotels & Resorts as a hold at this time, namely due to:

- Plateauing RevPAR growth across hotels in both high and low-priced locations

- Growth in expenses having outpaced growth in revenues in the most recent quarter

Performance

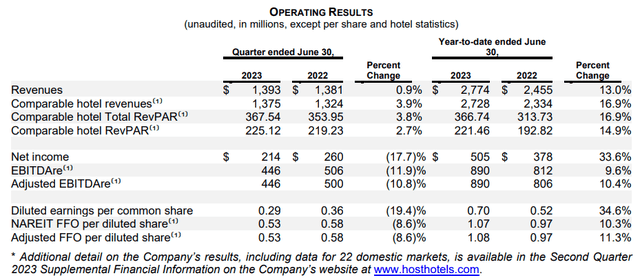

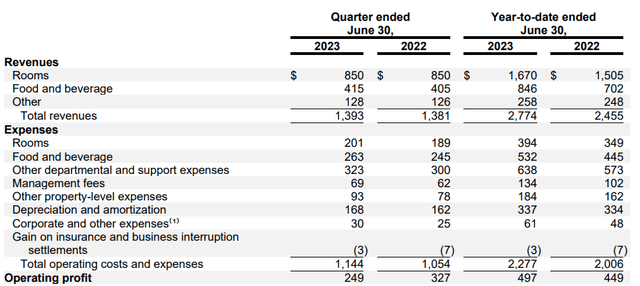

When looking at the most recent earnings results for Host Hotels & Resorts, we can see that while revenues and comparable hotel RevPAR (revenue per available room) showed a modest increase on a quarterly basis – we can see that diluted earnings per common share were down by nearly 20% on that of the same quarter last year.

Host Hotels & Resorts: Second Quarter 2023 Results

We can see that performance was better on a year-to-date basis, but this reflects strong growth in revenues, RevPAR and earnings between Q1 2022 and Q1 2023.

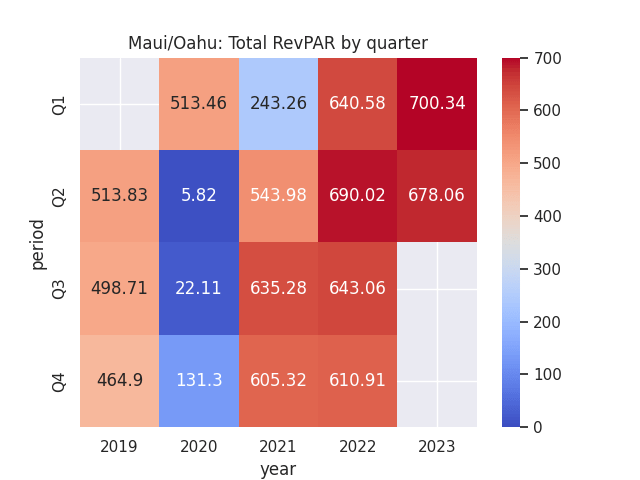

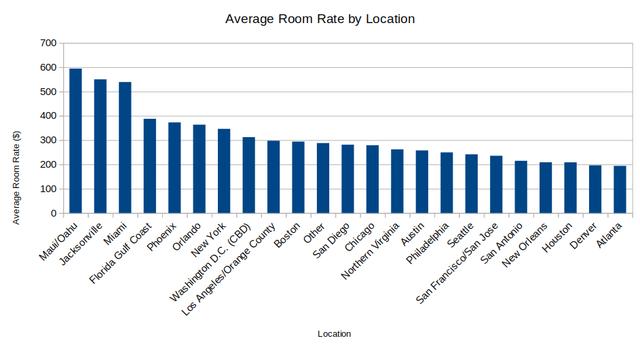

I had previously made the argument that across locations with a high average room rate – the Maui/Oahu location showing the highest average room rate at $594.07 – we could see a potential slowdown in RevPAR growth as inflationary pressures start to dampen demand.

When looking at Maui/Oahu as an example, we can see that while RevPAR by quarter for Q1 2023 was substantially higher than Q1 2022, this trend reversed in Q2 – with quarterly RevPAR lower than that of last year.

Figures (in U.S. dollars) sourced from historical Host Hotels & Resorts quarterly financial reports. Heatmap generated by author using Python’s seaborn library.

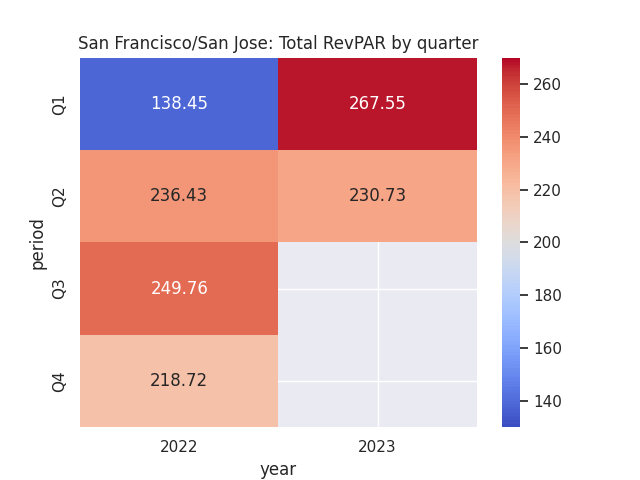

With that being said, let us also take a look at the largest location by number of rooms for Host Hotels & Resorts: San Francisco/San Jose with 4,162 rooms as of Q2 2023.

When looking at total RevPAR by quarter, we can see that while RevPAR was substantially higher in Q1 of this year as compared to last, Q2 RevPAR was slightly lower than that of last year.

Figures (in U.S. dollars) sourced from historical Host Hotels & Resorts quarterly financial reports. Heatmap generated by author using Python’s seaborn library.

Moreover, the average room rate for San Francisco/San Jose for Q2 2023 was $235.44, which is on the lower end of the scale when comparing across other locations.

Figures (in U.S. dollars) sourced from Host Hotels and Resorts Q2 2023 Press Release. Bar chart created by author.

From this standpoint, Q2 has shown signs of a plateau in RevPAR growth across locations at both the higher and lower end of the scale with regards to average room rate.

From a balance sheet standpoint, we can see that the debt to assets ratio for the last quarter remained at a similar level as that of last December:

| Dec 2022 | Jun 2023 | |

| Total debt | 4215 | 4210 |

| Total assets | 12269 | 12365 |

| Debt to assets ratio | 34.35% | 34.05% |

Source: Figures (in millions of U.S. dollars except ratios) sourced from Host Hotels and Resorts Q2 2023 Press Release. Debt to assets ratio calculated by author.

For context, total debt in Q2 2019 was $3.864 billion with total assets of $12.525 billion, yielding a debt to assets ratio of just under 31%.

With that being said, cash and cash equivalents also saw an increase from $667 million in December 2022 to $802 million in June 2023.

My Perspective

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, the trends in total RevPAR across locations are showing signs of a slowdown across expensive locations such as Maui/Oahu and cheaper locations such as San Francisco/San Jose.

In this regard, we are seeing a slowdown in demand more generally – and with the winter months approaching, RevPAR is expected to see a seasonal decline for Q3 and Q4.

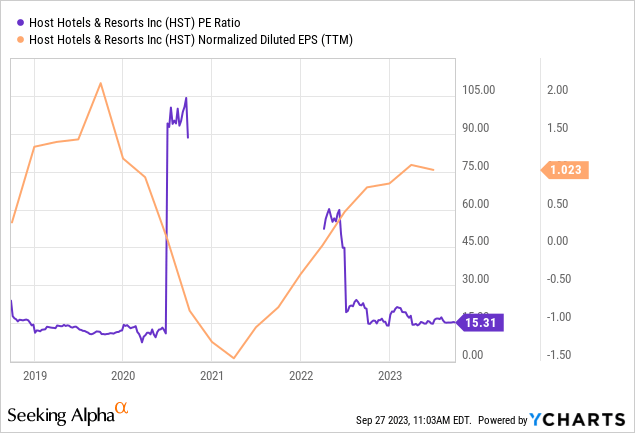

Additionally, we can see that while earnings per share has been reaching back near levels seen pre-pandemic, we are seeing a slight levelling off in the same.

ycharts.com

As regards an assessment of fair value – we can see that Host Hotels and Resorts (with a P/E ratio of 15.31 and normalised diluted earnings per share of $1.023) is trading at a similar level to that seen at the beginning of 2019 – between $17-19 per share for the first three months of the year.

investing.com

At a price of $15.84 at the time of writing – I take the view that if Host Hotels & Resorts can continue to sustain earnings at their current level – then my estimate of fair value under this scenario would be between the range of $17-19 per share – which is the same level we saw at the beginning of 2019 given a similar P/E ratio and earnings per share.

From a balance sheet and cash flow standpoint, the fact that Host Hotels & Resorts has not seen an increase in debt levels and has also managed to increase free cash flow is a positive sign.

Risks and Looking Forward

Going forward, I take the view that growth for Host Hotels & Resorts could be set to remain modest over the next two quarters, as RevPAR is expected to decline in accordance with seasonal demand.

In my view, the main risk for Host Hotels & Resorts at this time is that RevPAR continues to see a plateau heading into 2024 but we do not see a decrease in expenses to preserve profitability. For instance, Host Hotels & Resorts saw a 8% increase in total operating costs and expenses from $1.054 billion to $1.144 billion from Q2 2022 to Q2 2023, while revenue growth was much more modest at 0.86% over the same period (from $1.381 billion to $1.393 billion).

Host Hotels & Resorts: Second Quarter Results 2023

From this standpoint, even if we see a decline in RevPAR heading into the winter months – investors are likely to pay close attention as to whether the company can concurrently reduce its operating expenses and debt levels going forward.

Conclusion

To conclude, Host Hotels & Resorts has seen a plateau in RevPAR growth across major locations, and revenue growth more generally.

I take the view that while a decline in RevPAR growth is probable heading into the winter months, investors are likely to want to see evidence of a reduction in debt and operating expenses before further upside can be justified.

Read the full article here