Investment Thesis

In our writeup dated Jan 14, 2023, we were of the view that the substantial underperformance of TH International Limited (NASDAQ:THCH) was not warranted and believed that the valuation gap would converge as there appeared to be a potential alignment of macro, fundamental and technical factors in 2023.

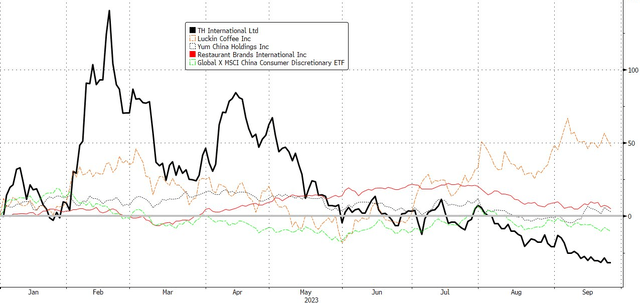

As of September 26, 2023, THCH was down another 32% year to date (following a 72% decline in 2022) while its licensor Restaurant Brands International (QSR) was up 5%, coffee chain competitor Luckin Coffee (OTCPK:LKNCY) was up 48% and fast food competitor Yum China Holdings (YUMC) was up 3%. THCH also underperformed the Global X MSCI China Consumer Discretionary ETF (CHIQ) by a large margin during the same period, with CHIQ down just 11%.

Bloomberg.

At the same time, THCH reported solid and improving operating and financial results for the Tim Hortons business while announcing its acquisition of the exclusive right to develop Popeyes brand restaurants in mainland China. On the technical side, the company completed the warrant exchange to both reduce future dilution and alleviate the low free float caused by the deSPACing process. The deepening disconnect between THCH’s fundamentals and the stock performance was arguably driven in large part by increasing concerns about China (macro) and the company’s own poor communication with the investor community.

We remain convicted in our investment thesis and believe that THCH has been unfairly penalized by macro and technical factors. Its current stock price is now lower than the implied price paid by institutional investors in private rounds, which represents a rare opportunity with asymmetric upside and limited downside. In this update we will analyze THCH’s store opening status, the China discount factor and investor relations efforts. We will dig deeper into the fundamentals and valuation analysis in subsequent writeups.

Store Openings: Acceleration Ahead in 2H 2023

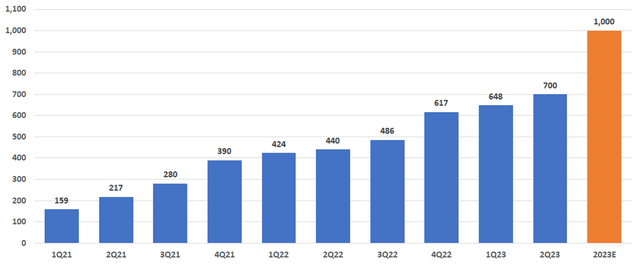

Per its earnings release, THCH operated 700 Tim Hortons stores by the end of 2Q 2023 with a target of opening an additional 300 stores during the second half of this year (see chart below). Separately the company opened its first Popeyes store in Shanghai in August and planned to open 10 stores in 2023 and 1,700 stores across China in the next 10 years.

THCH Total Store Count

Company filings.

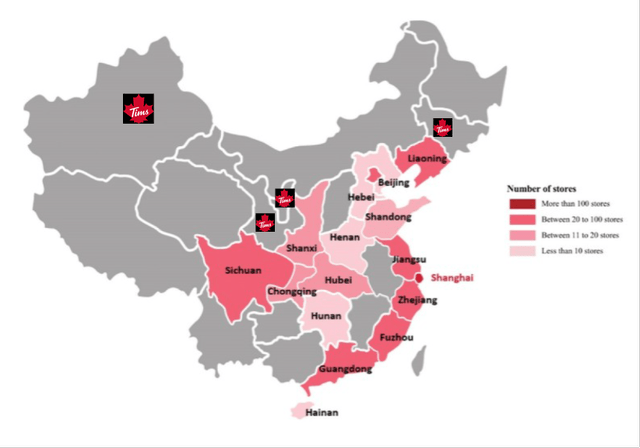

THCH did not break down the store numbers by city in its earnings release. Based on the data we collected via THCH social media channels and a Baidu map, the company likely operated stores in 56 cities in China as of August 31, 2023, up from 39 cities at the end of 2022. While THCH added most of these new cities in its four main clusters centered around Shanghai, Beijing, the Chengdu-Chongqing region, and the Pearl River Delta, it also opened stores in some relatively remote but strategically important new markets (marked by the Tims logo in the map below), such as Lanzhou (Gansu Province), Yinchuan (Ningxia Province), Changchun (Jilin Province) and Urumqi (Xinjiang Province).

Company filings and social media channels.

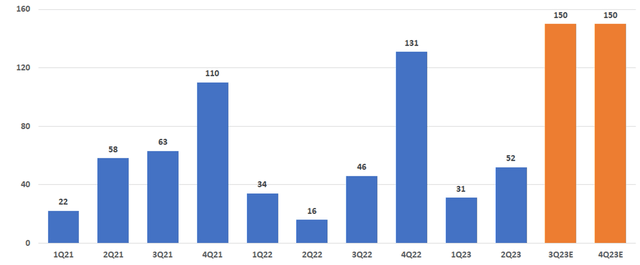

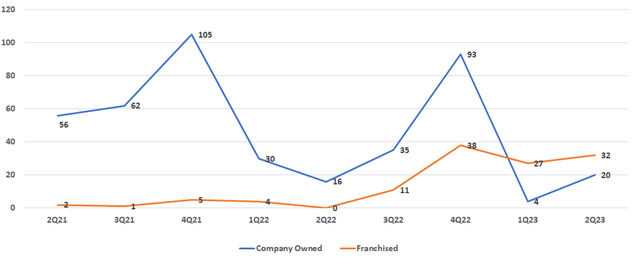

Given that THCH needs to open at least 300 new stores to hit its full year target of 1,000 stores, it will have to accelerate its pace of new store openings to an average of 150 stores per quarter or 50 stores per month from July to December, which would be a historic high since 2021 (see chart below). The previous record was 131 stores per quarter during 4Q 2022 which could be partially due to seasonality and partially due to the lifting of COVID restrictions in November 2022. How will THCH achieve this new pace of 150 stores in 2023? The answer might be the franchised stores.

THCH New Store Openings Per Quarter

Company filings.

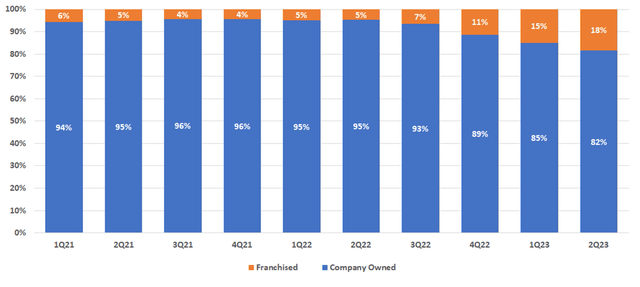

The share of THCH franchised stores was almost unchanged at around 5% of the store mix until 3Q 2022 when the number started to increase by 3-4 percentage points per quarter (see chart below). By the end of 2Q 2023, the franchised stores accounted for 18% of THCH stores in China.

THCH Store Mix: Company Stores vs. Franchised Stores

Company filings.

If we break down the quarterly store openings by store type, we can clearly see the growth strategy shift in 3Q 2022 (see chart below) when the franchised stores started to play an increasingly important role in driving growth. The key shift came in 1Q 2023 when the pace of newly opened franchised stores surpassed that of the company stores. This trend may continue for the rest of 2023 and onwards as the company shifts towards a more “asset-light” model with a higher return on capital. We would not be surprised at all if most of the upcoming new stores in 2H 2023 are franchised stores.

New Store Openings per Quarter: Company Stores vs. Franchised Stores

Company filings

THCH in 2023 is very similar to SBUX in 1995 in terms of store count and growth stage (see tables below). THCH operated 700 stores at the end of 1H 2023 and plans to open an additional 300 stores by year end. By 2026, the company targets a level of 2,750 stores in China and should be able to surpass 3,000 total stores by 2027. SBUX operated 677 stores at the end of 1995 and it took the company five years to hit and surpass the milestone of 3,000 stores.

|

THCH Store Count |

|

|

1H 2023 |

700 |

|

2023E |

1,000 |

|

2026E |

2,750 |

|

2027E |

>3,000 |

Source: Company filings.

|

SBUX Store Count |

|

|

1995 |

677 |

|

1996 |

1,025 |

|

1997 |

1,412 |

|

1998 |

1,886 |

|

1999 |

2,498 |

|

2000 |

3,501 |

Source: Company filings. Notes: SBUX fiscal year end is September 30.

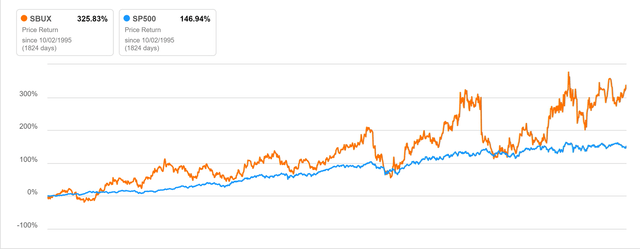

During its growth period between 1995 to 2000, SBUX stock generated a 325% return, far surpassing the S&P 500 Index’s 147% return during the same period (see chart below). It would be too simplistic to conclude that THCH could generate similar returns over the next five years as the two companies have different target markets, business models and historical contexts, but we think it is not a stretch to suggest that timing is quite good for THCH, with the stock at a rock bottom valuation at a point of high, accelerating growth from a low base.

SBUX Stock Chart from 9/30/95 to 9/30/2000

Seeking Alpha.

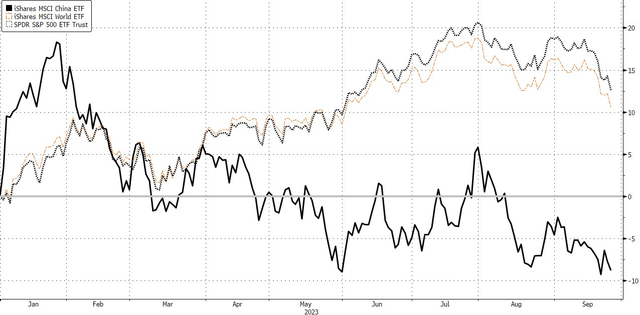

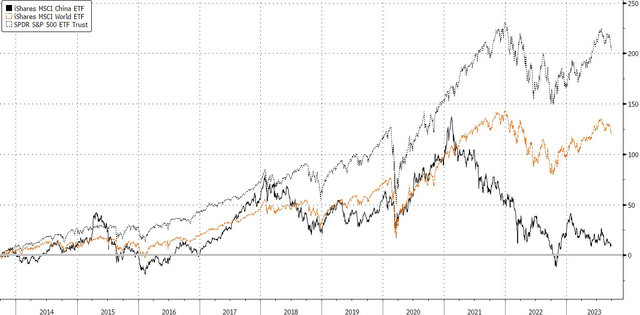

China Factor: Headwind or Tailwind

Contrary to the expectation that the post-COVID recovery in China would provide a much-needed tailwind to Chinese ADRs, the economic data released so far this year have been dismal and worsening. The market indices have captured the faltering status of Chinese economy as the iShares MSCI China Index ETF (MCHI) has underperformed the iShares MSCI World Index ETF (URTH) and the S&P 500 ETF (SPY) year to date by approximately 19 percentage points and 21 percentage points respectively (see chart below).

Bloomberg.

The divergence looks even more striking if we lengthen the period to 10 years (MCHI was up just 9% vs URTH’s 119% and SPY’s 203%). Note that MCHI held up well until 2021 and has since given up nearly its entire cumulative gain (no doubt COVID and its aftermath are at least partly to blame).

Bloomberg.

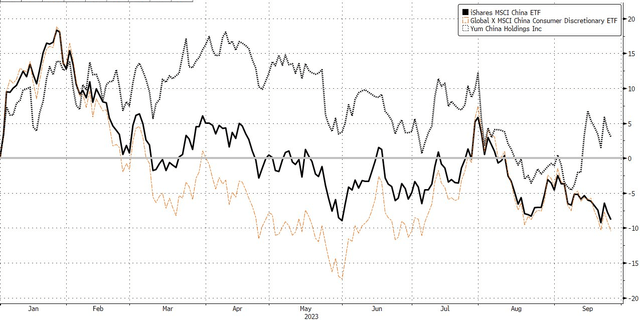

CHIQ, a good proxy for discretionary consumer spending in China, has correlated strongly with MCHI in 2023. One of CHIQ’s top holdings is Yum China Holdings, Inc. (YUMC) which has had a similar trajectory year-to-date in 2023 (see chart below).

Bloomberg.

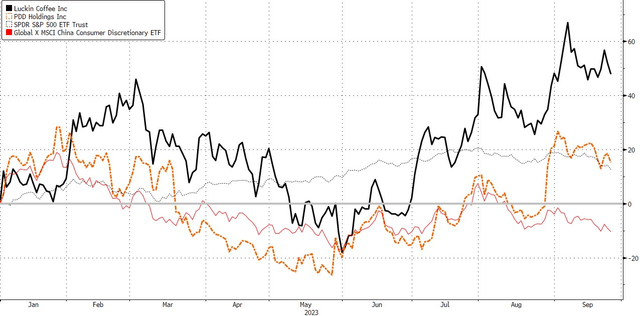

With this backdrop, it may seem unlikely that there would be any consumer-oriented Chinese ADRs bucking this downtrend, yet take a look at the performance of Luckin Coffee (OTCPK:LKNCY) and PDD Holdings (PDD) which have both beaten the S&P 500 this year.

Bloomberg.

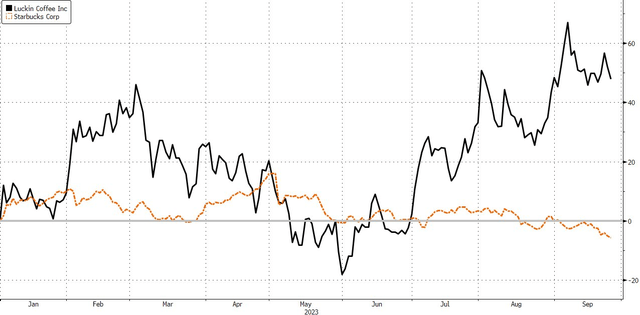

These two companies have one thing in common, i.e. their businesses deliver superior value for their customers, which is a positive in this economic downturn. LKNCY, which we have frequently written about, is the largest coffee chain in China by store count. It not only leads Starbucks, the second largest in China, by over 4,000 stores but also prices its coffee products at a fraction of Starbucks and still makes money. Year to date, LKNCY outperformed SBUX by over 50 percentage points (see chart below).

Bloomberg.

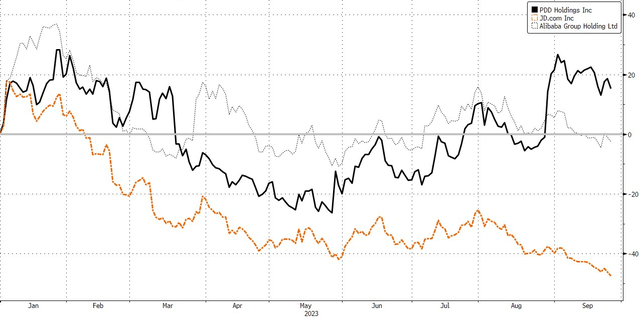

PDD is one of the leading ecommerce platforms in China, competing directly with Alibaba (BABA) and JD.com, Inc. (JD). What differentiates PDD from the other competitors is that PDD focuses on white-labeled products with deep price discounts to similar branded merchandise sold on BABA and JD. It also successfully exported its business model overseas via its international platform TEMU which is already among the top 10 most downloaded apps in the world. As shown in the chart below, the market certainly has rewarded PDD vs JD, and it has outperformed BABA to a lesser extent.

Bloomberg.

Another observation is that both companies underperformed in the S&P 500 during the second quarter of 2023 as concerns over China mounted. However, the market quickly realized after their earnings releases that these were “babies in the bathwater” situations and the stocks recovered.

THCH in theory should be in the same camp as LKNCY and PDD for the following reasons:

- THCH is a well-recognized premium brand, but its products are priced lower than its competitors such as Starbucks, creating an attractive value proposition for customers in China;

- The company reported solid earnings results in the first half of 2023 and its top-line growth should remain robust due to easy comparisons in 2H 2022; and

- Per Bloomberg, THCH’s free float has increased from 1.4M post SPAC to 41M.

Now the key question is why has THCH been overlooked by the market for so long despite its attractive fundamentals and rock bottom valuation? Does the company have an effective investor relations strategy and a good team to implement that strategy?

IR Team: Up for the Challenges?

From an investor relations perspective, THCH indeed faces unique challenges as the company is a master franchisee of two well-known Western brands with all its business operations and customers in China, but its common stock is publicly traded in the US. In other words, its shareholders are not necessarily its customers, so the company cannot simply assume that what THCH does in China for its customers will be fully understood by (or resonate with) its shareholders in the US. In addition, its shareholders may have preconceived notions (potentially unfavorable) of Tim Hortons and Popeyes brands based on their experiences in North America, which might not be applicable to China.

Is the current THCH IR team up for the challenge? In all fairness, THCH’s current IR team has made great efforts in communicating with the market, from presenting at well-regarded industry conferences to participating in mainstream media interviews. However, the fact that THCH’s stock appears to ignore positive catalysts suggests that more needs to be done. Below are a few areas that we think THCH’s IR team should address first and foremost:

- Earnings release date. Ideally, THCH should issue a press release to alert the shareholders when it will announce quarterly earnings. As it stands, THCH simply announces earnings without notifying shareholders in advance. The earnings release is a key channel to communicate with shareholders, and it would go a long way in shoring up THCH’s commitment to shareholders by shining a brighter light on these events.

- Earnings call. Currently, THCH only issues an earnings release in writing and holds a prerecorded call, which begs the question “is the company afraid of communicating with the shareholders”? Why can’t THCH have a normal conference call like all other companies? The company did a webcast at one of the industry conferences early this year, in which Board Director Gregory Armstrong did a great job articulating THCH’s strategy and the market opportunities in China during a fireside chat with a sellside equity analyst. If the current management is more comfortable running the business than managing shareholders on earnings calls, Mr Armstrong would be a great candidate to host the earnings calls.

- Twitter account (X account). It is not clear how THCH wants to position its Twitter account as it simply reposts official press releases and marketing materials used in its social media account in China. However, a number of postings do not really resonate with shareholders outside China. For example, a new drink or combo launched by THCH in China will not help an investor in the US to decide how will that impact the top line of the business as the drinks are not available in stores in North America and the Twitter posting does not provide any context or operating data about the new drink. Another example is the posting of a newly opened store in a city in China. It would be hard for an investor outside China to understand the significance of that specific city (or its correct pronunciation) and how it fits into THCH’s growth strategy. It would be more shareholder-friendly to show a map of where the city is in China and how it adds to the existing store network or THCH’s main clusters. The dilemma of this Twitter account is that the institutional investors may not be the targeted audience of the account while retail investors might be, but the content does not really add meaningful value to retail investors outside China.

- Disclosure. Unlike Luckin Coffee, THCH does not disclose much operating data via its social media accounts in China, especially new store openings (it does disclose the city name from time to time if THCH enters that market, however). It would be particularly beneficial to THCH to disclose more data in the second half of 2023 as it is critical to show its shareholders that THCH is on schedule to accomplish its 1000 store count goal by the end of the year.

- KPI. Most importantly, what are the KPIs of THCH’s management team and its IR team in terms of managing the investor community? Are their interests perfectly aligned with other shareholders?

Stay Tuned

In the upcoming Part 2 of this write-up, we will provide an analysis of THCH fundamentals.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here