Investment Summary

Terex Corporation (NYSE:TEX) is a company that specializes in manufacturing industrial equipment that helps industries across the world. Their products are designed to cater to different industries such as construction, infrastructure, mining, and transportation. Terex Corporation’s range of products is quite diverse and includes equipment like aerial work platforms, cranes, materials processing equipment, and utility equipment.

Within the company, there are two notable segments, namely Aerial Work Platforms and Material Processing. The two segments are quite similar in the revenues they generate and they experienced similar growth in the last quarter as the company as a whole saw sales increase 23% YoY despite a challenging market to operate in. With $1.2 billion in sales, the company still has a very strong order backlog of over $4 billion. With a decent dividend yield and steadily decreasing outstanding shares, I think the future outlook in terms of long-term investment is very bright and I will be rating the company a buy.

Market Outlook

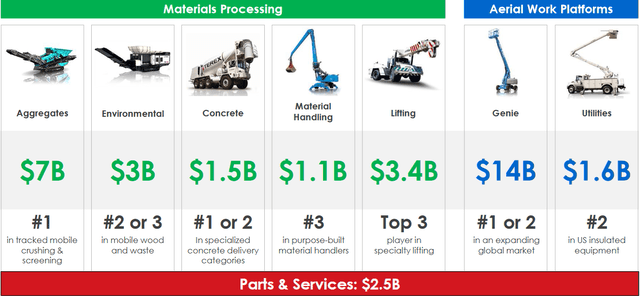

TEX has been able to build up a strong presence in many key markets and has a large $34 billion TAM to tap into, presenting an intriguing opportunity for investors as growth is likely to continue as the company has so far been successful in executing its growth strategy.

Company Key Markets (Investor Presentation)

Besides the strong market position they have, some major tailwinds the company lists that will help catapult growth are large amounts of infrastructure investments around the world, expected to be around $49 trillion between 2016 – 2030, which will just help bolster demand for the products that TEX manufactures. The target for TEX seems to remain in that they want an operating margin of 13-14% in 2027, a strong improvement from the 9.5% the company had estimated in 2022. This higher margin will help increase the financial flexibility of the company and should help in raising the dividend and keep on buying back shares. For the coming quarters though, I think it will be especially worth looking at the margins for the company and whether or not they are on track to improving them. Growth estimates remain quite low for TEX, so an unexpected improvement might be a major catalyst for the share price.

Quarterly Result

As I mentioned before, the last earnings report was a major improvement for the company as they were able to enter 2023 with a strong start. Sales improving 23% You is nothing to hide under the carpet. What might have been even more important though is seeing that the order backlog remained very strong at over $4 billion. This gives me some comfort the company will be able to steady revenues for the coming years at least.

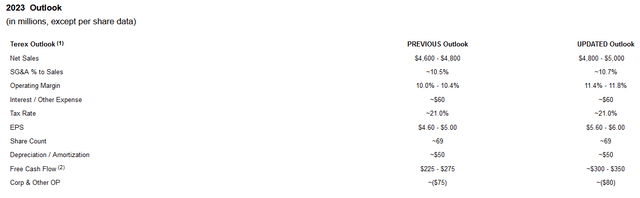

2023 Outlook (Earnings Report)

With the strong start to the year, the company also raised the outlook for 2023. One key figure I noticed first was the operating margin, expected to be around 11.4 – 11.8%, an increase of 1% from previous estimates. I think this helps support the 2027 operating margin target of 13-14% a lot as the company is well on its way to achieving it. This uptick in 2023 margins also helped raise the free cash flow estimates to $300 – $350 million which I think will end up with the company both raising the dividend and eventually announcing more buybacks of shares. All this should help bolster the long-term value that investors will get for entering at these prices. Looking at the debt the company has I expect it to be of little issue, sitting at under $800 million for the long term. If the company achieves the cashflow targets the debt won’t be an issue in my opinion. To even further highlight the stable state the company is in, the net debt/EBITDA is just under 1, which is a very healthy position to be in as they should be able to continue investing and executing their growth strategy without much hindrance of debt.

Risks

In terms of risks, I think one of the major ones is a slowdown in spending for the markets that TEX serves. This would obviously hurt growth and sales for the company. But as many were expecting a tough recession and slowdown, it seems we haven’t gotten there yet. Speculating when the slowdown will happen might just end up with losing appreciation in a position as money is left on the sidelines.

What I think would hurt TEX the most is a failure in achieving the 2027 operating margins. As the company has a strong position in several markets, I believe investors will be looking at the company more for reassurance in their business and improving that instead of targeting new high-growth opportunities and spending capital on that.

Valuation & Wrap Up

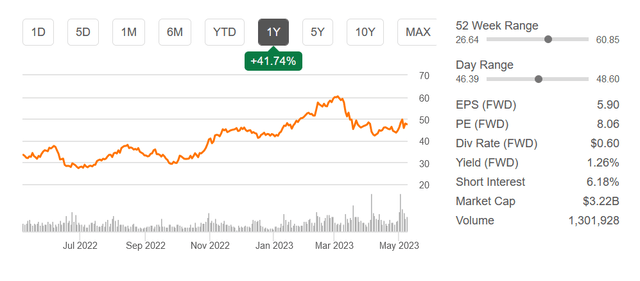

Looking at the valuation of TEX right now I think buying at 8x forward earnings really doesn’t offer that much risk. You are buying into a company with a strong balance sheet and a management that has proven they want to bring value to shareholders through dividends and buybacks. The last earnings report also helped me be more confident that TEX will be a winner in the long run as they dominate still in a difficult market. Improvements can of course be made for the company, the cash flow is something I’d like to see go even higher but that of course comes as the overall margins of the business improve. A failure though in achieving the 2027 targets is what I fear could bring the share price down heavily.

Stock Chart (Seeking Alpha)

There are many companies benefiting from the increased spending on infrastructure in the coming years, and what makes me believe in TEX is their proven track record of growth. Not to say that proves they will continue that way, it’s that they are in the best possible position to do so. With all that said I think TEX is a buy at these prices.

Read the full article here