Greif, Incorporated (NYSE:GEF) produces industrial packaging and is based in Ohio. The company operates in three reportable business segments: Global Industrial Packaging, Paper Packaging and Services, and Land Management. Its products include steel and fiber drums, package lids, boxes and tubes and cores. Greif operates in 37 countries to reach local markets and has factories in 22 of those, including the US (31), China (8), Russia (9), Brazil (8). Its primary customers are chemical companies, paint manufacturers, food and beverage manufacturers, and pharmaceuticals businesses. This is a mid-cap company with a capitalization of $3.1 billion that has been in existence since 1926. It has a Beta of 1.01, so Greif’s shares generally move with the market over the long term. However, the stock has a lot of short-term volatility in its performance, as the company is generally sensitive to recession and changes in interest rates.

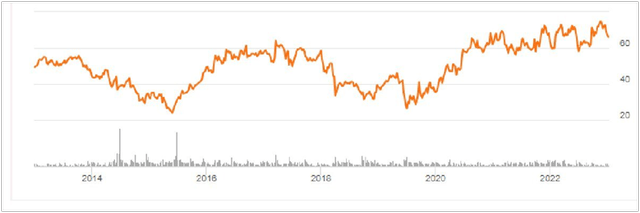

GEF Price History (Seeking Alpha charting)

Greif shares reached an all-time high of $74.90 in July 2023. They are currently down 11.3% to $66.47. However in March of this year, they were as low as $58.00. As discussed in the 2022 Annual Report, the company has two classes of common stock, the familiar Class A shares (GEF) and the less traded Class B shares (NYSE:GEF.B), both listed on the NYSE. Greif’s fiscal year ends on October 31.

2022 Was Another Strong Year

Greif generated record sales of $6.35 billion in 2022, up 14.4% from $5.55 billion in 2021 and up 40.8% from $4.51 billion in 2020. The increase in 2022 was primarily due to higher volumes and higher sale prices across the reportable segments. There was record consumer demand in 2021 and 2022, due to stimulus payments, and inflation-boosted selling prices. Currently about 60.0% of the company’s revenue comes from the Global Industrial Packaging division (GIP), another 39.0% from Paper Packaging and Services (PPS) and 1.0% or less from Land Management. Land Management has about 244,000 acres of timberland in the southeastern US that it manages and occasionally harvests. Despite the strong earnings in 2022, Global Industrial Packaging experienced slowing demand toward the end of the year, mostly from headwinds in the economies of Europe, the Middle East and Africa. Paper Packaging and Services had favorable price increases for the whole year, which offset inflation in its materials costs.

The Class A earnings per share were $6.36 in 2022, $6.57 in 2021 and $1.83 in 2020. According to its annual report, the Company applies the ”two-class method” of computing earnings per share, so earnings are allocated in the same fashion as dividends would be distributed. Under the Company’s certificate of incorporation, this results in a 40% to 60% split to Class A and B shareholders, respectively. Earnings per share for the Class B were $9.53 in 2022, $9.84 in 2021, and $2.74 in 2020. Despite two years of strong results, Greif is in an industry that is highly dependent on the performance of the economies where it is located, so earnings are volatile, varying from year to year, as you can be below:

Variation in Earnings Per Shares (Author sourced)

2023 Will Be Slower, Guidance Lowered

According to the Q3 2023 Earnings Transcript, per Larry Hilsheimer, Chief Financial Officer “…while we may not be in a broad economic recession, global manufacturing PMIs remained below 50 for the 11th month in a row, and year-to-date volumes across Global Industrial Packaging and Paper Packaging and Services are both tracking down mid to high teens year-to-date…If that’s not indicative of an industrial recession, then I’m not sure what is… volumes (generally) were more or less 15% lower…Our customers are telling us that it’s not getting worse, but they’re also telling us that they don’t expect any improvements over the next two quarters.”

Because of the slowing economies in Greif’s primary markets, 2023 earnings have been revised below those of 2022. For the fiscal year ending Oct 2023, the Consensus EPS is $5.90 per A Share, with a range of $5.81 to $6.05. For B Shares, this would equal a range of $8.72 to $9.08.

In the third quarter 2023, across the company, sales were down 17.9% from $1.62 billion in 2022 to $1.33 billion in 2023. Gross profit was down 11.5% from $346.9 million in Q3 2022 to $307.0 million in Q3 2023. Earnings per share for the third quarter dropped from $2.35 in 2022 to $1.75 in 2023. The slowdown was felt across both segments.

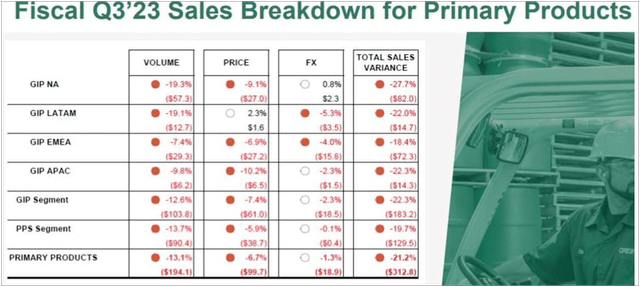

In Global Industrial Packaging, volumes remained at a low level throughout the quarter, trending slightly down from the second quarter. The Asia Pacific markets did not see any improvement from government stimulus actions there, and Latin America and North America had weak demand. There were some margin improvements in Q3, the result of consistent cost management. In Paper Packaging & Services gross profit declined 23.1% as reported in the Q3 2023 Presentation. Demand remained soft across most important paper end markets but was partially offset by an increase in construction markets. An analysis of third quarter results by division and region is presented below:

Third Quarter Performance by Segment (Q3 2023 Investor Presentation)

Inflation and Supply Issues

The pandemic had varying impacts on the company, including volatility in demand for its products, changes to business operations, and disruptions to customers. The Russian invasion of Ukraine was also a problem. Greif continues to operate nine facilities in Russia, but these plants serve locals, making up only 3% of operating profit. In late 2022, North American demand began to slow. Supply chain disruptions and inflation were an issue throughout 2021 and 2022 as raw materials Greif uses increased in price. So far the company has been able to pass on rising costs to its customers, and 2021 and 2022 were two of its best years despite the headwinds.

Steel, resin and containerboard, as well as used industrial packaging, are the principal raw materials for the Global Industrial segment. Pulpwood, old corrugated containers, and recycled coated and uncoated paperboard are the principal raw materials for the Paper Packaging & Services segment. Greif satisfies the need for these materials through purchases on the open market or long-term supply agreements. The company expects prices for steel to decline slightly next year, and prices for resin and old corrugated containers to remain stable. However, the costs of labor and, in particular, energy are expected to increase as oil prices have risen substantially since July.

Long-Term Debt

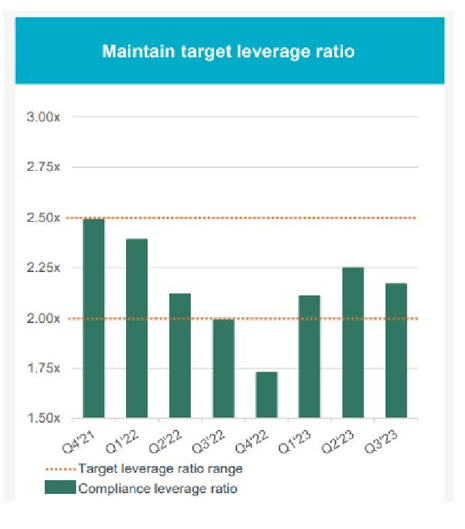

This industry is capital intensive, but Greif is trying to reduce its debt. This is a wise move in a rising interest rate environment. Long term debt was equal to 33.5% of total assets in 2022, down from 35.0% of total assets in 2021, and 42.0% in 2020. Debt can make the earnings per share vary considerably and interest costs – about one-third of net income in many years – dropped to $61.2 million in 2022 (15.5% of net income), down from $92.7 million in 2021 (22.4.0% of net income), from $115.8 million in 2019 (93.2%). The company is trying to significantly de-lever its balance sheet and achieved a lower leverage ratio (defined here as net debt/EBITDA) last year of 1.60x at the end of 2022, down from 2.49x in 2021, compared to 3.66x in 2020. It is currently 2.17x. Greif’s targeted leverage range is 2.0x – 2.5x. It paid off $189.4 million in long-term debt in 2022, using proceeds from the sale of its Flexible Products division. The company also undertook overall cost cutting measures, which led to five plant closings, and a total of 177 employee severances with reduced pension liabilities.

GEF Current leverage Ratio (Q3 2023 Investor Presentation)

Growth through Acquisitions

Packaging is a competitive industry and Greif frequently grows through targeted acquisitions. In early 2019, Greif acquired Caraustar Industries from private equity firm HIG Capital for $1.8 billion. Caraustar is a leader in manufacturing high-quality paper products that include tubes and cores, located in Austell, Georgia. In 2020, Greif’s net sales increased $136.9 million, primarily due to a full year contribution from Caraustar.

In late 2022, Greif acquired Lee Container for $300 million. Lee is, as described in the Fourth Quarter 2022 Investor Presentation, is a manufacturer of high-performance molded containers, mostly serving customers in agriculture, specialty chemicals (where it is the North American leader), and pet care. Lee provided Greif with the immediate production of small plastic bottles. This is expected to increase Greif’s sales dollar for dollar by $162 million in 2023.

In the recent Q3 2023 Investor Presentation the company announced a new joint-venture taking 51% ownership in ColePak Inc., a leader in the niche North American partitions market (cardboard that separates items in boxes). ColePak produces specialty partitions for the food and beverage industries. This will bring in another $20 million per year.

On April 1 of 2022, Greif sold its 50% interest in its Flexible Products & Services to Gulf Refined Packaging, of Vernon, California. The company held this stake for 11 years and the division made bags and flexible packaging. The sale netted the Greif roughly $123 million in proceeds, which it used to pay down debt.

Packaging is a Competitive, Cyclical Industry

The markets in which Greif sells its products are competitive and there are many manufacturers. No single company dominates the global industrial packaging business, and Greif competes with companies such as International Paper (IP), Crown Holdings (CCK), Graphic Packaging (GPK), Packaging Corporation of America (PKG), TriMas Corporation (TRS), Sealed Air (SEE), as well as Berry Global (BERY), Nefab Group and Schutz. Per Greif’s management they “are particularly sensitive to price fluctuations caused by shifts in industry capacity and other cyclical industry conditions…and raw materials are purchased in highly competitive, price-sensitive markets, which have historically exhibited price, demand and supply cyclicality.” Thus you have the wide variety in earnings per share of $2.89 in 2019, $1.83 in 2020, and $6.57 in 2021 and $6.36 in 2022 for the Class A shares.

The Dividend

The Company has two classes of common stock, Class A (GEF) and Class B (GEF.B). Both are listed on the NYSE. Under the Company’s articles of incorporation, a distribution of dividends must be in the ratio of $0.01 a share for Class A Common Stock to $0.015 cents a share for Class B Common Stock. Many B shares are owned by descendants of the founding families, and these are the only voting shares, effectively controlling the firm. The average volume of A shares traded per day is 124,000; B shares average volume is about 16,000, so less than 13.0% of the A volume. The shareholder rights are slightly different. In the event of dissolution: dividends will be paid equally to both holders, but A Class dividends must be paid first. Thereafter proceeds of a sale are divided equally among all the holders.

Greif recently announced a 4.0% increase in the quarterly dividend, now at $0.52 (up from $0.50) and $0.78 (up from $0.75) for Class A and B shares, respectively. The current yield on Class A shares is 3.13% with a price of $66.38 (the 52 week high was $72.00). Current yield on Class B is 4.64%, with a share price of $66.96. The company has paid quarterly dividends on the A Shares since 1996 and they have increased from $0.04 to $0.52, an annual compound growth rate of 10.0%. However, the company does not raise its dividend every year, and it was stuck at $0.44 per quarter from 2018 to the first part of 2021, when it was raised to $0.46. The B Shares have been listed on the market since 2003 and began with a dividend of $0.10 per quarter. The dividend is now $0.78, for a compound annual growth rate of 10.8%. Here, also, increases have not been consistent by year.

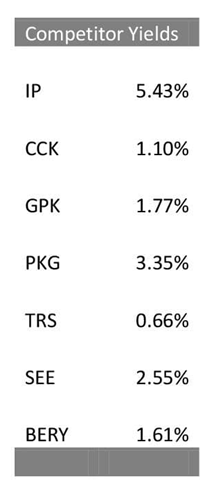

In 2022, total dividends paid to stockholders and non-controlling interests of Greif, Inc. were in the amount of $128.5 million (a 32.6% payout ratio), $113.6 million in 2021 (a 27.5% payout ratio) and $117.7 million in 2020 (a 95.7% payout ratio). Below are the dividend yields of some of Greif’s competitors.

Competitor Dividend Yields (Author generated)

Share Price Supported by Buybacks

In June 2022, the Board of Directors authorized the repurchase up to $150.0 million shares of Class A or Class B Common Stock or any combination thereof. In June 23, 2022, Greif entered into a $75.0 million accelerated share repurchase agreement with Bank of America, N.A. for the repurchase of Class A or Class B Common Stock, in open market purchases. About 80% of the expected repurchases have already occurred as 1,021,451 shares of Class A Common Stock, with the rest to be delivered in later in 2023.

Share Valuation

I estimate the current value of GEF Class A shares to be $60.92, so these shares are about 9.0% overvalued today versus the current price of $66.38. I used a discounted cash flow cash to value the company’s A shares, which involved taking the estimated EPS, beginning in 2023, then projecting forward. I used a five-year time period then capitalized the last year into a perpetuity. For the discount rate, I looked to the average annual return of the S&P 500. The long-term average is about 9.25% while over the last 10 years it has been 10.4%. In valuing this company, I think I’d take a more conservative approach, especially given the cyclical nature of the stock and expected upcoming rate hikes from the Fed. I have elected to use a discount rate of 11.0%, discounting beginning in the second year. Greif’s earnings per share vary considerably from year to year, but the overall long-term trajectory is up. Therefore I have used a very conservative growth rate of 1.0% per year.

I used a starting EPS for 2023 as $5.85, just below the average analyst consensus but within the predicted range. For calculating the reversion, I have used a rate of 10.0%. The results are presented below:

GEF Discounted Cash Flow (Author calculated)

The current PE Ratio for the A Shares is 9.98. For the B Shares it is 6.73, significantly lower, so the market is perceiving higher risk with these shares. From the 2022 annual report: “Class A Common Stock is entitled to cumulative dividends…after which Class B Common Stock is entitled to non-cumulative dividends… distribution in any year must be made in proportion of one cent a share for Class A Common Stock to one and a half cents a share for Class B Common Stock.” Noncumulative does not entitle investors to get paid any missed dividends, so in theory there’s an element of risk, even though the B Shares get dividends that are 50.0% higher. To value the B Shares I used an EPS of $8.75 for 2023, with 1.0% annual growth, a 12.0% discount rate and a 12.0% reversion rate. The results are presented below:

GEF.B Discounted Cash Flow (Author calculated)

Even with very conservative assumptions, the B Shares value at $79.45, significantly higher than the current price of $66.96. So I estimate that B Shares are about 15.0% undervalued.

Risks to Outlook

The primary risks to share valuations for Greif are further increases in interest rates by the Federal Reserve and the possibility of a true industrial recession in any of the global markets in which it operates. In fact, recent articles state that demand for cardboard boxes is declining rapidly, an industrial slowdown indicator. Demand is slowing in China in particular as well as in Asia Pacific countries. However Greif is diversified geographically and across packaging types.

Conclusion

Currently the A Shares of Greif are about 9.0% overvalued while the B Shares are 15.0% undervalued. The B Shares are clearly the better buy with a dividend of 4.61% versus 3.14% for the A Shares. And the B Shares dividend will always be 50% higher than the A, as mandated by the company organization filings. As a packaging business Greif is subject to cyclical demand and is interest rate sensitive, but for a long term investor, the B Shares represent a strong buy option, especially if we have any further downturns in the broader market. I believe investors can get a healthy yield and share price appreciation from these. I have personally owned the A Shares for many years, but I think the Class B are a better investment.

Read the full article here