The energy sector is a great spot to be looking for high-yielding companies that can deliver in the long term for investors seeking dividend income additions to a portfolio. I like this niche market and find that there are plenty of opportunities here. In today’s article, I am covering Hess Midstream LP (NYSE:HESM). The company operates in the midstream industry where it provides services to Hess Corporation which is creating reliable and sustainable FCF for the business. Over the last decade, the FCF development has been phenomenal and the company has in the last 12 months delivered the highest result ever on this front. The company is incredibly well suited to continue paying out significant dividends and buy back shares to boost the value of shareholders. I think the business is one of the best in the industry and from an investment point of view at a good price given the reliable inflows of capital it has.

Business Performance

HESM is an energy infrastructure company specializing in the ownership, operation, development, and acquisition of a wide range of midstream assets. It offers fee-based services to both Hess Corporation (HES) and external customers. HESM manages various midstream assets and operates within three distinct segments: Gathering, Processing and Storage, and Terminaling and exporting. The Gathering segment is responsible for the ownership and operation of natural gas gathering and compression systems, crude oil gathering systems, as well as produced water gathering and disposal facilities.

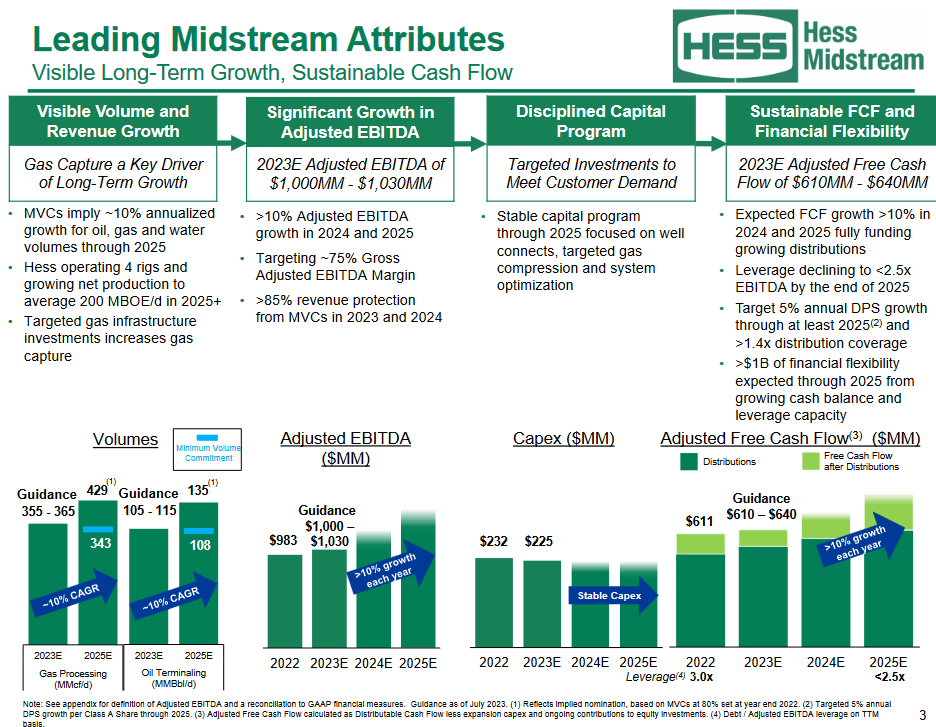

Company Overview (Investor Presentation)

Thanks to the business model that the company has it can reliably support the high dividend that it currently has and investors could, based on the dividend alone, collect a near market-beating return of 8%. The guidance the company has for the FCF seems quite strong with nearly 10% growth each year going into 2025. This will likely result in further raises to the dividend in my opinion and be a key reason for the strong ROI investors can get here. This continued move upward has also been a key factor behind the higher valuation the company is receiving right now in terms of p/e.

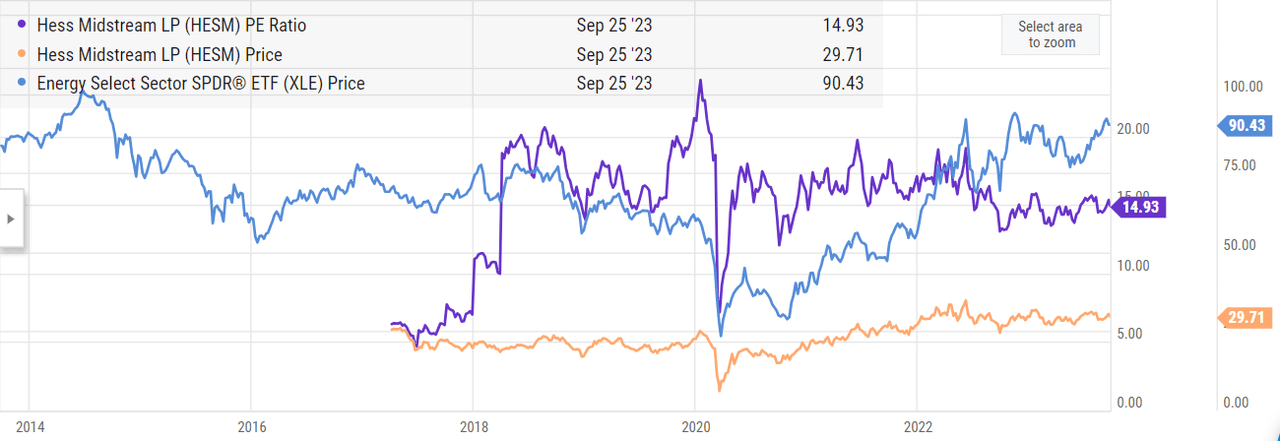

Peer Comparison (Ycharts)

In comparison to the XLE the shares of HESM have been able to significantly outperform and yield a strong return in the last couple of quarters. Besides this, the p/e of HESM has also been declining from the high of 22 it had in March 2020 when the commodities market went haywire. I think that the drawdown in valuation has made HESM very appealing and even if the price is high, the fact the company continues to improve the bottom line speaks a lot about the quality of the business and the reliable earnings potential.

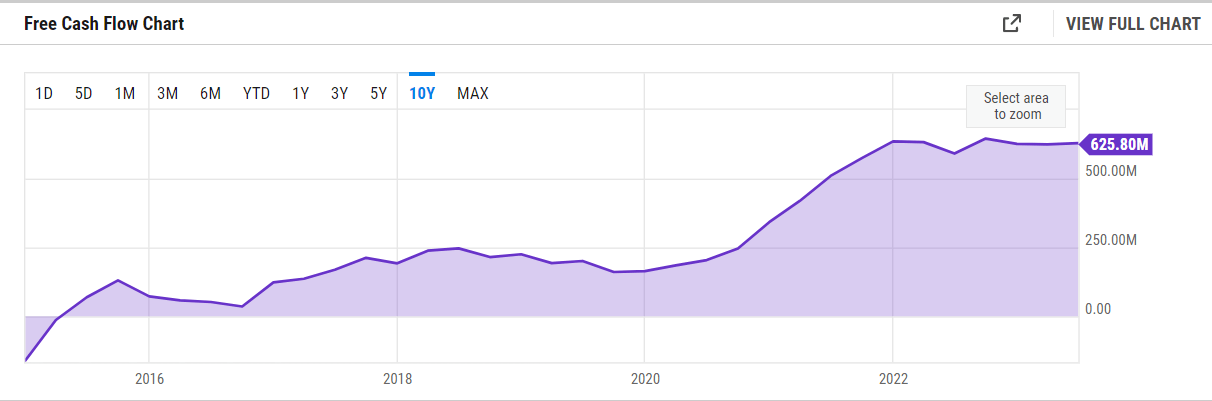

FCF Chart (Ycharts)

I mentioned before that the FCF of the company has been improving quite a lot over the last few years and the chart above I think showcases that. With $625 million in FCF, the company is more than capable of paying out just over $100 million in dividends it had last year. The projects and targets of the company are to grow the distribution per share by 5% annually over the next few years into 2025. I think that the business model they have is capable of doing this. The operation performance of HESM so far I think has been solid and the operating margins for the business have remained above the 60% line for quite a while right now, netting HESM the high amount of EBITDA they have.

Dividend Evaluation

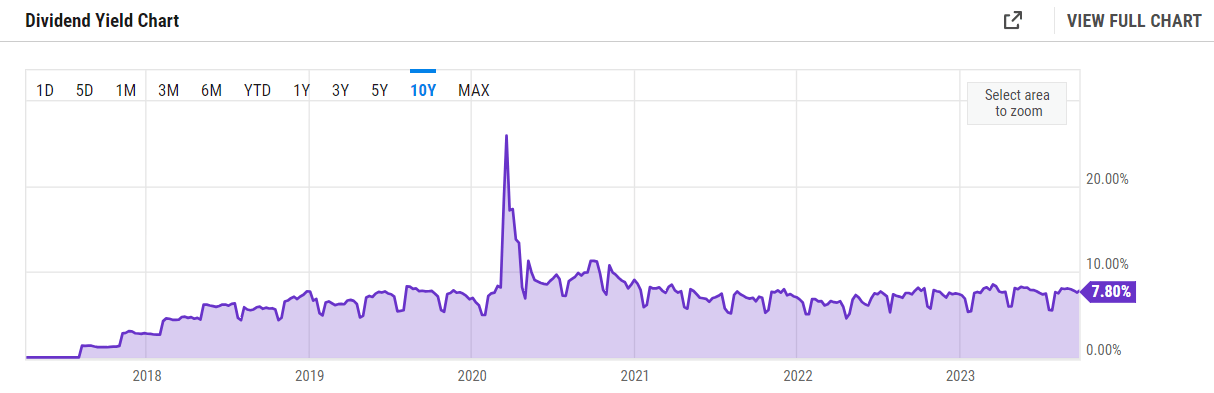

Dividend Yield (Ycharts)

The dividend yield for HESM has been quite high for a long time now and is nearing the 8% mark on an FWD-estimated basis. The improving natural gas prices are resulting in more optimistic forecasts I think.

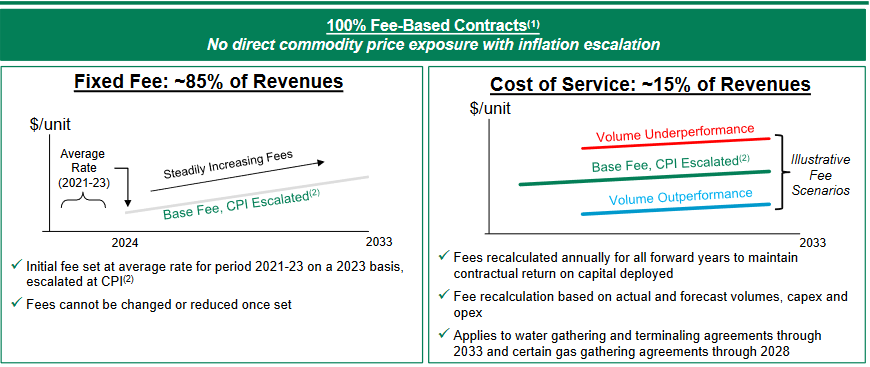

Contracts Overview (Investor Presentation)

With 100% fee-based contracts the company is in a great post as we have gone over to support the dividend. I can see a 5% annual growth rate for the next decade without HESM overleveraging or reaching above its financial capabilities. The outlook for natural gas is still quite positive as it makes up a large sum of our energy generation. This is unlikely to change drastically in the coming decade as the capital necessary to switch it out to renewable energy is quite frankly a daunting amount.

Risk/Reward

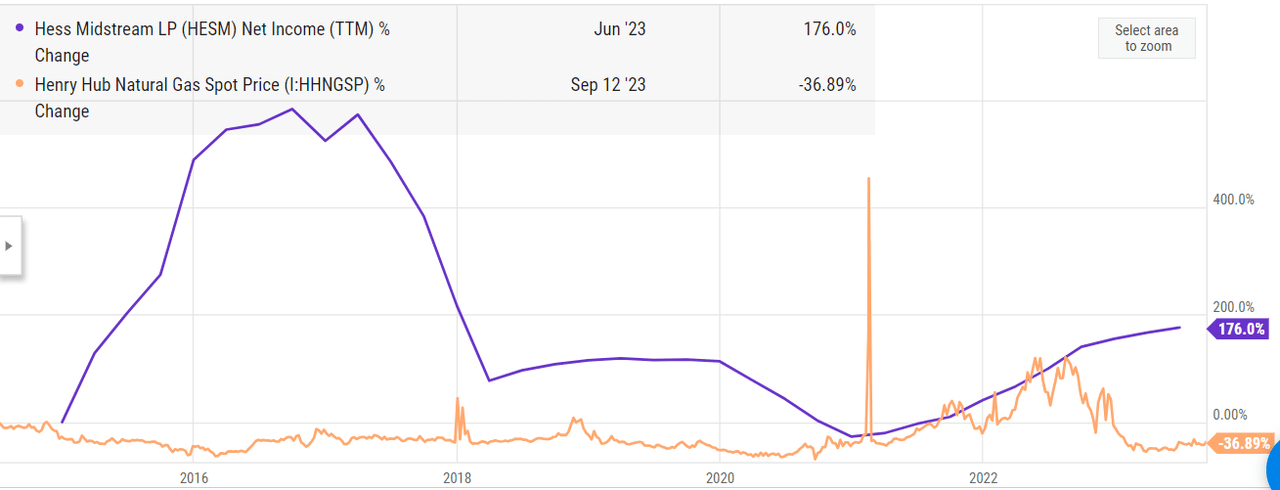

The price of oil presents a notable risk for HESM, even though its direct exposure is minimal. Although a significant portion of its assets and revenue is derived from natural gas, it’s important to note that HES also operates oil wells in the Bakken region. HESM’s natural gas revenues are linked to associated natural gas extracted during oil drilling operations. Consequently, a drop in oil prices can result in reduced drilling activity, leading to lower production volumes, which in turn can hurt the throughput of its systems. This interconnectedness with the oil market poses a potential challenge for HESM’s operations and financial performance. The company as seen below has however been quite efficient with hedging and still growing at the back of softer natural gas prices. This I think speaks volumes of the reliability the company has. The company hasn’t had a negative bottom line since late 2014, whilst a lot of other midstream companies have seen fluctuating earnings. With sustained profitability, I can see the premium the company is receiving to be justified quite frankly.

Net Incomes (Ycharts)

HESM encounters notable concentration risks due to its sole source of revenue, which comes from its affiliated entity, HES. The company heavily relies on Hess Corporation for its income. If HES were to face any operational disruptions, it could potentially result in a decline in revenue for HESM. Furthermore, the commercial agreements in place with HES contain provisions that grant HES the authority to suspend or terminate its obligations under these agreements in response to specific events or circumstances. It’s worth noting that these decisions can be made by HES, regardless of the potential adverse consequences they might have on HESM operations and financial performance. This contractual arrangement introduces a level of vulnerability to HESM business. I think that this is one of the least likely risks to the company. Volatile commodity prices for natural gas are a far riskier point to HESM I think.

Key Notes

In the midstream industry, I don’t think many companies compare themselves to HESM in terms of a reliable dividend. HESM generates its revenues on 100% fee-based contracts. This has resulted in stable FCF over time and made it possible to have a high dividend yield of over 8% on an FWD basis. I find the prospects very promising with HESM stock and will be rating it a buy. It may trade above the sector on metrics such as earnings but that is a premium worth paying when you get reliable dividend growth.

Read the full article here