Introduction

Whenever I think of Mondelez International (NASDAQ:MDLZ), I think of the last time I ate way too many Oreos. However, it also makes me think of one of the best consumer defensive stocks on the market – maybe THE best?

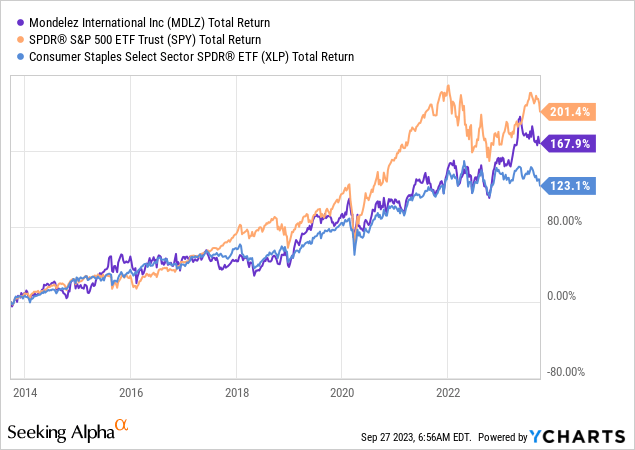

Not only does the company come with a 2.4% dividend yield and a terrific dividend track record, but its stock price has turned into an outperformer.

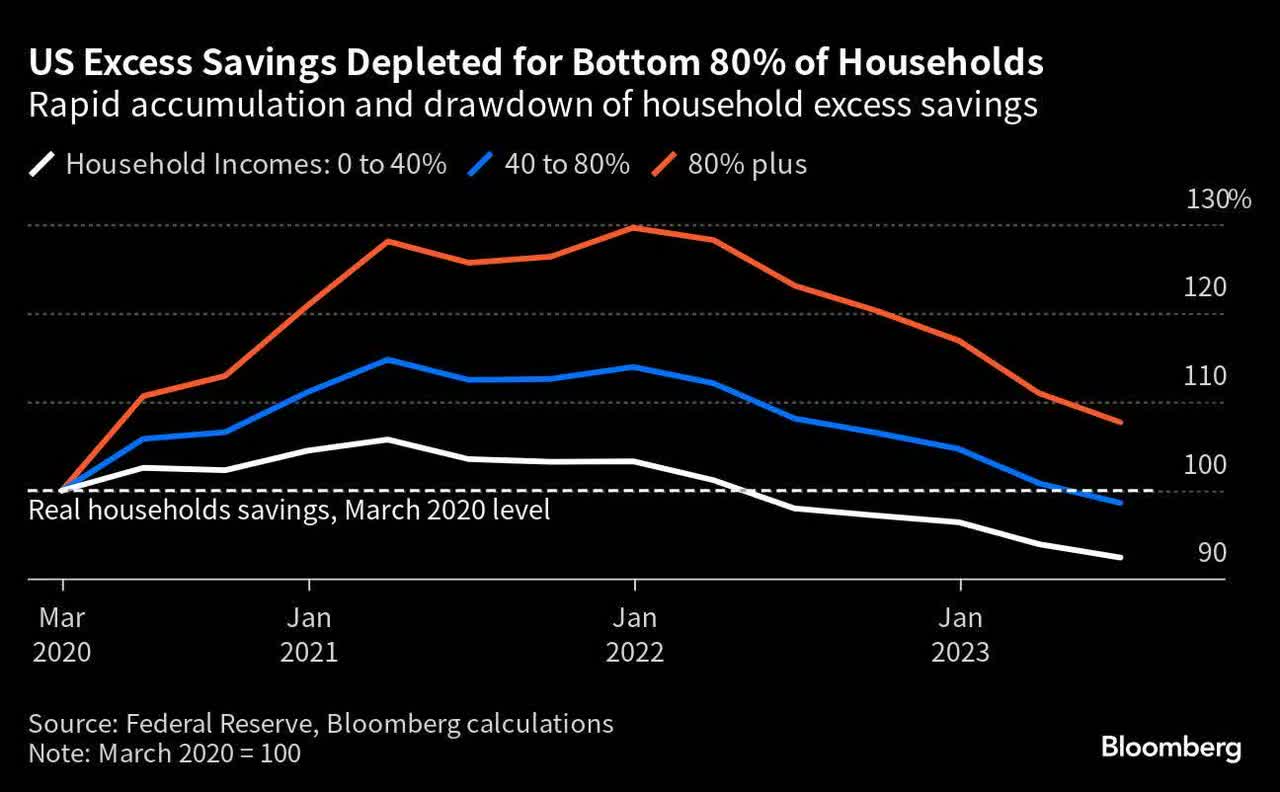

In general, consumer staples are in a tough place. Inflation is rising again, putting tremendous pressure on the consumer, especially in light of quickly deteriorating savings.

The bottom 80% of households have completely depleted their pandemic savings.

Bloomberg

When adding that inflation is rising again, we’re dealing with a very delicate situation.

Most consumer staples had pricing power when the pandemic started. However, two years after the start of higher inflation, the situation has changed.

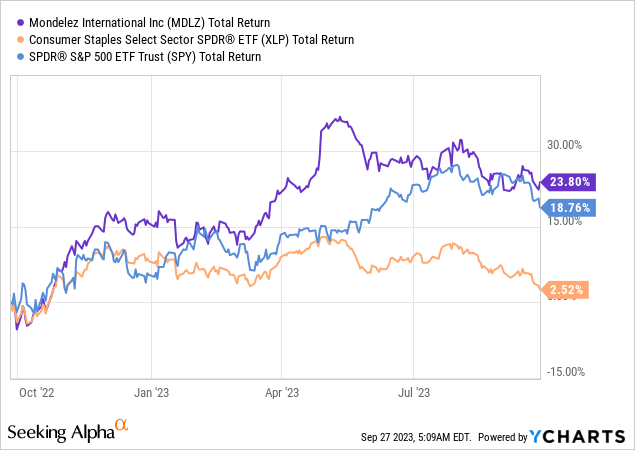

Over the past 12 months, the Consumer Staples ETF (XLP) has returned just 2.5%, including dividends. The S&P 500 has returned 19% during this period.

Then there’s Mondelez International. The company has outperformed even the S&P 500, which benefited tremendously from its elevated tech exposure over the past two quarters.

Mondelez is doing everything right.

As we’ll discuss in this article, the company is focusing on the right products, promoting its best sellers, expanding into strong markets, and improving its margins.

In the second quarter, the company saw massive price hikes. However, its volumes didn’t suffer, which in itself is impressive. The company hiked its guidance and remained upbeat about its future despite a number of headwinds, including inflation and geopolitical risks.

So, in this article, we’ll discuss all of this and assess the risk/reward of buying what may very well be the best (or one of the best) consumer staples on the market right now.

Mondelez is Firing On All Cylinders

Let’s start this article by taking a look back at the company’s earnings in the first two quarters of this year, which revealed a lot about the company’s strengths.

In the first half of 2023, MDLZ achieved impressive financial results.

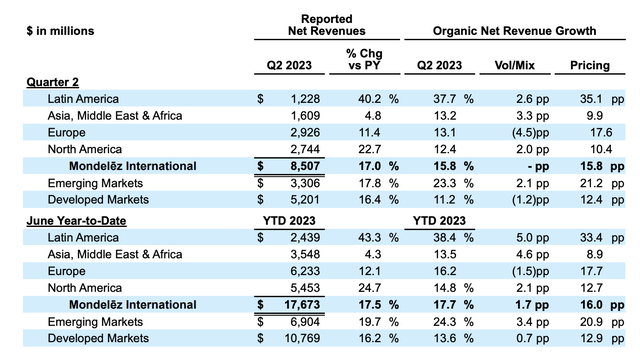

Looking at the table below, we see that emerging markets saw 23.3% organic revenue growth. Developed nations saw 11.2% organic growth.

Mondelez International

Furthermore, what really impressed me is that the company’s pricing did not lead to lower volumes. Total pricing was up 15.8%, which is a number we don’t see in periods without elevated inflation.

Total volumes were unchanged, which shows the company’s strong pricing power. Almost every single consumer staple company is struggling with declining volumes, as higher pricing is pushing consumers to generic brands and toward less consumption.

In developed markets, the company saw a 1.2 points decline in volumes, more than offset by 2.1 points growth in emerging markets – despite 21.2% higher prices!

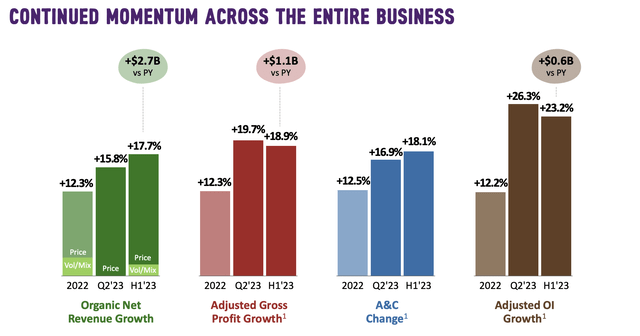

Adjusted gross profit dollar growth exceeded $1 billion, which is an 18.9% increase compared to the previous year. This exceptional financial performance was attributed to the company’s strong focus on cost management and its ability to adjust pricing to counteract inflationary pressures.

Mondelez International

The company’s success is based on a number of factors.

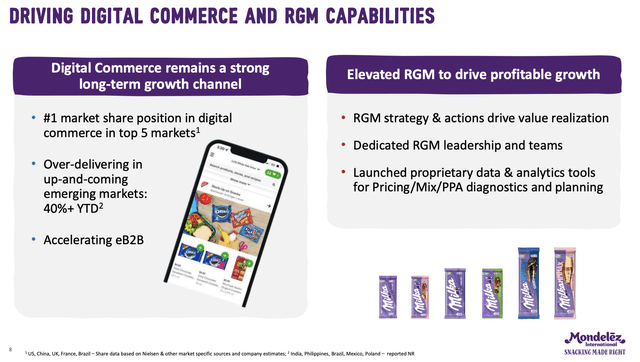

During its 2Q23 earnings call, the company emphasized its investments in digital commerce and revenue growth management tools to support brands and enhance partnerships with customers.

Mondelez International

They stated that they achieved the number one market share position in digital commerce in their top five markets – the United States, China, the United Kingdom, France, and Brazil.

Additionally, emerging markets like India, the Philippines, Brazil, Mexico, and Poland showed a 40% year-to-date growth.

Mondelez International

In order to maintain strong momentum, the focus is on accelerating eB2B capabilities to expand distribution and fortify partnerships with key customers.

The company also expressed confidence in the resilience of consumer consumption, brand reinvestments, and the completion of pricing strategies, which is something most competitors are likely jealous of.

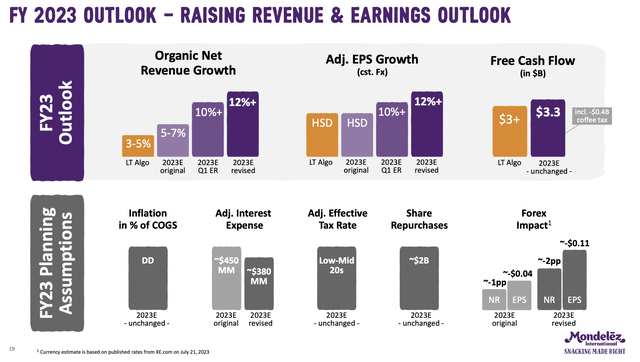

Also, based on the robust first-half performance and a positive outlook across businesses, MDLZ raised its expectations for the year. The company now anticipates a top-line growth of at least 12%, a substantial increase from their original outlook of 5% to 7%, and even surpassing the most recent outlook of more than 10% growth.

Mondelez International

According to the company (emphasis added):

The outlook revision reflects our increased confidence in the year. Ongoing resilience of consumer consumption in our categories, relatively benign elasticities, continued brand reinvestments, and completion of pricing in Europe as well as health of our emerging markets. This current outlook does not consider a material deterioration of geopolitical environment surrounding some areas of our business. – MDLZ 2Q23 Earnings Call

In other words, the company has the right products, catering to strong markets that allow it to hike prices when it matters most.

This was reiterated at this month’s annual Barclays Global Consumer Staples Conference, where the company emphasized the strength of consumer consumption in their key categories, which include chocolate and biscuits/baked snacks.

Despite challenges, the sentiment among consumers appeared optimistic, with Europe, the U.S., and emerging markets all showing positive attitudes.

Promotional pressure and private-label market share changes are minimal, with private labels accounting for about 10% in the biscuits segment and a 0.2% increase in the 5% share of private-label chocolate.

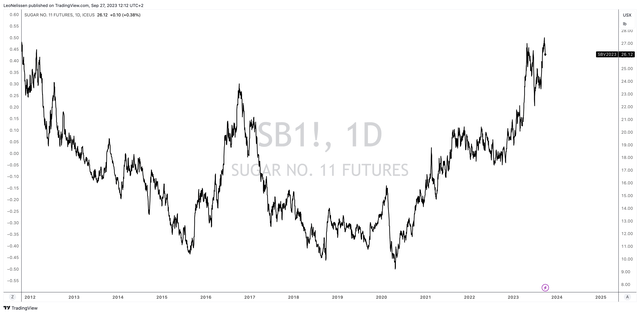

The company also commented on inflation. Sugar inflation, for example, is an issue as prices have skyrocketed.

TradingView (SB11 ICE Sugar Futures)

While cost increases have been significant, Mondelez has hedged effectively, securing favorable prices for most commodities through 2023.

The company intends to adjust pricing in a way that minimizes the impact on consumers and retailers, with a focus on pricing at replacement cost.

Special attention will be given to protecting price points in emerging markets, where low-priced products play a crucial role in attracting consumers.

Also, with regard to my emerging market comments, the company highlighted the success of Mondelez in emerging markets during the conference, which is driven by improved distribution, localized advertising, and popular brands like Oreo.

The company continues to expand into third-tier cities in China and has made strategic acquisitions, like Ricolino in Mexico, to improve its market share.

Mondelez aims to double the number of stores in China and continuously add new SKUs to extend its product offerings.

Google News

Speaking of expanding and Oreo, the company’s Oreo brand has a 10% market share in the U.S. Now, the company aims to replicate this success worldwide.

Through innovations, licensing, and strategic partnerships like Oreo merchandise in ice cream, Mondelez aims to establish Oreo as a dominant global brand. In 2022, Oreo generated $4 billion in revenue, and it’s projected to reach $5 billion next year.

With regard to external growth, the company is committed to preserving its capital structure while pursuing growth opportunities. Mondelez believes that acquisitions are the way forward and is actively looking at potential takeovers globally.

However, the company aims to stay nimble and avoid overextending in regions where acquisitions are already underway, such as Mexico and the U.S.

Mondelez’s priority is organic growth, and any potential acquisitions will be evaluated carefully to optimize the balance sheet.

Speaking of balance sheet health, the company is expected to maintain roughly $19.5 billion in net debt, which translates to roughly 2.8x EBITDA.

MDLZ has an investment-grade BBB credit rating.

This brings me to the next part of this article.

Impressive Total Return & Shareholder Distributions

Because of strong organic growth, a healthy balance sheet, and the belief that its successful strategy will continue to bear fruit in the future, the company has a terrific track record when it comes to rewarding shareholders.

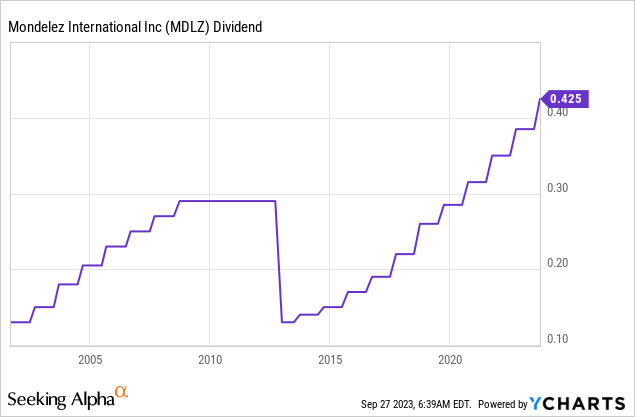

We also announced today an increase in our dividends of plus 10%, marking a double-digit increase in eight of the last nine years of the history of Mondelez. – MDLZ 2Q23 Earnings Call

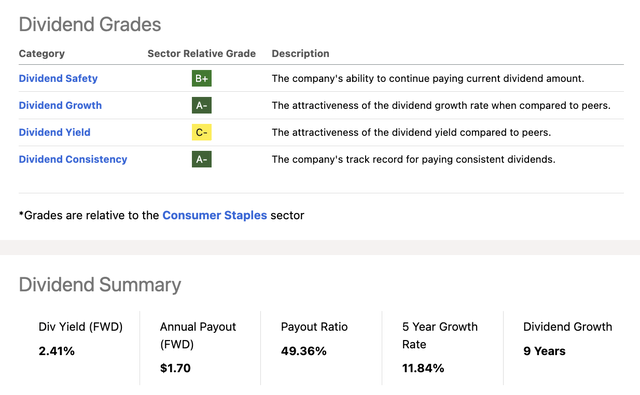

MDLZ currently pays $0.425 per share per quarter. This translates to a yield of 2.4%. This yield is below the sector median of 2.7%. It’s the only reason why the company’s dividend scorecard has one bad grade, which I think we can ignore – unless investors depend on high income from their investments.

Seeking Alpha

All other grades are great. The company has a healthy sub-50% payout ratio of less than 50% and a five-year average annual dividend growth rate of 11.8%.

During the Great Financial Crisis, the company kept its dividend unchanged.

It did not cut its dividend in 2012. Back then, it spun off the Kraft Foods Group.

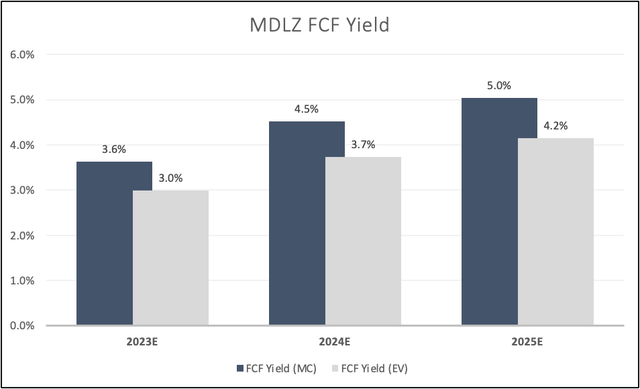

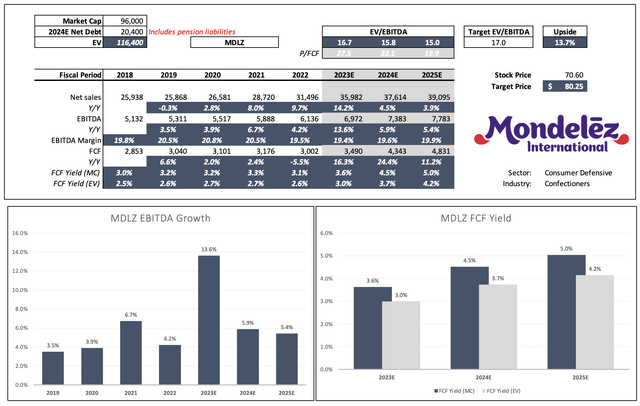

Looking at the chart below, we see that analysts expect the company to end up with a 4.5% free cash flow yield in 2024. This is based on its current market cap.

This number implies a 53% cash dividend payout. After 2024, free cash flow growth is expected to remain in double-digit territory, indicating a potential continuation of long-term double-digit dividend growth.

Leo Nelissen (Based on analyst estimates)

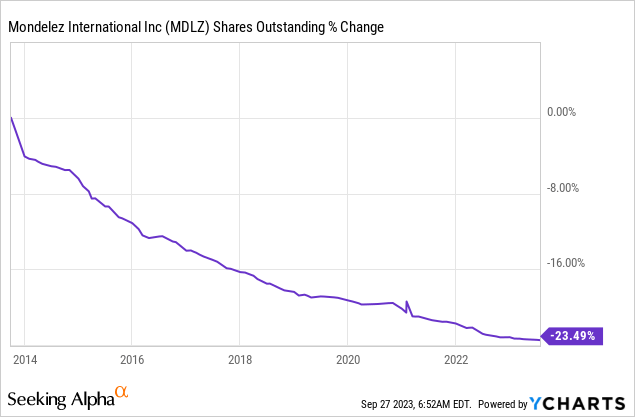

The company has also consistently bought back stock. Over the past ten years, the company has bought back 24% of its stock.

Thanks to consistent growth, a healthy balance sheet, and very attractive shareholder distributions, MDLZ shares have returned close to 170% over the past ten years, beating the aforementioned XLP ETF by a significant margin.

It failed to beat the S&P 500 during this period, which is mainly a result of the post-pandemic strength in tech stocks.

So, what about the valuation?

Valuation

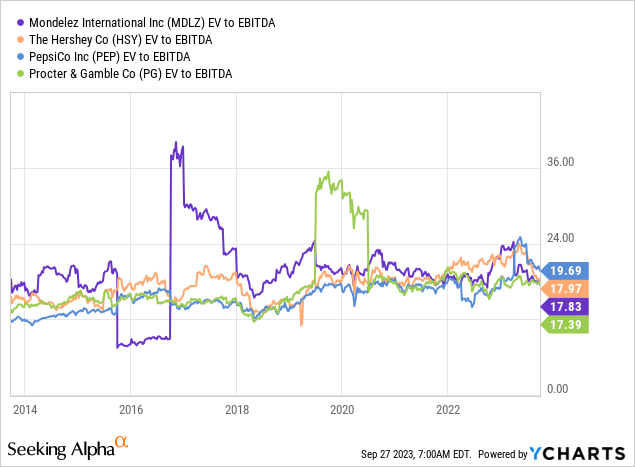

Historically speaking, MDLZ shares have traded close to 17-18x EBITDA, which is in line with what I like to call the gang of greatness of consumer staples, which includes PepsiCo (PEP), The Hershey Company (HSY), and Procter & Gamble (PG).

All of these companies have one thing in common: great brands with strong pricing power.

Using a 17x multiple, I get a fair value of $80 per share, which is 14% above the current price. This is based on $7.8 billion in expected 2025E EBITDA. Analysts expect annual EBITDA growth to remain in the mid-single-digit range, which I believe is a fair assumption.

Leo Nelissen (Based on analyst estimates)

The current consensus price target is $83, slightly above my target.

In other words, a lot has been priced in already, which is why I started this article by showing the company’s stellar performance.

So, here’s how I would deal with MDLZ if I were looking for more consumer staples exposure.

- I would put MDLZ on my watchlist to wait for a 5% to 10% pullback. This may happen if inflation remains sticky and investors start to become more fearful of what could be an ugly mix of weaker economic growth and sticky inflation (elevated rates).

- Buying MDLZ at current prices. However, I would do it gradually. If the stock drops, investors can average down (get a better valuation and higher yield). If the stock takes off, investors have a foot in the door.

Regardless of my medium-term expectations, the company is in a great spot to keep outperforming its peers, as I believe that MDLZ is one of the best defensive stocks on the market.

Takeaway

Mondelez stands out as a top-tier consumer staple stock, showing a strong performance and resilience in the face of economic challenges.

With a solid 2.4% dividend yield, impressive revenue growth, and strategic market expansion, MDLZ outperforms its peers and the S&P 500 despite rising inflation.

The company’s ability to maintain pricing power without compromising volumes is noteworthy, while leveraging digital commerce and strategic partnerships, especially in emerging markets, has propelled MDLZ’s growth.

The company’s commitment to preserving a healthy balance sheet, rewarding shareholders, and pursuing organic growth paves the way for long-term gains.

I expect the stock to remain an outperformer in its sector and a great source for accelerating shareholder distributions.

Read the full article here