The Compagnie Générale des Établissements Michelin (OTCPK:MGDDF; OTCPK:MGDDY) share might be known mainly because of the well-known lettering with the famous Michelin mascot.

The French tire manufacturer is a traditional company from Europe. The company’s history dates back to 1889. Today, the company generates most of its revenue from the sale of tires for cars, trucks, buses, motorcycles, bicycles, and aircraft, and operates globally. Michelin generates the largest share of its sales, most recently nearly €28 billion, in North America. In fiscal 2022, the company achieved sales in North America of almost €11 billion. Only then follows Europe (including France) with €10 billion.

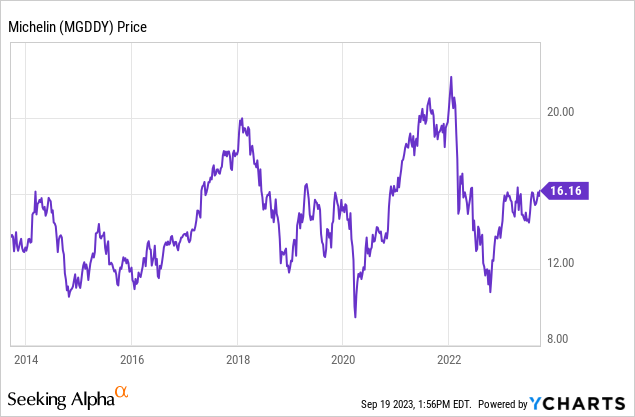

Overall, however, only lucky market timing could have brought investors substantial profit in recent years. Currently, the share is trading at just over €30, the same level as in 2017. Investors would have had to strike at the Corona low, for example, to achieve a significant return. However, the Michelin share is still almost 20% away from the interim high of €38.

Given the good operating performance in the first six months of the first half of the year, I think the price has priced in slightly more risks than opportunities. This does not make the share a buy due to the existing macroeconomic uncertainties, but it nevertheless justifies a hold rating.

Good Q1 and Q2 results

The results for the first half of the current fiscal year were quite respectable.

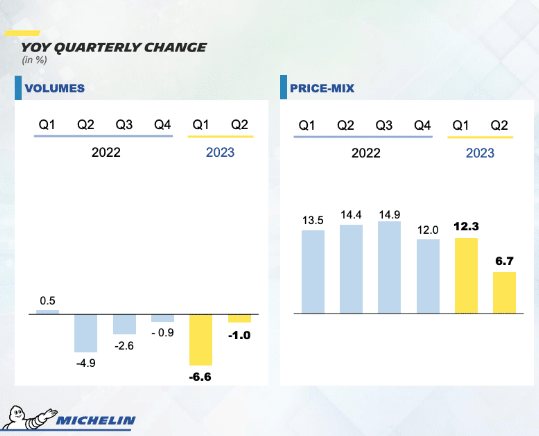

For example, sales in the first half of the year rose by 5.9 percent to 14.08 billion euros. In the process, the company benefited from price increases that more than offset volume declines. For example, volumes fell by 6.6% in Q1 and by 1% in Q2. Most recently, volumes increased by 0.5% in Q1 2022.

However, the price mix was decisive. In Q1 in particular, price increases of 12.3% offset the volume declines. In Q2, the price mix increased by 6.7%. However, price increases are declining overall. In Q1 to Q4 2022, they amounted to 13.5%, 14.4%, 14.9% and 12%, although the volume declines there were lower than in Q1 2023.

YoY quarterly change (Investor relations)

For investors, of course, a picture like Q1 2022 is most attractive: volume increases plus price increases.

Unfortunately and as shown above, Michelin is not currently in a position to offer that. But overall and based on a long-term view, Michelin has a decent sales performance considering that its business is cyclical. The company has almost doubled its sales over the last 20 years, from 15.6 billion euros in 2002 to 28.6 billion euros in 2022.

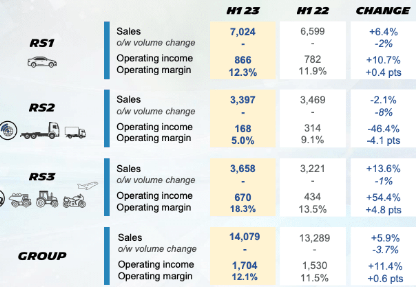

Let’s now look at profit. Here, too, the first six months in 2023 were solid. Despite the volume declines, Michelin was able to increase operating profit by more than 11 percent.

Results in the individual business units varied. The large truck, aircraft, and specialty tire businesses (RS3 segment) were particularly strong performers, with sales and profit growth of 13% and 54% respectively. By contrast, the 8% volume decline in tires for smaller trucks (RS2 segment) was somewhat disappointing. Overall, operating profit in the RS2 segment fell by 46%. The passenger car business (RS1) grew by 6.4% with a slight decline in volumes. However, operating profit here rose disproportionately by more than 10%.

Growth by segment (Investor relations)

Looking into the future

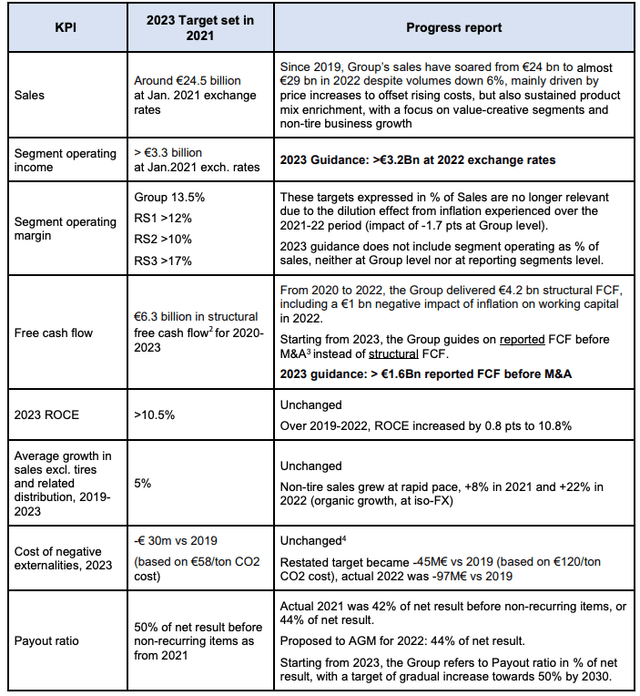

In view of the decent Q1 and Q2 figures, Michelin has also raised its forecast.

Despite a softer market scenario, Michelin’s 2023 guidance has been revised upwards, and now calls for segment operating income at constant exchange rates of more than €3.4 billion (vs. €3.2 billion previously) and free cash flow before acquisitions of more than €2.0 billion (vs. €1.6 billion previously).

In addition, Michelin has raised its cost inflation forecast from minus €0.4 billion to €0.9 billion to €0.2 billion.

With sales growth of 5.9% in Q1 and Q2 to date, Michelin is fully on track to achieve the sales growth targets it has set in 2021. And with the raised guidance, Michelin can also meet its operating income target of more than €3.2 billion. It is a bit of a shame that the company has changed its free cash flow reporting to show only FCF before M&A instead of structural FCF. I would have liked to have a better comparability here. Just for the sake of completeness: Michelin explains the terms Structural FCF and FCF before M&A. Structural FCF until 2023 meant free cash flow before acquisitions, adjusted for the impact of changes in raw material prices on trade payables, trade receivables, and inventories. Conversely, Michelin summarizes FCF before M&A as )net cash from operating activities less net cash used in investing activities, adjusted for net cash flows relating to cash management financial assets and borrowing collaterals.

KPI and targets (Michelin investor relations)

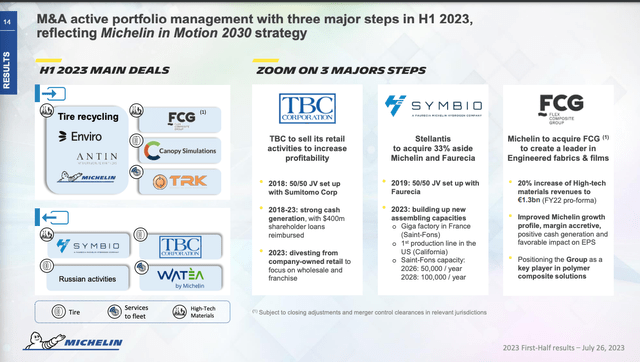

Overall, Michelin has strong brands and a solid M&A track record over the last five years. M&A activities include RoadBotics, Canopy Simulations, and the Flex Composite Group. Michelin has also divested parts of its business, for example, the retail activities of TBC corporation, a 50/50 JV with Sumitomo Corp. With these activities, Michelin intends to strengthen its business units Tire, Services to fleet, and high-tech materials.

M&A activities H1 (Investor relations)

The dividend is safe and the stock is still undervalued

However, investors should keep in mind that Michelin’s business is cyclical and management does not shy away from cutting the dividend in difficult economic times. In the Corona year, for example, Michelin cut its dividend from €0.93 per share to €0.50. But part of the truth is that Michelin is quick to raise its payouts again. For example, the dividend in 2022 was €1.13, well above 2019 again, and in 2023 the dividend was even €1.25 per share.

Overall, long-term dividend growth and management commitment to payouts is solid. Since 2001, dividends per share have increased from €0.20 in 2001 to €1.25 most recently, and payout ratios are more than secure as measured by this year’s dividend at 38% of earnings and 53% of free cash flow. According to the dividend policy, Michelin aims to gradually increase the payout ratio to 50% of profit. Thus, even with stagnating profits, an increase in the annual payout should be possible, barring a more severe economic downturn. With a current dividend yield of 4.2% and this positive outlook for increases, dividend investors are therefore getting their money’s worth.

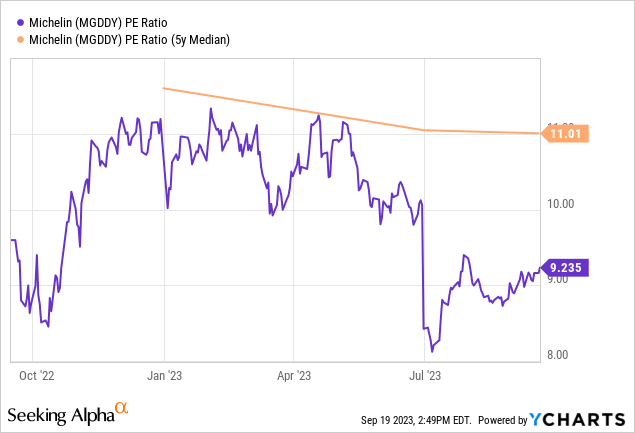

Michelin is also currently still quite favorably valued. With an adjusted P/E ratio of 9.2, the share is significantly below the 5-year median of 11. Given the current macroeconomic environment, there are good reasons for Michelin’s fairer value to be rather below the 5Y median. After all, a multiple of 10 would be almost a 10% discount to the 5Y median. With such a multiple, I would also rate Michelin’s stock as fair. This would indicate an upside potential of between 5% and 10%.

The opportunities with an investment, therefore, lie in the realization of price gains and the collection of a juicy dividend with a total short- and mid-term return of up to 14-15%. That’s nice, but there’s also a scenario with economic deterioration and volume declines becoming entrenched. Michelin’s past share price performance has shown that it is always a good idea to buy such a cyclical company when there is blood on the streets. Such a situation does not currently exist, which conversely also means that the share may still have downside potential.

Conclusion

Michelin has a strong market position and well-known brands. The share is currently tempting with a dividend yield of over 4% and a fundamental undervaluation. However, the business is also cyclical. The expectation of associated declines in sales and profits may put pressure on the share price. Currently, it looks as if Michelin will close the fiscal year successfully. The fears weighing on the share price may therefore be exaggerated in view of the solid performance. Conversely, the volume declines show that macroeconomic conditions are not optimal and Michelin will not be able to absorb these forever with price increases. For such a cyclical company as Michelin, this risk/return ratio does not suffice for a buy rating. From my point of view, Michelin is thus a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here