By Robert Carnell, Regional Head of Research, Asia-Pacific

While this is mostly down to less helpful base effects, international energy prices and excise duty hikes, it is not safe to conclude that the RBA rate cycle has peaked.

In line with expectations, but more progress needed

At 5.2% YoY, the August inflation figures were bang in line with expectations. However, inflation is rising again, not falling, and the month-on-month and core inflation figures (0.69% MoM and 0.3% MoM respectively) leave no room for complacency.

It is still possible that the Reserve Bank of Australia (RBA) will conclude that the trend pace of improvement in inflation is insufficiently fast and that a further hike is required.

Base effects can take some of the blame for the rise in inflation this month. In 2022, the August CPI index rose only 0.3% MoM, so this year’s August CPI was always going to have to come in low just to keep inflation steady.

It didn’t come in low enough. This could be a problem over the coming two months, with September and October 2022 CPI increases also just 0.3% MoM.

Excluding volatile items, the rise in CPI was indeed only 0.3%, but with oil prices rising, and September retail gasoline prices likely to boost the transport component almost as much as it did in August, this is not going to be enough to keep inflation on a downward trend.

And that sort of consecutive backsliding in inflation could be exactly the sort of condition that could pressure the Reserve Bank of Australia to respond with some further tightening.

This could perhaps occur at the November meeting, after the September (and 3Q23) CPI release, or even in December, when the October inflation figures will be available.

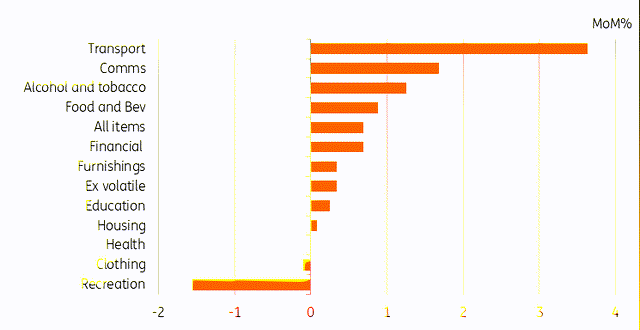

Australian CPI by major component (MoM%)

CEIC, ING

Inflation will likely rise again in September

The chart above shows where most of the inflation came from in August. A 9.1% increase in motor fuel prices lifted the transport component by 3.6% MoM.

This is likely to be repeated in September, as retail gasoline prices have continued to rise, though it may not be quite so large as indexed excise duties on fuel will not reoccur until February next year.

That same twice-yearly excise duty indexation also means that some other price rises are not likely to be repeated next month. Alcohol and tobacco prices, for example, rose 1.3% MoM in August.

With rising inflation, comes a rise in excise duties. That resulted in an August jump in the price of booze and tobacco six months after excise duties were raised in February. But that won’t reoccur again until next February, so this component is likely to be much flatter in September.

The housing component is still rising strongly, with rents up 0.7% MoM, the same as July, and only slightly down from their June peak growth of 0.9% MoM.

Some moderation over time is probable. But with supply still constrained and strong demand in the face of a rising population, we don’t expect much slowdown any time soon.

One factor that was a sizeable drag for a second consecutive month was recreation. This is a seasonal factor. The end of the holiday season leads to a drop in the prices of hotel room charges and airfares. But it doesn’t last.

So this month’s 3.9% MoM decline in holiday prices, after July’s 3.3% decline, is likely to revert to a positive figure in September in line with past trends.

The AUD has taken some comfort from the data

The AUD started the day languishing below 64 cents to the USD, but it has been buoyed by this data, and by the growing possibility of a bit more rate support from the RBA, recovering back above 64 cents.

Futures markets are still undecided about the RBA, with very little chance of a rate hike priced in before the end of this year, rising to a peak of about a 66% probability for a further 25bp of tightening, though not until May 2024.

We think that if the RBA is going to hike again, it will need to be this year, as we don’t believe the current inflation backsliding will last beyond the year-end.

So we’d expect these cash rate futures to start pricing in more tightening sooner over the coming months, as headline inflation continues to go in the wrong direction.

That may also provide some additional lift to the AUD, though for that, we also would like to see some generalised USD weakness, and the US inflation and rates story is very similar to that of Australia, so we aren’t taking that for granted.

Content Disclaimer

This publication has been prepared by ING solely for information purposes, irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here