Investment summary

After a number of investment updates, there is no change in the investment rating for Adaptive Biotechnologies Corporation (NASDAQ:ADPT) following my July publication. That publication covered ADPT’s core offerings, its potential to create medical breakthroughs in complex disease segments, and its new CFO, Tycho Peterson, who comes with years of experience in capital markets and corporate finance.

As a reminder, ADPT books revenues from diagnostic and research services within its immune medicine and minimal residual disease markets. Immune medicine revenue includes services like sample testing, via its immunoSEQ collaborations with biopharmaceutical companies like Genentech, and provision of T-Detect COVID tests to clinical customers. This collaboration also has numerous milestone payments baked into it and is one to watch out for.

However, as mentioned in the last report, “there just isn’t the fundamental and economic data to support the case just now in my opinion” and this is a sentiment I share in this latest analysis. The question of opportunity cost immediately arises here, warranting a neutral posture at the time being. Net-net, reiterate hold.

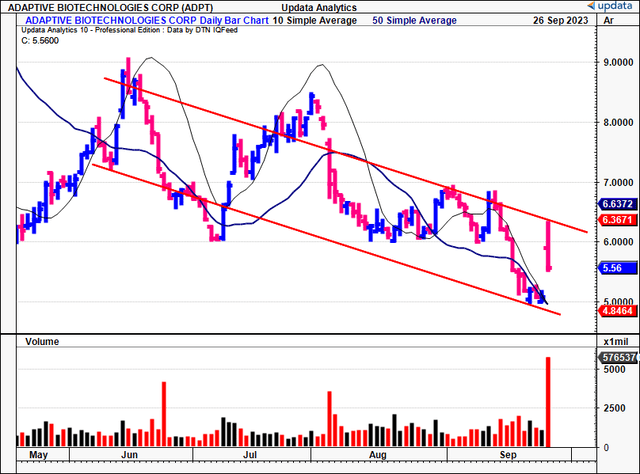

Figure 1.

Data: Updata

Critical findings supporting reiterated hold position

1. Q2 FY’23 insights

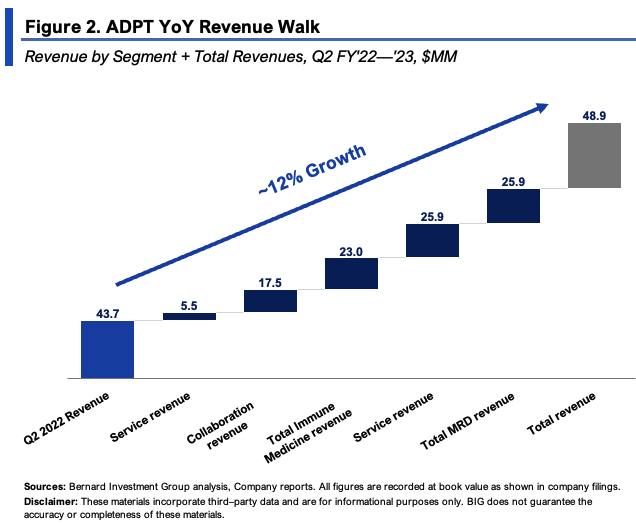

ADPT posted its Q2 numbers in early August with mixed results throughout the P&L and cash flows. It put up ~$49mm in revenues, up 12% YoY, on core EBITDA of negative $42mm and a net loss of $0.33/share. Based on performance YTD, management reiterated FY’23 guidance of $205—$215mm in top-line sales. It expects a split of 55% from its minimal residual disease (“MRD”) business and the remaining 45% from its immune medicine segment. It is ~60% of the way there based on its $128.4mm in sales this YTD.

Critically, the bulk of ADPT’s sales are typically booked in H2. Last year, it booked 55% of its sales clip in the second half, but by the looks of it, it would recognize ~40% of its FY’23 guidance in H2 at the upper end of range ($128/215 = 60%; 1-0.6 = 0.4).

The following points are relevant to the divisional breakdown (also observed in Figure 2):

- MRD sales were up 21% YoY to ~$26mm, underscored by growth in clinical testing and partnerships with pharma players. No milestone revenues were booked. It shipped 13,664 ClonoSEQ tests, up 52% from Q2 last year. Management said multiple myeloma is the key driver to test and revenue volumes. But I’d also point out that its healthcare accounts accelerated by 44%, whilst reordering accounts were up 37% YoY, and that around 37% of all its MRD testing volumes are concentrated in bloods.

- Its immune medicine business did $23mm of business, growing 300bps, with its collaborations/drug discovery segment clipping ~$17.5mm of this, whilst service revenues were down from $7.3mm last year to $5.5mm.

BIG Insights

2. Economic factors for consideration

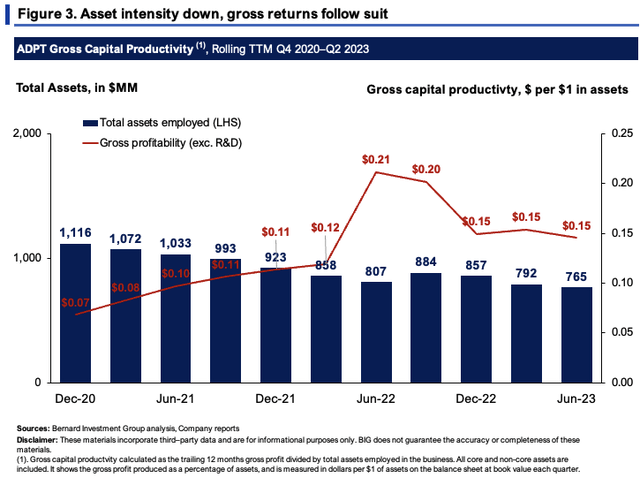

ADPT recycles the bulk of its revenues back into its clinical programs so it’s understandable it isn’t cash flow positive and hasn’t posted operating profits to speak of.

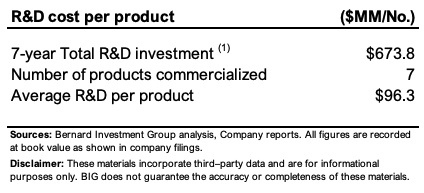

We can look further up the P&L for guidance. Figure 3 captures the company’s gross profitability as a function of total assets employed in the business on a rolling TTM basis. Most of the company’s asset value is tied up in cash, NWC and a portion towards its research facilities. Cash is included seeing as it is critical to fund ADPT’s clinical programs at this stage, given the lack of cash flows. Gross profitability is adjusted for investments in R&D, which are then added to gross asset value. As seen, the productivity of these assets is rotating back ~$0.15 on the dollar, down from highs of $0.21 last year, when certain milestone payments were recognized. As a function of R&D alone, it has 7 identifiable products commercialized, 6 in its MRD/ClonoSEQ platform and 1 in its immune medicine segment. Since 2017, it has invested ~$673mm towards R&D, bringing the average R&D per product to ~$96mm.

BIG Insights BIG Insights

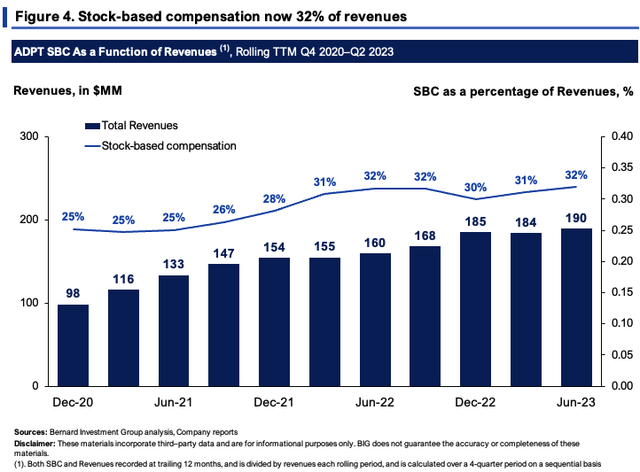

Another factor I’d highlight is the ratio of stock-based compensation (“SBC”) to revenues. Companies use SBC as a form of compensation to executives/employees instead of cash. Younger companies tend to utilize SBC more frequently than more mature names. Counterpoint Global indicates that “SBC can be viewed as a way to finance growth for the firm, an incentive for employees to deliver results, a tool for retaining workers, and a means to foster an overall sense of ownership”. It also argues that SBC could be treated as a financing cost, rather than an operating one. It can also be an incentive for both executives and employees, it says (key word, incentive).

Figure 4 outlines that ADPT’s SBC as a percentage of revenues has increased to 32%. I take somewhat of an issue with this, given ADPT missed key milestones last quarter that would have seen it book milestone payments under its collaborations. It begs the question if ADPT is on its shareholders’ side. This could mean the company is focused on growing the business, instead prioritizing its clinical programs. It is in the business of making breakthroughs in complex disease segments, after all. But the question of opportunity cost therefore presents itself, and perhaps advocates to look for more selective opportunities elsewhere.

BIG Insights

3. Technical considerations

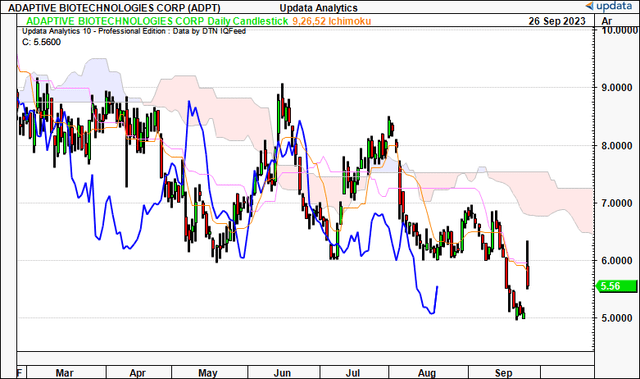

Technical studies are crucial to guide price visibility downstream for ADPT given the lack of earnings and cash flows to go by. Figure 5 shows the daily cloud chart, and how ADPT is tracking relative to its recent trend action. You can see both price and lagging lines are beneath the cloud, indicating a neutral posture from the market at best. It crossed the cloud base in August after a brief snapback rally. A cross above $7.20 by December would be needed to corroborate a bullish reversal.

Figure 5.

Data: Updata

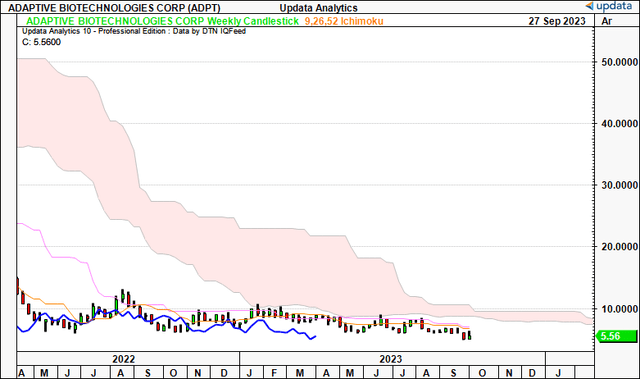

The weekly chart is more bleak. It looks to the coming months ahead. Both price and lagging lines have been tracking the cloud base with conformity throughout ’23, with no signs of a reversal. On the weekly, you’d be looking to a break above the $9.00 mark to return to a bullish light. In this vein, I am neutral on ADPT over the coming months.

Figure 6.

Data: Updata

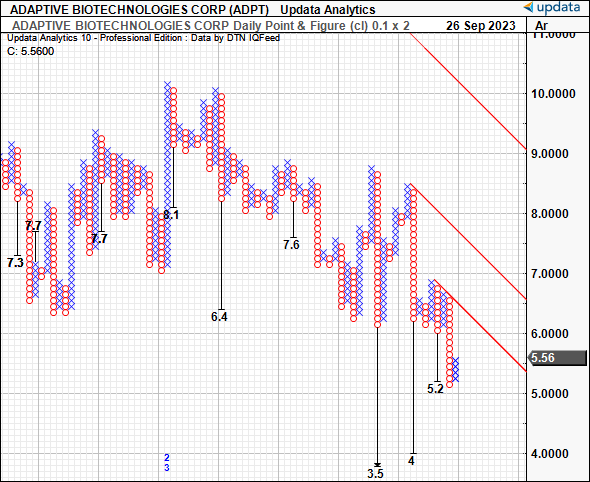

Given the above, it’s unsurprising to see the downside targets to the $3.50–$4.00 range on the point and figure studies below. These studies have eyed the price action well across FY’22 and FY’23 and called the pullbacks to $6.40 and ~$5.20 well, so there is validity in their use. A further break lower could see us activate the $4 target.

Figure 7.

Data: Updata

Valuation and conclusion

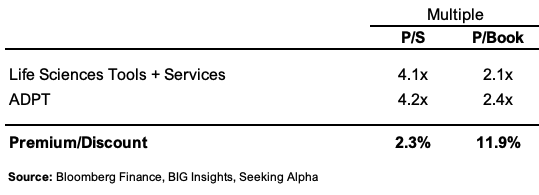

The stock sells at ~4x forward sales and is priced at $2.40 for every $1 in net asset value on a market cap of $804mm. At a c.4x multiple, this is relatively flat to the sector, but it ~12% premium to the sector’s price to book value. At management’s of $215mm for FY’23, this derives a price target of $860mm or $5.95/share, no significant price differential from the current market value as I write. Management has guided conservatively to revenues so far, so I’m content in utilizing its estimates. Consensus also expects $207mm in revenues this year, and assigning the 4x multiple to this figure derives a target market cap of $824mm. In my view these are fair assumptions, especially given the factors outlined here today:

- The tight gross profitability on assets employed, $0.15 for every $1 in assets. I’d be looking more to the $0.25–$0.30 region.

- Technical targets to the $5.20 region outlined earlier. The market data is important here to guide price visibility downstream.

- Sector multiples are also priced at ~4x sales (Figure 8). It is my view that ADPT should trade in line with the sector given its performance this YTD.

Collectively, this supports a neutral view, and would imply the market has ADPT priced about right at its current marks.

Figure 8.

BIG Insights

In short, ADPT’s clinical programs are pushing ahead and it is growing sales at a reasonable clip. There is no denying the company’s mission either, aiming to provide medical breakthroughs to complex disease segments. In the investment context however, there are challenges to advocating a buy rating. Gross profitability as a function of asset growth is tight, and this would see the investor buying ADPT for cash flows priced well into the future. At the current interest rate environment, this would compress the present value of these cash flows at a heavy rate. Further, technicals are unsupportive of indicating a reversal at this stage as well. Net-net, I continue to rate ADPT a hold.

Read the full article here