In February, I wrote that it was time to fade the rally in Himax Technologies, Inc. (NASDAQ:HIMX) as its core business was facing excess inventory issues. In July, meanwhile, I said Q2 should be weak, but also likely the trough for the company. The stock is down over -20% since both write-ups. Let’s catch up on the name.

Company Profile

As a reminder, HIMX produces components, such as display drivers, timing controls, and power ICs, that are built into Thin-Film Transistor (TFT) LCD panels, which are used in products such as computer monitors, televisions, and automobile dashboards.

While HIMX says it has over 200 customers, the majority of its revenue comes from two large customers. It has about the 4th largest market share in the display driver space.

Himax also produces wafer level optics (WLO) and 3D Sensing solutions that are used in devices for 3D sensing, AR/VR, and holographic displays. The company is also involved in projects covering time-of-flight (TOF) for world-facing cameras with its partner VCSEL. It also makes LCoS microdisplays for use in AR goggle devices and head-up displays.

Q2 to Mark a Bottom

In my original article, I discussed that HIMX was facing excess inventory issues that was causing ASPs to fall and margins to deteriorate. Given the issues, after its first quarter, the company decided to terminate some high-cost foundry capacity agreements before their expiration dates, leading to one-time early termination expenses that will hurt Q2 gross margins.

That played out in Q2, as gross margins came in at 21.7%. That was down from the prior quarter’s gross margin of 28.1% and 43.6% a year ago. The company expects gross margins to improve meaningfully in Q3, coming in between 30.5% to 32.0%, depending on product mix.

Revenues continues to be weak, with sales falling nearly -25% to $235.0 million. On a sequential basis, revenue was down nearly -4%.

Revenue from small and medium drivers fell -2.9% sequentially to $150.3 million, with strength in smartphone and tablet driver sales, both of which grew sequentially. Its largest business, automotive drivers, saw sales decrease single digit sequentially. Large driver sales dropped -14% sequentially to $45.4 million.

The company squeaked by with a profit of $0.9 million, or 0.5 cents per ADS, versus, $70.6 million, or 40 cents per ADS, a year ago.

The company generated $1.7 million in operating cash flow in the quarter. Free cash flow was -$1.2 million.

Inventories came in at $297.3 million, a decline of -11% from last quarter. That’s a nice improvement.

Looking ahead, HIMX forecast Q3 revenue to be down -7% to flat sequentially. As noted before, it sees gross margins recovering to 30.5%-32.0%. EPS is projected to be between 1.5 to 6 cents.

On its Q2 earnings call, CEO Jordan Wu said:

“By sacrificing margin last quarter, we now have added flexibility where new wafer starts are no longer bound by minimal fulfill requirements and higher wafer costs set during the severe foundry capacity shortage period. Furthermore, we can now leverage diverse foundry sources for optimal operational efficiency, a much improved cost structure, thereby maintaining our product competitiveness. Favorable product mix shift is also a key factor contributing to our expected Q3 gross margin expansion. This is predominantly driven by increased automotive sales, as discussed earlier, thanks to a robust recovery in the Chinese automotive market, leading to order resumption from customers. Notably, our automotive sales for traditional DDIC, TDDI and Tcon are all set to enjoy decent double-digit sequential growth in the third quarter and collectively are expected to represent almost 45% of our total sales. As a reminder, all these automotive products have a better than corporate average profit margin profile. Moving on to inventory destocking. Our inventory depletion is progressing nicely with Q3 inventory level on track for meaningful reduction. At this point, we are comfortable in our overall inventory level, thanks to our continuous effort to destock for several quarters. In addition, the remaining stocks are comprised of IC products, which have a solid customer design base and long-expected lifetimes. We now expect that our inventory will normalize near historical average levels by the end of the year. While the macroeconomic environment still presents some headwinds for us, given the expected strength in automotive sales, improve operating flexibility and cost structure, in addition to our commitment to expand our presence in high value-added areas such as Tcon, OLED and AI. We expect second half sales and gross margin to improve from the first half and believe we are well positioned for long-term sustainable revenue growth.”

The company also noted that it expects a “decent” shipment of its WLO technology in the second half to support customers new generation VR devices.

Overall, HIMX reported a weak quarter, but that was to be expected. However, inventory appears to be getting into a better position and gross margins should continue to expand in Q3 and further into Q4.

The company is expecting the second half to be better than the first, and management commentary that it is seeing a strength in the automotive market, especially in China, is a good sign, as earlier the Chinese automotive market was a place of concern. The consumer electronic market, however, does remain weak, and we’ll have to see how well the microenvironment holds up.

Valuation

HIMX trades at nearly 16.8x the 2023 EBITDA consensus of $69.8 million. Based on 2024 analyst estimates calling for EBITDA of $132.2 million, it trades just below a 9x multiple. Note that these estimates are down meaningfully since I first looked at the name, when they were $138.9 million for 2023 and $175.2 million for 2024.

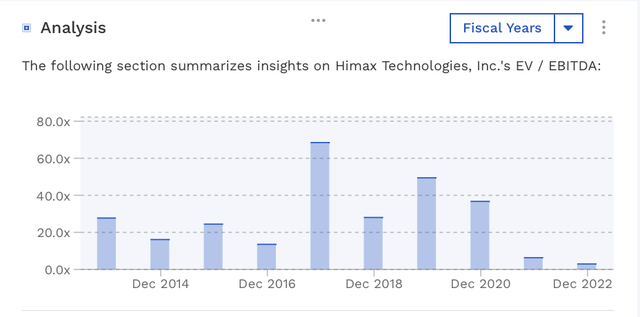

The company has commanded a high EV/EBITDA multiple in the past at over 20x, but it has traded at under 6.5x the last couple of years.

HIMX Historical Valuation (FinBox)

The company is projected to see a nearly -22% decline in revenue in 2023, followed by an 11% increase in 2024.

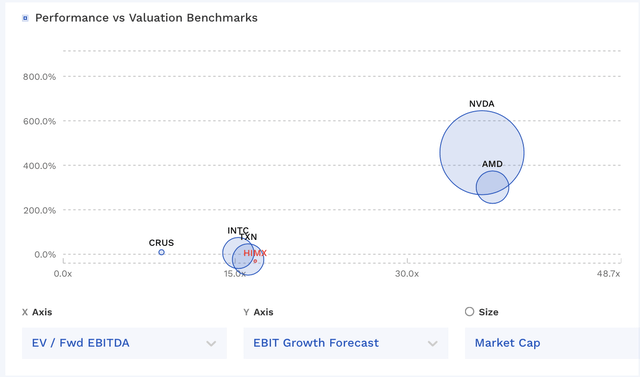

The company trades at towards the middle end of valuations for semiconductors firms, but its growth rate and gross margins are weaker.

HIMX Valuation Vs Peers (FinBox)

Conclusion

While a tech company, HIMX is in a highly cyclical business. That business looks like it troughed in Q2, and there are some positive signs with improved inventory, better projected gross margins, and a recovery in its largest segment – the auto market. While I don’t put much credit into HIMX’s new ventures, it did announce a WLO shipment and there is some optionality with these businesses.

Given its cyclical nature, the stock is more speculative, as certainly the auto market could take a turn for the worse and the consumer electronics market could remain in the doldrums for a while. The company is also facing some increased competition as well, which could lead to some pricing pressure.

That said, the best time to buy a more cyclical name is often when its troughs and its numbers look bad. With Himax Technologies, Inc. stock down over -20% since I last looked it and the worst appearing to be behind the stock, I think now is the time to upgrade the stock to “Buy.” However, it is only for more speculative investors.

Read the full article here