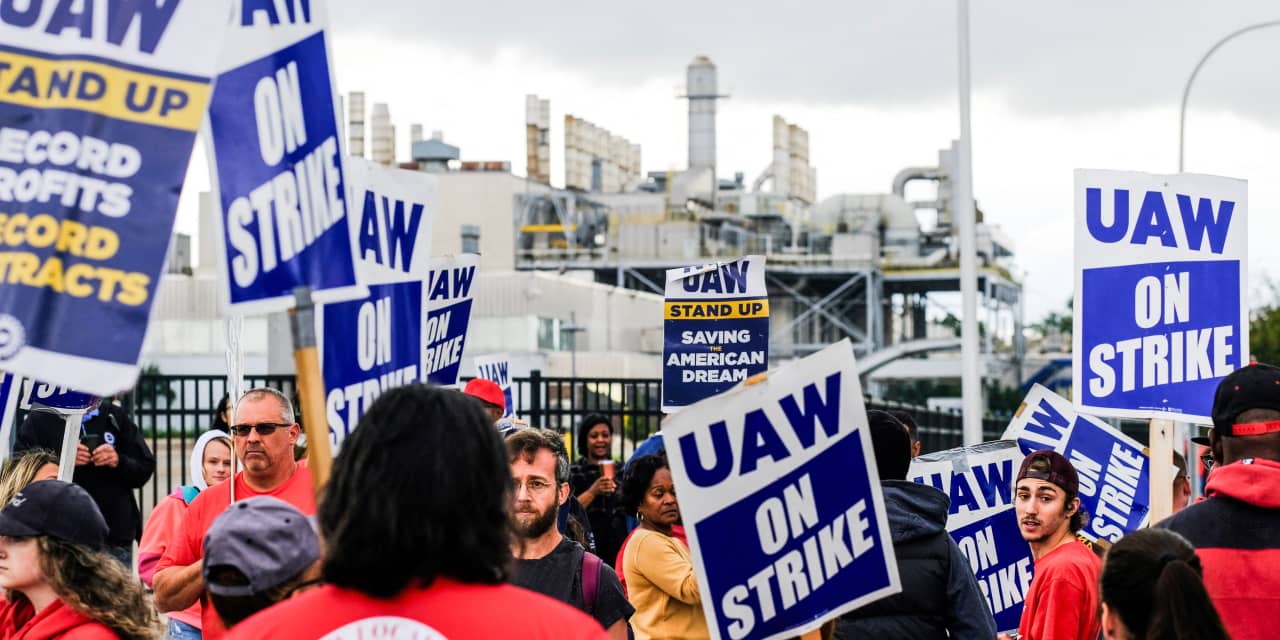

The United Auto Workers said not enough progress has been made in its labor negotiations with Ford, General Motors, and

Stellantis,

and it is prepared to name more strike targets on Friday, as it did last week.

A union spokesperson said Wednesday that UAW President Shawn Fain is set to announce further steps Friday at 10 a.m. ET, such as “new strike targets against the companies barring significant progress.”

“The UAW has set a new, 12 p.m. Eastern time deadline for Sept. 29 to reach agreements with auto makers,” the spokesperson said.

Investors shouldn’t be all that surprised. This strike likely won’t be over for weeks.

Last Friday, Fain announced that UAW workers would walk out on 38 parts and distribution facilities at both

General Motors

(ticker: GM) and

Stellantis

(STLA).

Ford Motor

(F) was spared because of progress made in negotiations with that company.

The parts and distribution facilities came as a surprise to Wall Street, which had expected actions against more assembly plants. The UAW strike kicked off Sept. 15 at one assembly plant for each of the Detroit-Three auto makers.

Strike locations can serve as a gauge of the labor talks’ progress. For instance, if the union strikes at plants making pickup trucks, such as Ford’s Kansas City complex, it’s a sign the union is looking to inflict more pain on auto makers. Trucks generate significant profits for all three companies.

If Ford is included in any additional strike targets this week, that could be a signal the union wasn’t pleased with the company’s decision to pause the development of a battery-making facility in Michigan. Ford said there were many reasons for the construction pause, without getting specific. Some reasons could include the federal government expressing concern about the Chinese company from whom Ford is licensing battery technology. That’s the world’s largest battery maker,

Contemporary Amperex Technology Co Ltd

(300750.China), better known as CATL. Weaker-than-expected demand for Ford electric vehicles could be playing a role as well, as could the cost structure of the plant, which would likely be a target for a UAW unionization effort.

Ford, GM, and Stellantis didn’t immediately respond to a request for comment Wednesday.

The UAW has been on strike for just under two weeks, but analysts aren’t expecting a rapid resolution. In a recent report, Wells Fargo analyst Colin Langan suggested 45 days was likely. The UAW went on strike against GM for 40 days in 2019.

That strike was costlier for both the company and the union. The UAW went on strike against the entire company, with estimates at some 40,000 or 50,000 workers. That put a strain on the UAW strike fund.

Currently, with fewer than 20,000 workers on strike, there should be less financial strain on the union’s estimated 140,000 to 150,000 members at the Detroit-Three. That also limits the damage for the auto makers. The 2019 strike cost GM about $3.6 billion in lost profits. With production still running and fewer workers out, that number remains much smaller at this point in 2023.

There are other reasons investors shouldn’t expect a rapid resolution. One is both sides have significant sticking points. The union wants dramatically higher wages partly to catch up for prior concessions made during tougher times in the auto business. GM, don’t forget, declared bankruptcy during the 2008-09 financial crisis. Meanwhile, the companies are worried about competing with nonunion EV companies, such as

Tesla

(TSLA), as EV penetration of new car sales rises. It’s a far more complicated time for the industry, and neither side will likely give in on their core demands quickly.

Another reason the strike could last a little while longer is human nature: It doesn’t make sense to strike for days given the importance of worker demands. It also doesn’t seem realistic that both sides can soon close the apparently wide negotiating gap.

Ford and GM shares have declined about 17% and 16%, respectively, since the start of July, when labor issues came to the fore. The

S&P 500

is down about 2% over the same span.

Stellantis shares have risen about 7%, but Stellantis’s business is more global than GM or Ford. That’s one reason its stock doesn’t trade in line with the other two auto makers’ shares. Its stock is also cheaper, trading for less 4 times estimated 2024 earnings. GM and Ford shares trade for less than 5 times and 7 times, respectively.

Shares of all three haven’t done much of anything over the past few days while the negotiations have heated up. Investors are likely waiting to see what happens next.

Write to Al Root at [email protected]

Read the full article here