We present our note on Partners Group (OTCPK:PGPHF), a Swiss-based global private markets investment manager with a Hold rating. While we value Partners Group’s robust business model, at the current multiples we think the shares are fairly valued. We will provide a brief introduction of Partners Group, analyze the latest set of results and the industry backdrop, lay out our investment case, and value the company’s shares.

Introduction to Partners Group

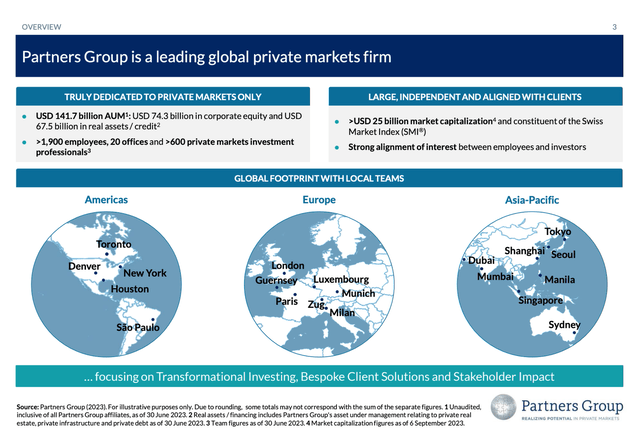

Partners Group is a leading global private markets firm that invests across private equity, private credit, private infrastructure, and private real estate on behalf of clients. Since 1996 Partners Group has invested more than $200 billion, and as of the end of H1 2023 the company has ca. $142 billion of assets under management. The founders own around 15% of the company, the staff owns 10%, and the rest is free float. The company has an established track record and is one of the largest listed PE firms. Partners Group is a Swiss Market Index constituent and has a current market capitalization of CHF27 billion.

Investor Relations Presentation

H1 Results

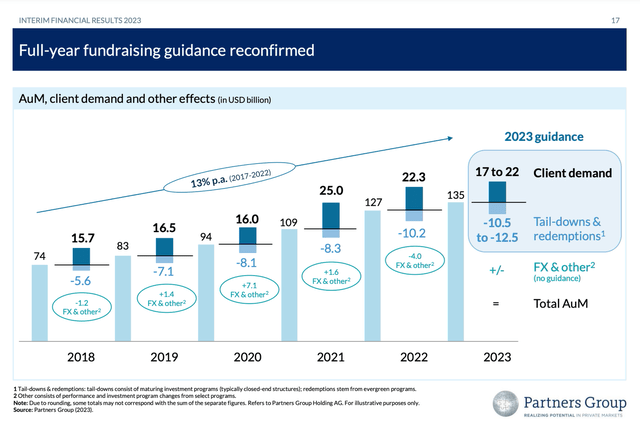

After a robust AUM announcement, H1 results were above sell-side analyst consensus. Revenue and EBIT came in respectively 13% and 14% above company-compiled consensus, largely driven by higher performance fees, while management fee growth was low-single-digit negative. Infrastructure represented the highest outperformance contributor as many funds hit hurdle rates after divesting. Going forward we expect private infrastructure to be a more significant part of the group, reducing performance fee volatility and increasing earnings quality – although we expect private equity to remain the main contributor. Guidance was reiterated regarding assets under management client demand and redemptions, as well as EBIT margin (ca. 60%), and performance fees as a percentage of total revenue (20-30%). Moreover, we would like to note management’s constructive outlook expressed in the calls, highlighting more relaxed debt financing conditions and positive expectations for H2 compared to H1.

H1 Results Slides

A Solid Business Model

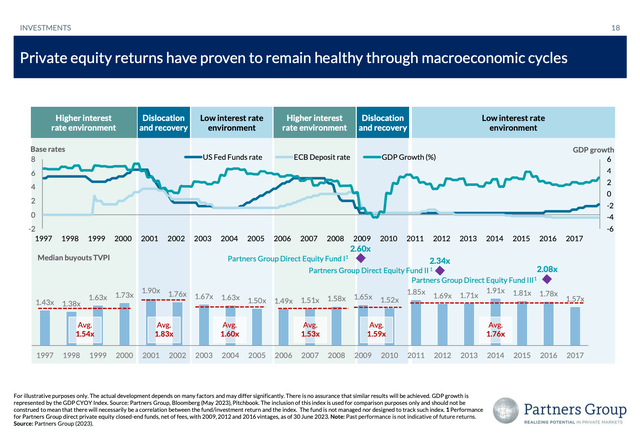

We appreciate private markets investment management firms’ high-quality business model supported by stable predictable margins, long-term horizons, high ROICs, and AUM expansion driven by structural growth coming from higher allocations to private markets investments, etc. Higher exposure to private markets vis-à-vis public markets is in turn driven by the former’s higher performance as reflected in buyout returns outperforming public equity returns as well as private credit outperforming leverage loans on public markets on all of the last 20 vintage years.

Moreover, private markets represent a significantly larger opportunity set especially as the number of listed companies shrinks, and an additional source of diversification and generation of additional premiums (for illiquidity, duration, etc.).

In addition to its solid business model, Partners Group leverages an excellent track record of value creation for investors leading to an embedded competitive advantage. Partners Group stresses exposure to businesses in sectors benefiting from profound tailwinds and targets mid-sized companies and sector leaders/winners. The group’s superior business performance has led to impressive total shareholder returns since listing, outperforming the broader Swiss market indices multiplefold.

Investor Relations Presentation

Industry backdrop

As per McKinsey’s industry report, private market investors have faced a tough backdrop since H2 2022 reflected in lower deal volumes, declining valuations, and worse investment performance. However, as per McKinsey, private markets outperformed public markets on the way down likely due to healthier portfolios as well as timing lags and discretion over NAV marking. This has pushed the allocation as a percentage of portfolios higher, sometimes causing the denominator effect leading allocators to abandon commitments and sell stakes. Partners Group has little exposure to this effect as just a few of its investors have been affected. Moreover, investors tend to go towards larger funds and known names in tougher times, which is constructive for Partners Group. In addition, citing the report, on the other hand, the private credit class is shining, avoiding the negative trends of other private markets, due to higher current yields and lower exposure to declining valuation given the position in the capital structure. In addition, allocations to infrastructure and natural resources keep increasing, also shirking negative trends.

Investment case and valuation

We prefer valuing private market investment firms using a dividend discount model and PE ratios primarily as a sanity check. We forecast 13% AUM growth in the next fiscal year, and 10% the year after, and management fees of 125 basis points while performance fees stand at around 25% of total fees. This leads to a net revenue forecast of nearly CHF2.6 billion, an EBIT of CHF1.5 billion, and a net profit of CHF1.25 billion. Our estimates are in line with consensus expectations and differ only by low single-digit percentages. Our EPS24e estimate is CHF49 per share, implying a forward PE ratio of 21x. In addition, also in line with expectations, we forecast a dividend per share of CHF42 (ca. CHF1.07 billion of dividends), i.e. an 86% dividend payout ratio. This implies a forward dividend yield of 4.1%.

Assuming a cost of equity of 8%, a terminal growth rate of 4% (derived from low-mid single digits AUM growth long term with potential margin compression), and applying the dividend growth model, we arrive at a valuation implying current market prices.

The current PE ratio is also in line with the 5-year median and stands above European peers EQT, Bridgepoint, Antin, Tikehau, etc. We believe Partners Group is fairly valued and do not see a risk/reward attractive enough to recommend buying the stock.

Risks

Downside risks include but are not limited to an adverse fundraising environment, lower allocations to private markets from investors leading to a decline in inflow, worse-than-expected fund performance / declining track record resulting in lower fees, lower performance fee contribution as a result of exits at low multiples given the industry backdrop, structurally lower fees, foreign exchange risk, regulatory risk, reputational risk, loss of human capital to competitors, etc.

Conclusion

Despite our appreciation of the business model and Partner’s group strengths, given the fair valuation, we are neutral on Partners Group and have a Hold rating on the name. We will monitor the company, and in case of derating to a more compelling multiple, we will revisit the name.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here