Investment Thesis

SPX Technologies, Inc.’s (NYSE:SPXC) revenue is poised to benefit from good demand and healthy backlog levels across its HVAC and Detection & Measurement (D&M) segments. Further, improvement in supply chain conditions, which is helping increase throughput, and good execution with initiatives like new product launches should drive organic growth. Apart from organic growth, the company’s bolt-on M&As strategy which focuses on higher growth and higher margin businesses should also aid the revenue growth in the near term as well as long term. On the margin front, the company should see benefits from strong execution, investment in automation, and productivity gains. This, coupled with volume leverage from sales growth, should drive margin growth in the medium to long term. Moreover, the valuation is reasonable. Hence, I have a buy rating on SPXC’s stock.

Revenue Analysis and Outlook

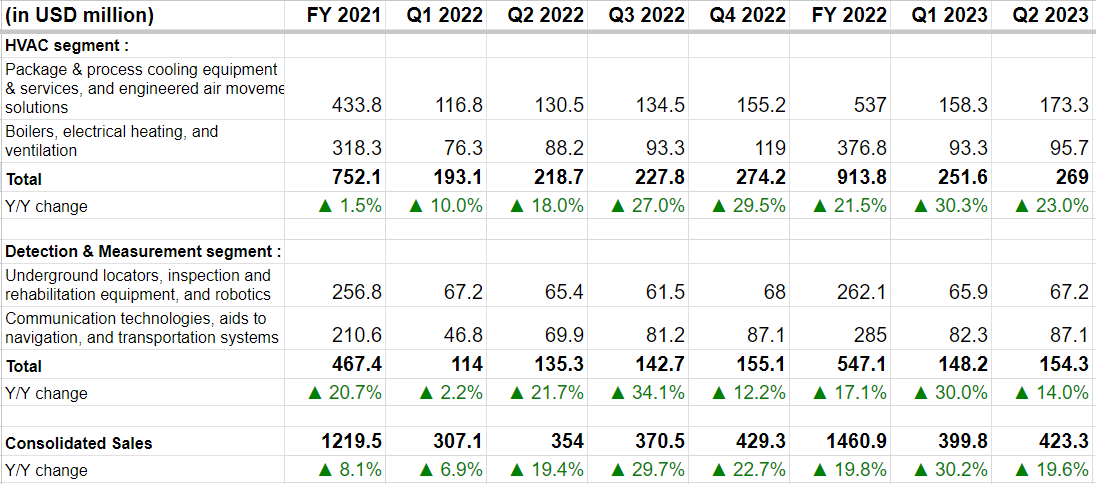

The company has seen good growth in recent years aided by healthy demand, strong execution, and bolt-on M&As. In the second quarter of 2023, the company’s revenue benefited from strong organic growth in both the HVAC and Detection and Measurement segments and the acquisitions of TAMCO and ASPEQ. The revenue increased 19.6% Y/Y to $423.3 million, driven by 14.6% Y/Y organic growth and 5.3% contributions from acquisitions. These positives were partially offset by a 0.3% unfavorable impact of FX translation.

In the HVAC segment, revenue of $269 million grew 23% Y/Y including 15% Y/Y organic growth and an 8.6% contribution from TAMCO and ASPEQ acquisitions, which more than offset the 0.6% negative impact from FX translation. The increase in organic revenue was driven by price increases and volume increases, primarily of cooling products, resulting from greater plant throughput and stable labor and supply chain environments. In the heating business, the organic revenue was flat Y/Y.

The Detection and Measurement (D&M) segment’s revenue increased 14% Y/Y to $154.3 million with organic growth across all businesses. The increase in organic revenue was attributed to the execution of large projects within the communication technologies, transportation, and aids to navigation businesses.

SPXC’s Revenue Growth (Company Data, GS Analytics Research)

Looking forward, SPX Corporation should deliver good growth supported by good demand and healthy backlog, improvement in supply chain conditions which is helping increase throughput, strong execution with initiatives like new product launches helping sales, and further bolt-on M&As.

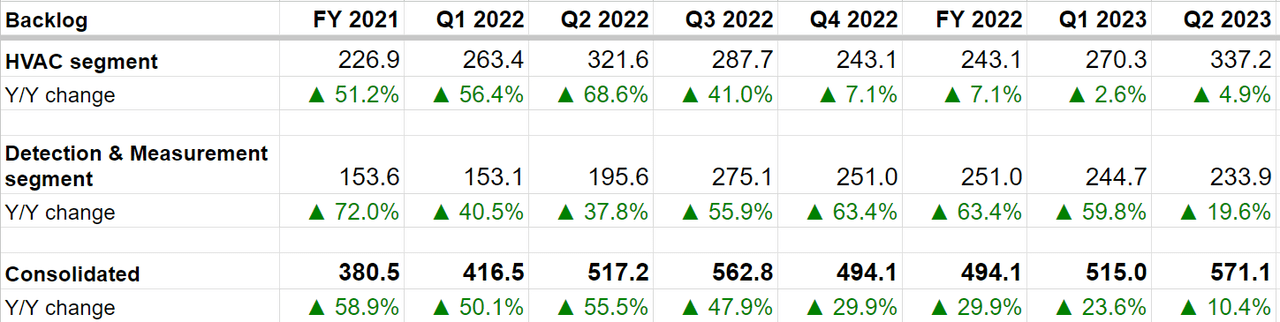

The company’s consolidated backlog at the end of Q2 2023 showed a good 10.4% Y/Y growth with both the HVAC segment and Detection and Measurement segment up Y/Y. This healthy backlog coupled with improving supply chain conditions, which has helped increase production efficiency and throughput (and hence backlog conversion), should help the revenue growth in the coming quarters.

SPXC’s Backlog Growth (Company Data, GS Analytics Research)

The company is seeing continued strength in demand in both segments, which bodes well for further backlog increases. The HVAC segment’s organic backlog was up 13% sequentially. While the segment backlog for detection and measurement was down 4% sequentially, it was mostly due to the timing of project deliveries and management noted that it is seeing a strong environment for project sales in this segment.

The company is also doing a good job in terms of execution and continues to launch new innovative products to add value to the customers. Last quarter, the company launched a water-saving and optimization system – Marley WaterGard – which significantly reduces water usage in its evaporative cooling products. The company also continues to gain increasing traction for its Cues’ AI-enabled GraniteNet software, which helps customers assess the condition of water and wastewater systems and reduce wastage.

SPX Corporation has come a long way since it spun off the SPX Flow business in 2015 and started focusing on businesses that can drive long-term growth. The company winded down or sold most of its legacy power businesses with exposure to the power generation end-market which was facing increased competition, and established HVAC and Detection and Measurement businesses as growth platforms. The company continues to do bolt-on acquisitions in these two growth categories and realize synergy benefits. The company has a strong balance sheet and despite more than $500 mn deployment in Q2 to acquire TAMCO and ASPEQ, its net leverage remains at 1.8x which is below the midpoint of its target range of 1.5x to 2.5x. The company’s strong FCF generation should allow it to reduce leverage to below 1.5x by the year-end and I expect the company to continue looking for M&A targets.

Overall, the company’s sales outlook looks attractive with both good organic and inorganic growth prospects.

Margin Analysis and Outlook

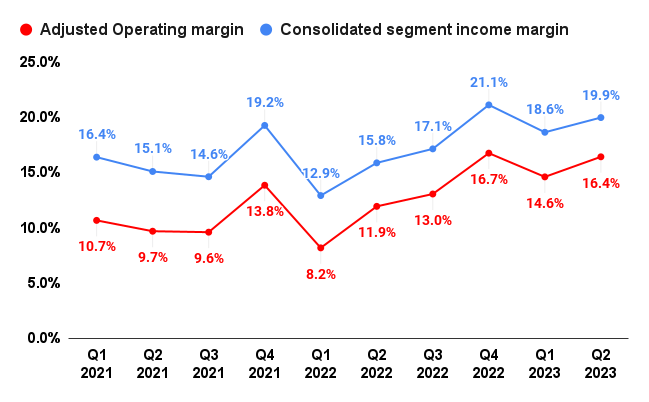

In Q2 2023, the company posted a 410 bps Y/Y and 450 bps Y/Y improvement in consolidated segment income margin and adjusted operating margin, respectively. This expansion was driven by strong operational improvement in the HVAC segment and positive price/cost impact.

SPXC’s Adjusted Operating margin and Consolidated segment income margin (Company Data, GS Analytics Research)

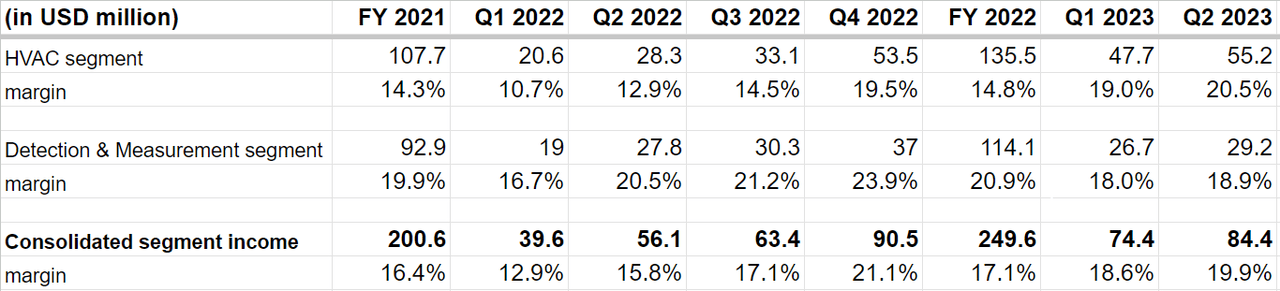

The HVAC segment income margin in the second quarter expanded by 760 bps to 20.5% due to price increases, better absorption of manufacturing costs resulting from the higher volumes, and improved operational execution due to investments in plant automation and stable labor and supply chain environments. The D&M segment income margin declined 160 bps Y/Y to 18.9% due to an unfavorable sales mix resulting from a higher volume of lower-margin project revenues in the CommTech platform.

SPXC’s Segment Wise income margin (Company Data, GS Analytics Research)

Looking forward, the company’s medium to long-term margin outlook is positive. The company’s focus on continuous improvement and strong plant-level execution along with volume leverage from sales growth should continue to help its margins. The shortage of labor and supply chain constraints that the company has seen in the past few years are also easing.

A couple of years ago, management used to have a 15% to 16% long-term segment margin target for the HVAC segment. However, the management has now increased it to between 18% and 20% thanks to structural cost takeout under its continuous improvement approach. I believe the company should continue to do well in terms of margin in the long run, thanks to its investment in automation, productivity, and lean manufacturing along with operating leverage.

However, the near-term outlook is somewhat mixed. The company’s HVAC business is currently posting margins at the upper end of management’s target range and while there is certainly a possibility of management further revising their long-term margin targets a few years down the road, in the near term, I expect the HVAC segment margin to normalize in the coming quarters. On the other hand, the Detection and Measurement segment margin was adversely impacted last quarter by a project in the CommTech business that contained a high amount of pass-through content, and supply chain disruption related to a limited number of locator products. The company has implemented steps to address these issues and margins should sequentially improve for this segment in the coming quarters as these impacts fade.

Valuation and Conclusion

The company is trading at 18.46x FY23 consensus EPS estimates and 16.92x FY24 consensus EPS estimates. Over the last 5-years, the company has traded at 18.50x forward P/E estimates.

Given the company’s good execution track record in recent years, bolt-on acquisition strategy to drive inorganic growth, and good organic growth prospects in both the HVAC and D&M segments, I believe the stock can continue to see a re-rating of its P/E multiple. Industrial companies, like Danaher (DHR), which follows a similar bolt-on acquisition strategy and has a good long-term track record of executing well, trades in the mid to high 20s P/E range. I believe SPXC’s stock can also reach a P/E multiple in the mid-20s in the long run if it continues to execute well. Hence, I have a buy rating on the stock.

Read the full article here