Investment Thesis

With the tough macroeconomic environment still present, FTI Consulting (NYSE:FCN) may benefit and hurt if we see a tighter environment for longer. The company’s financials are decent, however, the big picture outlook carries too much uncertainty, therefore, I assign the company a hold rating, until I see margins improve and the macroeconomic outlook becomes clearer.

Macroeconomic Outlook

The Fed is going to keep interest rates higher for longer which means further turmoil in the economies and the markets. This will be a double-edged sword for consulting firms like FTI Consulting. In the short term, this may decrease the demand for the company’s services during periods of higher unemployment as companies may start to cut back on these types of services when margins begin to be squeezed. This will certainly affect the company’s top line and if the company isn’t prepared for such a downturn, the costs may eat up the remainder of the profits and continue to squeeze margins further.

During the tougher times, the consulting sector may become even more cutthroat than before due to fewer projects available all around, which may lead to lower fees charged by the firms to get the project. There will certainly be more competition for each project and price may be the deciding factor. Lower prices lead to lower margins.

On the other hand, some revenue segments may see higher revenues because of the tumultuous climate where interest rates are staying higher and unemployment rates tick higher and higher. The company may benefit in some areas because of this, because there may be bankruptcies in the near future. Many companies may require FCN’s restructuring services to deal with a higher interest rate environment to stay afloat and not declare bankruptcy.

It is still up in the air and we don’t know what is going to happen in the upcoming months. The Fed isn’t showing signs of easing and may continue to raise interest rates and JPMorgan (JPM) CEO Jaimie Dimon says the world is not ready for a 7% interest rate environment. It’s all speculation, but it is important to have a worst-case scenario in this situation where everything is up in the air still.

Financials

Just to note, all the graphs below will be as of FY22 because I would like to look at the full picture of the company and where it is going. I will include some figures from the latest quarter if needed for extra color.

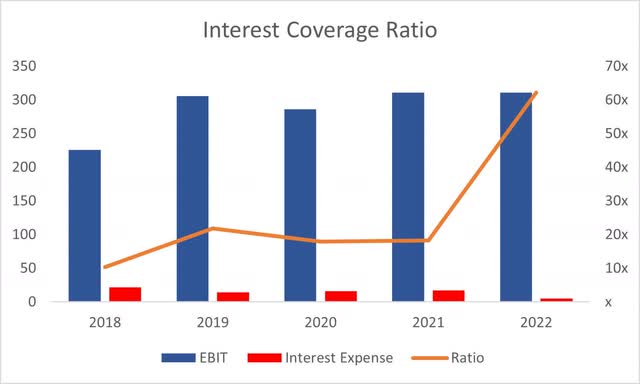

As of Q2 ’23, the company had around $203m in cash against $340m in long-term debt. That’s a decent position to be in terms of leverage. It doesn’t look like it’s excessive in any way and is manageable in my opinion. What I consider to be manageable is if the company can easily pay off annual interest on debt. The company’s historical interest coverage ratio has been very healthy over the last 5 years. As of FY22, the interest coverage ratio was 62x, meaning that EBIT can cover annual interest expense on debt 62 times over. As of Q2, that number has fallen to around 25, which is still remarkable. For reference, analysts consider 2x to be healthy, while I view 5x to be optimal, so it’s safe to say the company is at no risk of insolvency.

Interest Coverage Ratio (Author)

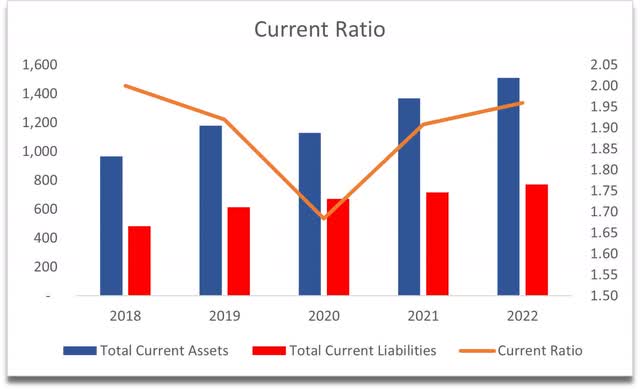

The company’s working capital ratio is exactly where I want it to be, within what I call the efficient range of 1.5-2.0. This tells me that the company is rather efficient with its assets and doesn’t have too much cash lying around that could be used for further growth of the company. I believe that this range is efficient because it strikes a nice balance between the ability to pay off short-term obligations with ease and still having plenty of capital for growth initiatives. As of Q2, the ratio increased to 2.3 but it’s still fine.

Current Ratio (Author)

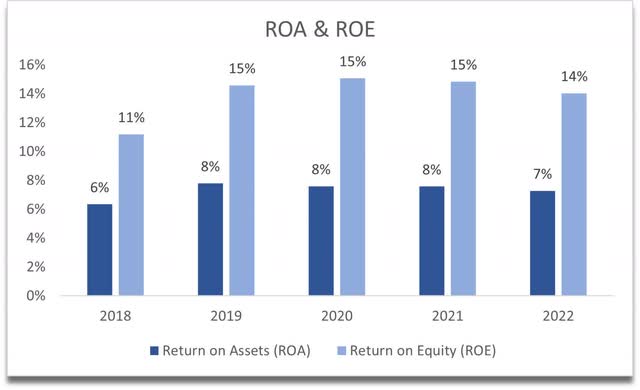

In terms of efficiency and profitability, the company’s ROA and ROE have been excellent over the last 5 years and are above my minimum requirements of 5% for ROA and 10% for ROE. This tells me that the management is doing a good job of utilizing the company’s assets and shareholder capital.

ROA and ROE (Author)

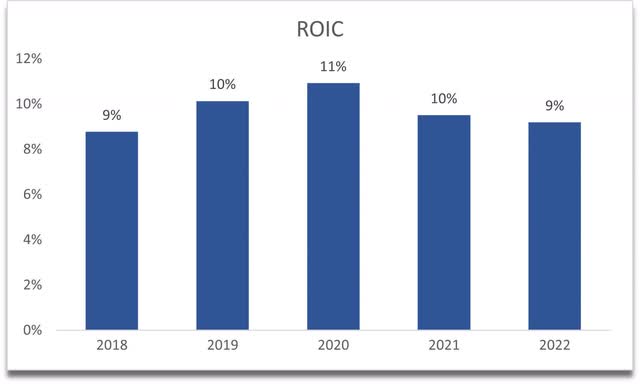

The company’s return on investment is decent, however, I would prefer it if it went over 10% in the following years. That would tell me the company has a decent competitive advantage and a moat, in addition, the management is good at finding profitable investments and is creating value. I don’t see why it wouldn’t be able to get back above 10% as it has in the past unless the macroeconomic climate gets much tougher.

ROIC (Author)

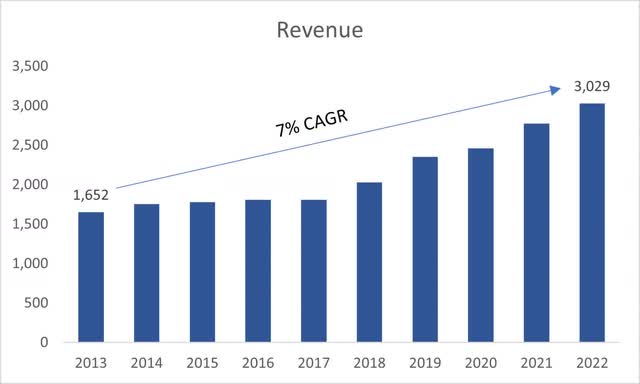

In terms of revenues, the company managed to grow at a 7% CAGR over the last decade. The company is slated to achieve around 11% growth for FY23, which is surprising, given the companies I’ve covered in the past usually have a slower growth for FY23 compared to their historical average. Nevertheless, for my valuation, I will go for a slightly more conservative assumption for growth prospects.

Revenue Growth (Author)

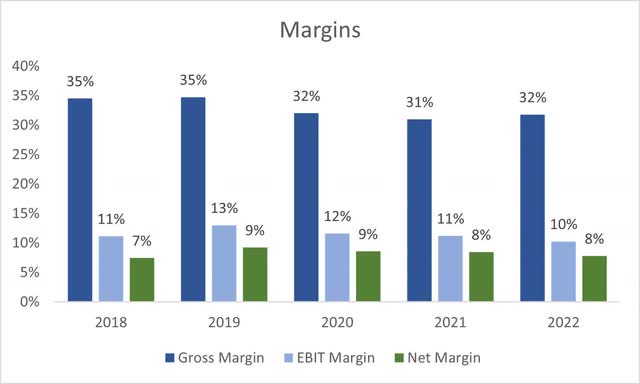

In terms of margins, I see that these have deteriorated slightly over the last couple of years. The latest quarter isn’t giving me much hope that the margins will improve, however, as I mentioned earlier, I like to look at the full-year results before judging the quarterly reports due to their fluctuation, so I will wait until the FY23 results are out.

Margins (Author)

Overall, the company has adequate financials. A couple of gripes would be the ROIC is below my minimum and the downtrend of the margins is slightly worrying if the company doesn’t manage to fix this soon. I don’t expect them to improve by FY23, however, I will listen intently to what the management is going to say about them for the next year when they provide guidance and cost-cutting initiatives (if any).

Valuation

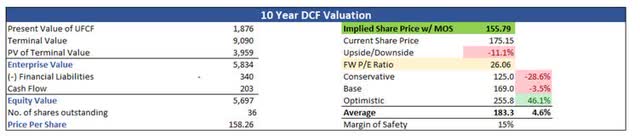

For my valuation analysis, I decided to approach it with a conservative mindset for an extra margin of safety. For the base case revenue growth, I decided to increase revenues by around 5.5% CAGR, which is below the company’s average growth of 7%. For the optimistic case, I went with around 8% CAGR, while for the conservative case, I went with around 3.7% CAGR for the next decade. I believe all three scenarios are possible depending on which macroeconomic climate we’re in.

For margins, I decided to worsen them by around 50bps for FY23, to reflect what the analysts are estimating and over time, I will improve margins by around 300bps or 3% by FY32. I believe that with time, companies will prioritize improving the deterioration of margins to keep investors happy and retain profitability. Advances in technology will provide further efficiencies and make the companies more profitable.

On top of these estimates, I will add a 15% margin of safety to be on the safer side. I believe 15% is enough because my revenue assumptions were on the lower end and the financials are decent enough. With that said, FCN’s intrinsic value is $155 a share, implying that the company is trading at a slight premium to its fair value in my opinion.

Intrinsic Value (Author)

Closing Comments

For me to take on the company’s risks, I would need it to pull back towards $155 or below. To be honest, a forward PE ratio of around 26 seems a little steep for a company that isn’t going to be growing very much in the coming years. It looks to me that the company is slightly overvalued, and I would like it to come down to around 20 PE ratio, which was around the average it saw in recent years.

I will add it to my price alerts and wait until it hits around $155. And if it doesn’t, that is also fine. The macroeconomic environment isn’t looking to improve any time soon, with interest rates staying higher for longer, which will bring further volatility to the markets in the next few months and probably in ’24. I will wait patiently and see how the global economy develops going forward and how the company manages to deal with such economic uncertainty.

Read the full article here