I don’t know how long it’s going to take, but there will come a day when some smart institutional buyers see the opportunity that’s developing in some of the most defensive option-income CEFs you can own, even as their NAVs continue to hold up far better than the broader market averages in this market sell-off.

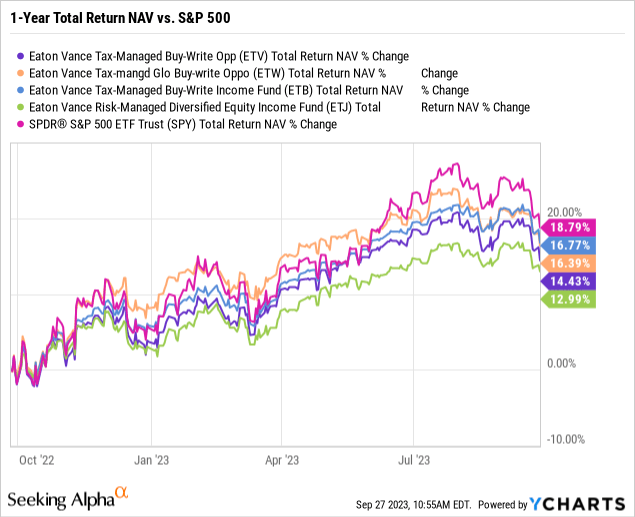

Many of these funds are from Eaton Vance and include the Eaton Vance Tax-Managed Buy/Write Opportunities fund (ETV), $11.90 closing market price, the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (ETW), $7.55 closing market price, the Eaton Vance Tax-Managed Buy-Write Income fund (ETB), $12.54 closing market price, and the Eaton Vance Risk-Managed Diversified Equity Income fund (ETJ), $7.54 closing market price.

All of these funds are essentially back to their 52-week market price lows (not including distributions) they saw at the end of last year during tax-loss selling in December after last year’s bear market.

But when you take a look at the fund’s one-year NAV total returns (including distributions), they’re performing just fine and are generally keeping up with the S&P 500 (SPY), $425.88 closing market price, which is a lot better than what I can say for most equity CEFs.

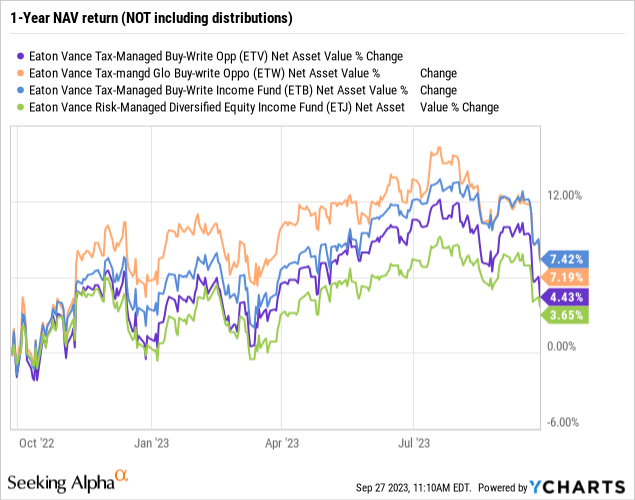

Not only that, all of these super defensive option-income CEFs from Eaton Vance have higher NAVs today than they did one year ago.

Note: the above graphs are as of Sept. 26, 2023, and include the recent market drop

This is exactly what you want to see and something I said to expect when I wrote this article from Dec. 9 of last year after Eaton Vance cut the distributions of most of their equity CEFs in November: Equity CEFs: Best Opportunity To Own The Eaton Vance CEFs All Year.

What makes this so confounding is that there are leveraged equity CEFs that are seeing their NAVs literally collapse, not just due to leverage, but due to NAV yields that cannot reasonably be expected to cover, and yet they have ascended to 80% to over 100% market price premiums.

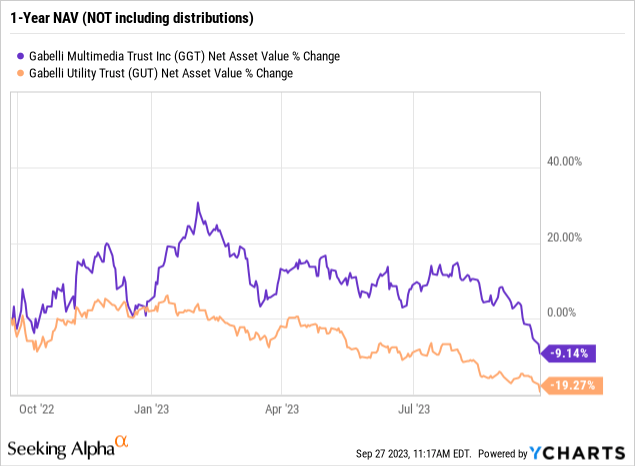

Compare the positive NAV performances from the Eaton Vance option-income CEFs above with the NAV performances, not including distributions, of the leveraged equity funds, the Gabelli Multimedia fund (GGT), and the Gabelli Utility Trust (GUT) below:

Do shareholders of GGT and GUT even know where their fund’s distributions come from? Here’s a hint, it’s not from the market price. Distributions are derived from the NAV and if the NAV keeps eroding, then it makes it that much more likely that the fund will not be able to cover future distributions without a major distribution cut.

So with a 26% current NAV yield for GGT, for example, the highest of all equity CEFs I follow, how is GGT going to be able to cover that actual distribution yield without losing even more NAV? I mean, this is a train wreck coming down the tracks. It’s only a question of when.

Compare a 26% NAV yield (GUT’s NAV yield is 20.1%) with the Eaton Vance option-income CEF’s NAV yields in the 8% to 9% sweet spot range and there’s no question which funds can be expected to cover their NAV yields and actually grow their NAVs. And it won’t even matter what kind of market environment we are in going forward. The die has already been cast even if shareholders don’t realize it yet.

Frankly, the CEF space has become a clown show in what funds are being sold down at market price and what funds seem to be expected to ride this out. The only funds that will actually ride this out at NAV if the broader equity markets go into a correction or something worse, will be the option-income CEFs. And the more defensive, the better.

I obviously have no control over the market prices of these funds and I do believe a big part of the valuation discrepancy that is going on in the CEF space is that the Eaton Vance funds are widely owned by banks and other financial institutions due to their size, and thus, are more susceptible to selling if banks and other financial institutions are deleveraging.

But eventually, NAV performance will win out and eventually, banks and other financial institutions will run out of shares to sell, and the smart money will step in. That also is not a question of if, but rather of when.

Read the full article here