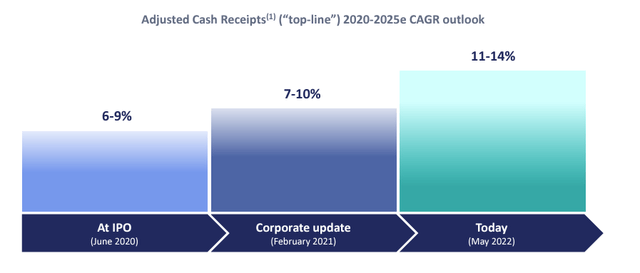

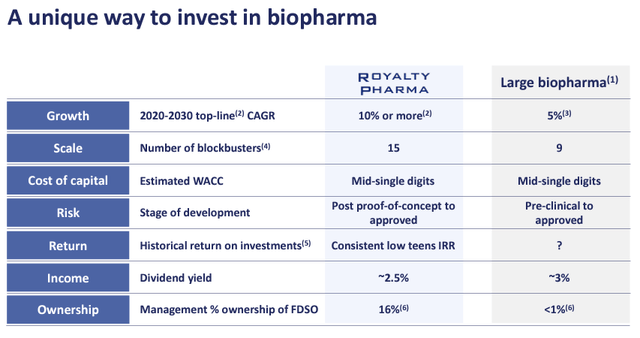

Within our Pharma universe coverage, today we decided to initiate Royalty Pharma plc (NASDAQ:RPRX). Here at the Lab, the company offers a unique business model with a diversified royalties portfolio based on biopharmaceutical therapies. Indeed, the company is the world’s largest buyer of pharma royalties (based on market share). Royalty Pharma was incorporated in 1996 and has collaborated with global pharmaceutical companies, Academic institutions (research hospitals), Small/Mid-cap Biotechnology players, and non-profit organizations. What is critical to highlight is that Royalty Pharma was listed in June 2020 with a stock price of $28.00 per share. As reported, the size of the IPO was increased from the previously announced 70,000,000 to 89,333,920 Class A ordinary shares. YTD, RPRX has sold off 32.67% despite a solid execution, no change in business fundamentals, and progressive capital deployment to further diversify its top-line sales. Before moving on with our upside, we start with a comment on RP’s negative highlights and our supportive forward-thinking estimates:

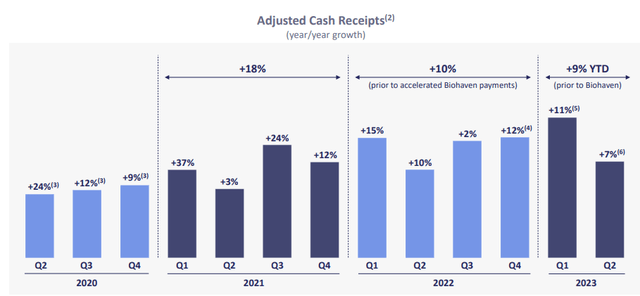

- Royalty Pharma’s revenue growth is decreasing. In detail (Fig 1), we see how RP-adjusted cash receipts grew by 18%, 10%, and 9% in 2021, 2022, and 2023 respectively (Fig 1). However, this year, the company has already announced transactions for more than $1.7 billion;

- Inflation expectations and ‘higher-for-longer‘ interest rates erode Royalty Pharma’s royalties net present value and negatively impact the business.

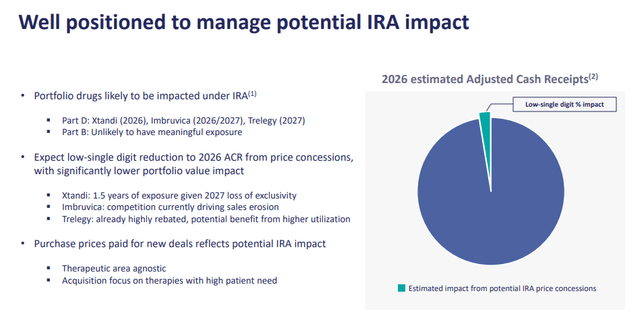

- IRA impact might cause generalists to deploy funds from Pharmaceutical corporations. However, according to the company’s latest news, RP anticipates a low-single-digit reduction in adjusted cash receipts (Fig 2);

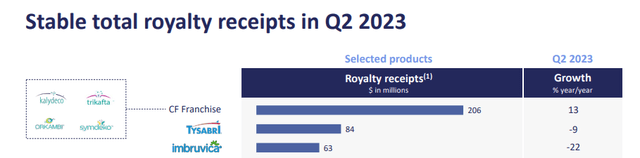

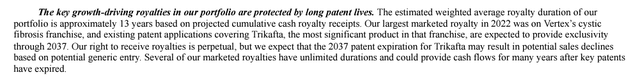

- Looking at the recent Q2 results, the Vertex franchise is one of the most significant RP contributors. This cystic fibrosis franchise is based on four therapies and accounts for 33% of RP’s adjusted cash receipts (Fig 3). In 2022, the franchise generated $811 million of royalties for RP (25% of its total). This drug was approved in October 2019 and is expected to create a royalty revenue stream by 2037, when the patent expires. Despite that, Vertex is moving on with another application already in phase 3. If approved, this could significantly limit RP’s earnings. Founder and CEO Pablo Legorreta described the company’s patent position as “defensible and solid.” In numbers, according to our analysis, assuming Vertex takes 100% of the current RP’s cystic fibrosis franchise, we estimate a minus 300 million lower adjusted cash receipts and a 20% negative net present value;

- There was a negative investor sentiment on RP’s dividend yield in the past. Currently, the company is yielding in line with the Big Pharma sector at around 3%. Therefore, this investor concern is unlikely to be a significant impediment on the share’s future performance (Fig 7).

Royalty Pharma adj. cash receipts evolution

Source: Royalty Pharma Investor Presentation – Fig 1

Royalty Pharma IRA impact

Source: Royalty Pharma Q2 results presentation – Fig 2

Royalty Pharma CF impact

Fig 3

Why is Royalty Pharma a buy?

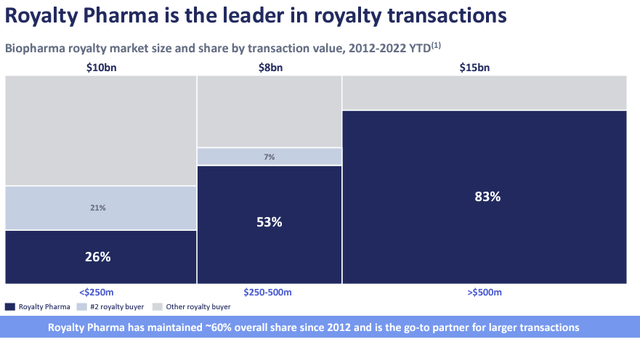

- Looking at our above points 1), we should report that the company has recently acquired two new royalties. Post Q2 results, RP announced a $150 million capped synthetic royalty funding agreement with Ascendis and a $300 million synthetic royalty on US net sales of Ferring’s Adstiladrin. This emphasizes RP’s solid momentum to accelerate sales growth further (Fig 5). With the latest royalties, RP confirmed its leadership position (Fig 4). Going to the numbers, the former agreement will likely generate an IRR of 12-15% with expected sales in the period (2025-2031) of $248 million (there is also a possibility to increase the LoE beyond 2031). At the same time, the latter transaction is structurally more complicated. $300 million is an upfront payment, with $200 million as a milestone when manufacturing goals are expected to be achieved in late 2025. Adstiladrin is a drug approved in late December 2022, and bladder cancer is the sixth most common cancer in the US. According to our analysis, since Ferring is private, we believe this drug could price in the $160-$200k range. Therefore, this might be a blockbuster therapy potential. In numbers, RP received a 5.1% royalty and will increase to 8.0% upon the second investment tranche;

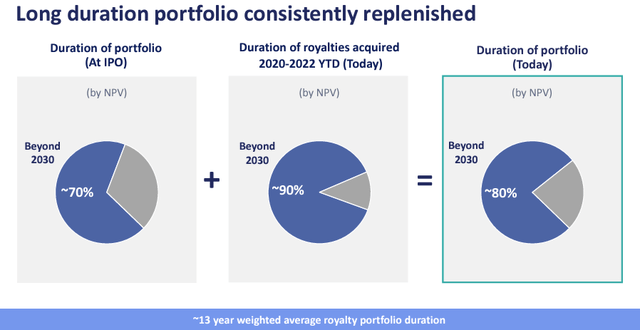

- To support our investment thesis, we should report that the company has aggressively deployed capital in quality assets (Fig 4) and also increased the royalties duration among its portfolio (Fig 6). This has a double aim of growth in the future expected adjusted cash receipts and also diversified risks;

- Looking at the company’s valuation, we believe the worst-case scenario is already well-priced in. Considering Vertex and the cystic fibrosis franchise, RP’s shares overly reflect this risk. In the meantime, there are significant opportunities to fund biopharma innovation, and we are not surprised to see that the company has already increased the guidance twice this year. In the current environment, RP might continue to deploy capital, given its lower cost of capital and cash at the bank (as of June-end, Royalty Pharma had cash of $2.2 billion);

- Aside from the dividend yield, the company announced a $1 billion share buyback in late March, also supported by the CEO “that he intends to purchase up to an additional $50 million of the company’s Class A ordinary shares.” Considering a 3% yield, RP already repurchased 6m shares in Q2, which equals approximately $186 million in value. The current buyback yield is 5% at the current market cap. Therefore, not considering a capital appreciation, RP’s return might be at around 8%.

Royalty Pharma market share

Fig 4

Royalty Pharma top-line evolution

Fig 5

Royalty Pharma Duration

Fig 6

Royalty Pharma in a Snap

Fig 7

Conclusion and Valuation

While the company’s shares lack a short-term catalyst, the valuation is increasingly compelling. With the latest guidance, RP growth is estimated between 6% and 10%, with cash receipts in the $2.9/$2.975 billion range. Even if Vertex readout might be positive, RP’s patent will expire in 2037. Therefore, a solution needs to be found; otherwise, we have no visibility on contracts. However, we believe that RP is well protected by IP rights. Despite solid fundamentals, RP’s valuation continues to struggle. This is why we initiated the company today with a buy rating target of $42 per share. Looking at the Pharma peers, 2024 EV/EBITDA is 12x, while Royalty Pharma trades at 9.02x. Applying the average peer multiple is enough to justify RP’s current valuation. This is because RP has a higher margin, higher FCF yield, less operational risk, and less risk on IRA. However, in our analysis, we decided to check other royalty companies and report that these entities usually trade at a premium compared to their respective sector. In detail, we analyzed royalties in the oil and mining sectors. In the oil and gas segment, we positively reported that Viper Energy, Black Stone Minerals, Sitio Royalties, and Granite Ridge Resource trade on a P/E average of 13.5x while major US oil corporations are trading at 10x. Therefore, there is a 30% premium in royalties valuation. Franco Nevada’s P/E is 40x in the mining sector, while Barrick Gold, Newmont Corp, and Aquico Eagle Mines are 20x P/E. On the contrary, RP’s 2024 P/E is at 7x while the sector trades at a double-digit rate. We believe this is not justified. Our buy rating is then confirmed.

Royalty Pharma CF Duration

Source: Royalty Pharma Annual Report – Fig 8

Read the full article here